This version of the form is not currently in use and is provided for reference only. Download this version of

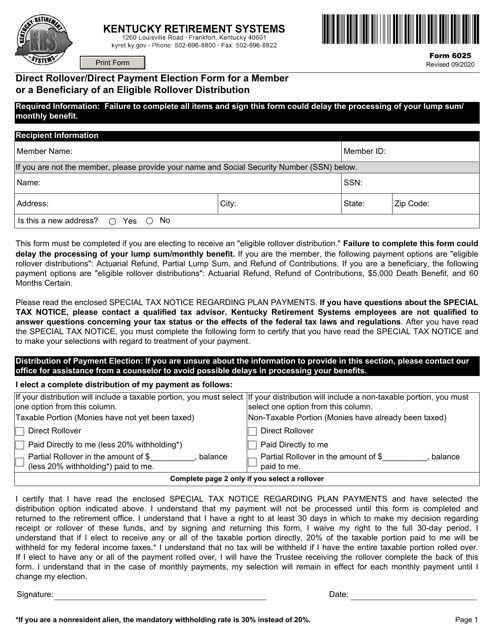

Form 6025

for the current year.

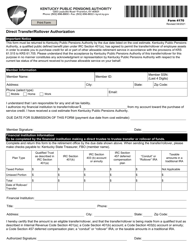

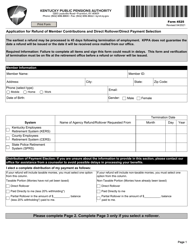

Form 6025 Direct Rollover / Direct Payment Election Form for a Member or a Beneficiary of an Eligible Rollover Distribution - Kentucky

What Is Form 6025?

This is a legal form that was released by the Kentucky Retirement System - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6025?

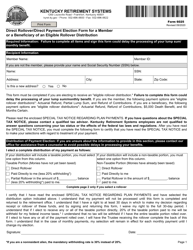

A: Form 6025 is the Direct Rollover/Direct Payment Election Form for a Member or a Beneficiary of an Eligible Rollover Distribution in Kentucky.

Q: Who can use Form 6025?

A: Form 6025 can be used by members or beneficiaries of an eligible rollover distribution in Kentucky.

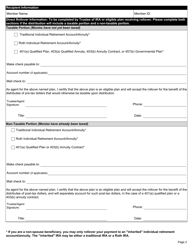

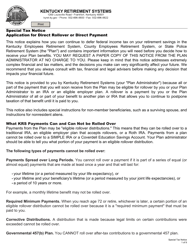

Q: What is a direct rollover?

A: A direct rollover is when retirement plan funds are transferred directly from one qualified plan to another without the funds being distributed to the individual.

Q: What is a direct payment?

A: A direct payment is when retirement plan funds are paid directly to the individual.

Q: What is an eligible rollover distribution?

A: An eligible rollover distribution is a distribution of retirement plan funds that are eligible to be rolled over into another qualified plan or IRA.

Q: Why would someone use Form 6025?

A: Someone would use Form 6025 to make an election for a direct rollover or direct payment of an eligible rollover distribution.

Q: Are there any deadlines for submitting Form 6025?

A: Yes, the form must be submitted within 60 days of the distribution.

Q: Are there any taxes or penalties associated with a direct rollover?

A: No, a direct rollover is a tax-free and penalty-free transfer of retirement plan funds.

Q: Can Form 6025 be used for non-rollover distributions?

A: No, Form 6025 is specifically designed for eligible rollover distributions only.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Kentucky Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6025 by clicking the link below or browse more documents and templates provided by the Kentucky Retirement System.