This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9410-S11) Schedule BC(S11)MJ

for the current year.

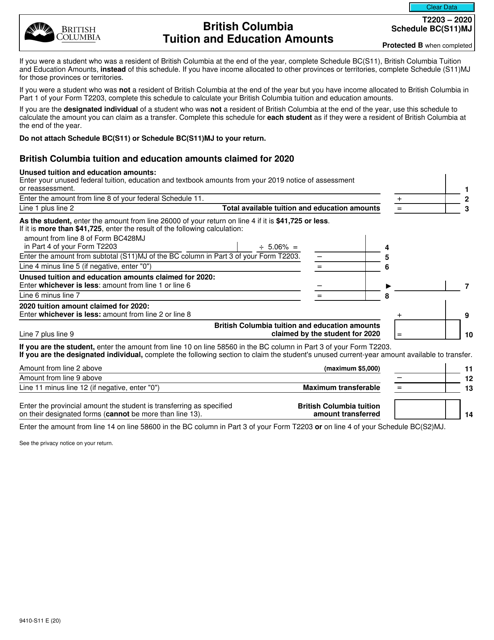

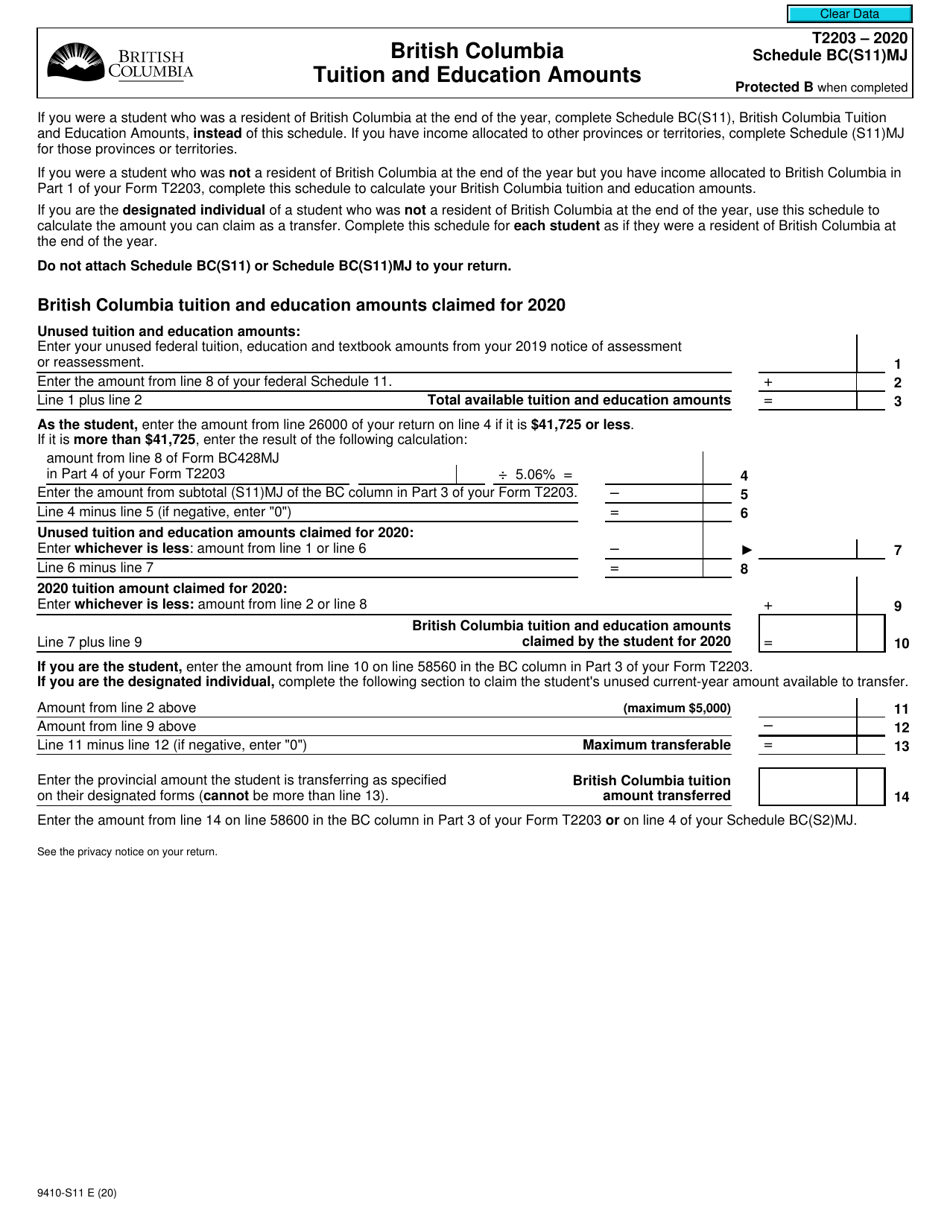

Form T2203 (9410-S11) Schedule BC(S11)MJ British Columbia Tuition and Education Amounts - Canada

Form T2203 (9410-S11) Schedule BC(S11)MJ is used for claiming the British Columbia Tuition and Education Amounts in Canada. This form is specifically designed for residents of British Columbia who are eligible to claim these amounts as specified by the British Columbia Ministry of Advanced Education, Skills & Training. The Tuition and Education Amounts are tax credits that can be used to reduce the amount of tax payable by eligible individuals. By filling out this form, individuals can provide the necessary information to calculate the tuition and education amounts that they are entitled to claim.

The Form T2203 Schedule BC(S11)MJ for claiming British Columbia Tuition and Education Amounts in Canada is typically filled out by individual taxpayers who meet the eligibility criteria set by the British Columbia government. This form allows residents of British Columbia to claim education-related tax credits and deductions.

FAQ

Q: What is Form T2203 (9410-S11) Schedule BC(S11)MJ?

A: Form T2203 (9410-S11) Schedule BC(S11)MJ is a tax form used in Canada for claiming tuition and education amounts specifically for residents of British Columbia.

Q: What are the tuition and education amounts?

A: The tuition and education amounts are tax credits that can be claimed by Canadian taxpayers to reduce the amount of tax they owe. These credits are available for eligible tuition fees paid for post-secondary education and certain educational programs.

Q: Who can claim the tuition and education amounts on Form T2203 (9410-S11) Schedule BC(S11)MJ?

