Estate Tax Filing Templates

If you're responsible for handling the tax affairs of a deceased person, you may be required to file estate tax documents.

Estate tax filing, also known as estate tax return, is a crucial step in calculating and reporting the tax liabilities associated with the estate of a deceased individual. These documents serve as a formal record of the estate's assets, liabilities, and tax obligations.When it comes to estate tax filing, each state may have its own specific requirements and forms to be completed.

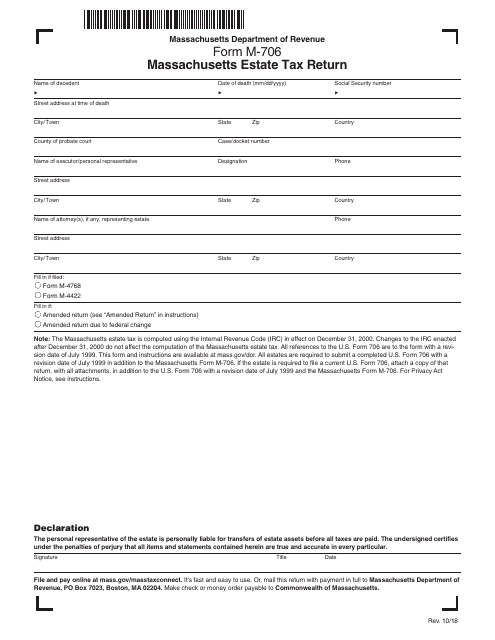

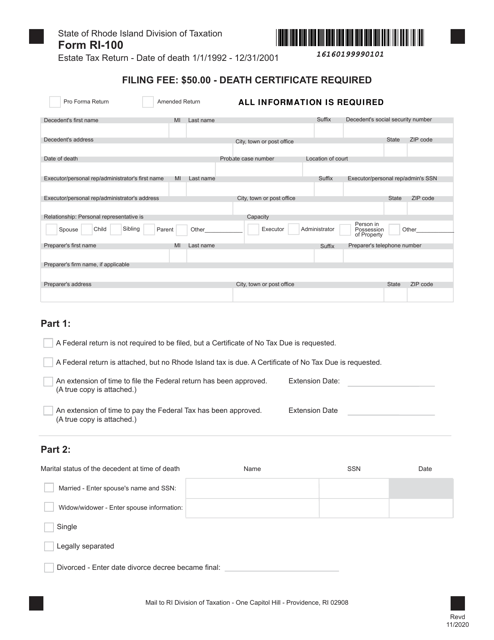

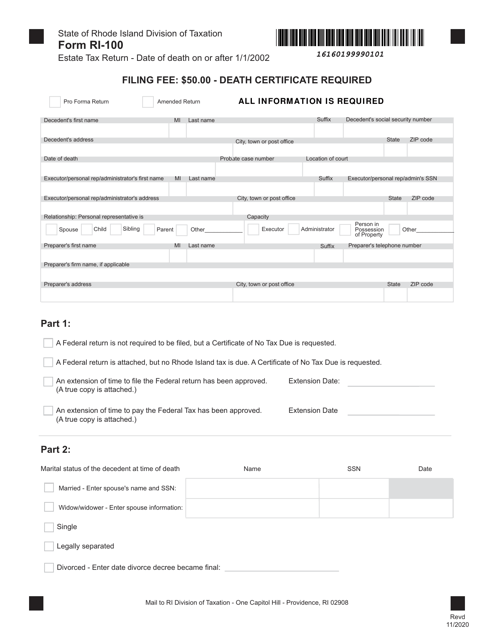

For example, in Rhode Island, you might need to submit Form RI-100 Estate Tax Credit Transmittal for All Decedents Dying Between 1/1/1992 and 12/31/2001 Only or Form RI-100 Estate Tax Return - Date of Death on or After 1/1/2002. In Massachusetts, on the other hand, you would need to fill out Form M-706 Massachusetts Estate Tax Return.These estate tax documents are essential for accurately determining the estate tax liabilities and ensuring compliance with the relevant tax laws.

They provide a comprehensive overview of the estate's financial situation, enabling the efficient calculation of estate taxes owed. Failure to properly file these documents can result in penalties and legal consequences.If you're unsure about which estate tax filing forms to use or how to complete them correctly, it's recommended to consult with a tax professional or an estate attorney.

They can provide expert guidance and ensure that you fulfill all your legal obligations. Remember, accurate and timely estate tax filing is crucial to protect the interests of the deceased's estate and avoid any unnecessary complications..

Documents:

5

This form is used for filing an estate tax return in the state of Massachusetts.

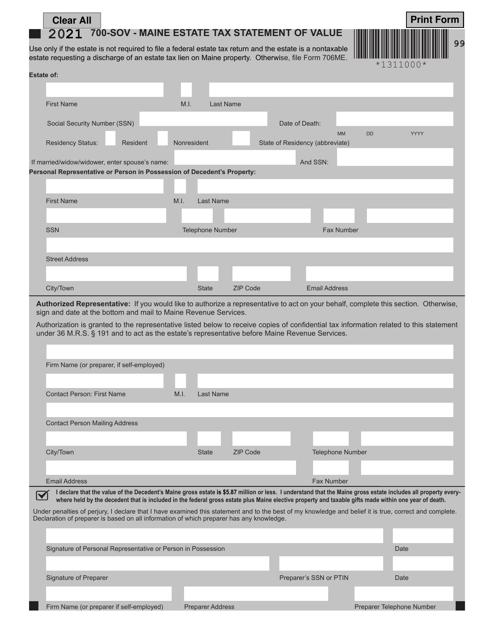

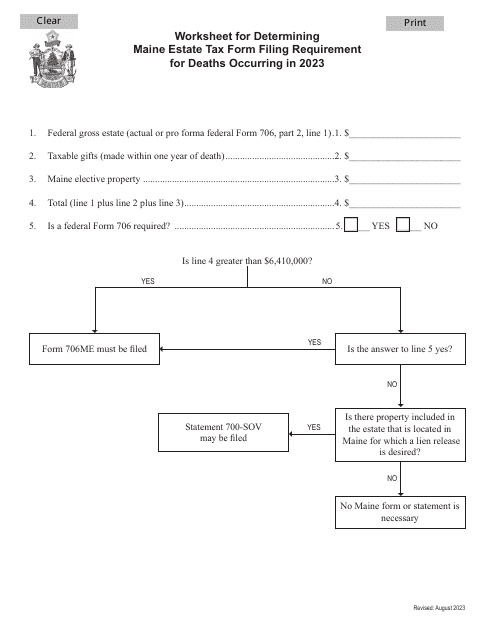

This form is used for reporting the value of an estate in Maine for estate tax purposes.