This version of the form is not currently in use and is provided for reference only. Download this version of

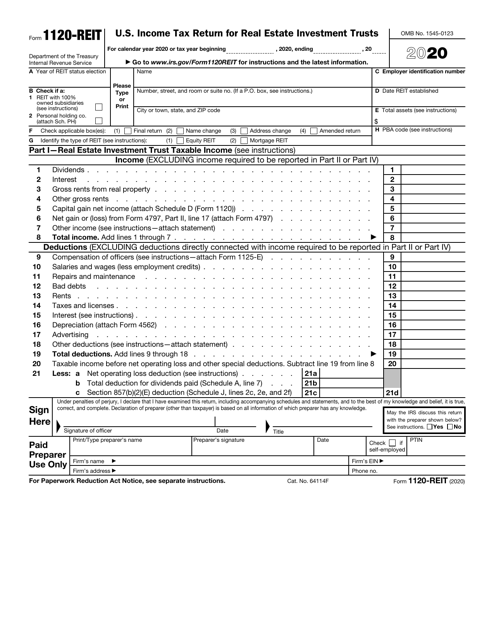

IRS Form 1120-REIT

for the current year.

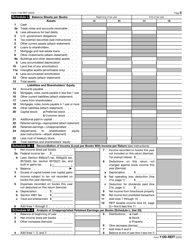

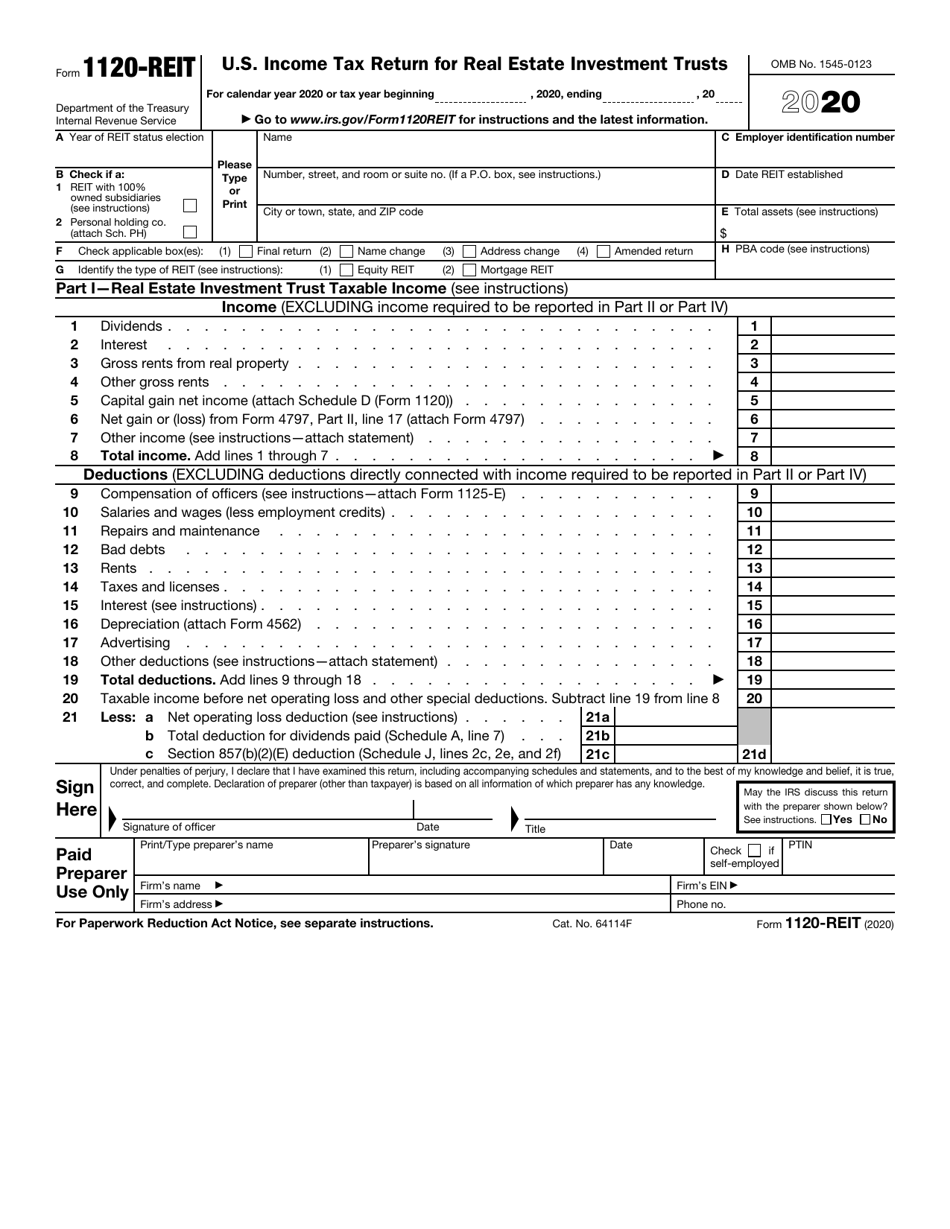

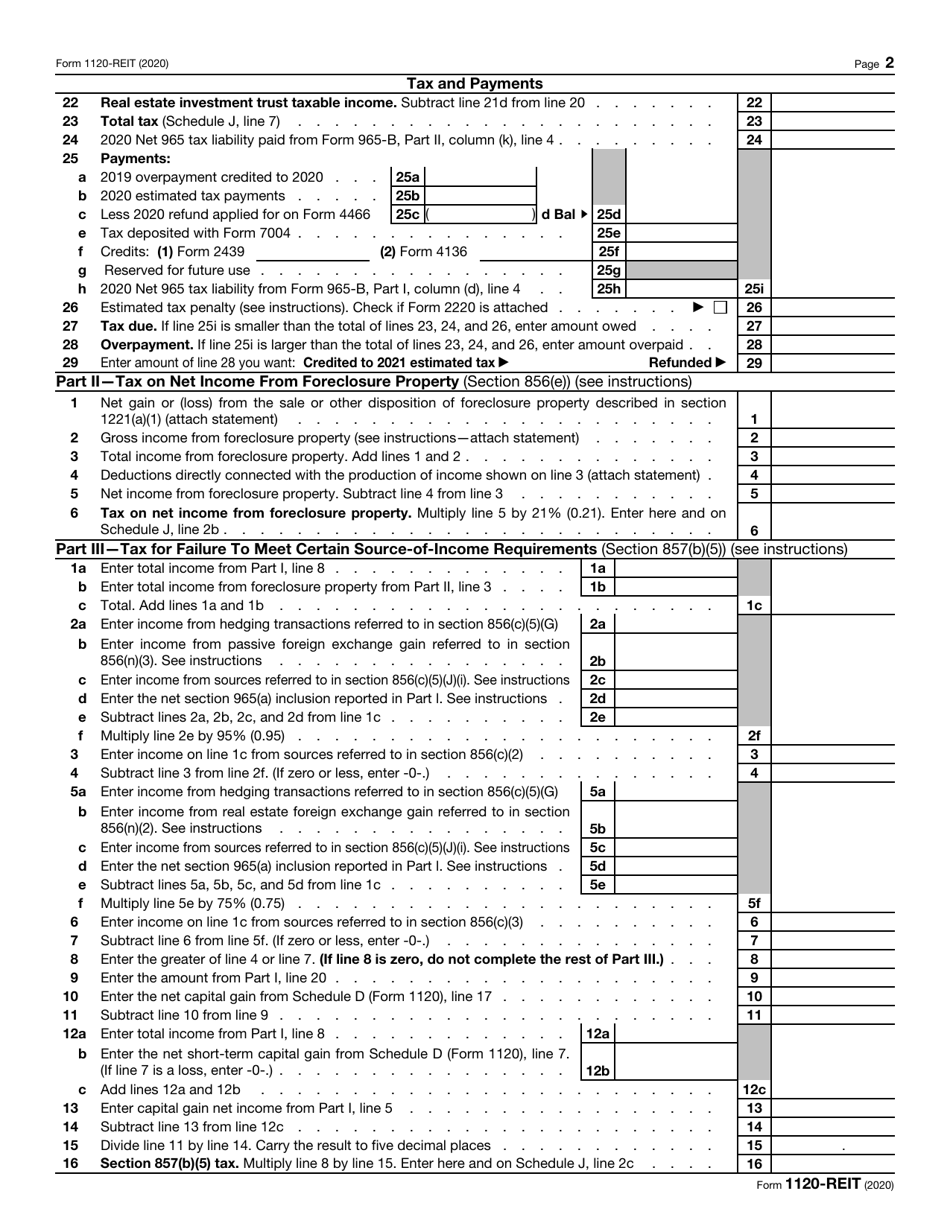

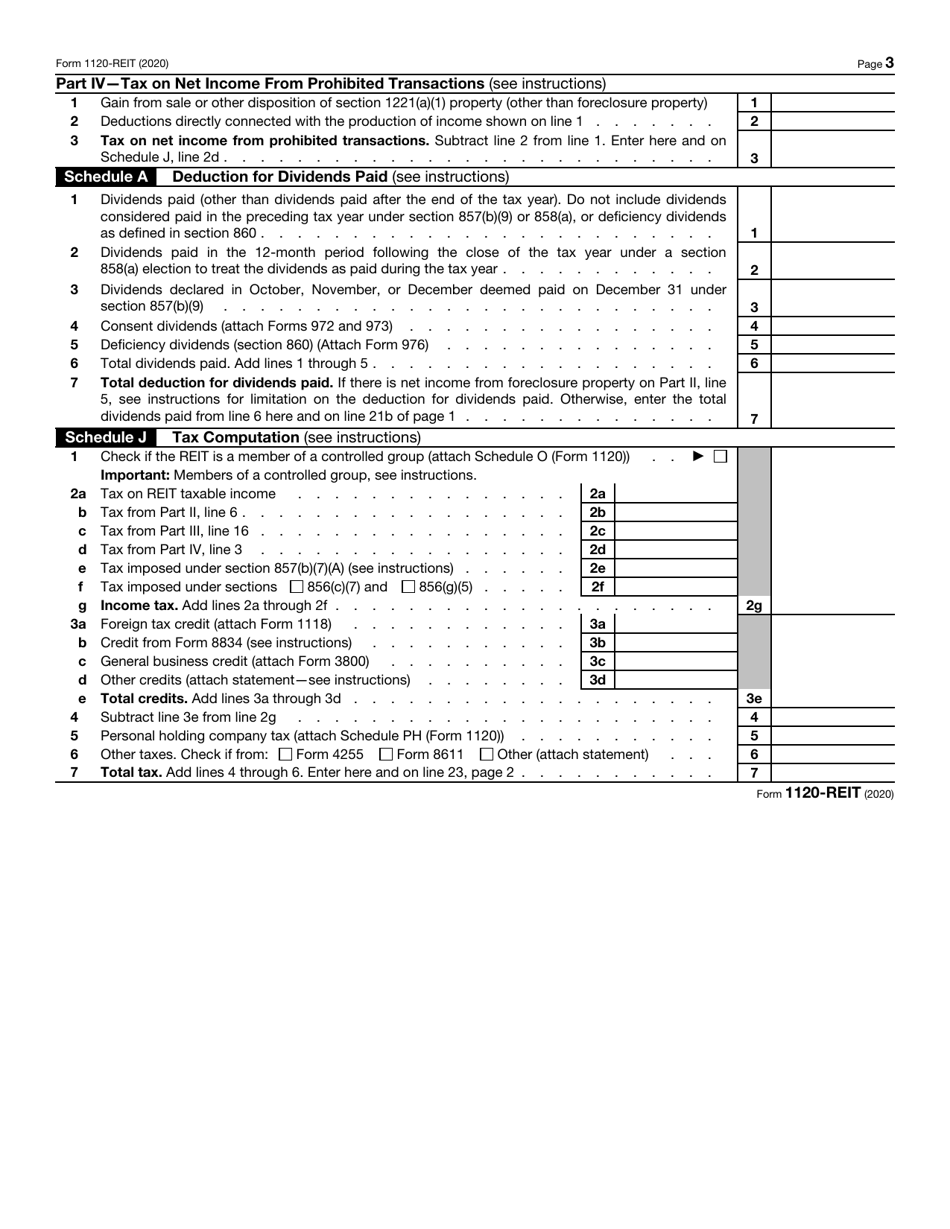

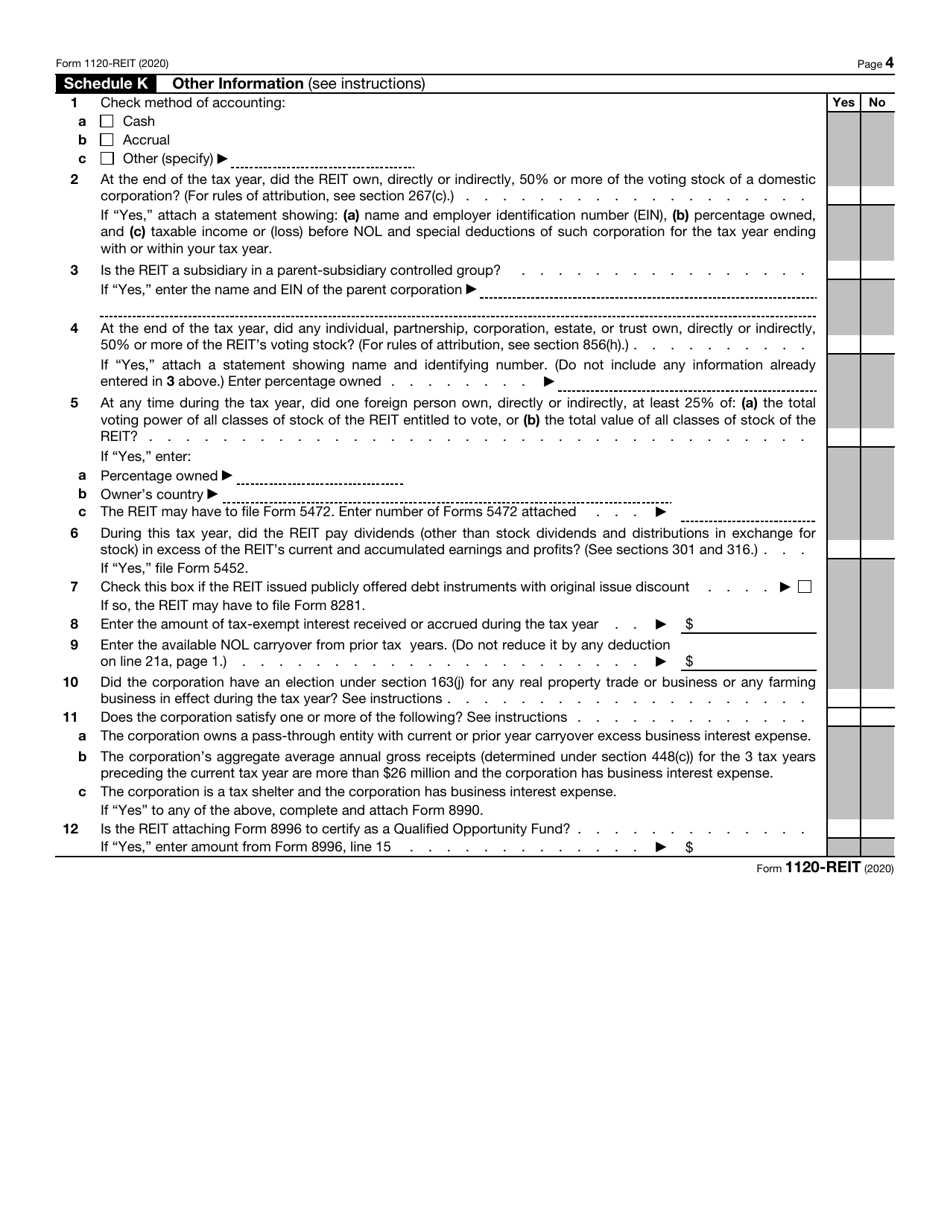

