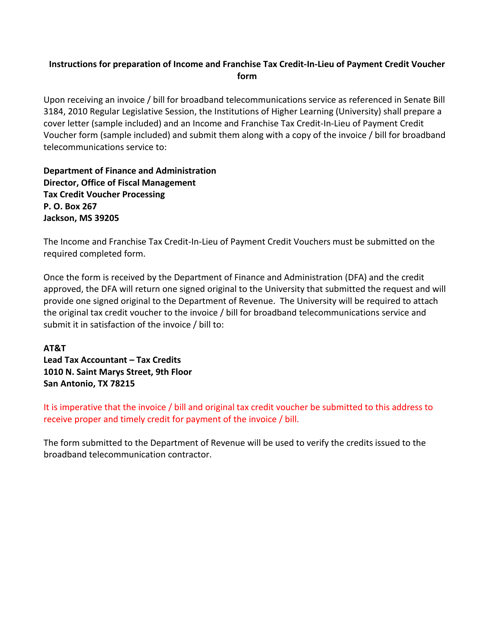

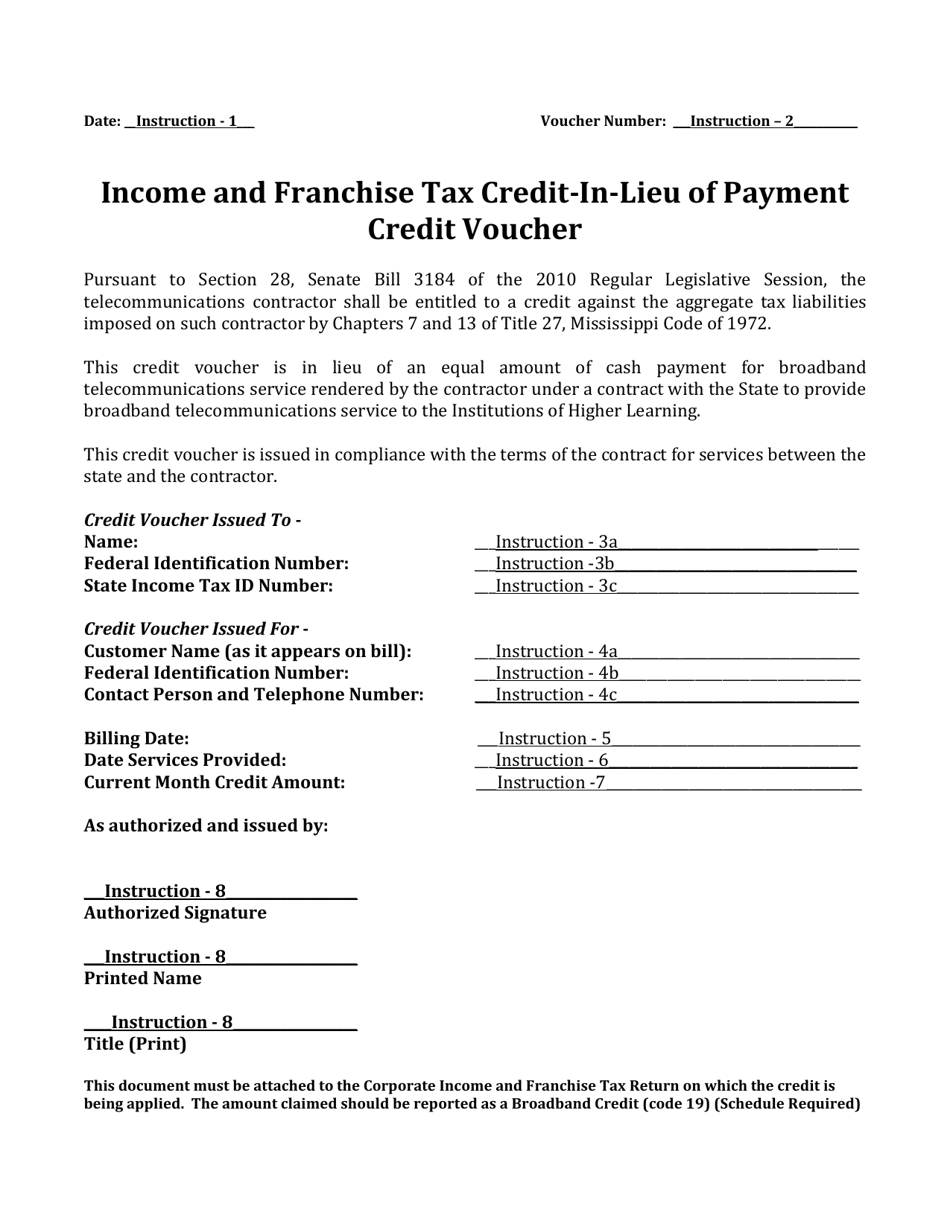

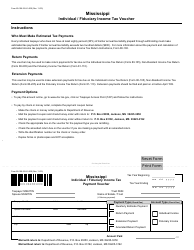

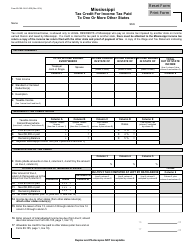

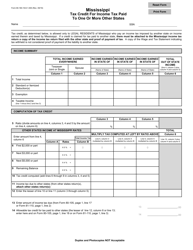

Instructions for Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher - Mississippi

