This version of the form is not currently in use and is provided for reference only. Download this version of

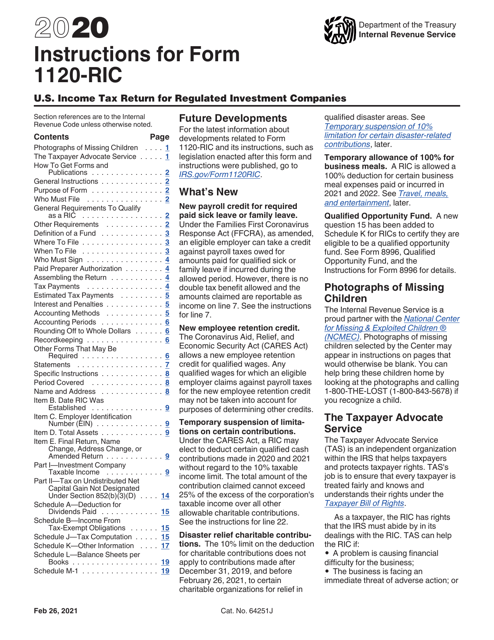

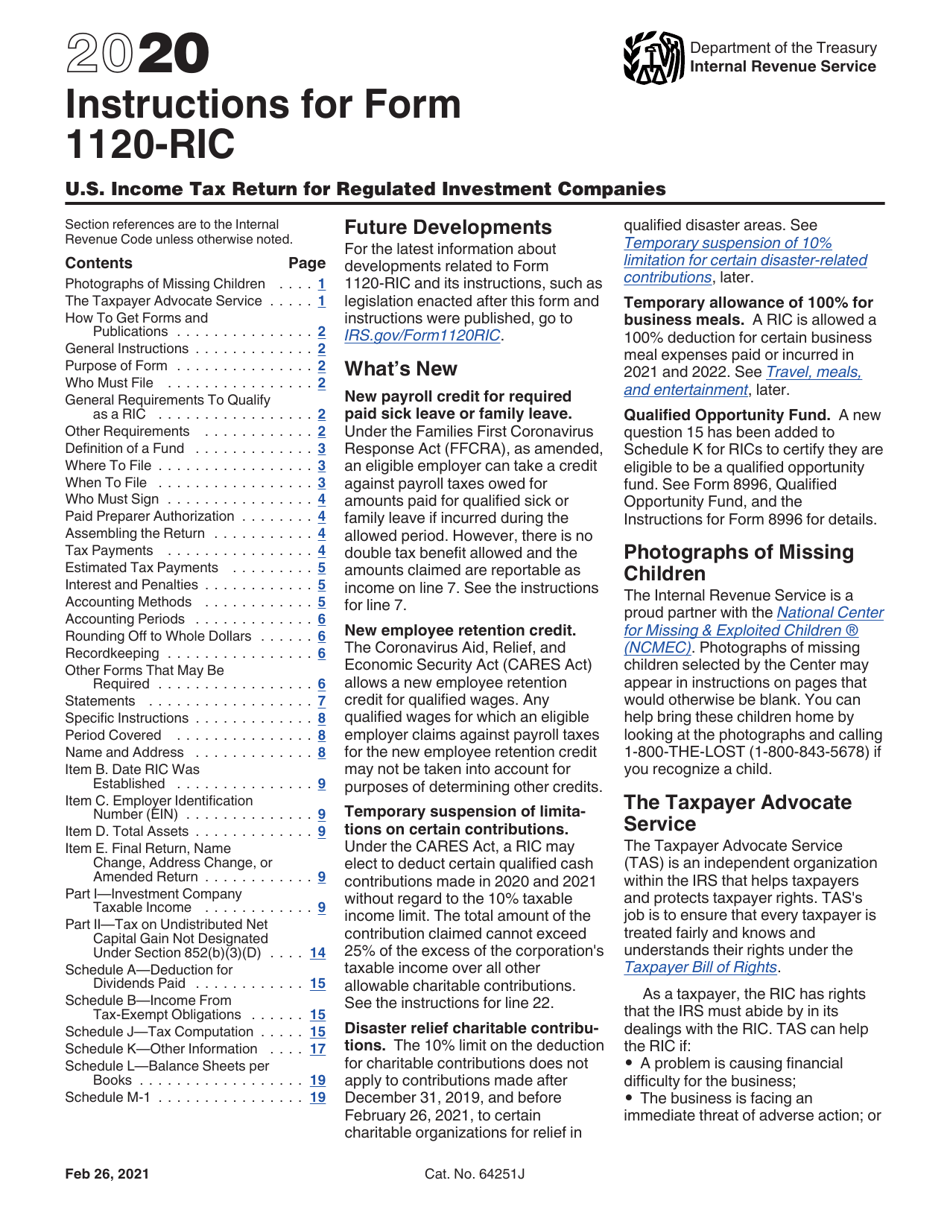

Instructions for IRS Form 1120-RIC

for the current year.

Instructions for IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

This document contains official instructions for IRS Form 1120-RIC , U.S. Income Tax Return for Regulated Investment Companies - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-RIC is available for download through this link.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return for Regulated Investment Companies.

Q: Who needs to file IRS Form 1120-RIC?

A: Regulated Investment Companies (RICs) need to file IRS Form 1120-RIC.

Q: What is the purpose of IRS Form 1120-RIC?

A: The purpose of IRS Form 1120-RIC is to report income, deductions, gains, losses, credits, and to calculate and pay taxes for RICs.

Q: When is the deadline to file IRS Form 1120-RIC?

A: The deadline to file IRS Form 1120-RIC is generally the 15th day of the 3rd month after the end of the tax year.

Q: Are there any penalties for late filing of IRS Form 1120-RIC?

A: Yes, there are penalties for late filing of IRS Form 1120-RIC. It is important to file the form on time to avoid penalties.

Q: Are there any special requirements for filling out IRS Form 1120-RIC?

A: Yes, there are specific requirements for filling out IRS Form 1120-RIC. It is recommended to refer to the instructions provided by the IRS.

Q: Can I file IRS Form 1120-RIC electronically?

A: Yes, you can file IRS Form 1120-RIC electronically. The IRS provides electronic filing options for various tax forms, including Form 1120-RIC.

Q: Do I need to attach any documents with IRS Form 1120-RIC?

A: Generally, you need to attach certain schedules and supporting documents with IRS Form 1120-RIC. It is important to review the instructions to determine the specific requirements.

Q: What should I do if I need help with IRS Form 1120-RIC?

A: If you need help with IRS Form 1120-RIC, you can consult a tax professional or contact the IRS for assistance.

Instruction Details:

- This 20-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.