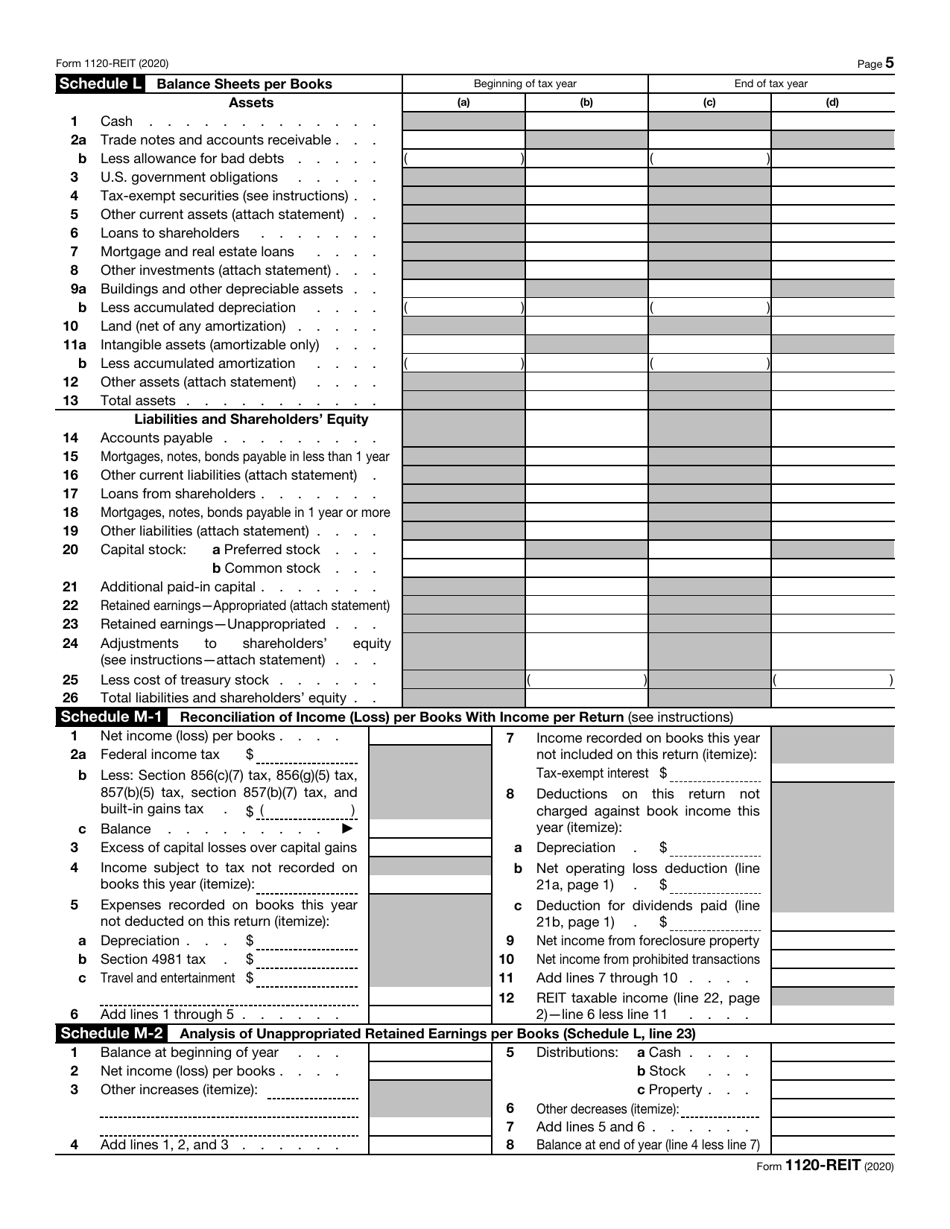

IRS Form 1120-REIT U.S. Income Tax Return for Real Estate Investment Trusts

What Is IRS Form 1120-REIT?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-REIT?

A: IRS Form 1120-REIT is the U.S. Income Tax Return form specifically designed for Real Estate Investment Trusts (REITs).

Q: Who needs to file IRS Form 1120-REIT?

