This version of the form is not currently in use and is provided for reference only. Download this version of

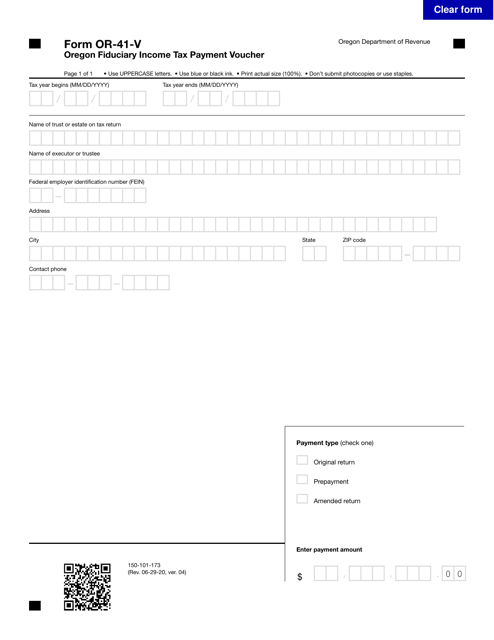

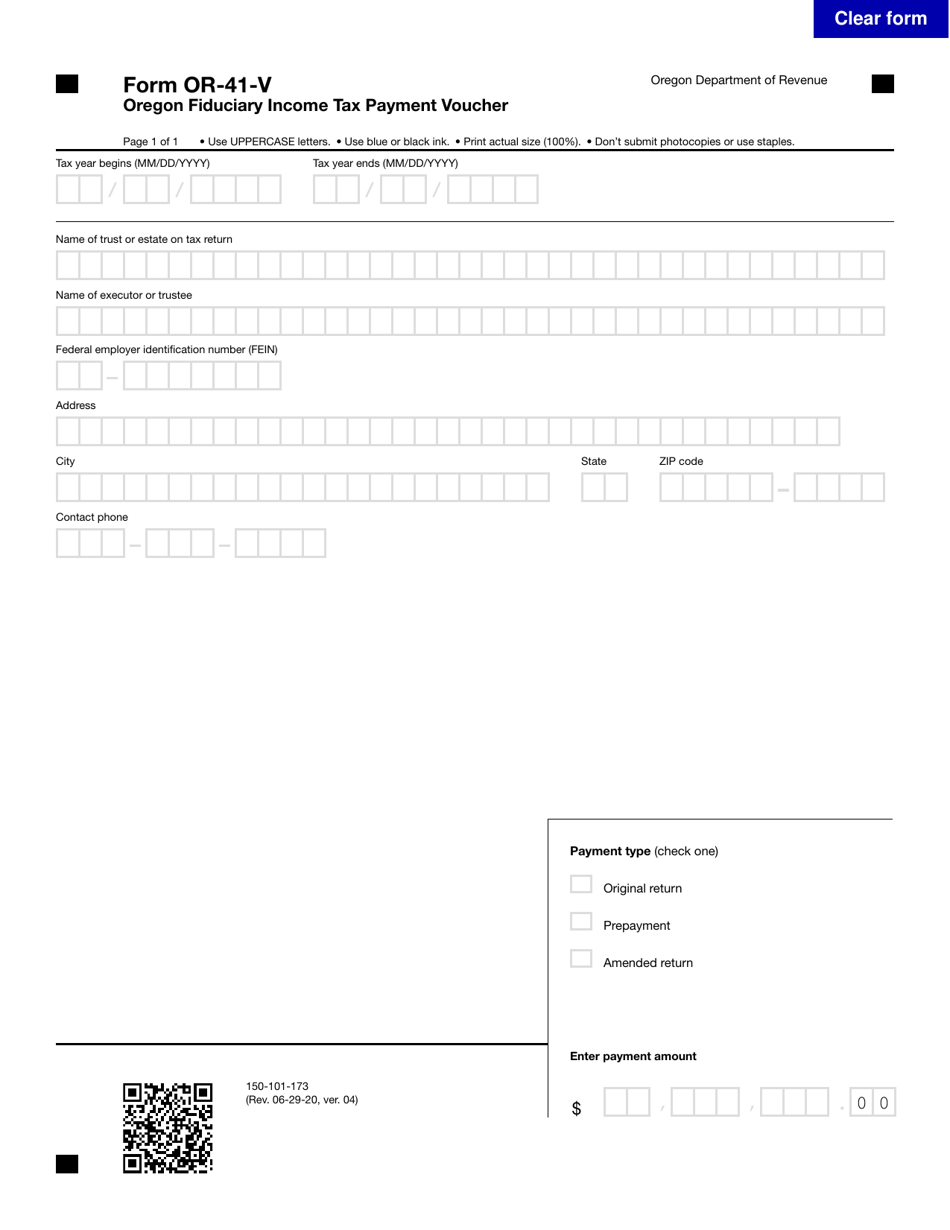

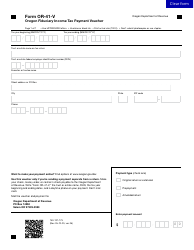

Form OR-41-V (150-101-173)

for the current year.

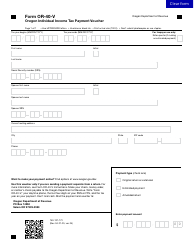

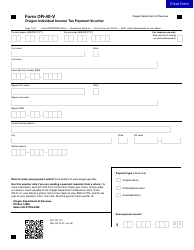

Form OR-41-V (150-101-173) Oregon Fiduciary Income Tax Payment Voucher - Oregon

What Is Form OR-41-V (150-101-173)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

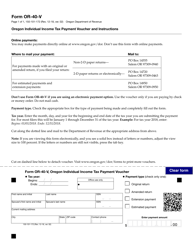

Q: What is Form OR-41-V?

A: Form OR-41-V is the Oregon Fiduciary Income Tax Payment Voucher.

Q: What is the purpose of Form OR-41-V?

A: The purpose of Form OR-41-V is to make a payment for Oregon fiduciary income taxes.

Q: Who should use Form OR-41-V?

A: Form OR-41-V should be used by individuals or entities filing Oregon fiduciary income tax returns.

Q: Can Form OR-41-V be used for other tax payments?

A: No, Form OR-41-V is specifically for making Oregon fiduciary income tax payments.

Q: How should I fill out Form OR-41-V?

A: You will need to provide your name, address, tax year, and payment amount on Form OR-41-V.

Q: How can I make a payment using Form OR-41-V?

A: You can make a payment using Form OR-41-V by including a check or money order with the voucher and mailing it to the Oregon Department of Revenue.

Q: When is the deadline for using Form OR-41-V?

A: The deadline for using Form OR-41-V corresponds with the due date for filing your Oregon fiduciary income tax return.

Q: Are there any penalties for late or insufficient payments using Form OR-41-V?

A: Yes, there may be penalties for late or insufficient payments, so it's important to submit your payment on time and for the correct amount.

Q: Can I file my Oregon fiduciary income tax return electronically?

A: Yes, you can file your Oregon fiduciary income tax return electronically, but you still need to use Form OR-41-V to make any required payments.

Form Details:

- Released on June 29, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-41-V (150-101-173) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.