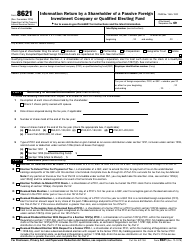

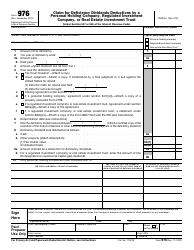

This version of the form is not currently in use and is provided for reference only. Download this version of

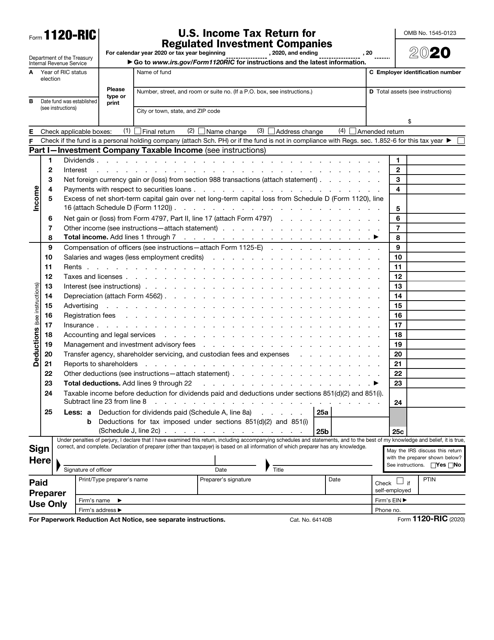

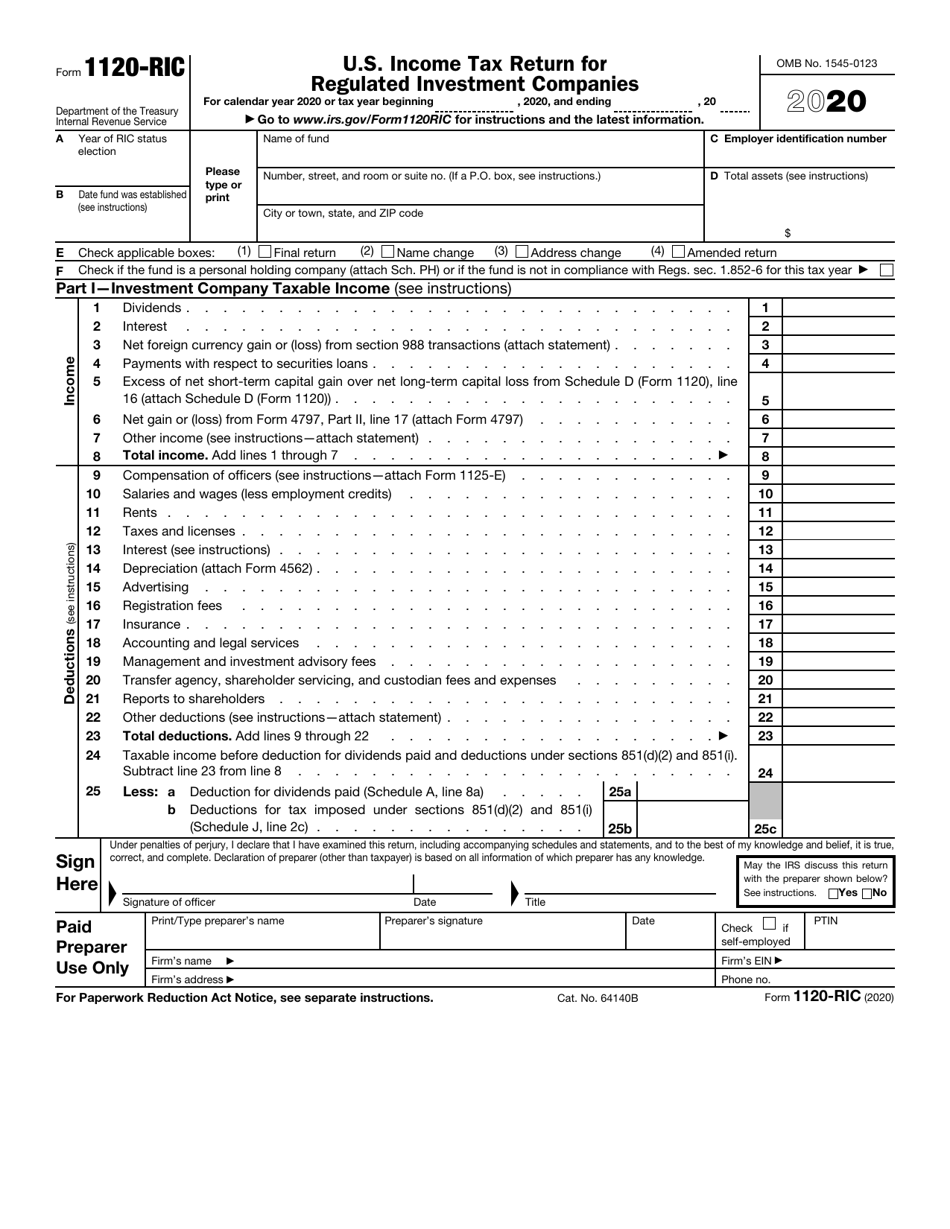

IRS Form 1120-RIC

for the current year.