A: REITs, which are certain types of companies that invest in real estate, need to file IRS Form 1120-REIT.

Q: What is the purpose of IRS Form 1120-REIT?

A: The purpose of IRS Form 1120-REIT is to report the income, deductions, and other information of a REIT to the Internal Revenue Service (IRS).

Q: When is the deadline to file IRS Form 1120-REIT?

A: The deadline to file IRS Form 1120-REIT is generally the 15th day of the 3rd month following the end of the REIT's tax year.

Q: Are there any penalties for not filing IRS Form 1120-REIT?

A: Yes, there can be penalties for not filing IRS Form 1120-REIT, including late filing penalties and potential interest on unpaid taxes.

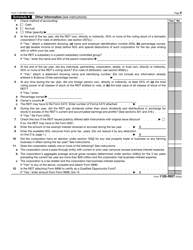

Q: Do I need to attach any documents to IRS Form 1120-REIT?

A: Yes, you may need to attach certain schedules and supporting documents to IRS Form 1120-REIT, depending on your specific situation.

Form Details:

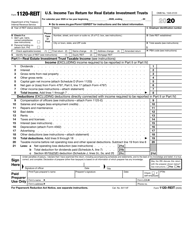

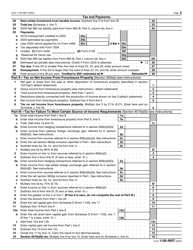

- A 5-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-REIT through the link below or browse more documents in our library of IRS Forms.