This version of the form is not currently in use and is provided for reference only. Download this version of

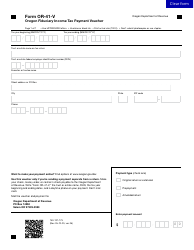

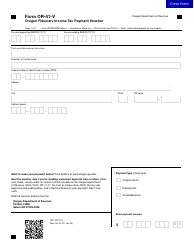

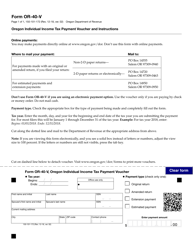

Instructions for Form OR-41-V, 150-101-173

for the current year.

Instructions for Form OR-41-V, 150-101-173 Oregon Fiduciary Income Tax Payment Voucher - Oregon

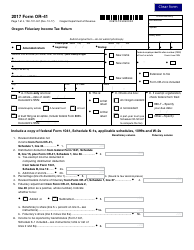

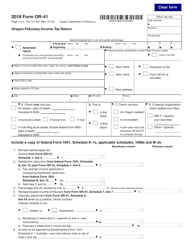

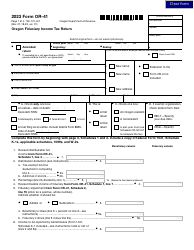

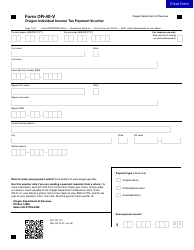

This document contains official instructions for Form OR-41-V , and Form 150-101-173 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-41-V is available for download through this link. The latest available Form 150-101-173 (OR-41-V) can be downloaded through this link.

FAQ

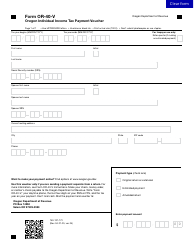

Q: What is Form OR-41-V?

A: Form OR-41-V is the Oregon Fiduciary Income Tax Payment Voucher.

Q: What is the purpose of Form OR-41-V?

A: The purpose of Form OR-41-V is to make payment for Oregon fiduciary income taxes.

Q: Who needs to file Form OR-41-V?

A: Form OR-41-V needs to be filed by individuals or entities that have a fiduciary relationship and are required to pay Oregon fiduciary income taxes.

Q: What information is required on Form OR-41-V?

A: Form OR-41-V requires information such as the taxpayer's name, address, Social Security number or federal identification number, and the amount of income tax due.

Q: When is Form OR-41-V due?

A: Form OR-41-V is due on or before the original due date of the Oregon fiduciary income tax return.

Q: What happens if I don't file Form OR-41-V?

A: If you don't file Form OR-41-V or pay your Oregon fiduciary income taxes on time, you may be subject to penalties and interest charges.

Q: Can I get an extension to file Form OR-41-V?

A: Yes, you can request an extension to file Form OR-41-V by filing Form OR-40-V, Oregon Automatic Extension Voucher.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.