This version of the form is not currently in use and is provided for reference only. Download this version of

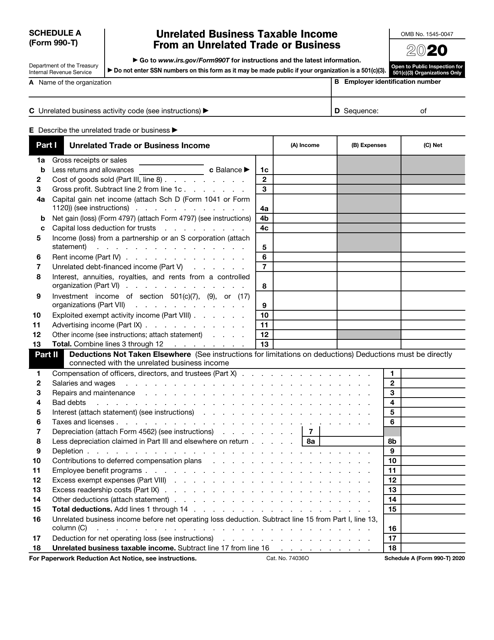

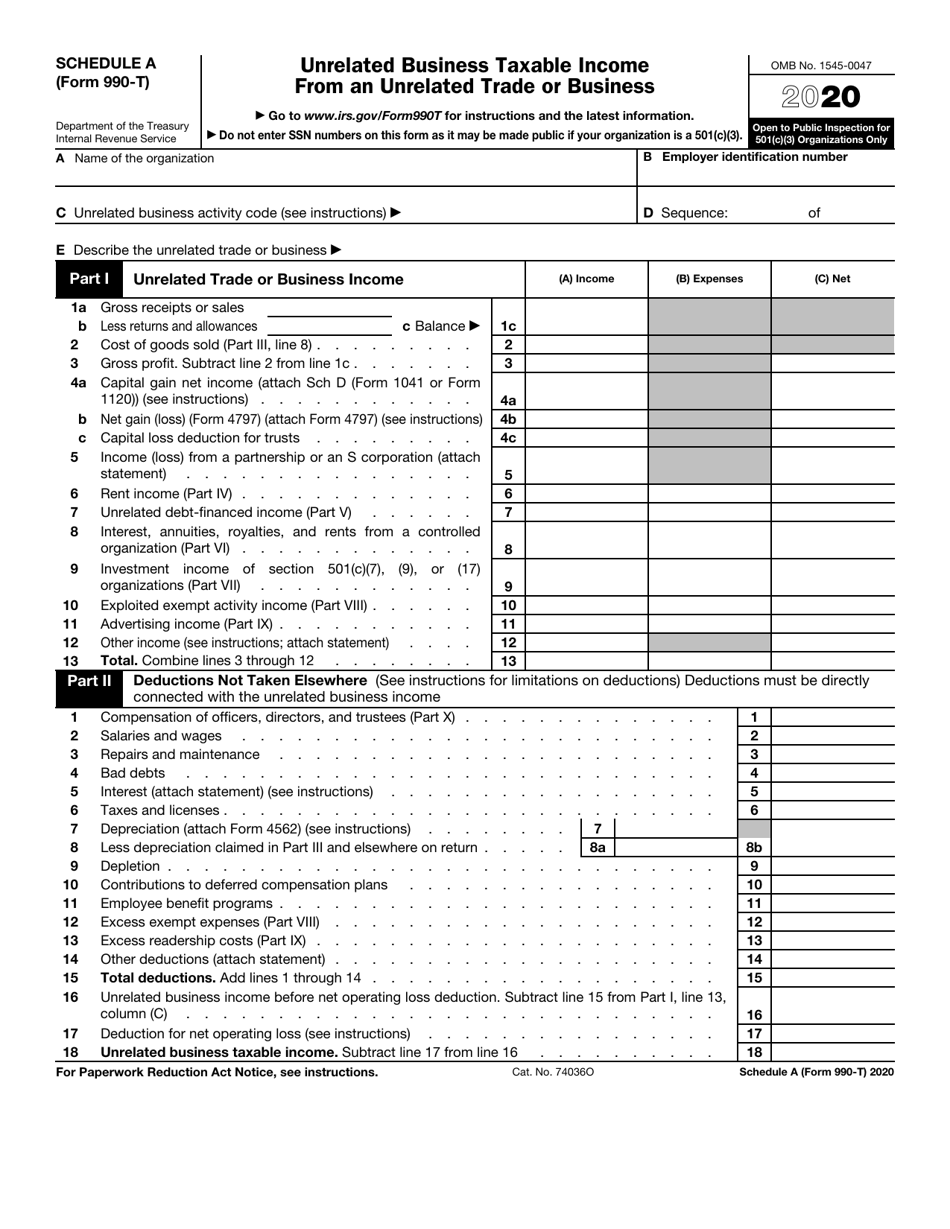

IRS Form 990-T Schedule A

for the current year.

