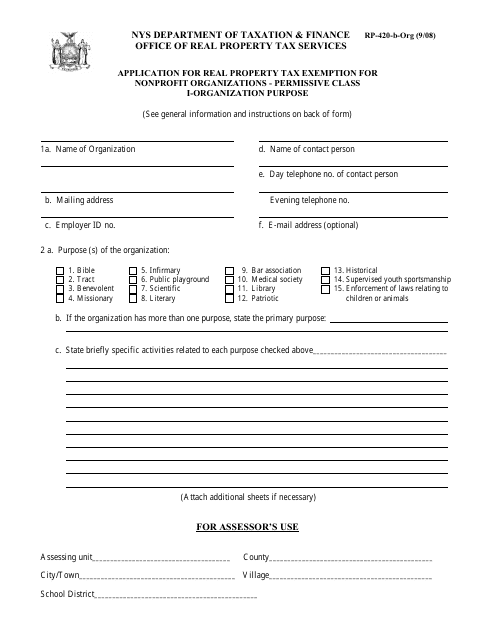

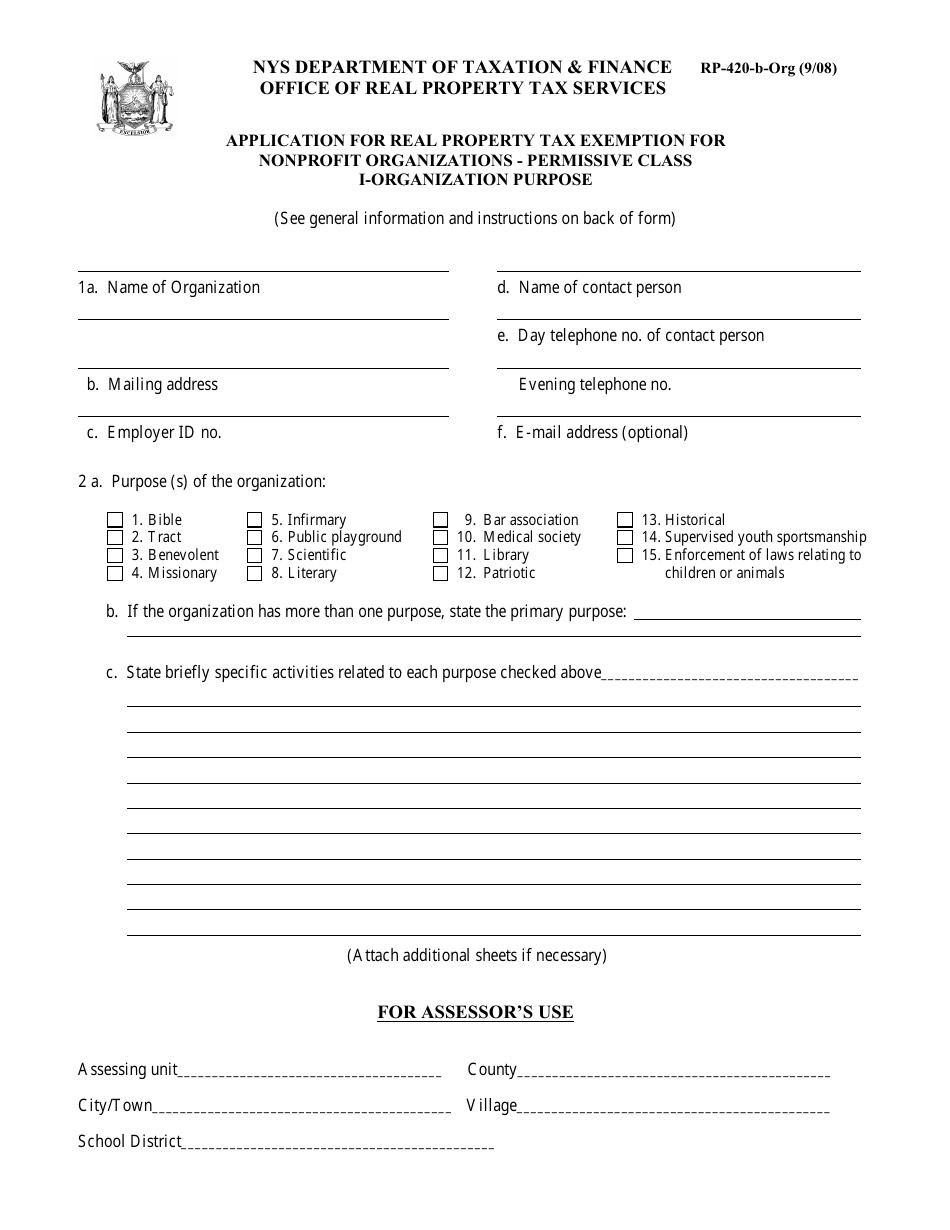

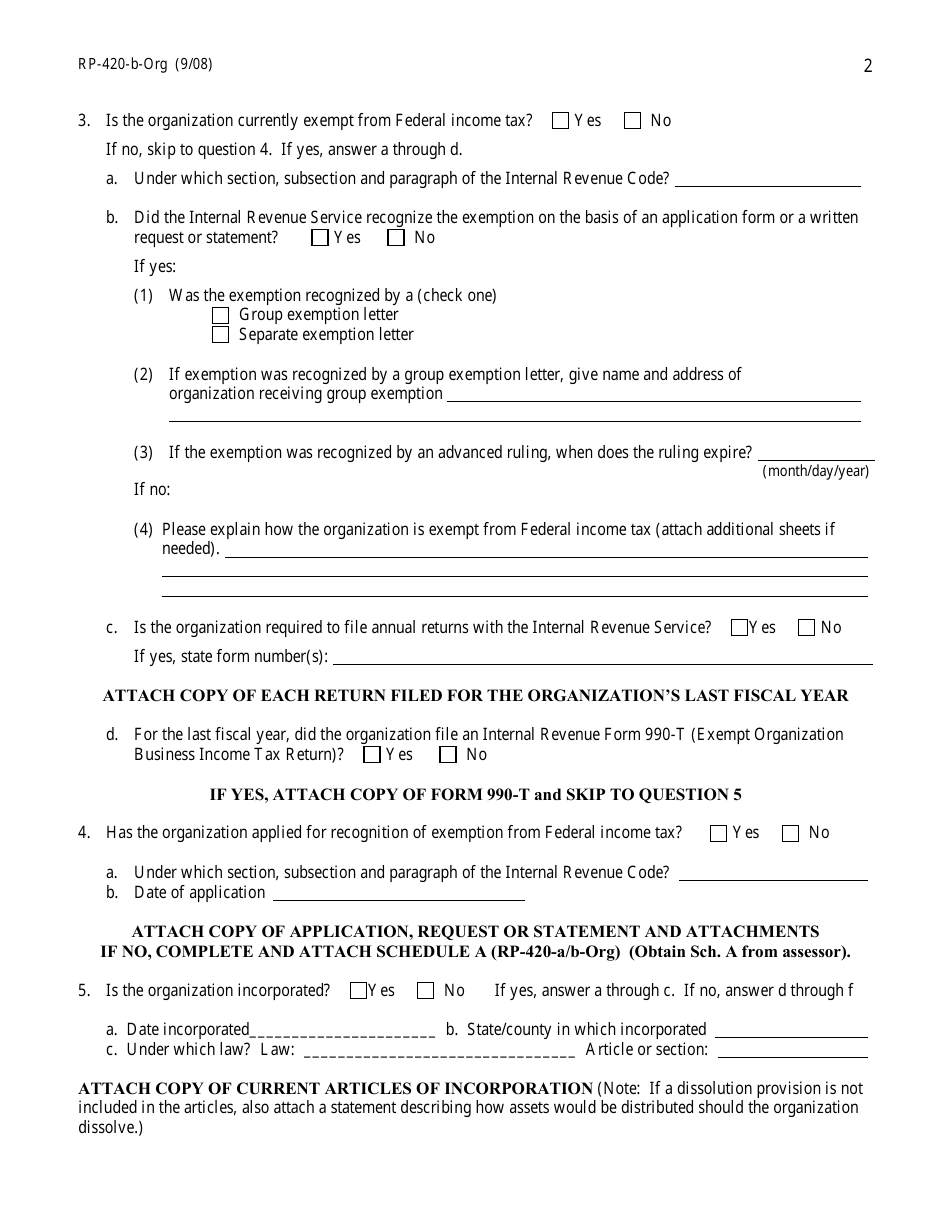

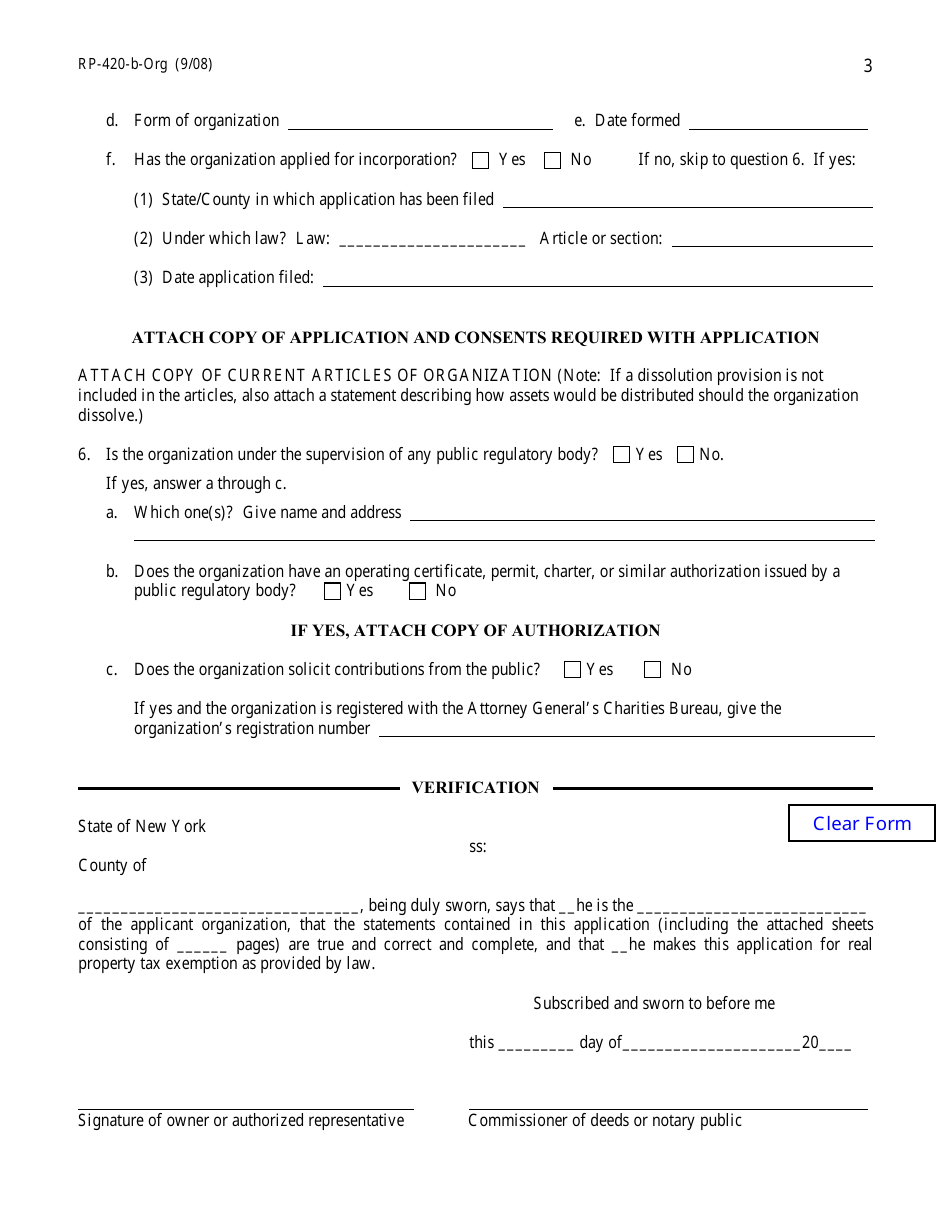

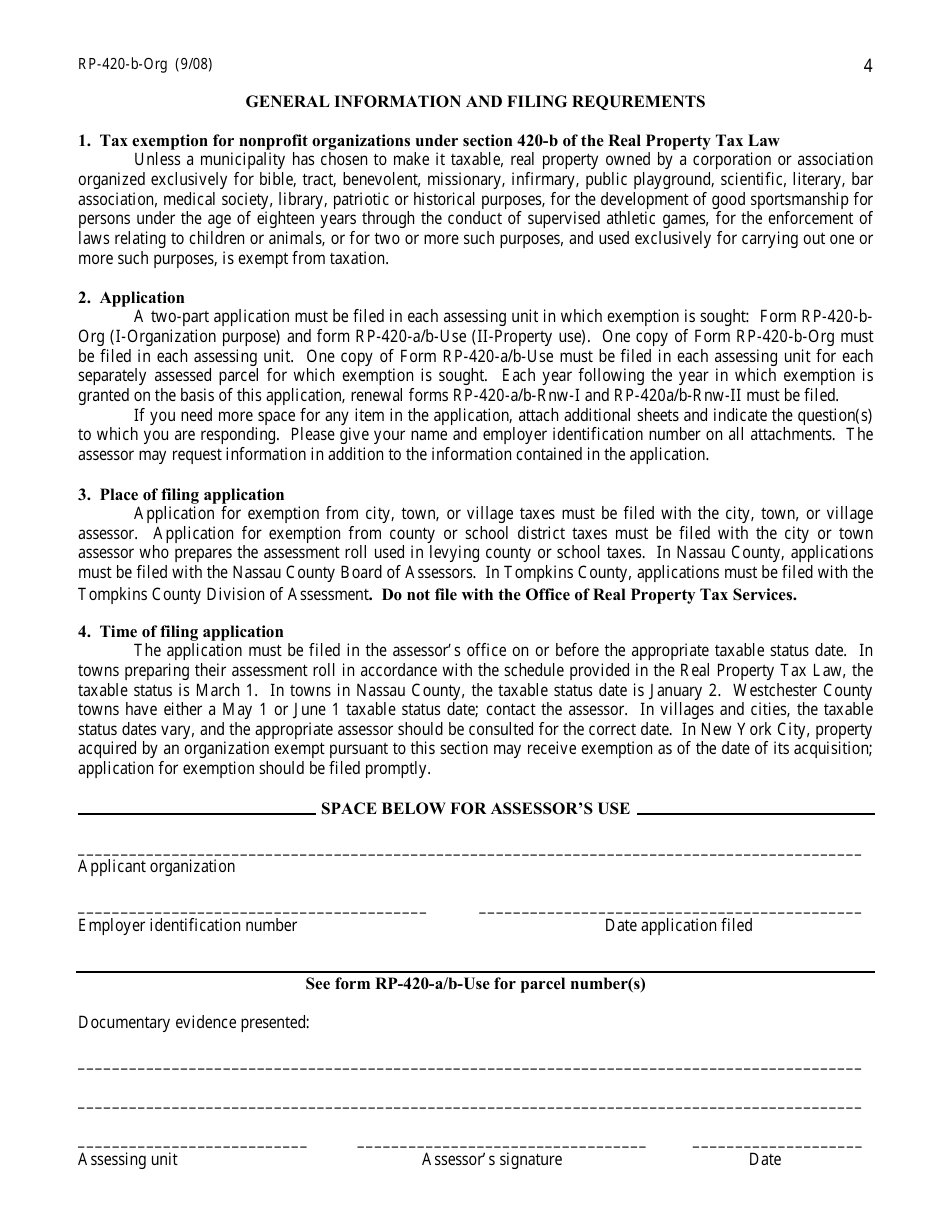

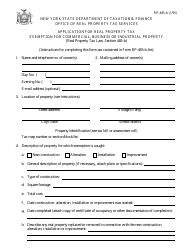

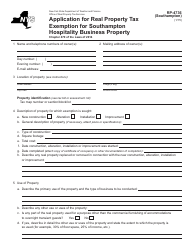

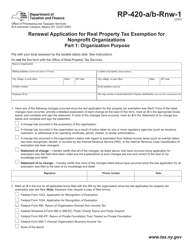

Form RP-420-B-ORG Application for Real Property Tax Exemption for Nonprofit Organizations - Permissive Class I-Organization Purpose - New York

What Is Form RP-420-B-ORG?

