This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14446 (PL)

for the current year.

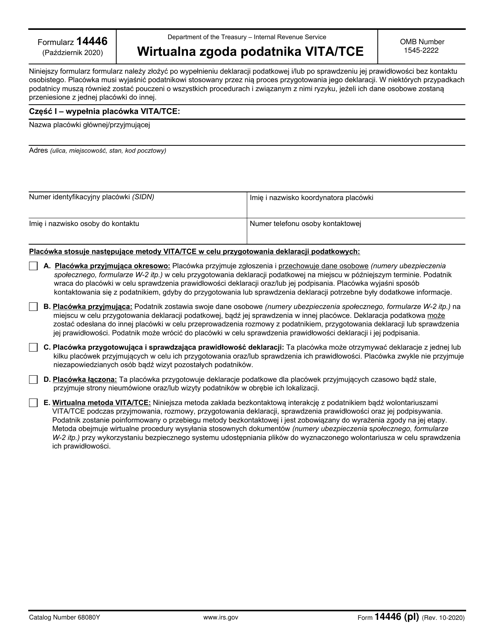

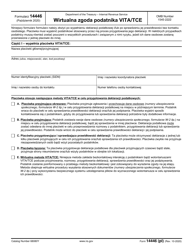

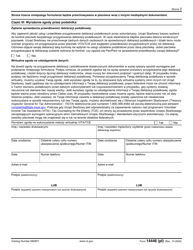

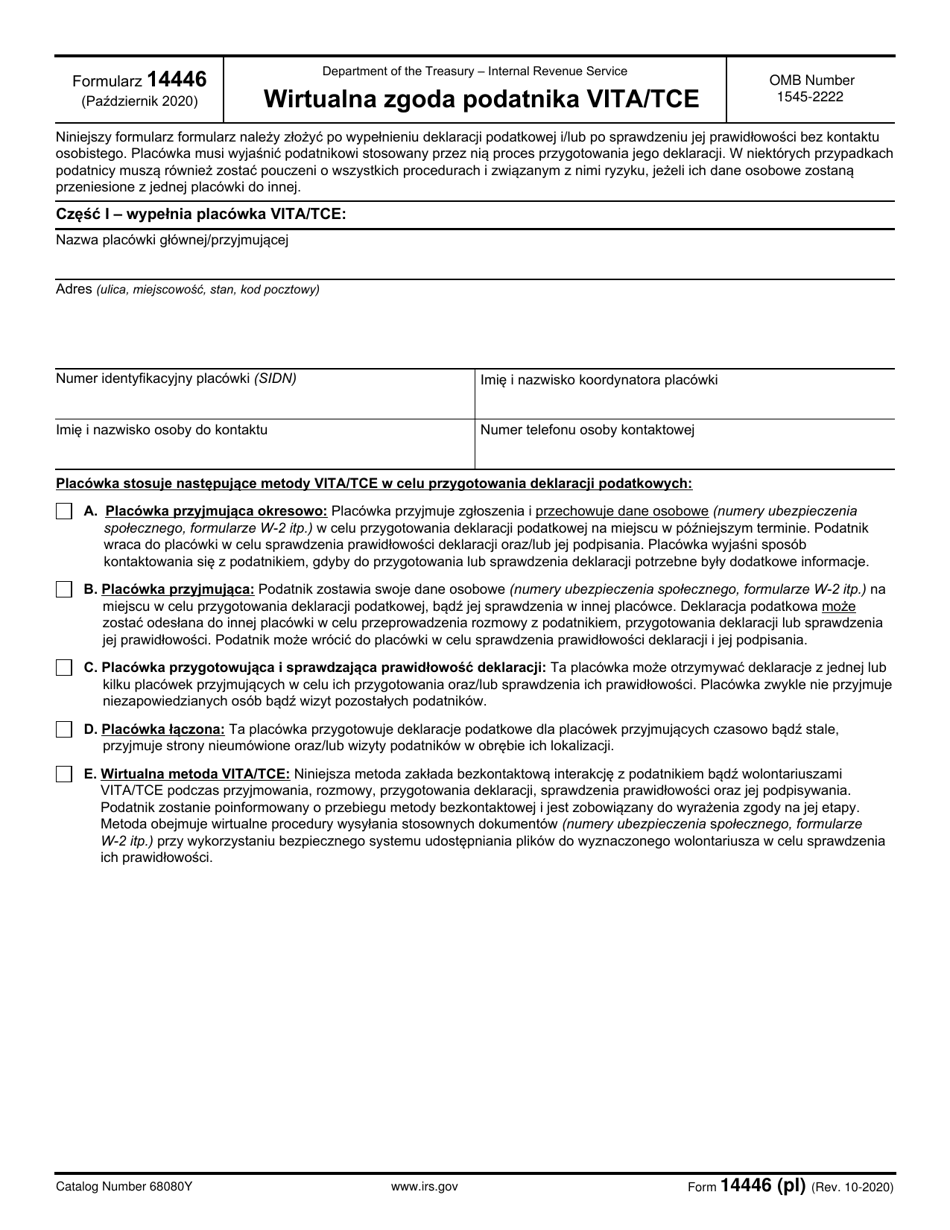

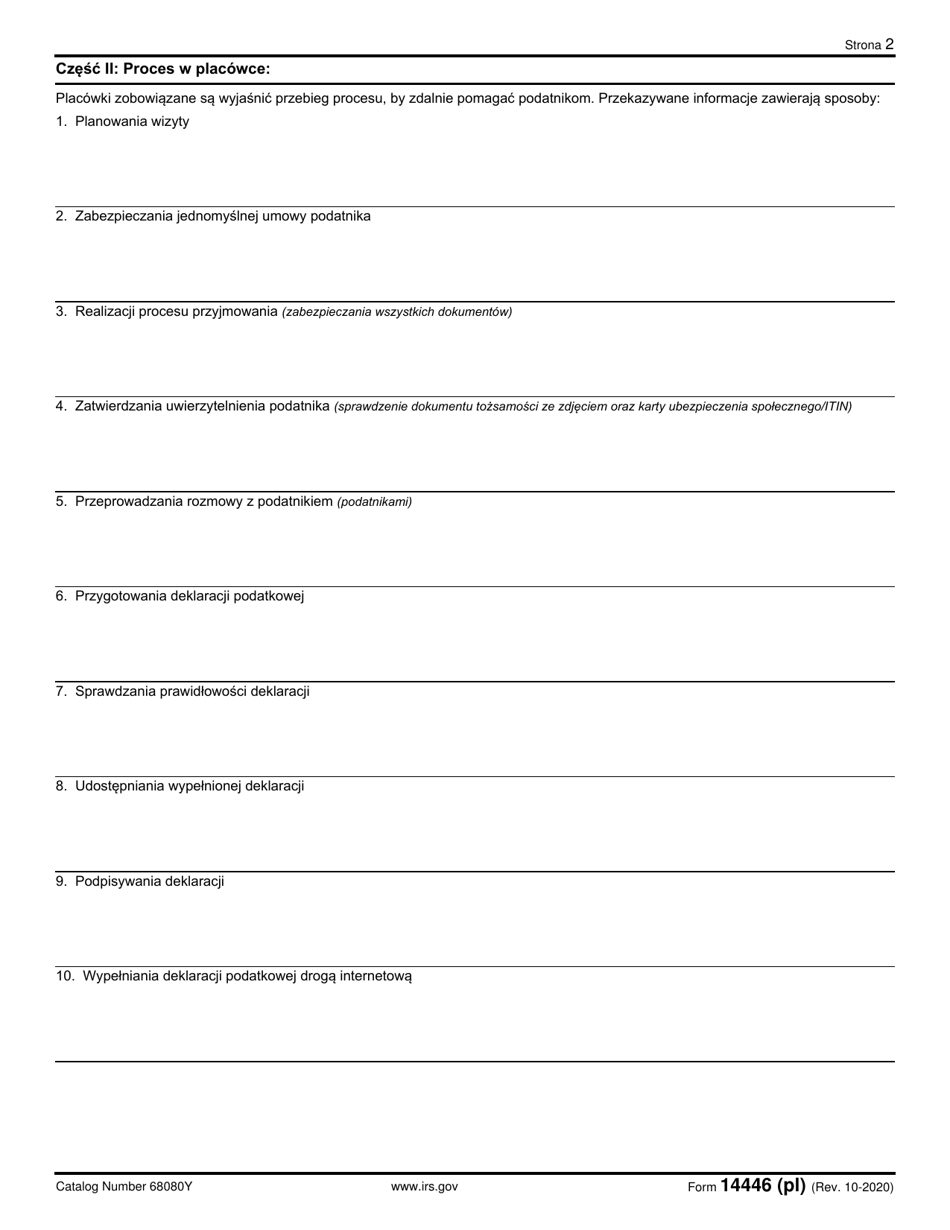

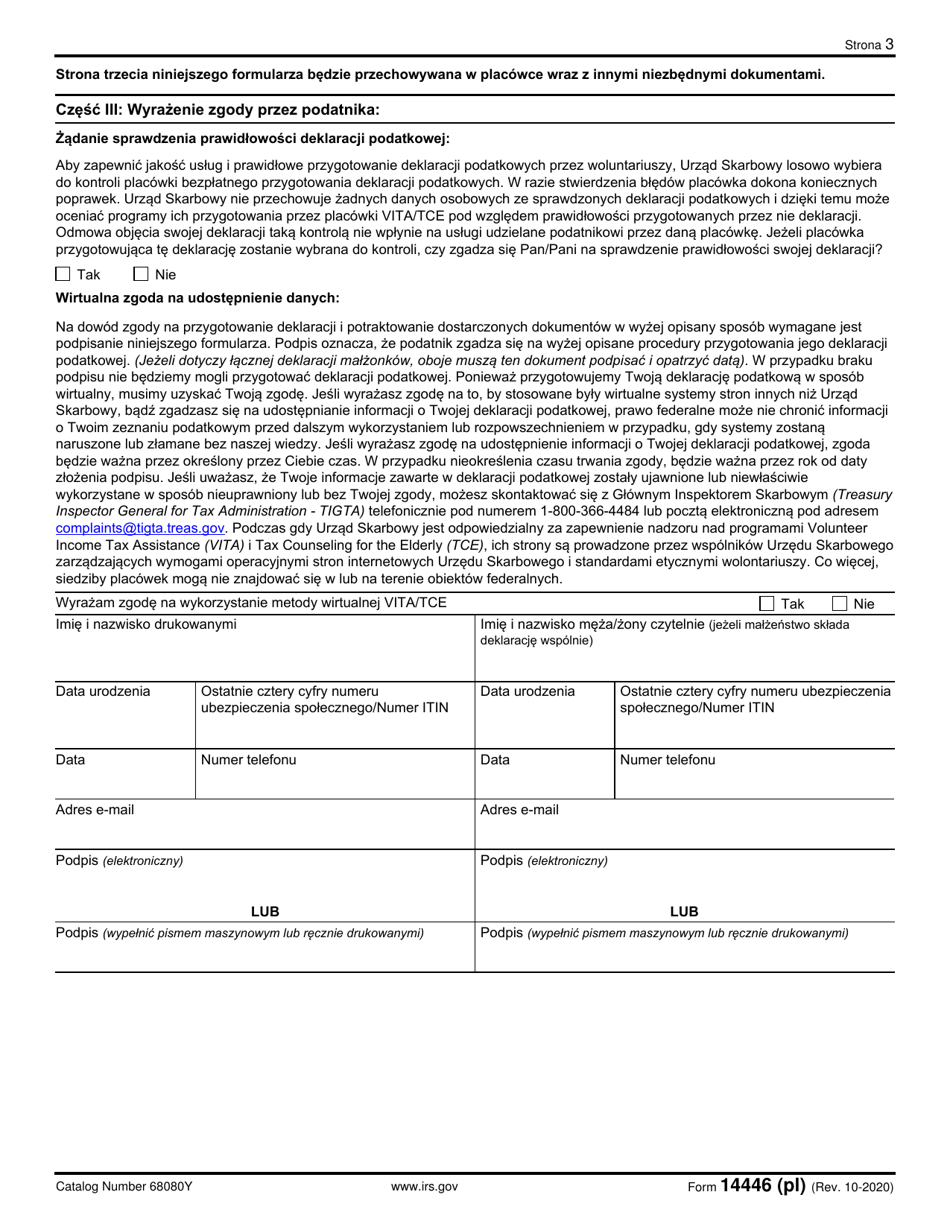

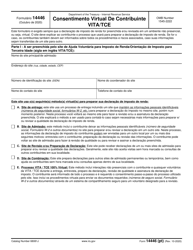

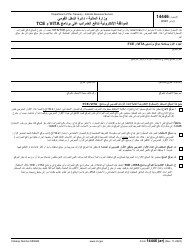

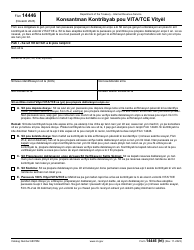

IRS Form 14446 (PL) Virtual Vita / Tce Taxpayer Consent (Polish)

IRS Form 14446 (PL) Virtual Vita/Tce Taxpayer Consent (Polish) is used to obtain the taxpayer's consent to participate in the Virtual VITA/TCE tax preparation program. It allows volunteers to prepare their tax returns remotely using online technology.

