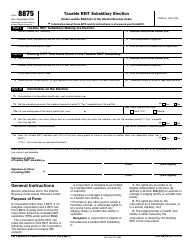

This version of the form is not currently in use and is provided for reference only. Download this version of

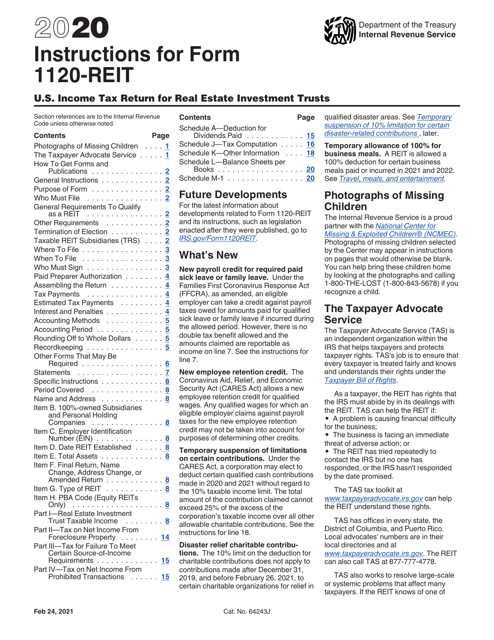

Instructions for IRS Form 1120-REIT

for the current year.

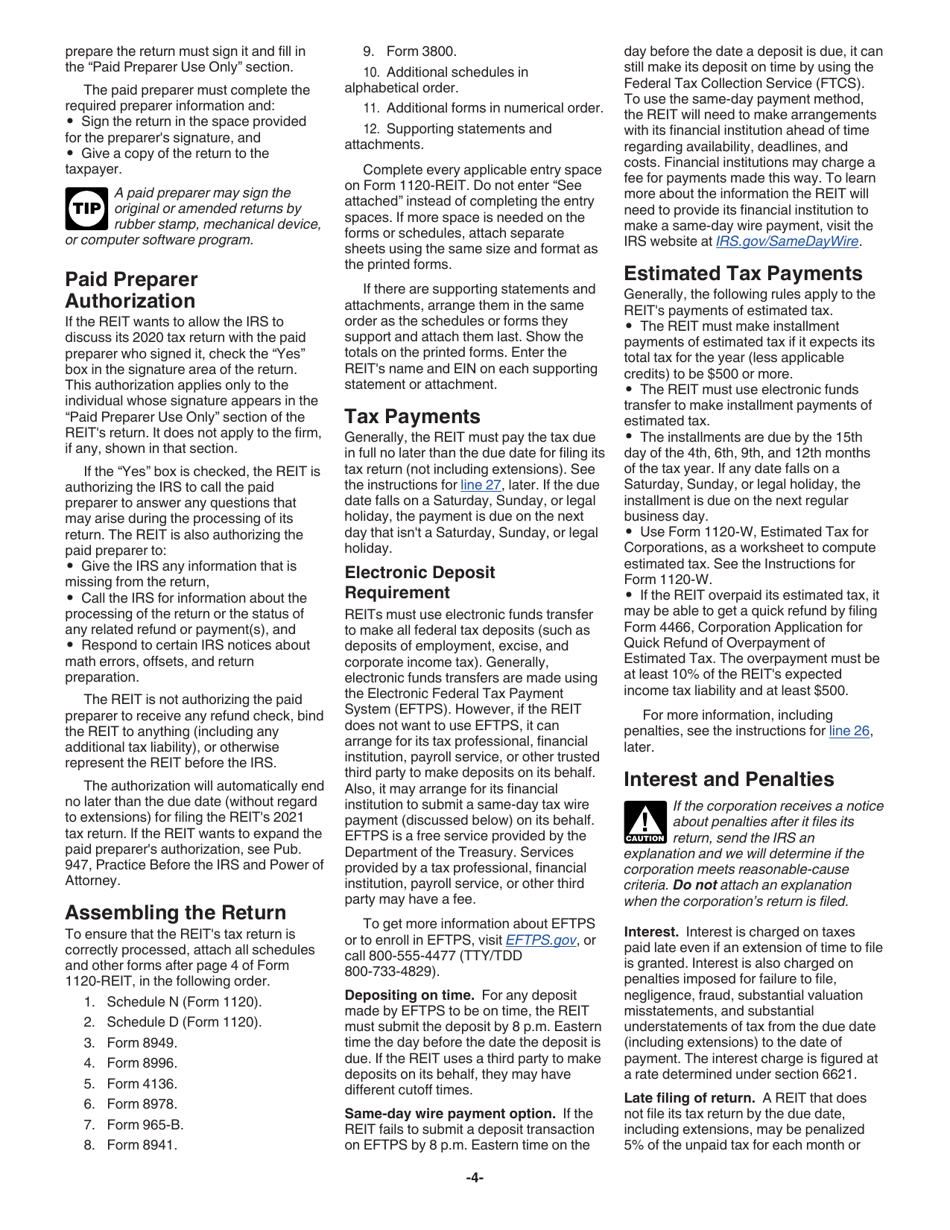

Instructions for IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

This document contains official instructions for IRS Form 1120-REIT , U.S. Income Tax Return for Real Estate Investment Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-REIT is available for download through this link.

FAQ

Q: What is IRS Form 1120-REIT?

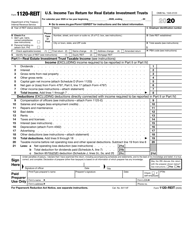

A: IRS Form 1120-REIT is the U.S. Income Tax Return specifically for Real Estate Investment Trusts (REITs).

Q: Who needs to file IRS Form 1120-REIT?

A: REITs are required to file Form 1120-REIT to report their income and expenses to the Internal Revenue Service (IRS).

Q: What information do I need to complete IRS Form 1120-REIT?

A: You will need information about the REIT's income, deductions, and other related financial information.

Q: When is the deadline to file IRS Form 1120-REIT?

A: The deadline to file IRS Form 1120-REIT is generally on the 15th day of the 3rd month after the end of the REIT's tax year.

Q: Are there any penalties for not filing IRS Form 1120-REIT?

A: Yes, failure to file or late filing of Form 1120-REIT may result in penalties and interest charges.

Q: Can Form 1120-REIT be filed electronically?

A: Yes, electronic filing is allowed for Form 1120-REIT.

Q: Are there any special tax rules for REITs?

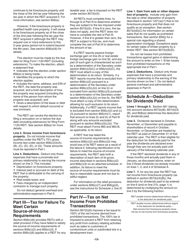

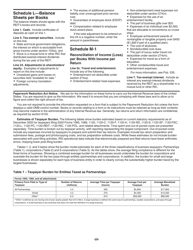

A: Yes, REITs have specific tax rules and requirements that differ from regular corporations.

Q: Can I get an extension to file IRS Form 1120-REIT?

A: Yes, you may be able to request an extension of time to file Form 1120-REIT, but you must meet certain requirements.

Q: Do I need to attach any additional forms with IRS Form 1120-REIT?

A: Yes, depending on the REIT's specific circumstances, you may need to attach additional forms or schedules to Form 1120-REIT.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.