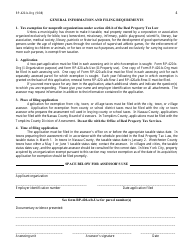

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-420-B-ORG?

A: It is an application for real property tax exemption for nonprofit organizations in New York.

Q: What is the purpose of Form RP-420-B-ORG?

A: The purpose is to request a tax exemption for nonprofit organizations.

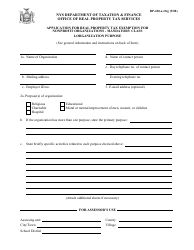

Q: What is Permissive Class I-Organization Purpose?

A: It is a category for organizations that meet specific criteria for tax exemption.

Q: Who can use Form RP-420-B-ORG?

A: Nonprofit organizations in New York that meet the requirements for Permissive Class I-Organization Purpose.

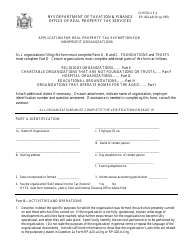

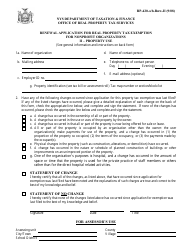

Q: Is Form RP-420-B-ORG only for new organizations?

A: No, it can also be used by existing organizations that want to apply for tax exemption.

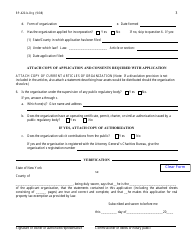

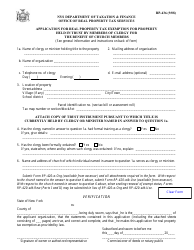

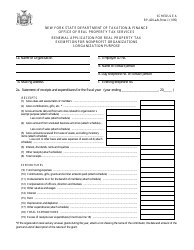

Q: What should be included in the application?

A: The application should include the organization's information, purpose, and supporting documents.

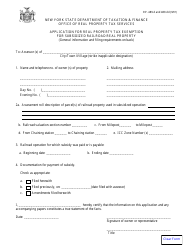

Q: Are there any fees associated with the application?

A: There may be a fee for filing the application, depending on the county.

Q: How long does it take to process the application?

A: The processing time varies, but it can take several months.

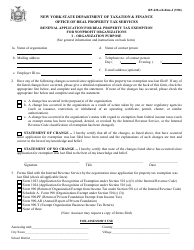

Q: Can the tax exemption be revoked?

A: Yes, the tax exemption can be revoked if the organization no longer meets the requirements.

Q: What happens if the application is denied?

A: If the application is denied, the organization can appeal the decision.

Q: Who can I contact for more information?

A: For more information, you can contact the New York State Department of Taxation and Finance.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-420-B-ORG by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.