FAQ

Q: What is IRS Form 14446 (PL)?

A: IRS Form 14446 (PL) is a consent form for Polish-speaking taxpayers to authorize a virtual VITA/TCE tax preparation service.

Q: What is VITA?

A: VITA stands for Volunteer Income Tax Assistance, which is a program that offers free tax help to taxpayers who generally make $57,000 or less, persons with disabilities, and limited English-speaking taxpayers.

Q: What is TCE?

A: TCE stands for Tax Counseling for the Elderly, which is a program that specializes in assisting taxpayers age 60 and older with their tax returns.

Q: Who needs to fill out IRS Form 14446 (PL)?

A: Polish-speaking taxpayers who want to use the virtual VITA/TCE tax preparation service need to fill out IRS Form 14446 (PL).

Q: What does IRS Form 14446 (PL) authorize?

A: IRS Form 14446 (PL) authorizes the virtual VITA/TCE tax preparation service to prepare and file the taxpayer's tax return on their behalf.

Q: Is IRS Form 14446 (PL) available in English?

A: No, IRS Form 14446 (PL) is specifically designed for Polish-speaking taxpayers and is only available in Polish.

Q: Can I use IRS Form 14446 (PL) if I don't speak Polish?

A: No, IRS Form 14446 (PL) is only for Polish-speaking taxpayers. If you don't speak Polish, you can use the English version of the form or seek assistance from an English-speaking VITA/TCE site.