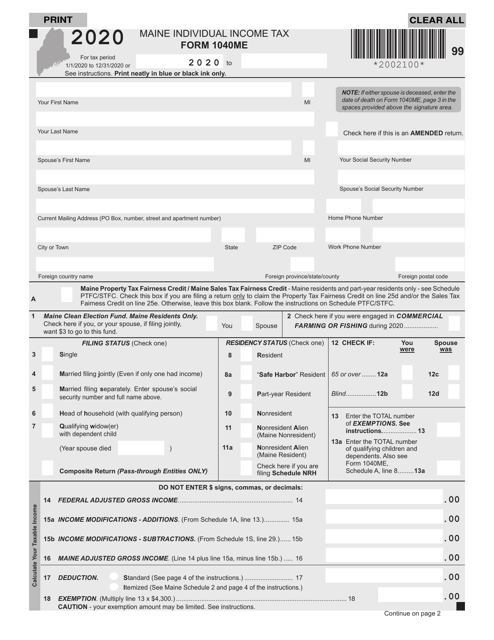

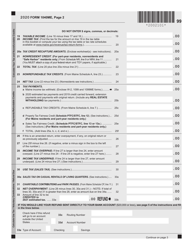

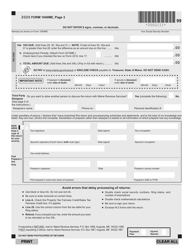

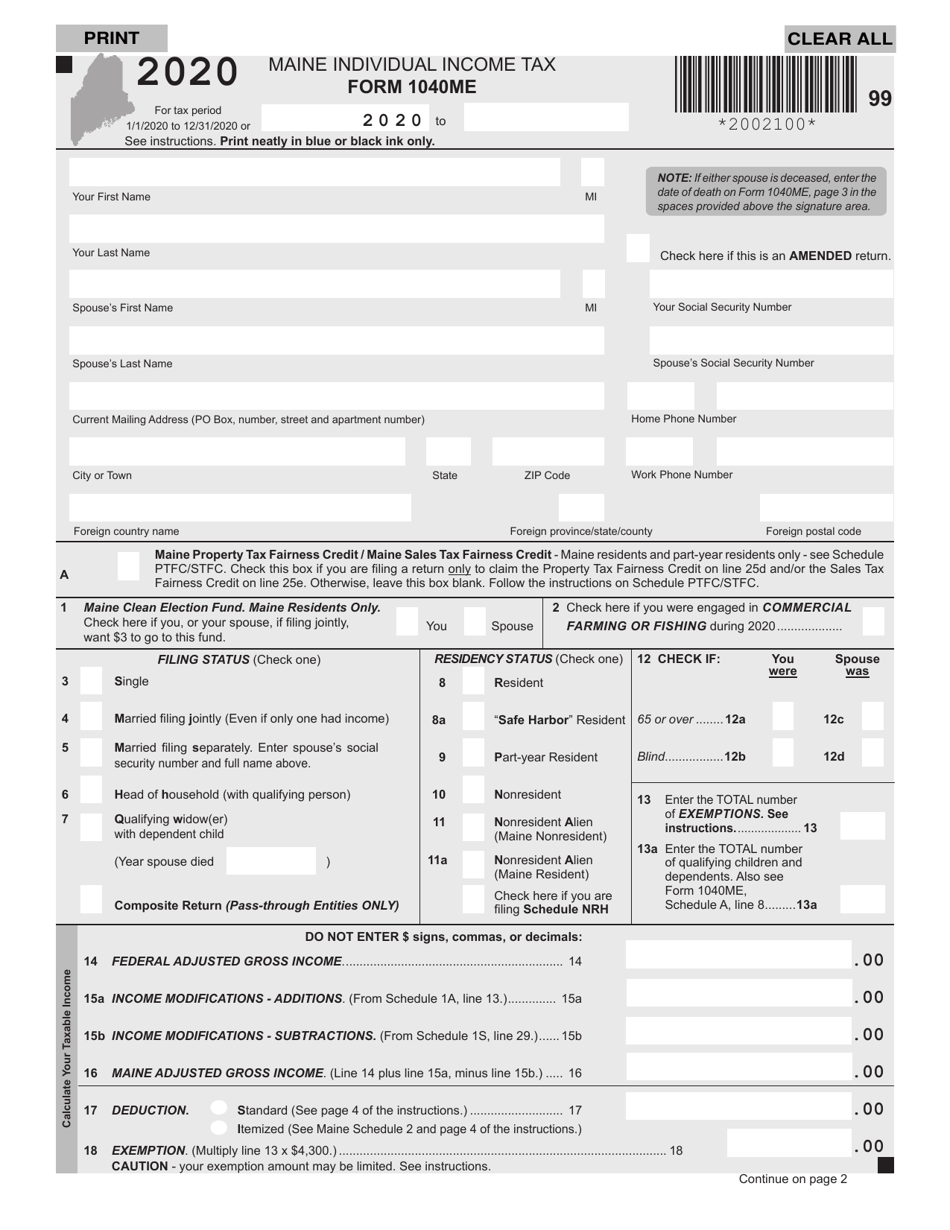

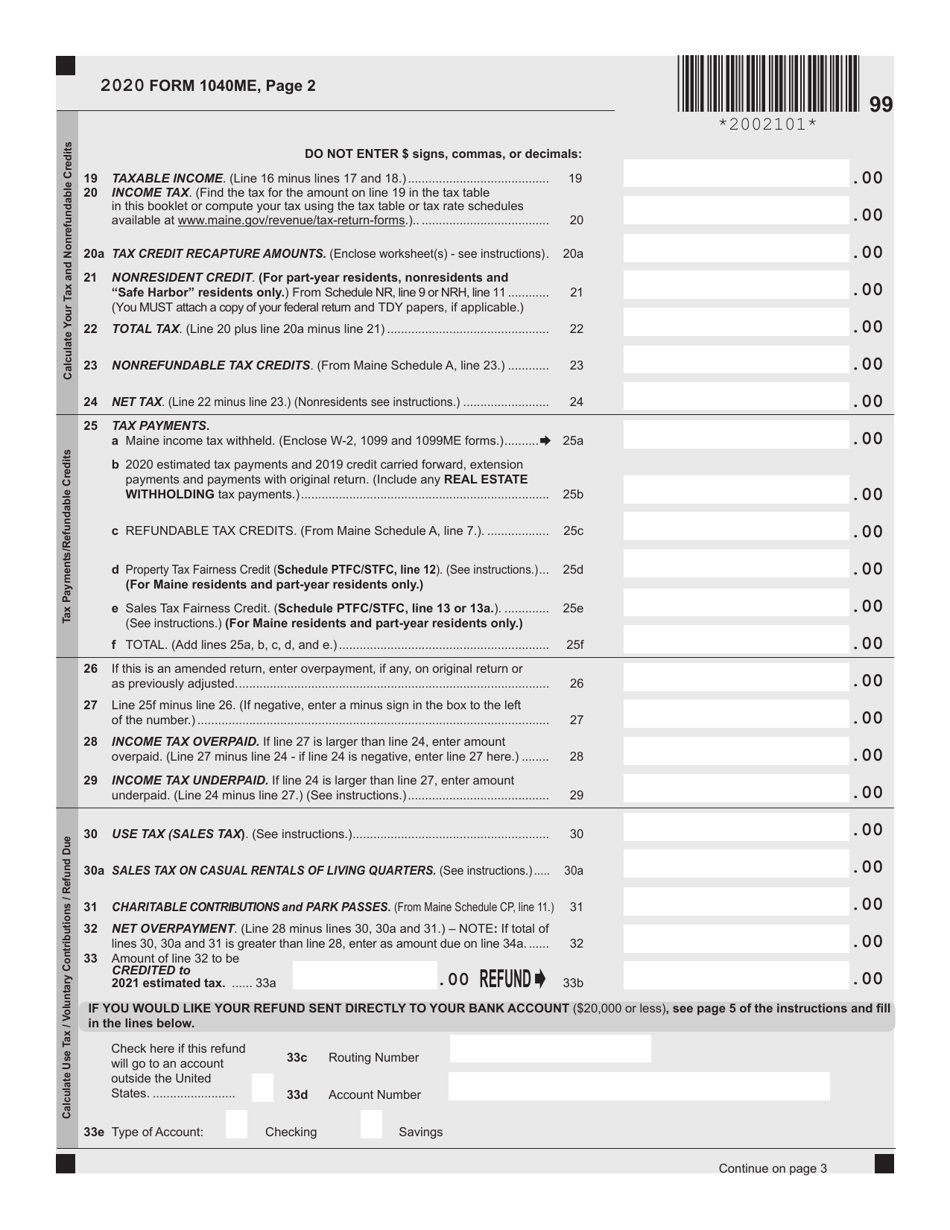

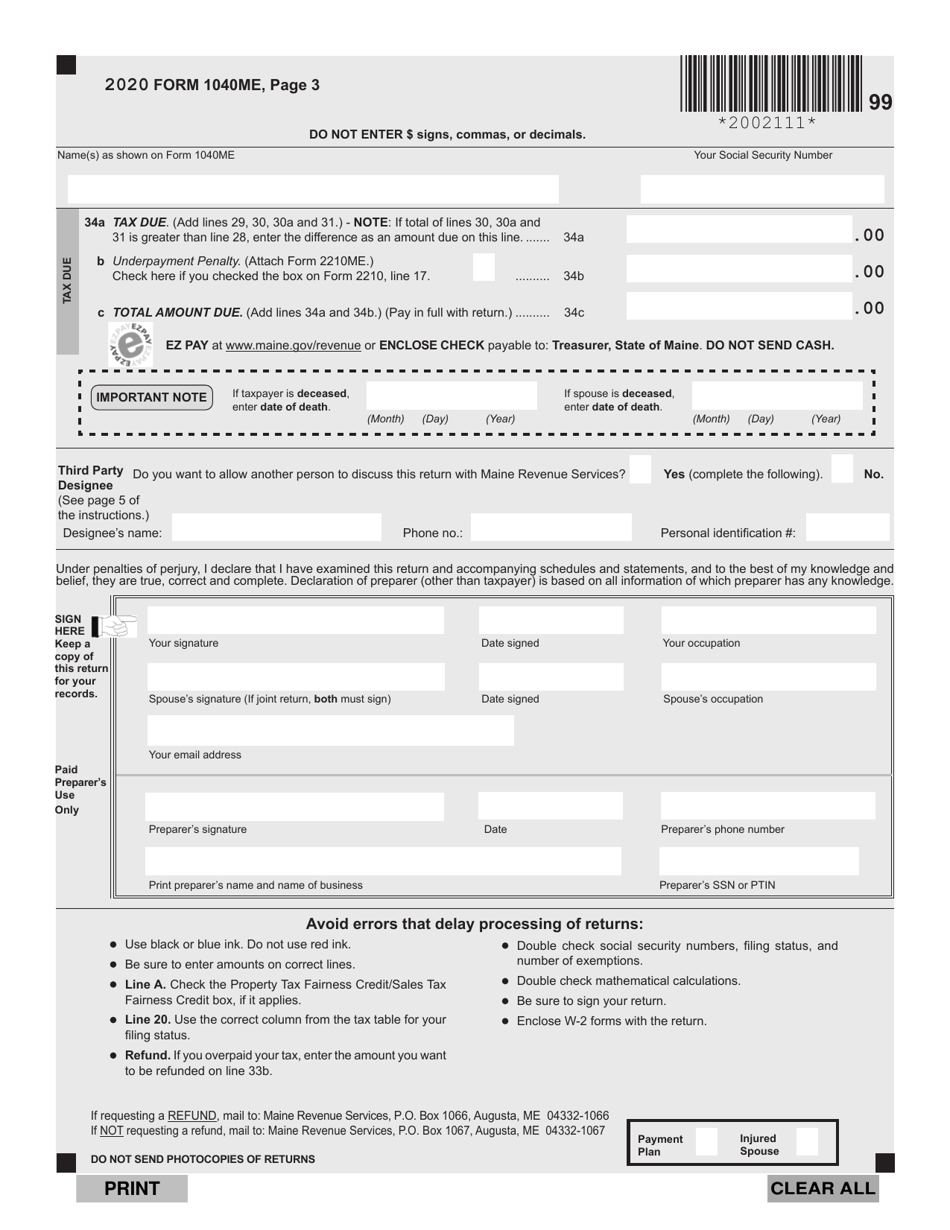

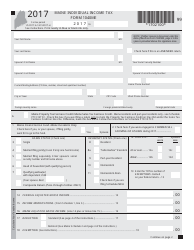

Form 1040ME Maine Individual Income Tax - Maine

What Is Form 1040ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1040ME?

A: Form 1040ME is the Maine Individual Income Tax return that residents of Maine must file.

Q: Who needs to file Form 1040ME?

A: Residents of Maine who have taxable income must file Form 1040ME.

