This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 943-X

for the current year.

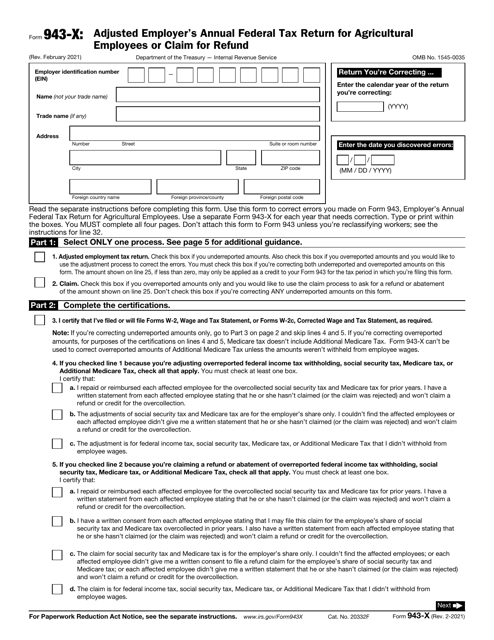

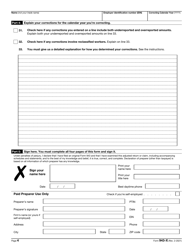

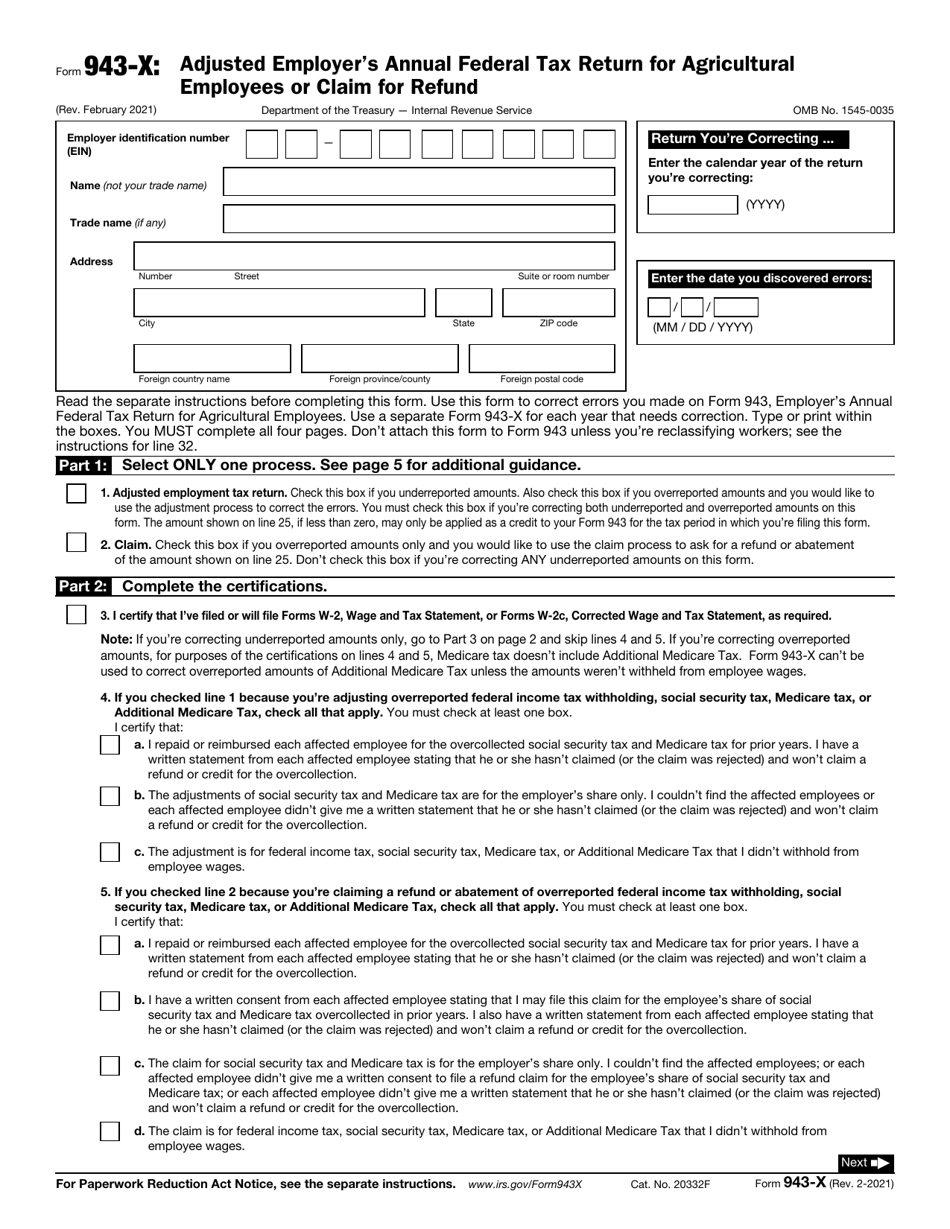

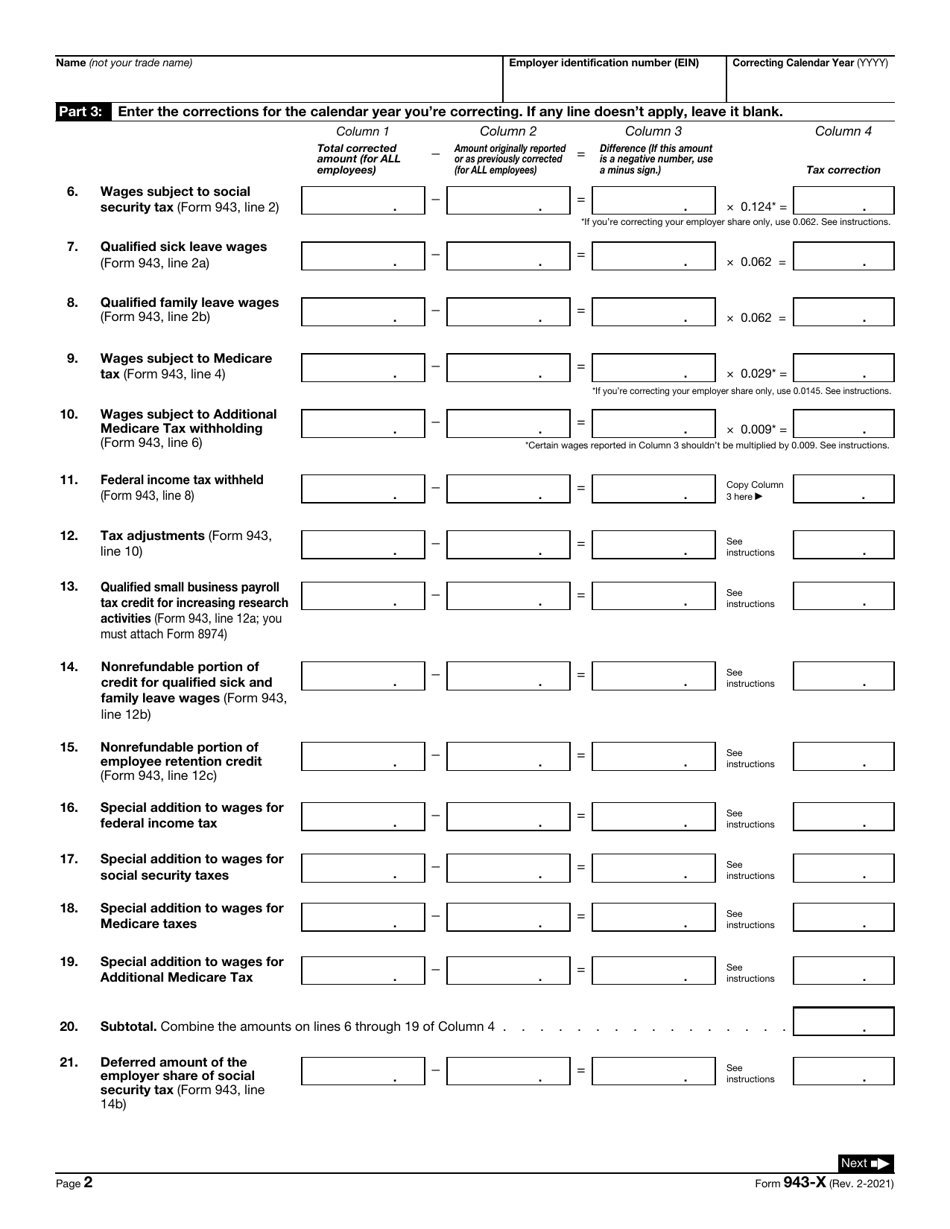

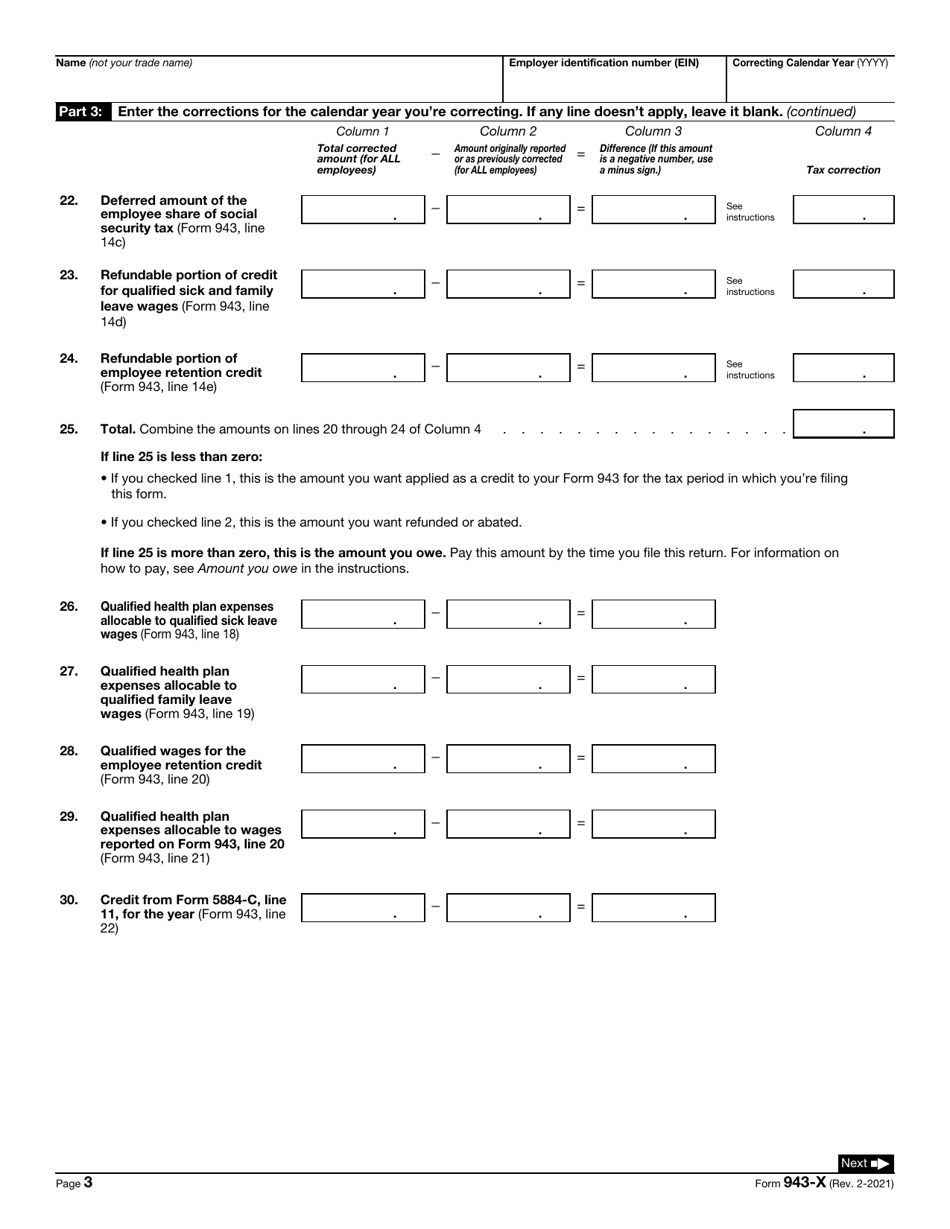

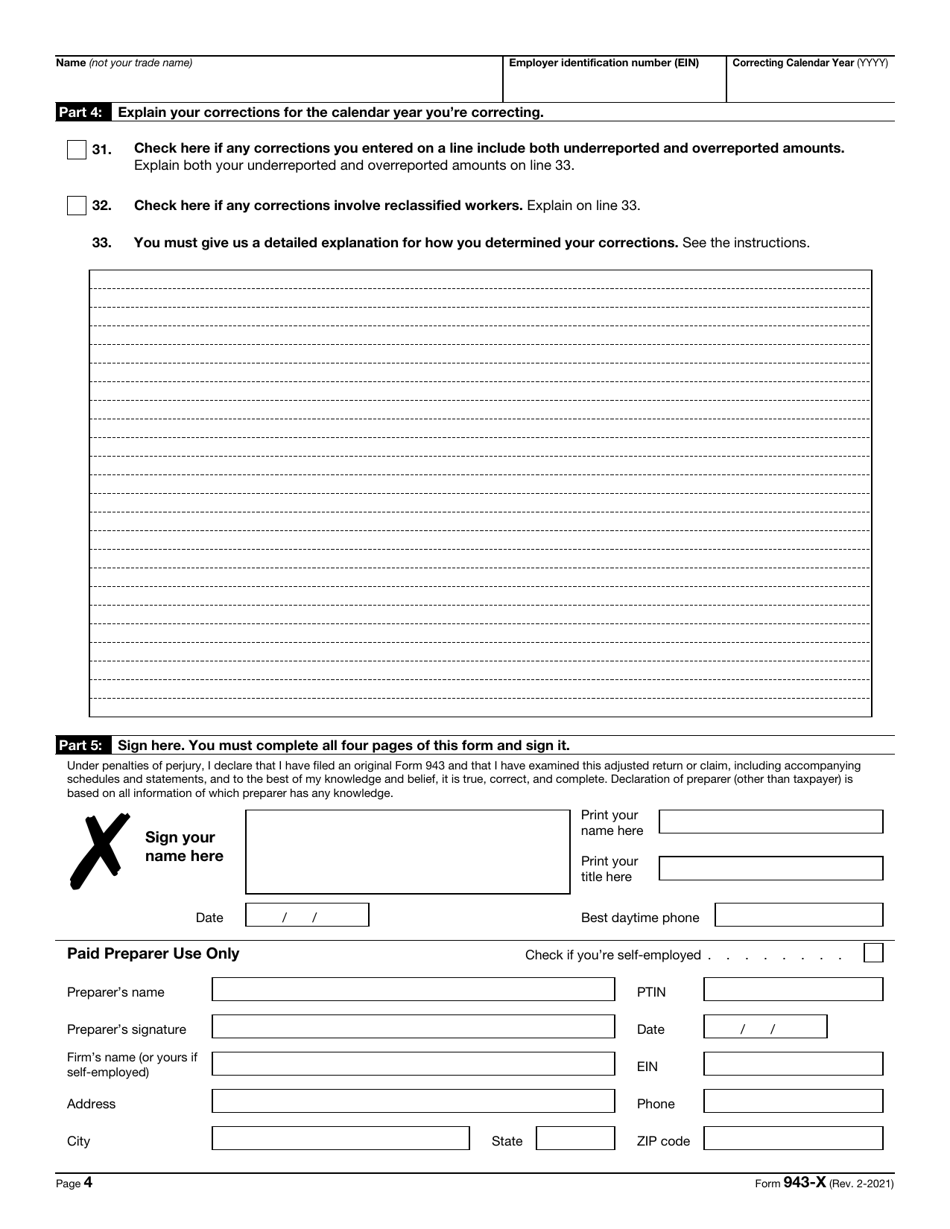

IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

What Is IRS Form 943-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 943-X?

A: IRS Form 943-X is the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund.

Q: Who should use IRS Form 943-X?

A: Employers who need to make adjustments to their previously filed IRS Form 943 or need to claim a refund for agricultural employees should use IRS Form 943-X.

Q: What is the purpose of IRS Form 943-X?

A: The purpose of IRS Form 943-X is to report adjustments or corrections to previously filed Form 943 or to claim a refund for agricultural employees.

Q: How do I file IRS Form 943-X?

A: You can file IRS Form 943-X by mail. Make sure to follow the instructions provided by the IRS and include any required documentation.

Q: Can I file IRS Form 943-X electronically?

A: No, you cannot file IRS Form 943-X electronically. It must be filed by mail.

Q: Are there any deadlines for filing IRS Form 943-X?

A: Yes, there are deadlines for filing IRS Form 943-X. Make sure to check the instructions or consult with the IRS to determine the deadline that applies to your situation.

Form Details:

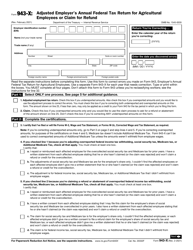

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 943-X through the link below or browse more documents in our library of IRS Forms.