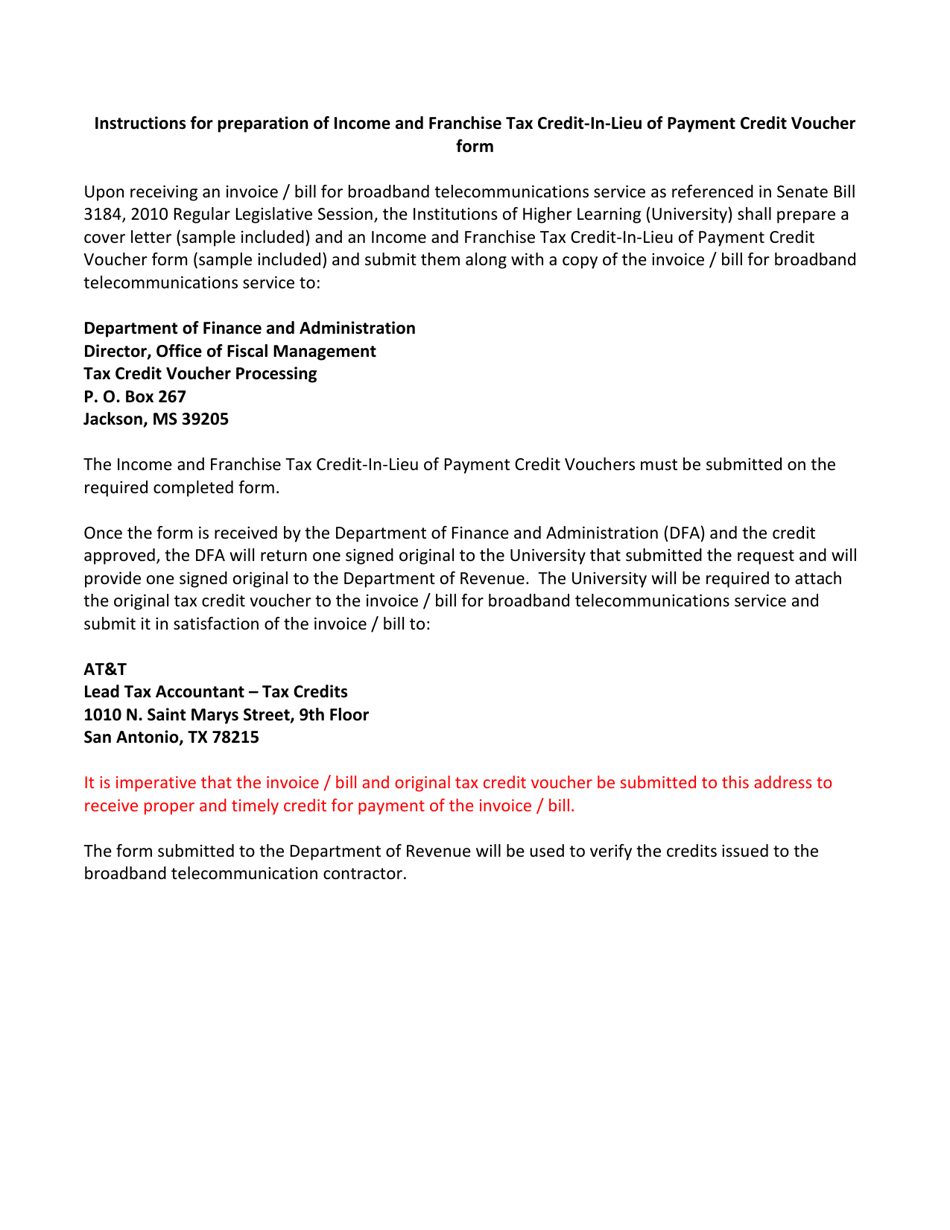

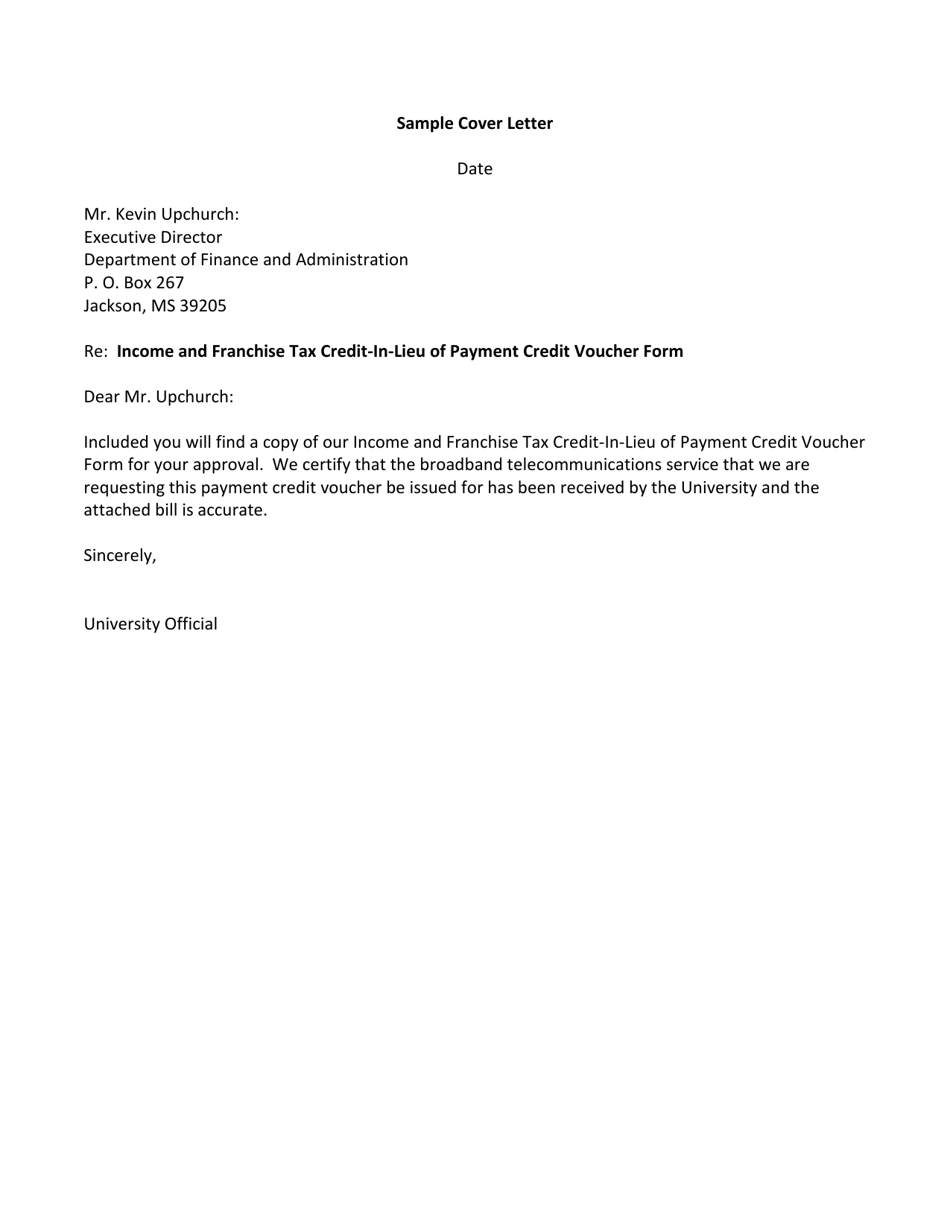

This document was released by Mississippi Department of Finance and Administration and contains official instructions for Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher . The up-to-date fillable form is available for download through this link.

FAQ

Q: What is the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher?

A: The Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher is a form used in Mississippi to claim a tax credit instead of making a payment.

Q: Who can use the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher?

A: Businesses and individuals who owe income taxes or franchise taxes in Mississippi and are eligible for a credit can use this voucher.

Q: What is the purpose of the voucher?

A: The voucher allows taxpayers to apply a tax credit to their tax liability instead of making a payment.

