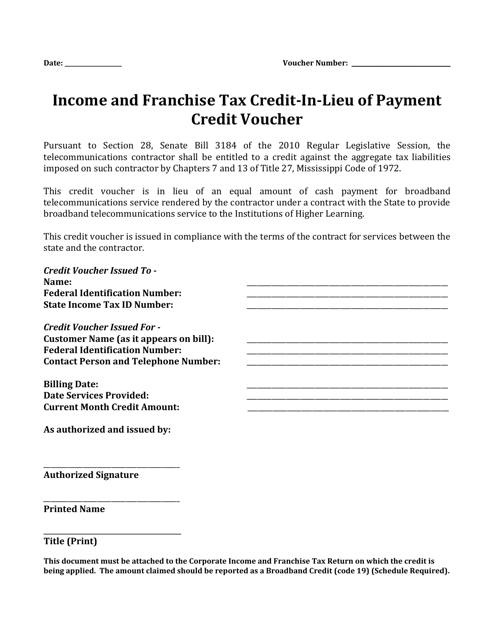

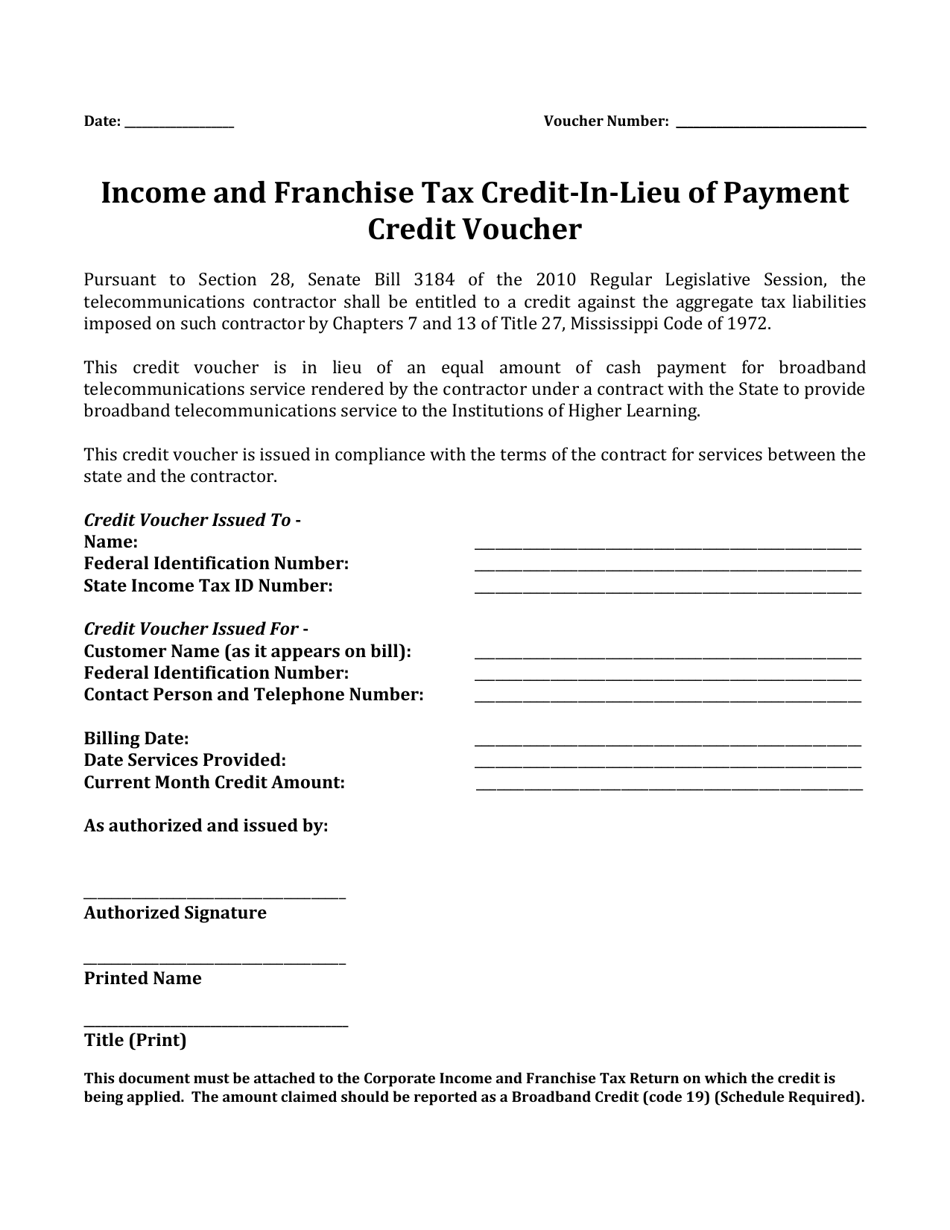

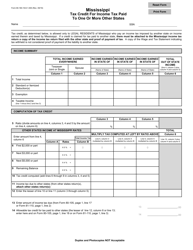

Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher - Mississippi

Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher is a legal document that was released by the Mississippi Department of Finance and Administration - a government authority operating within Mississippi.

FAQ

Q: What is the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher?

A: The Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher is a credit voucher that can be used to offset income and franchise tax liability in Mississippi.

Q: Who is eligible to use the Credit Voucher?

A: Corporations, financial institutions, and insurance companies that had a tax liability in Mississippi are eligible to use the Credit Voucher.

Q: How does the Credit Voucher work?

A: The Credit Voucher allows eligible taxpayers to reduce their income and franchise tax liability by applying the credit amount.

Q: How can I obtain the Income and Franchise Tax Credit-In-lieu of Payment Credit Voucher?

A: The Credit Voucher can be obtained from the Mississippi Department of Revenue.

Q: Is there a deadline to use the Credit Voucher?

A: Yes, the Credit Voucher must be used within three years from the date it was issued.

Q: Can the Credit Voucher be transferred or sold?

A: No, the Credit Voucher is non-transferable and cannot be sold.

Q: Are there any limitations on the use of the Credit Voucher?

A: Yes, the credit amount cannot exceed the income and franchise tax liability, and the total credits allowed per year are subject to certain limitations set by the Mississippi Department of Revenue.

Q: Can the Credit Voucher be used to offset other taxes?

A: No, the Credit Voucher can only be used to offset income and franchise tax liability in Mississippi.

Q: Are there any penalties for late or non-use of the Credit Voucher?

A: Yes, a penalty may be imposed for late or non-use of the Credit Voucher.

Form Details:

- The latest edition currently provided by the Mississippi Department of Finance and Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Finance and Administration.