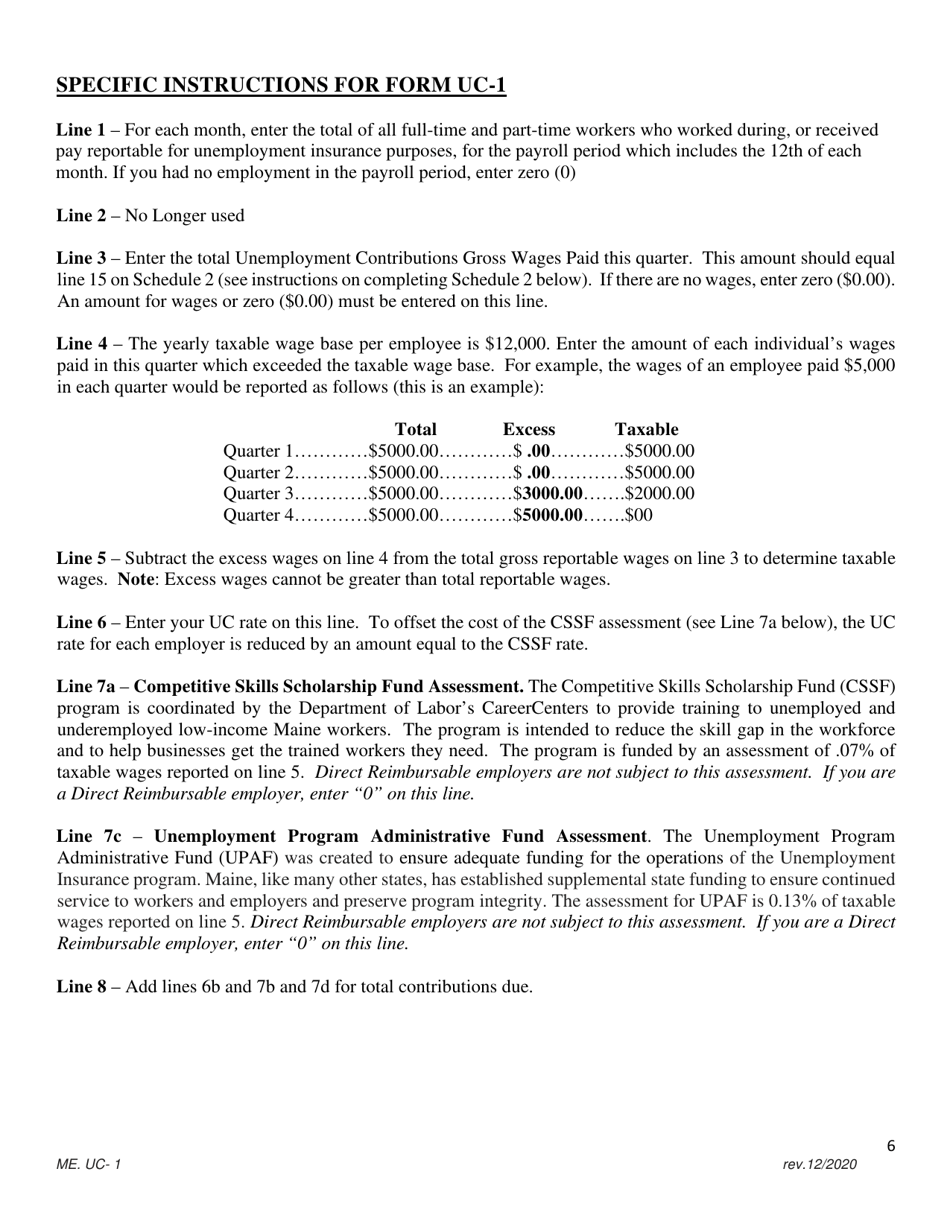

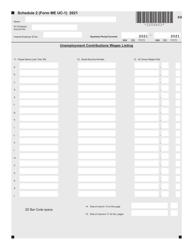

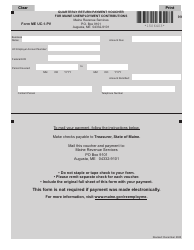

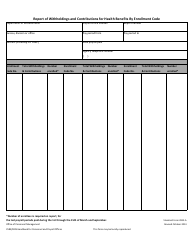

Instructions for Form ME UC-1 Unemployment Contributions Quarterly Report - Maine

This document contains official instructions for Form ME UC-1 , Unemployment Contributions Quarterly Report - a form released and collected by the Maine Department of Labor. An up-to-date fillable Form ME UC-1 is available for download through this link.

FAQ

Q: What is Form ME UC-1?

A: Form ME UC-1 is the Unemployment Contributions Quarterly Report in Maine.

Q: Who needs to file Form ME UC-1?

A: Employers who have employees in Maine and are subject to unemployment compensation contributions must file Form ME UC-1.

Q: What is the purpose of Form ME UC-1?

A: The purpose of Form ME UC-1 is to report the quarterly unemployment compensation contributions owed by employers in Maine.

Q: When is the deadline to file Form ME UC-1?

A: Form ME UC-1 must be filed on a quarterly basis. The deadlines are April 30th, July 31st, October 31st, and January 31st.

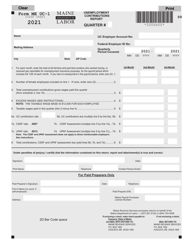

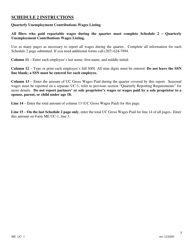

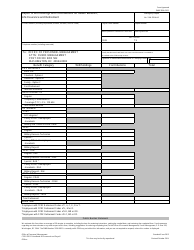

Q: What information is required on Form ME UC-1?

A: Form ME UC-1 requires information such as employer identification numbers, total wages paid to employees, and unemployment compensation contributions owed.

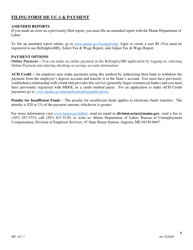

Q: Are there any penalties for late filing of Form ME UC-1?

A: Yes, there are penalties for late filing of Form ME UC-1. The penalties can range from fines to interest charges.

Q: Is it mandatory to file Form ME UC-1 even if there are no wages paid during the quarter?

A: Yes, it is mandatory to file Form ME UC-1 even if no wages were paid during the quarter. A zero report must be filed.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Department of Labor.