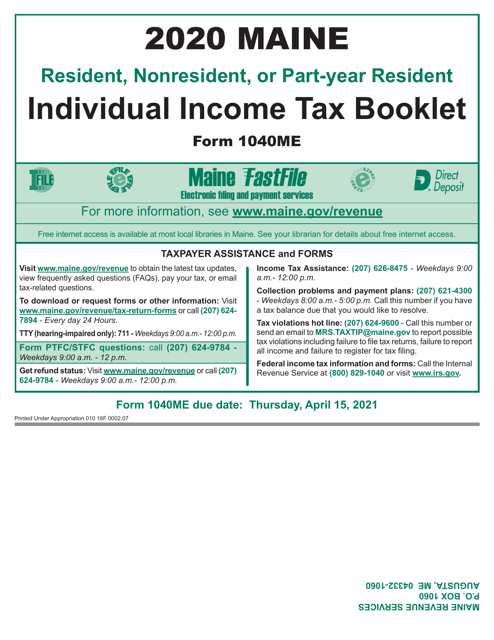

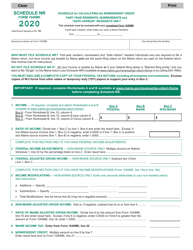

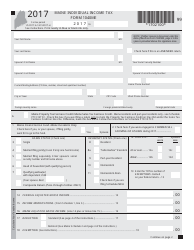

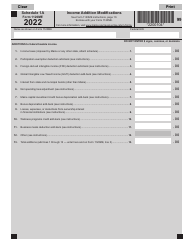

Instructions for Form 1040ME Maine Individual Income Tax - Maine

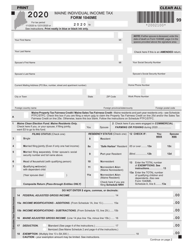

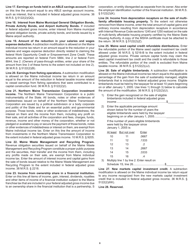

This document contains official instructions for Form 1040ME , Maine Individual Income Tax - a form released and collected by the Maine Department of Administrative and Financial Services. An up-to-date fillable Form 1040ME is available for download through this link.

FAQ

Q: What is Form 1040ME?

A: Form 1040ME is the Maine Individual Income Tax form.

Q: Who needs to file Form 1040ME?

A: Residents of Maine who have income that is subject to Maine income tax need to file Form 1040ME.

Q: What is the purpose of Form 1040ME?

A: Form 1040ME is used to report and pay Maine state income tax.

Q: When is the due date for filing Form 1040ME?

A: The due date for filing Form 1040ME is usually April 15th, but it may vary each year.

Q: What if I can't file my Form 1040ME by the due date?

A: If you can't file your Form 1040ME by the due date, you can request an extension or file for late filing.

Q: Do I need to include a copy of my federal tax return with Form 1040ME?

A: No, you don't need to include a copy of your federal tax return with Form 1040ME.

Q: Are there any payment options available for paying the taxes owed?

A: Yes, there are several payment options available including check, electronic funds transfer, or credit card.

Q: Can I e-file my Form 1040ME?

A: Yes, you can e-file your Form 1040ME. Check the instructions for the electronic filing options.

Q: What if I make a mistake on my Form 1040ME?

A: If you make a mistake on your Form 1040ME, you should file an amended return using Form 1040X.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Department of Administrative and Financial Services.