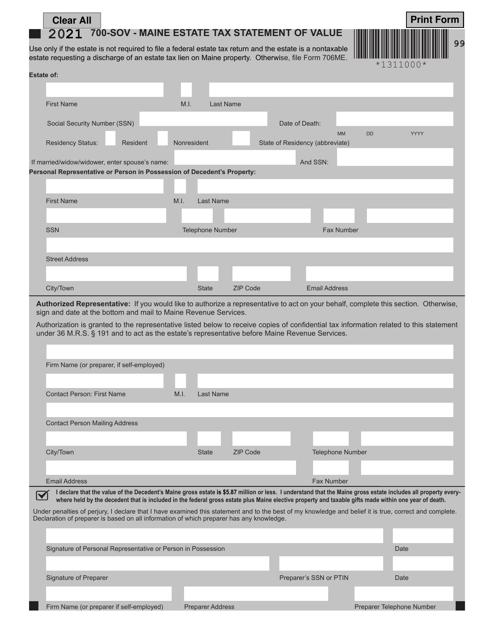

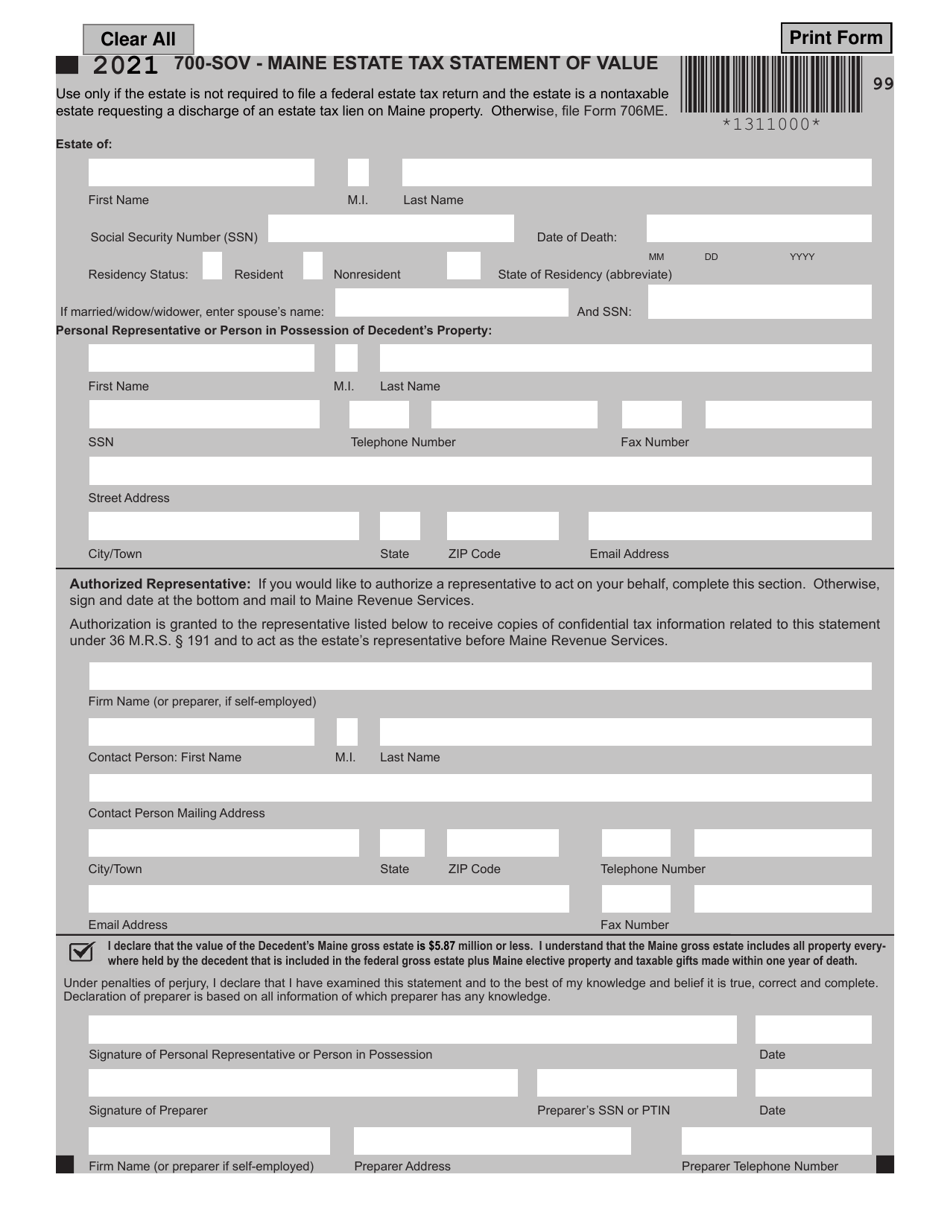

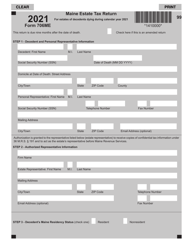

Form 700-SOV Maine Estate Tax Statement of Value - Maine

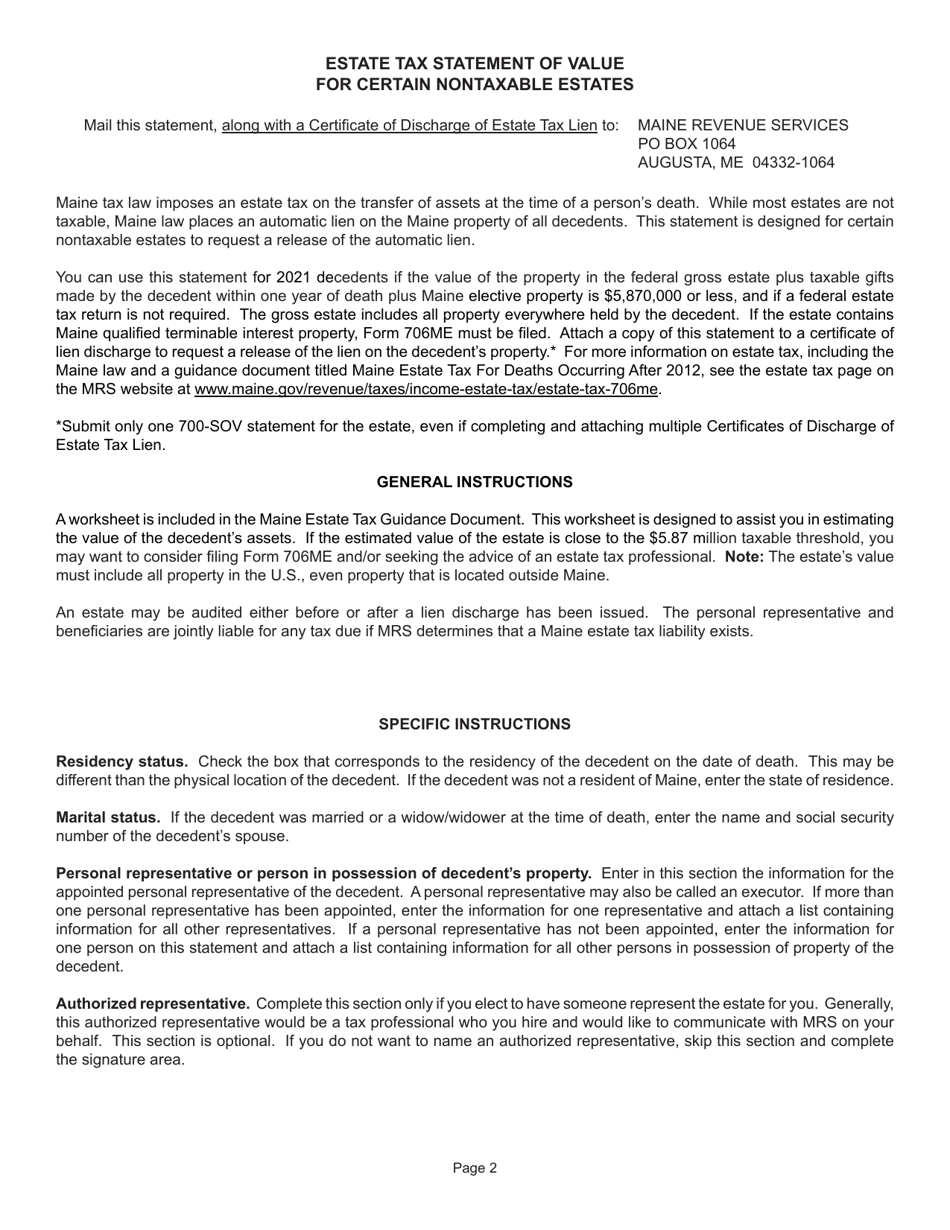

What Is Form 700-SOV?

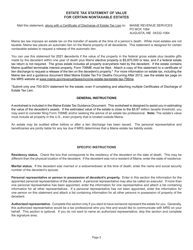

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 700-SOV?

A: Form 700-SOV is the Maine Estate Tax Statement of Value.

Q: What is the purpose of Form 700-SOV?

A: Form 700-SOV is used to report the total value of a decedent's gross estate for Maine estate tax purposes.

Q: Who needs to file Form 700-SOV?

A: Form 700-SOV must be filed by the personal representative of the decedent's estate if the decedent's gross estate exceeds the Maine estate tax exemption amount.

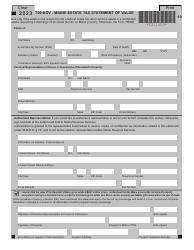

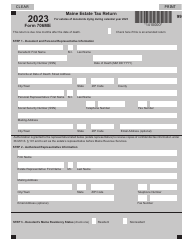

Q: What information is required on Form 700-SOV?

A: Form 700-SOV requires information about the decedent, the executor or administrator, and an itemized listing of the assets and liabilities of the estate.

Q: When is Form 700-SOV due?

A: Form 700-SOV is generally due within 9 months after the decedent's date of death, or within 6 months if the estate qualifies for the small estate election.

Q: Are there any filing fees associated with Form 700-SOV?

A: No, there are no filing fees associated with Form 700-SOV.

Q: What happens after I file Form 700-SOV?

A: After you file Form 700-SOV, the Maine Revenue Services will review the information provided and determine if any estate tax is owed.

Q: Is there a penalty for late filing of Form 700-SOV?

A: Yes, there may be penalties for late or non-filing of Form 700-SOV. It is important to file the form on time to avoid any penalties.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 700-SOV by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.