Q: What is taxable income?

A: Taxable income is the amount of income that is subject to taxation after deductions and exemptions.

Q: What information is required for Form 1040ME?

A: You will need to provide information about your income, deductions, exemptions, and credits.

Q: When is the deadline to file Form 1040ME?

A: The deadline to file Form 1040ME is April 15th, unless it falls on a weekend or holiday, in which case the deadline is the next business day.

Q: Are there different versions of Form 1040ME?

A: No, there is only one version of Form 1040ME for all residents of Maine.

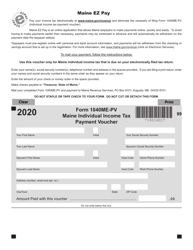

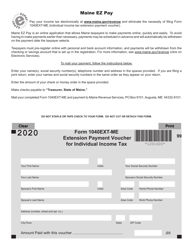

Q: Can I file an extension for Form 1040ME?

A: Yes, you can file an extension using Form 1040EXT. This will give you an additional 6 months to file your return.

Q: Is there a penalty for filing Form 1040ME late?

A: Yes, if you file your Form 1040ME after the deadline without an extension, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

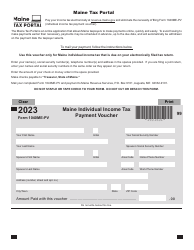

Download a fillable version of Form 1040ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.