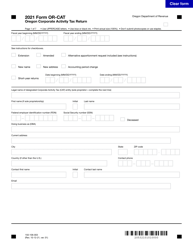

This version of the form is not currently in use and is provided for reference only. Download this version of

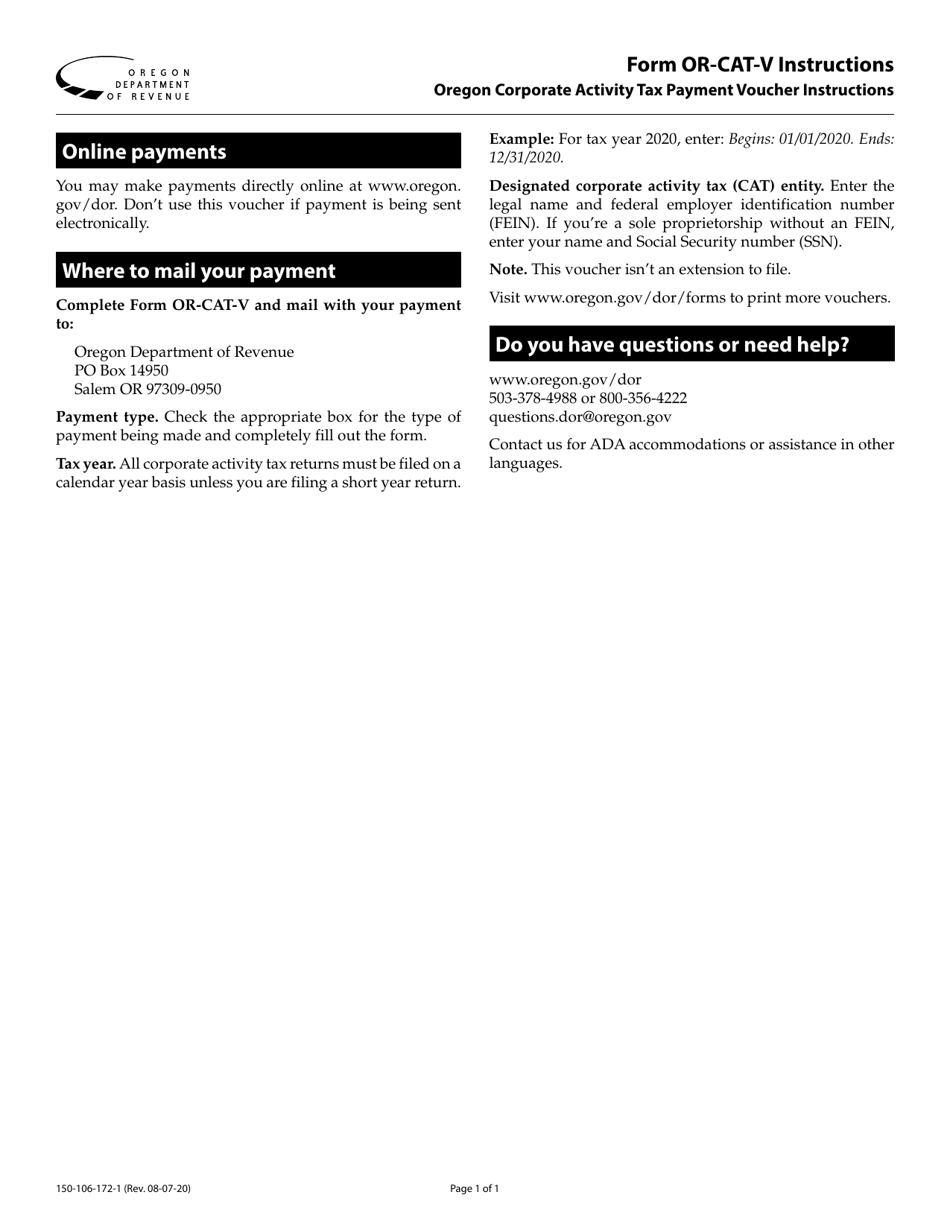

Instructions for Form OR-CAT-V, 150-106-172

for the current year.

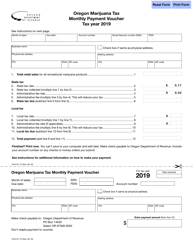

Instructions for Form OR-CAT-V, 150-106-172 Oregon Corporate Activity Tax Payment Voucher - Oregon

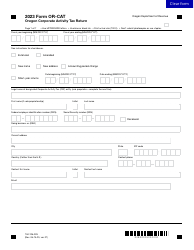

This document contains official instructions for Form OR-CAT-V , and Form 150-106-172 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-CAT-V (150-106-172) is available for download through this link.

FAQ

Q: What is Form OR-CAT-V?

A: Form OR-CAT-V is the Oregon Corporate Activity Tax Payment Voucher.

Q: What is the purpose of Form OR-CAT-V?

A: The purpose of Form OR-CAT-V is to make a payment for the Oregon Corporate Activity Tax.

Q: What is the Oregon Corporate Activity Tax?

A: The Oregon Corporate Activity Tax is a tax imposed on businesses that have substantial commercial activity in Oregon.

Q: How do I use Form OR-CAT-V?

A: You should use Form OR-CAT-V to remit payment for the Oregon Corporate Activity Tax.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.