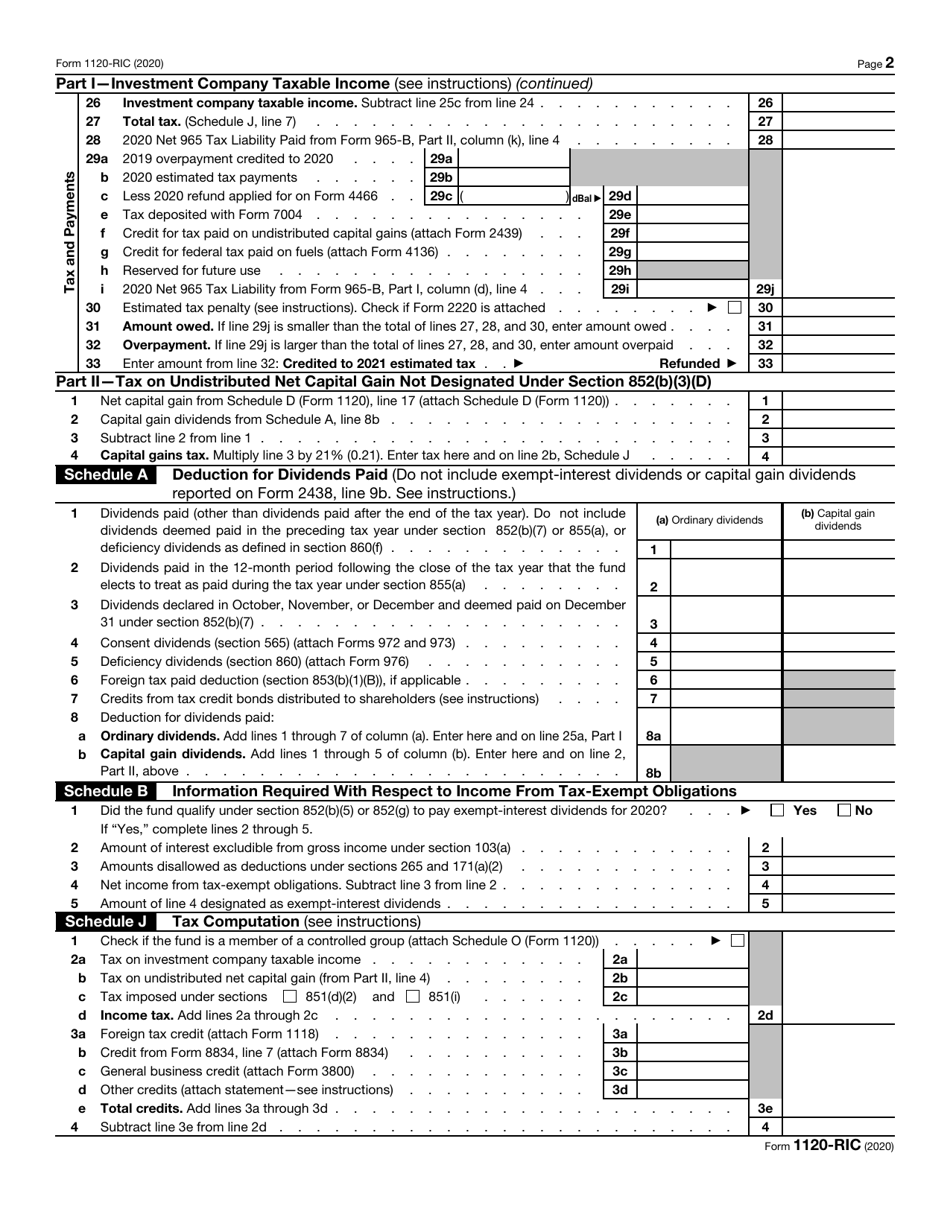

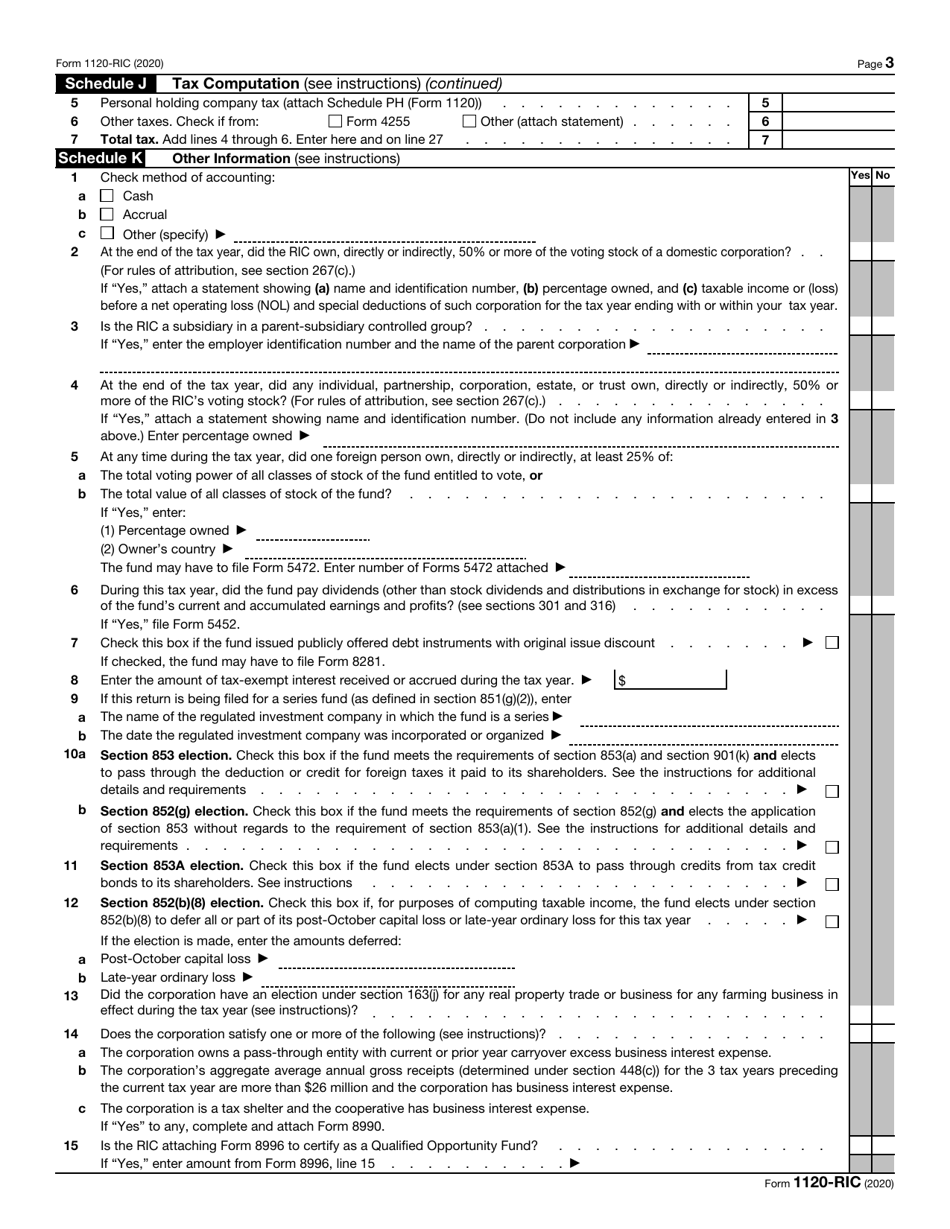

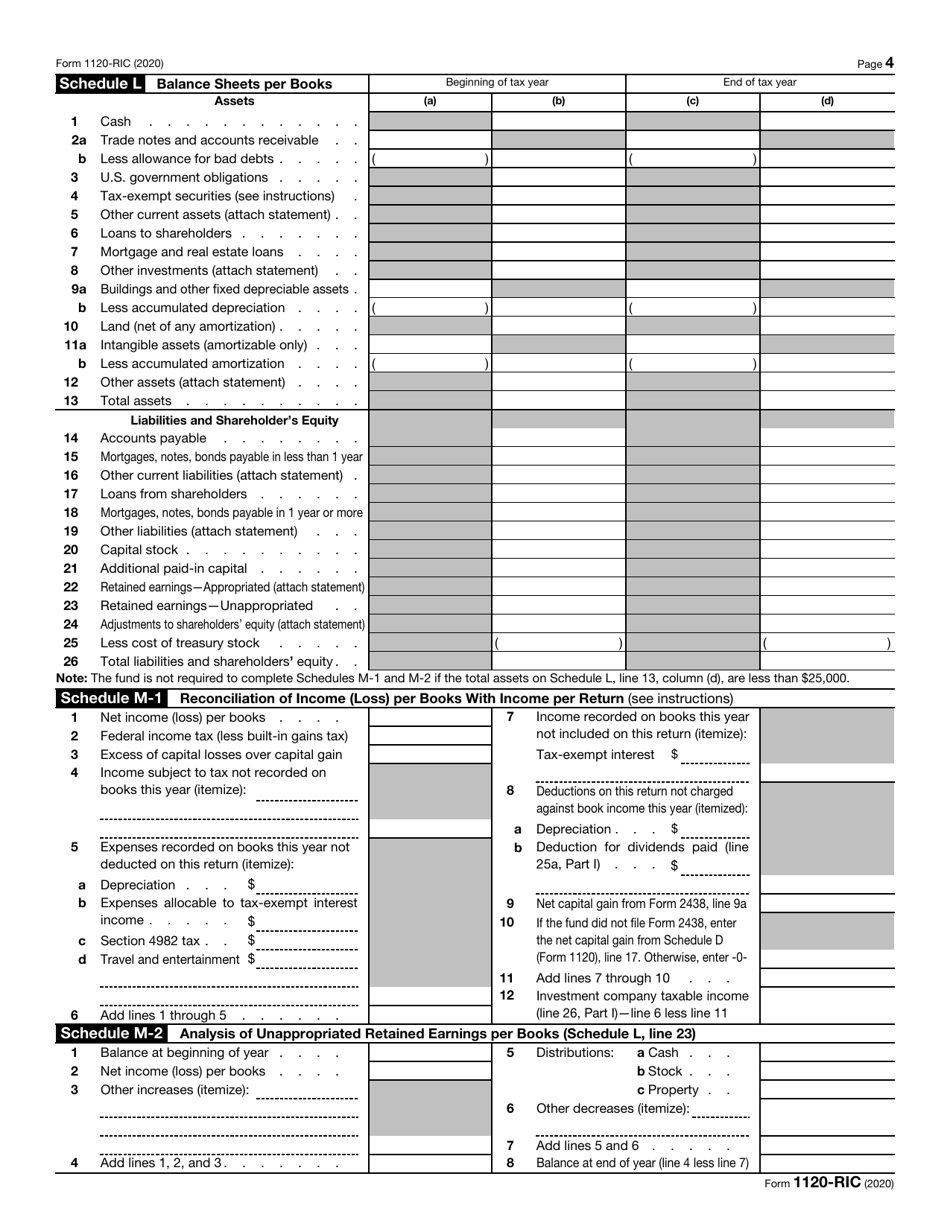

IRS Form 1120-RIC U.S. Income Tax Return for Regulated Investment Companies

What Is IRS Form 1120-RIC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-RIC?

A: IRS Form 1120-RIC is the U.S. Income Tax Return specifically for Regulated Investment Companies.

Q: Who needs to file IRS Form 1120-RIC?

A: Regulated Investment Companies (RICs) are required to file IRS Form 1120-RIC.

Q: What is a Regulated Investment Company (RIC)?

A: A Regulated Investment Company (RIC) is a type of investment company that meets certain requirements and elects to be treated as such for tax purposes.

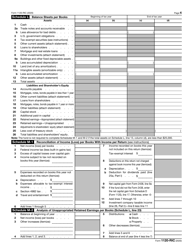

Q: What information is required on IRS Form 1120-RIC?

A: IRS Form 1120-RIC requires information about the RIC's income, deductions, credits, and other relevant financial information.

Q: When is the deadline to file IRS Form 1120-RIC?

A: The deadline to file IRS Form 1120-RIC is generally the 15th day of the 3rd month following the end of the RIC's tax year.

Q: Can IRS Form 1120-RIC be filed electronically?

A: Yes, IRS Form 1120-RIC can be filed electronically using the IRS e-file system.

Q: Are there any penalties for late filing or non-filing of IRS Form 1120-RIC?

A: Yes, there are penalties for late filing or non-filing of IRS Form 1120-RIC. It is important to file the form on time to avoid penalties.

Q: Can I seek professional help to file IRS Form 1120-RIC?

A: Yes, you can seek the assistance of a tax professional to help you file IRS Form 1120-RIC accurately and efficiently.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-RIC through the link below or browse more documents in our library of IRS Forms.