This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-T

for the current year.

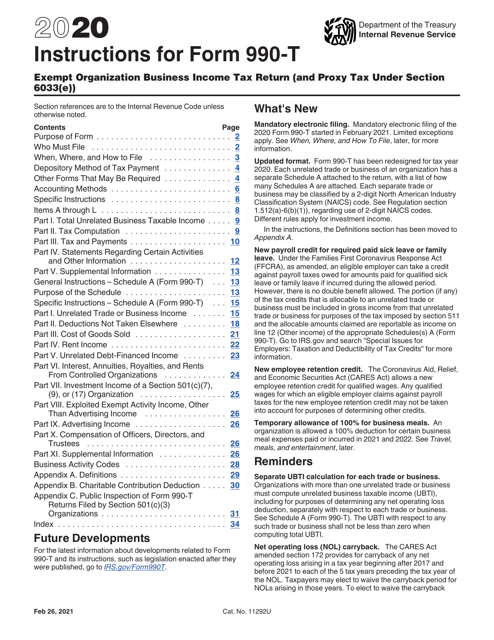

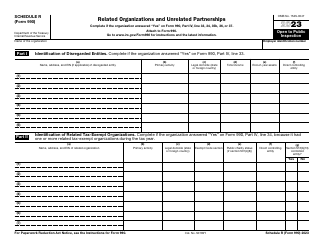

Instructions for IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

This document contains official instructions for IRS Form 990-T , Exempt Organization Proxy Tax Under Section 6033(E)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-T Schedule A is available for download through this link.

FAQ

Q: What is Form 990-T?

A: Form 990-T is the Exempt Organization Business Income Tax Return.

Q: Who needs to file Form 990-T?

A: Exempt organizations that have unrelated business income need to file Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income refers to income generated by an exempt organization from a trade or business that is not substantially related to its tax-exempt purpose.

Q: What is the purpose of Form 990-T?

A: The purpose of Form 990-T is to calculate and report the tax on unrelated business income.

Q: What is proxy tax under Section 6033(e)?

A: Proxy tax under Section 6033(e) refers to the tax imposed on certain tax-exempt organizations that spend money on lobbying activities.

Q: Am I required to pay proxy tax?

A: If your tax-exempt organization spends money on lobbying activities, you may be required to pay proxy tax.

Q: How do I fill out Form 990-T?

A: To fill out Form 990-T, you will need to provide information about your organization's unrelated business income and calculate the tax due.

Q: When is Form 990-T due?

A: Form 990-T is due by the 15th day of the 5th month after the end of your organization's tax year.

Q: What happens if I don't file Form 990-T?

A: Failure to file Form 990-T or to pay the tax due may result in penalties and interest charges imposed by the IRS.

Instruction Details:

- This 35-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.