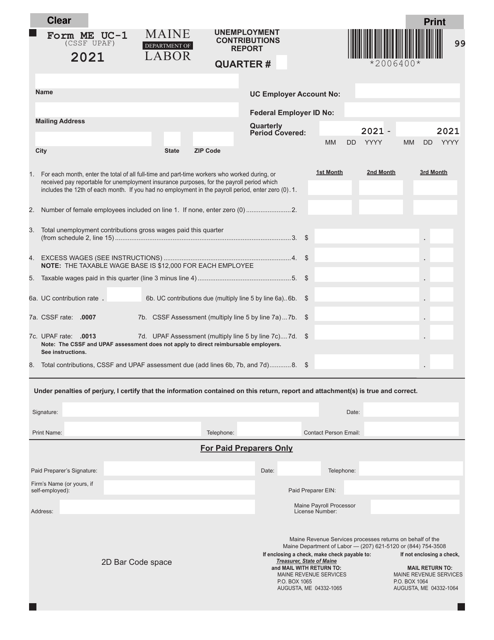

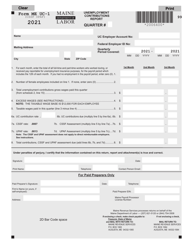

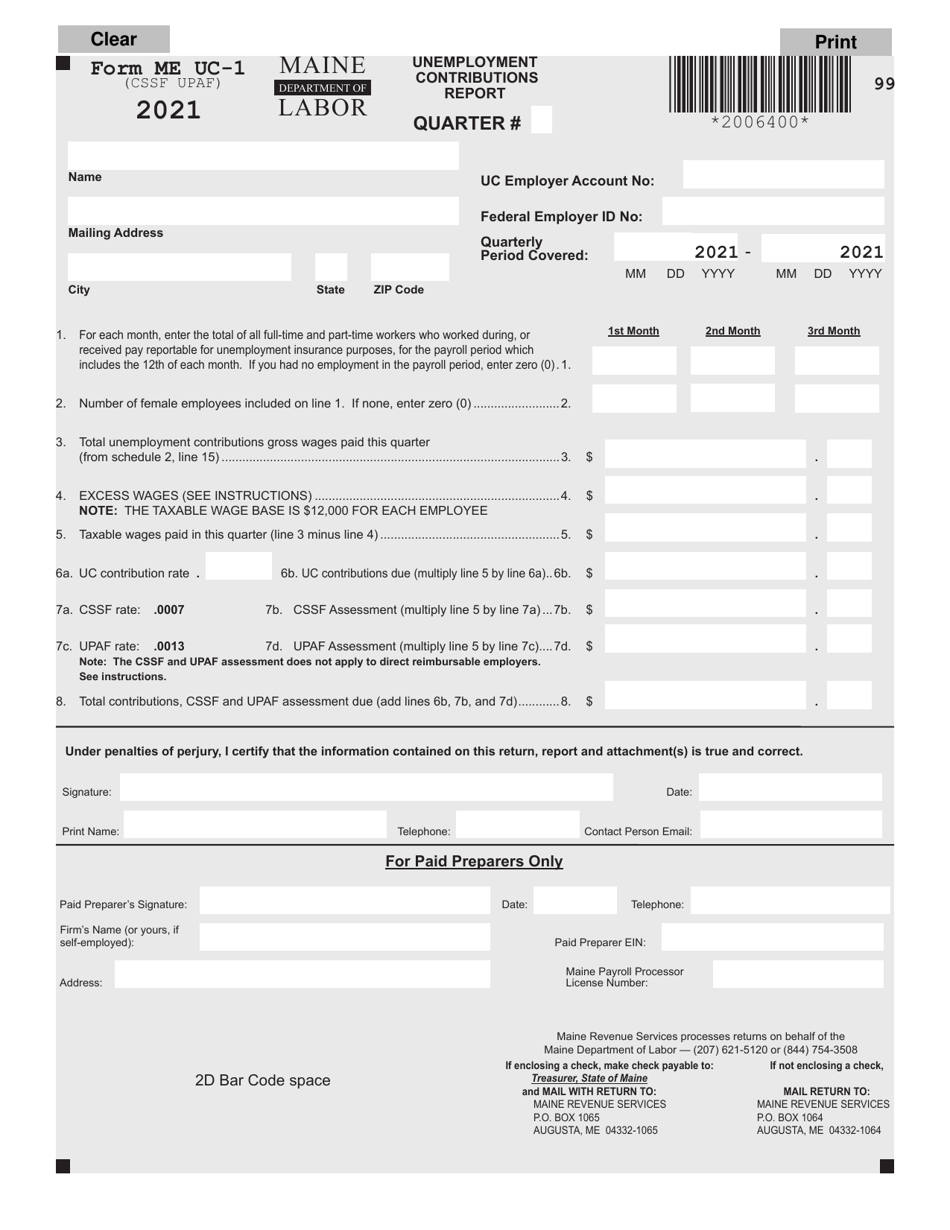

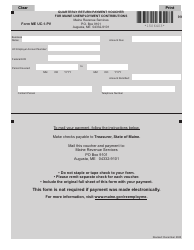

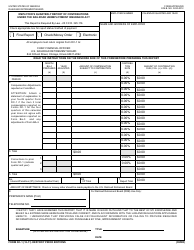

Form ME UC-1 Unemployment Contributions Report - Maine

What Is Form ME UC-1?