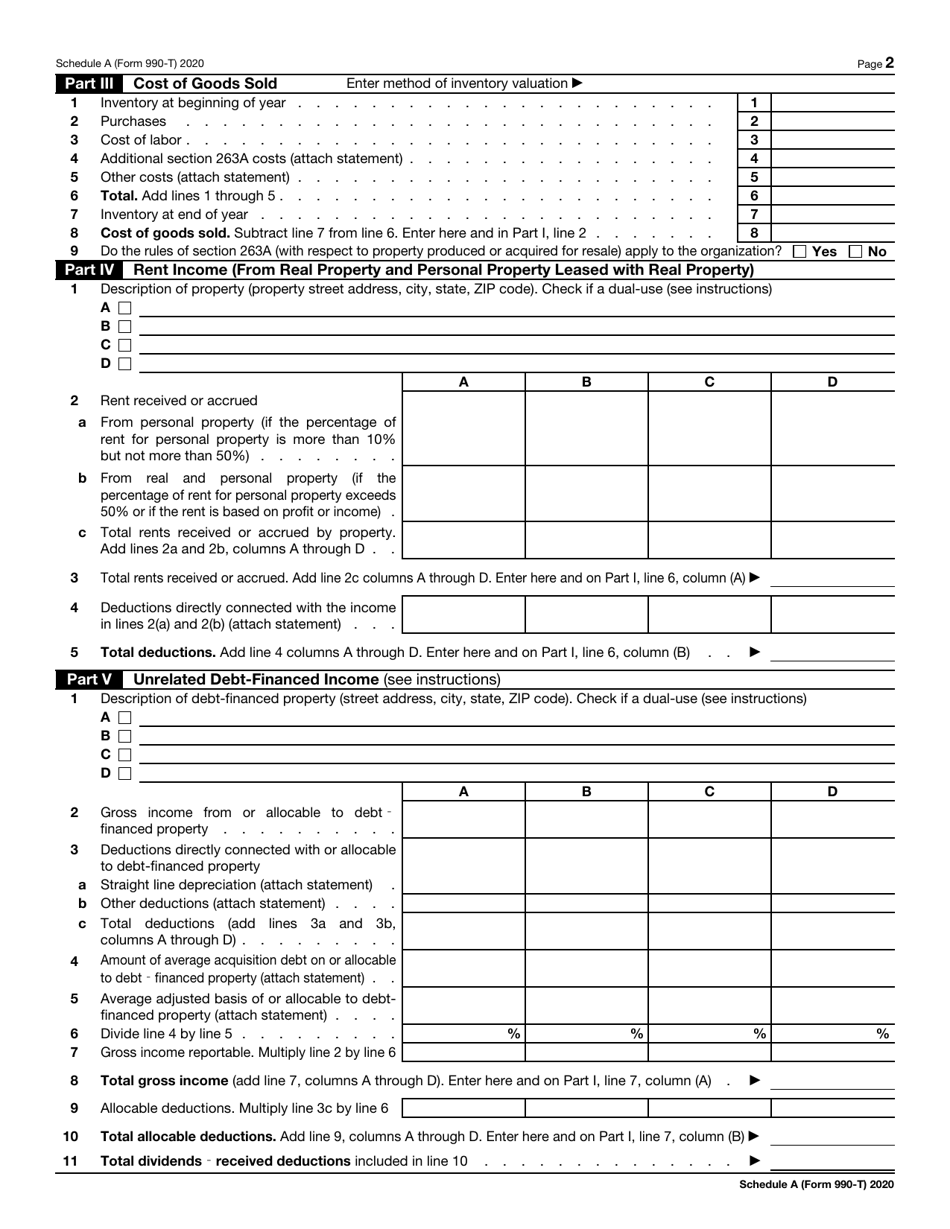

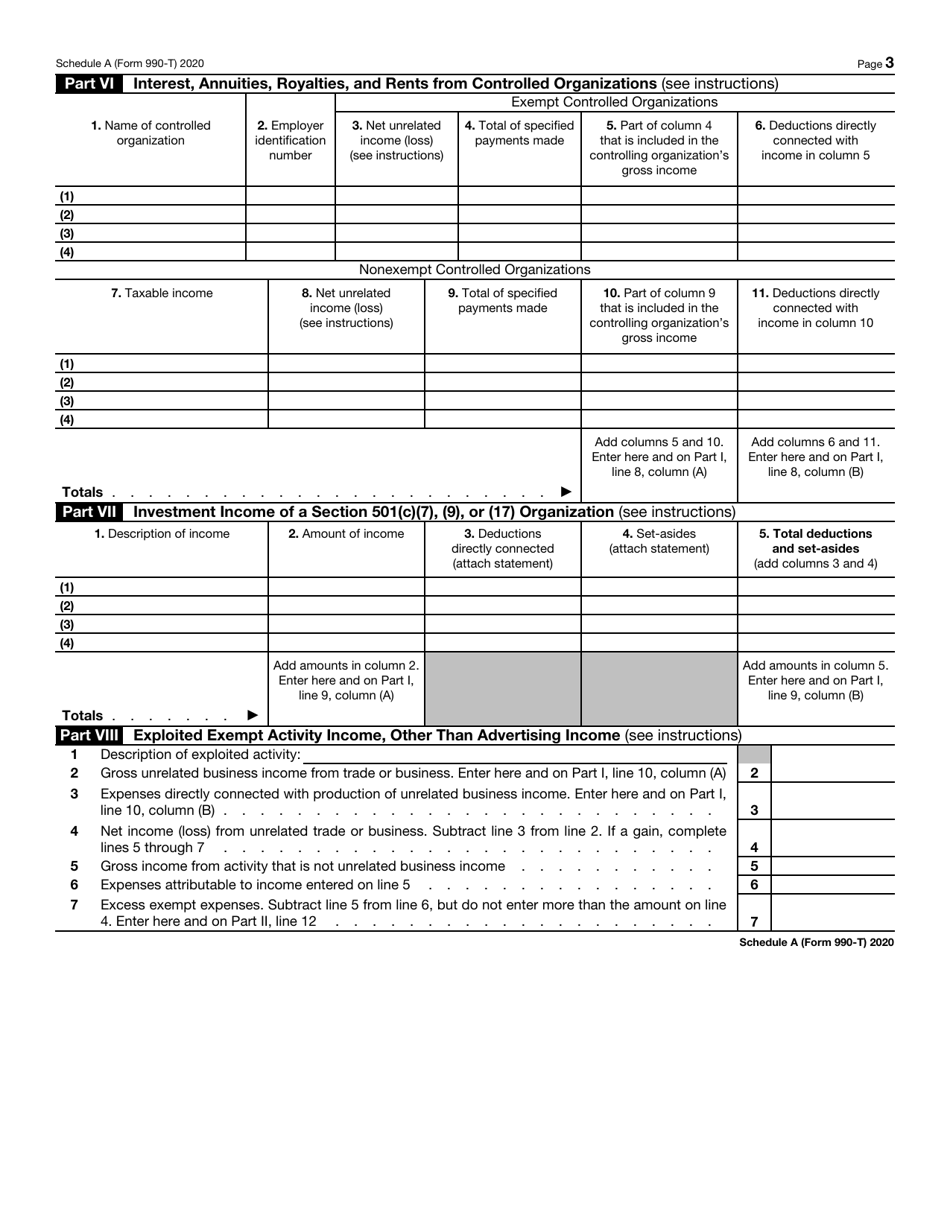

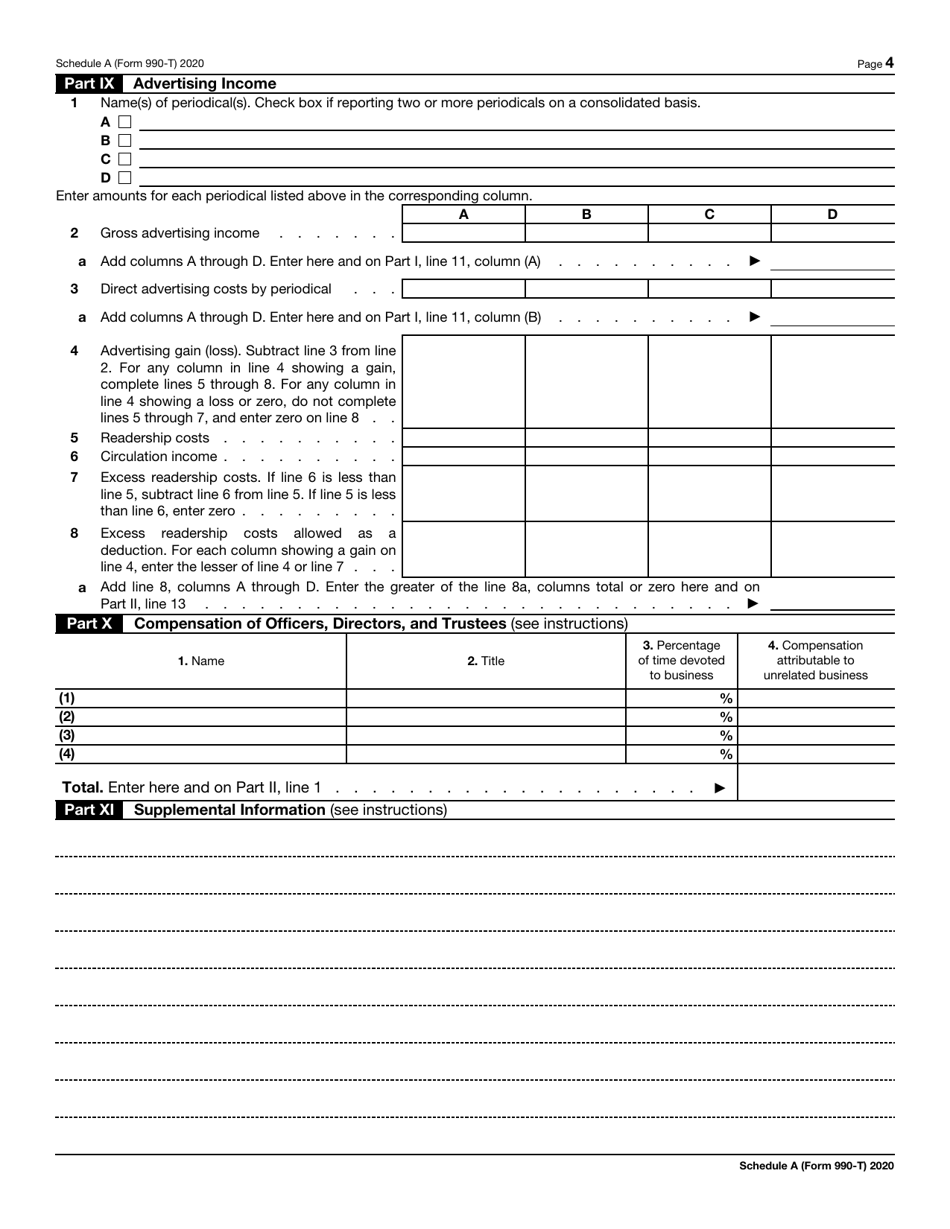

IRS Form 990-T Schedule A Unrelated Business Taxable Income From an Unrelated Trade or Business

What Is IRS Form 990-T Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990-T, Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E)). As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is a tax form used by tax-exempt organizations to report their unrelated business taxable income.

Q: What is Schedule A of Form 990-T?

A: Schedule A is a section of Form 990-T where tax-exempt organizations report their unrelated business taxable income from an unrelated trade or business.

Q: What is unrelated business taxable income?

A: Unrelated business taxable income is income generated by a tax-exempt organization through a trade or business that is not related to its exempt purpose.

Q: Why do tax-exempt organizations need to report unrelated business taxable income?

A: Tax-exempt organizations need to report unrelated business taxable income to comply with tax laws and determine if they owe any unrelated business income tax.

Q: What is an unrelated trade or business?

A: An unrelated trade or business is a trade or business activity conducted by a tax-exempt organization that is not substantially related to its exempt purpose.

Q: What information is required on Schedule A of Form 990-T?

A: Schedule A of Form 990-T requires information about the tax-exempt organization, details of the unrelated trade or business, and the calculation of unrelated business taxable income.

Q: Are there any exemptions to the unrelated business income tax?

A: There are certain exemptions and exceptions to the unrelated business income tax. Organizations should consult the IRS guidelines or a tax professional for specific details.

Q: When is Form 990-T Schedule A due?

A: Form 990-T, including Schedule A, is generally due on the 15th day of the 5th month after the end of the organization's tax year.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-T Schedule A through the link below or browse more documents in our library of IRS Forms.