This version of the form is not currently in use and is provided for reference only. Download this version of

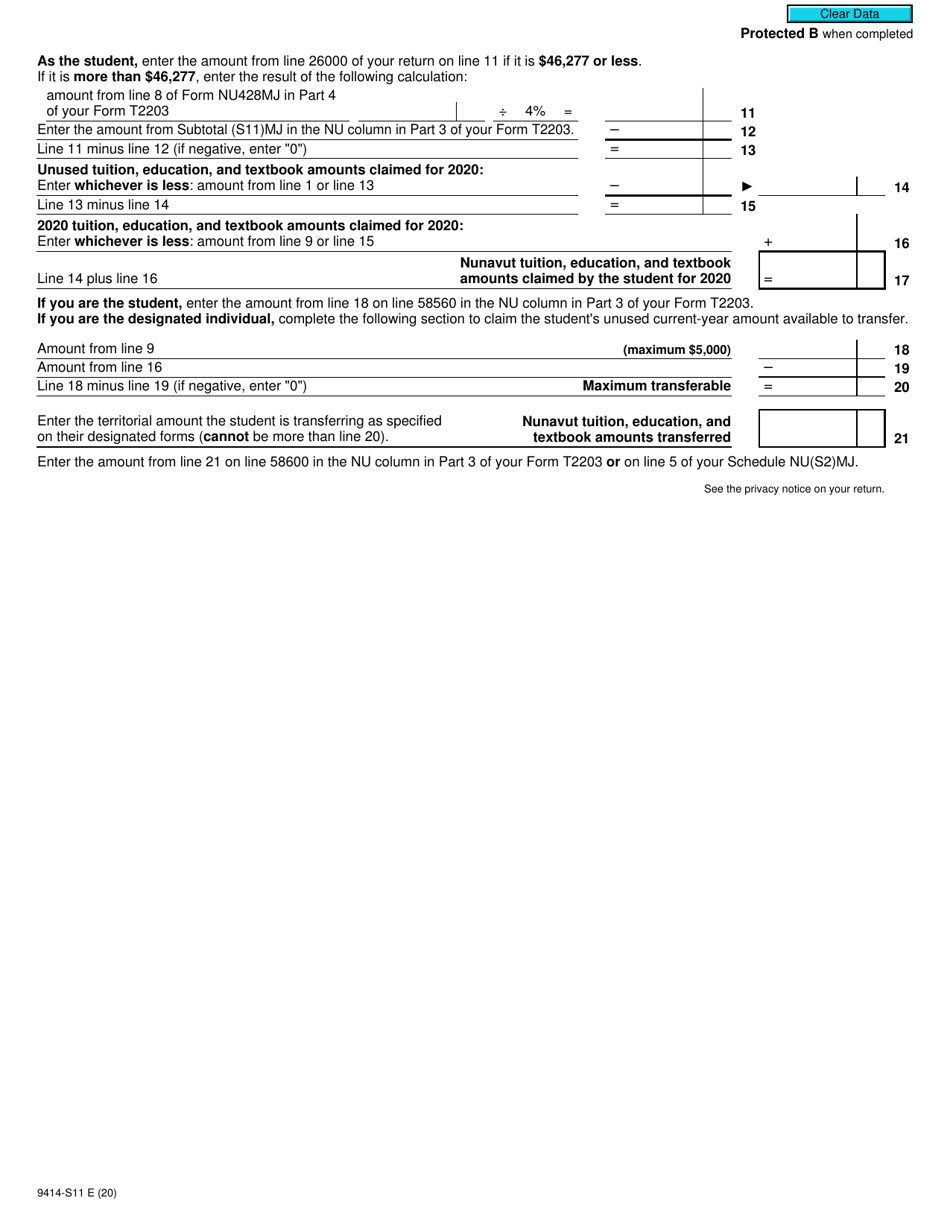

Form T2203 (9414-S11) Schedule NU(S11)MJ

for the current year.