This is a legal form that was released by the Maine Department of Labor - a government authority operating within Maine. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the ME UC-1 Unemployment Contributions Report?

A: The ME UC-1 Unemployment Contributions Report is a form used in Maine to report unemployment contributions.

Q: Who needs to file the ME UC-1 form?

A: Employers in Maine who have paid wages subject to unemployment contributions need to file the ME UC-1 form.

Q: When is the ME UC-1 form due?

A: The ME UC-1 form is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

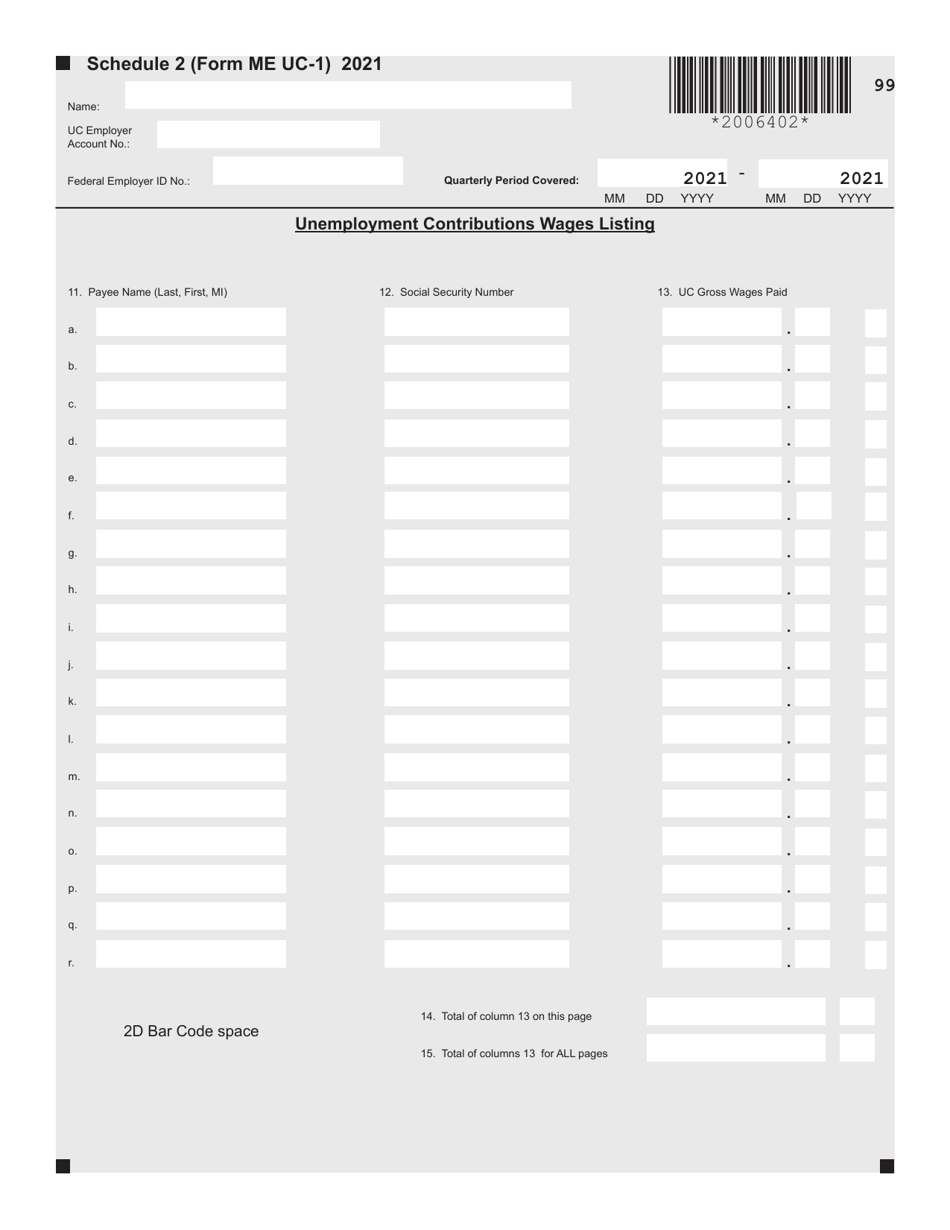

Q: What information is required on the ME UC-1 form?

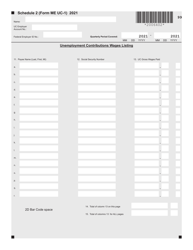

A: The ME UC-1 form requires information such as the total wages paid, the amount of unemployment contributions due, and the number of employees.

Q: What are the consequences of not filing the ME UC-1 form?

A: Failure to file the ME UC-1 form or to pay the required contributions on time may result in penalties and interest.

Form Details:

- The latest edition provided by the Maine Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ME UC-1 by clicking the link below or browse more documents and templates provided by the Maine Department of Labor.