This version of the form is not currently in use and is provided for reference only. Download this version of

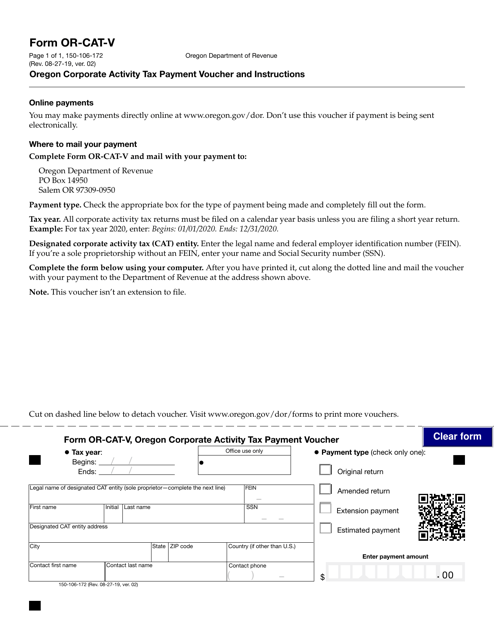

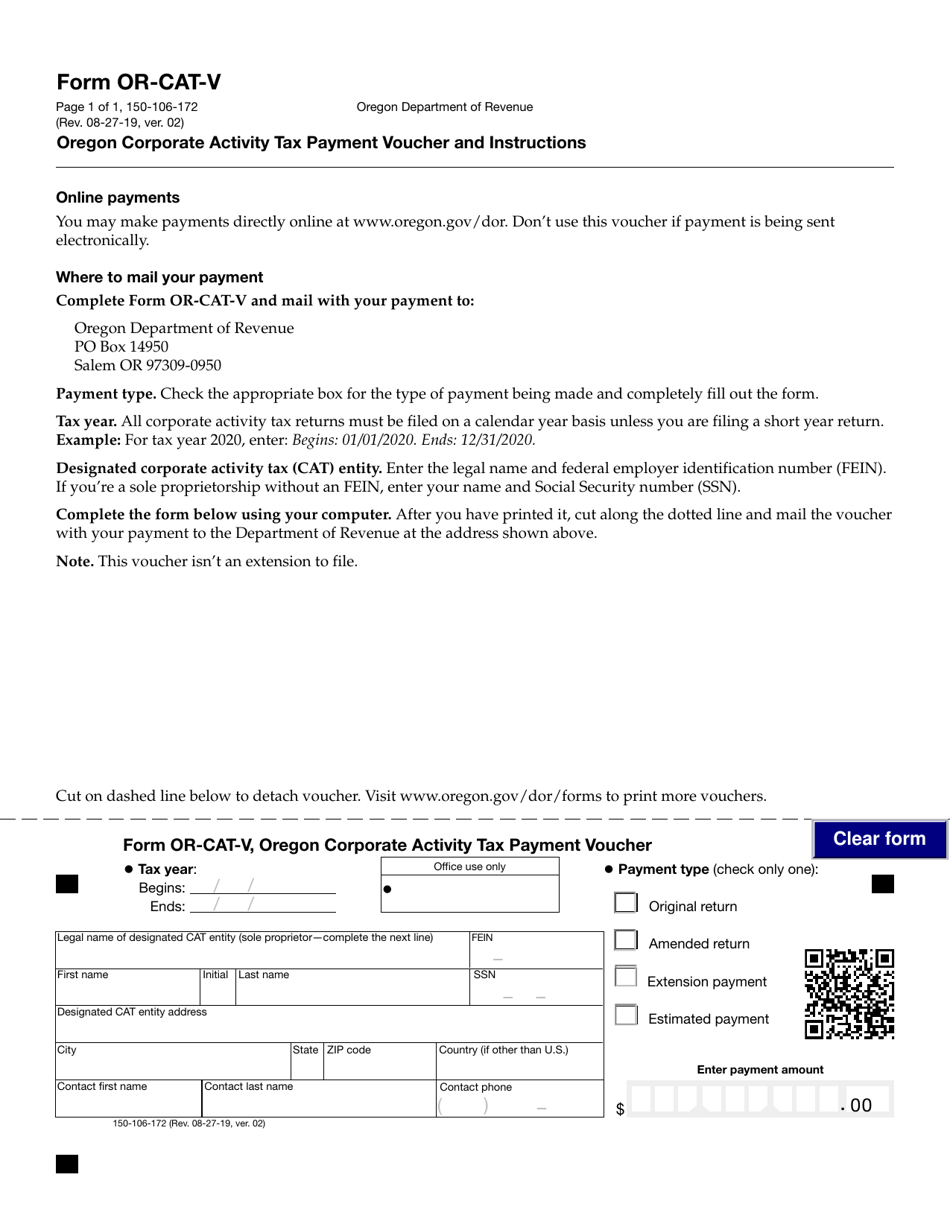

Form OR-CAT-V (150-106-172)

for the current year.

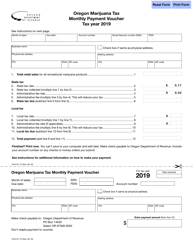

Form OR-CAT-V (150-106-172) Oregon Corporate Activity Tax Payment Voucher - Oregon

What Is Form OR-CAT-V (150-106-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-CAT-V?

A: OR-CAT-V is the Oregon Corporate Activity Tax Payment Voucher.

Q: How do I use OR-CAT-V?

A: OR-CAT-V is used for making payments towards the Oregon Corporate Activity Tax.

Q: What is the purpose of the Oregon Corporate Activity Tax?

A: The Oregon Corporate Activity Tax is a tax on certain types of business activity in the state of Oregon.

Q: Who needs to use OR-CAT-V?

A: Businesses subject to the Oregon Corporate Activity Tax are required to use OR-CAT-V for making tax payments.

Form Details:

- Released on August 27, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-CAT-V (150-106-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.