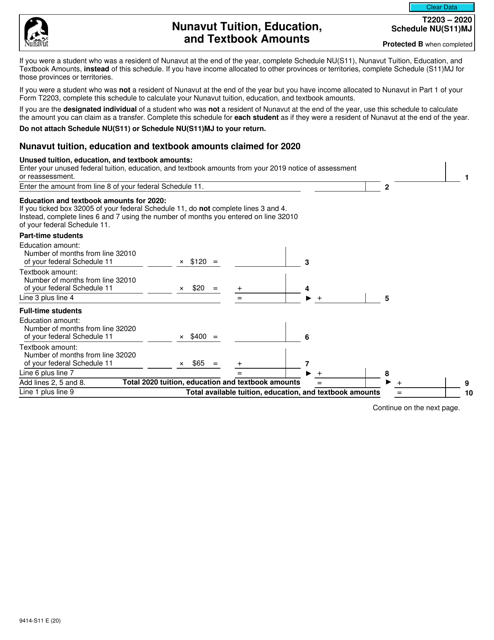

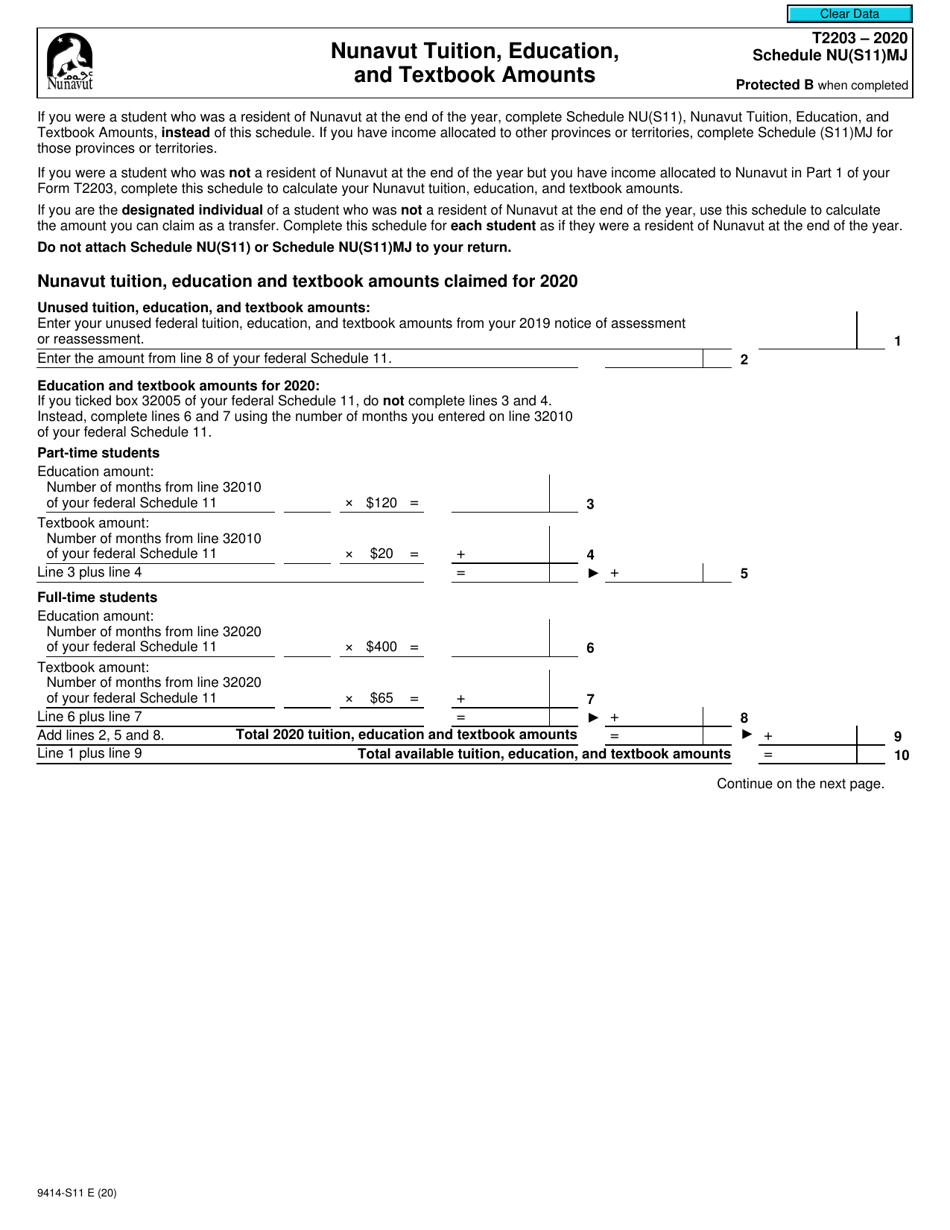

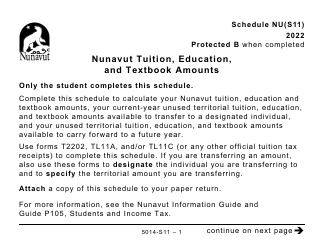

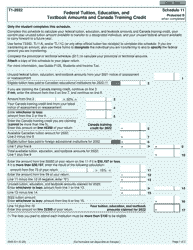

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9414-S11) Schedule NU(S11)MJ Nunavut Tuition, Education, and Textbook Amounts - Canada is used by residents of Nunavut for claiming their tuition, education, and textbook amounts on their federal tax return. This form helps individuals reduce their taxable income by claiming eligible educational expenses.

Individuals who are residents of Nunavut and have incurred eligible tuition, education, and textbook expenses can file Form T2203 (9414-S11) Schedule NU(S11)MJ to claim those amounts for tax purposes in Canada.

FAQ

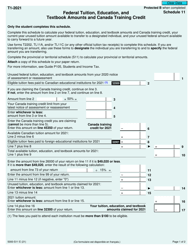

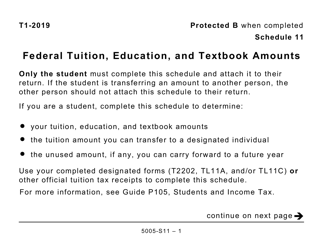

Q: What is Form T2203?

A: Form T2203 is a form used in Canada to claim Nunavut Tuition, Education, and Textbook Amounts.

Q: What is Schedule NU(S11)MJ?

A: Schedule NU(S11)MJ is a specific schedule within Form T2203 that is used in Nunavut to claim tuition, education, and textbook amounts.

Q: What are the Nunavut Tuition, Education, and Textbook Amounts?

A: Nunavut Tuition, Education, and Textbook Amounts are tax credits that can be claimed by residents of Nunavut to offset the cost of tuition and textbooks.

Q: Who can use Form T2203 Schedule NU(S11)MJ?

A: Form T2203 Schedule NU(S11)MJ is specifically for residents of Nunavut who want to claim the Nunavut Tuition, Education, and Textbook Amounts.

Q: How to fill out Form T2203 Schedule NU(S11)MJ?

A: To fill out Form T2203 Schedule NU(S11)MJ, you need to enter the required information about your tuition expenses and textbook amounts in Nunavut.