A: Only residents of British Columbia in Canada can claim the tuition and education amounts on this specific form. The amounts claimed should correspond to tuition fees paid to a qualifying educational institution.

Q: What is the purpose of Schedule BC(S11)MJ on Form T2203 (9410-S11)?

A: Schedule BC(S11)MJ is used to calculate and determine the allowable amount of tuition and education credits that can be claimed by a resident of British Columbia.

Q: When should I file Form T2203 (9410-S11) Schedule BC(S11)MJ?

A: Form T2203 (9410-S11) Schedule BC(S11)MJ should be filed along with your income tax return for the tax year in which you paid the tuition fees. The deadline for filing your income tax return is usually April 30th of the following year.

Q: What supporting documentation do I need to attach with Form T2203 (9410-S11) Schedule BC(S11)MJ?

A: You need to attach the official receipts or statements from the educational institution that show the amount of tuition fees paid. It's important to keep copies of these documents for your records.

Q: Can I claim tuition and education amounts for courses taken outside of British Columbia?

A: Yes, you can claim tuition and education amounts for eligible courses taken outside of British Columbia as long as they are offered by a qualifying educational institution and meet the requirements set by the Canada Revenue Agency.

Q: How do the tuition and education amounts affect my tax refund?

A: By claiming the tuition and education amounts on Form T2203 (9410-S11) Schedule BC(S11)MJ, you may be eligible for tax credits that can reduce the amount of tax you owe or increase your tax refund.

Q: What if I don't have any tuition fees to claim?

A: If you don't have any eligible tuition fees to claim, you don't need to file Form T2203 (9410-S11) Schedule BC(S11)MJ. However, it's always a good idea to review the eligibility criteria and consult a tax professional if you have any doubts.