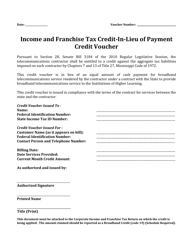

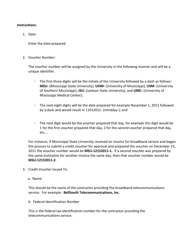

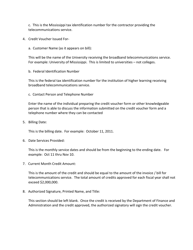

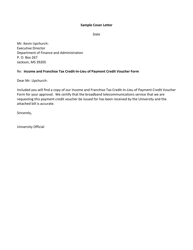

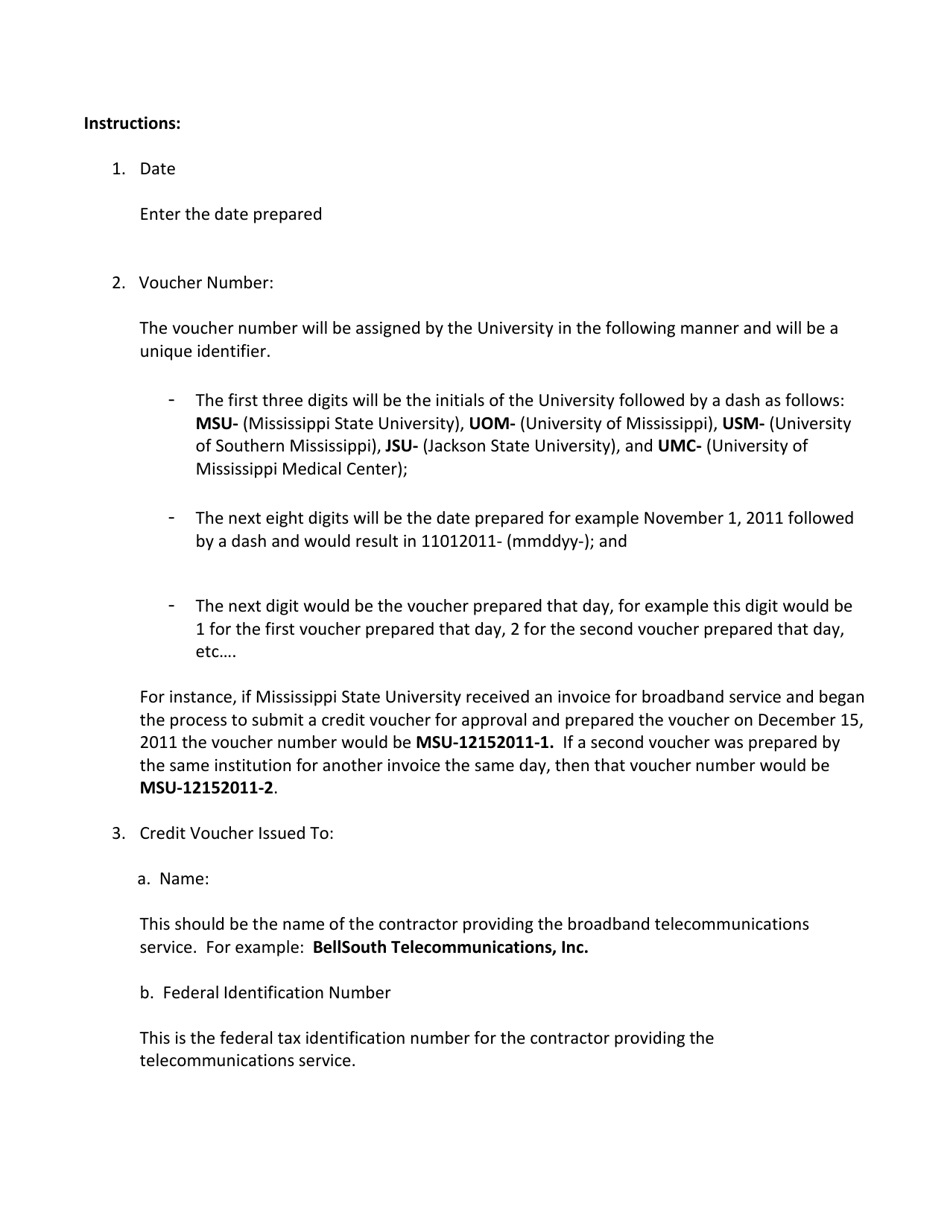

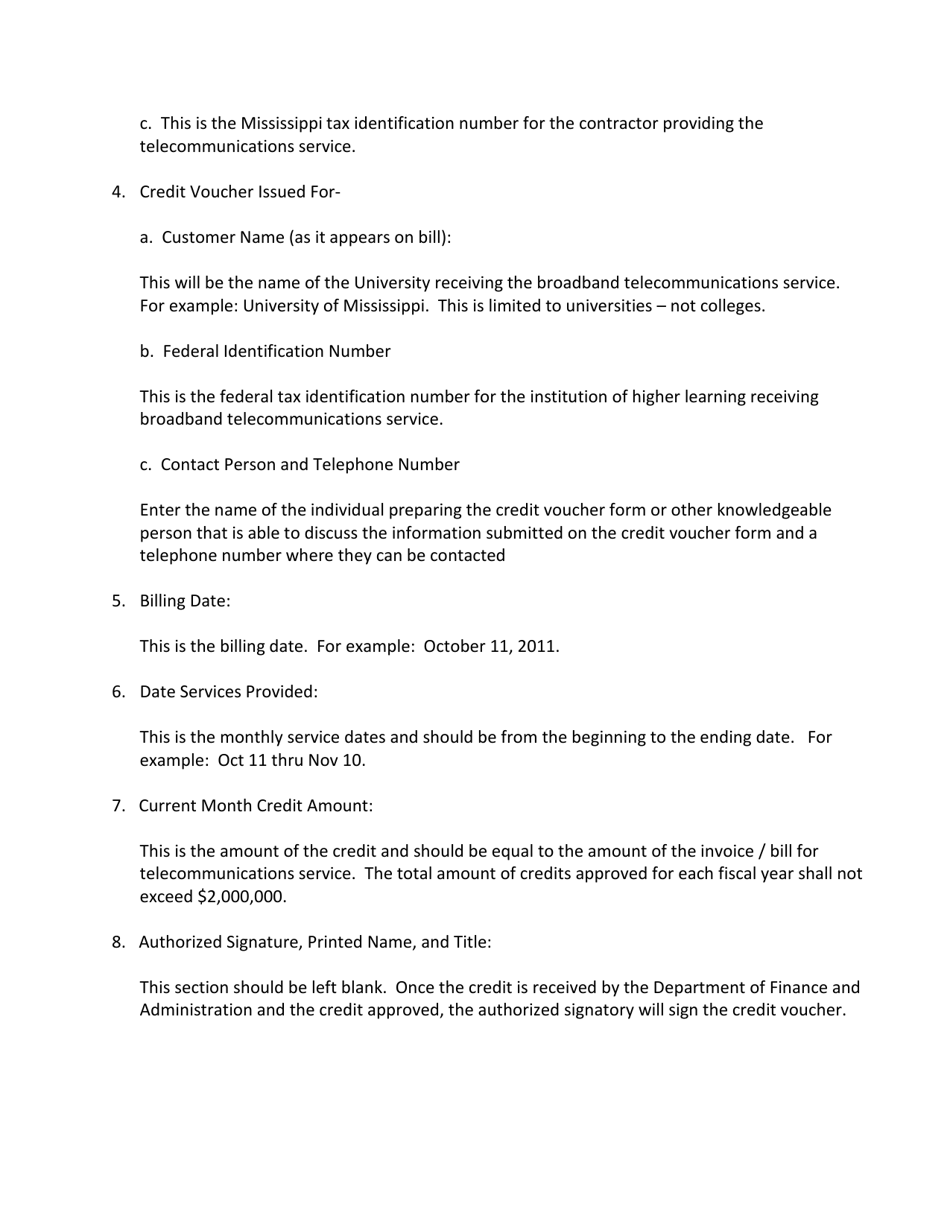

Q: How do I fill out the voucher?

A: You need to provide your name, address, taxpayer ID, the tax period, the amount of the credit you are claiming, and any other required information.

Q: When is the deadline to file the voucher?

A: The deadline to file the voucher is the same as the deadline to file your income tax or franchise tax return.

Q: Can I carry forward unused credits?

A: Yes, you can carry forward any unused credits to future tax years.

Q: Is there a limit to the amount of credit I can claim?

A: Yes, there may be limits on the amount of credit you can claim depending on the specific tax credit you are using.

Q: Can I use the voucher for any other taxes?

A: No, the voucher is specifically for Income and Franchise Tax Credit-In-lieu of Payment.

Q: What should I do if I make a mistake on the voucher?

A: If you make a mistake on the voucher, you should contact the Mississippi Department of Revenue for guidance on how to correct it.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Mississippi Department of Finance and Administration.