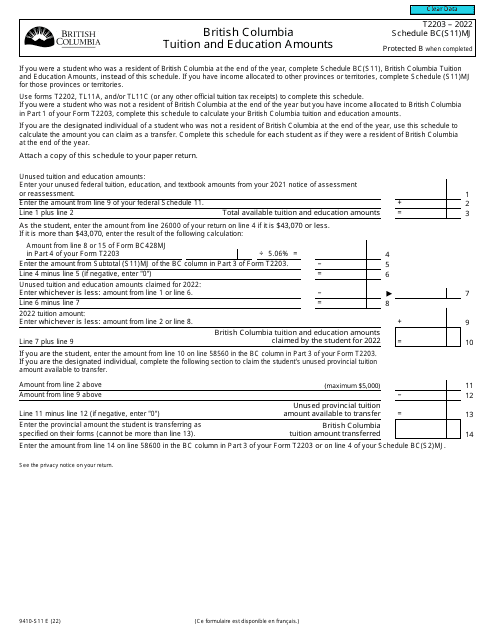

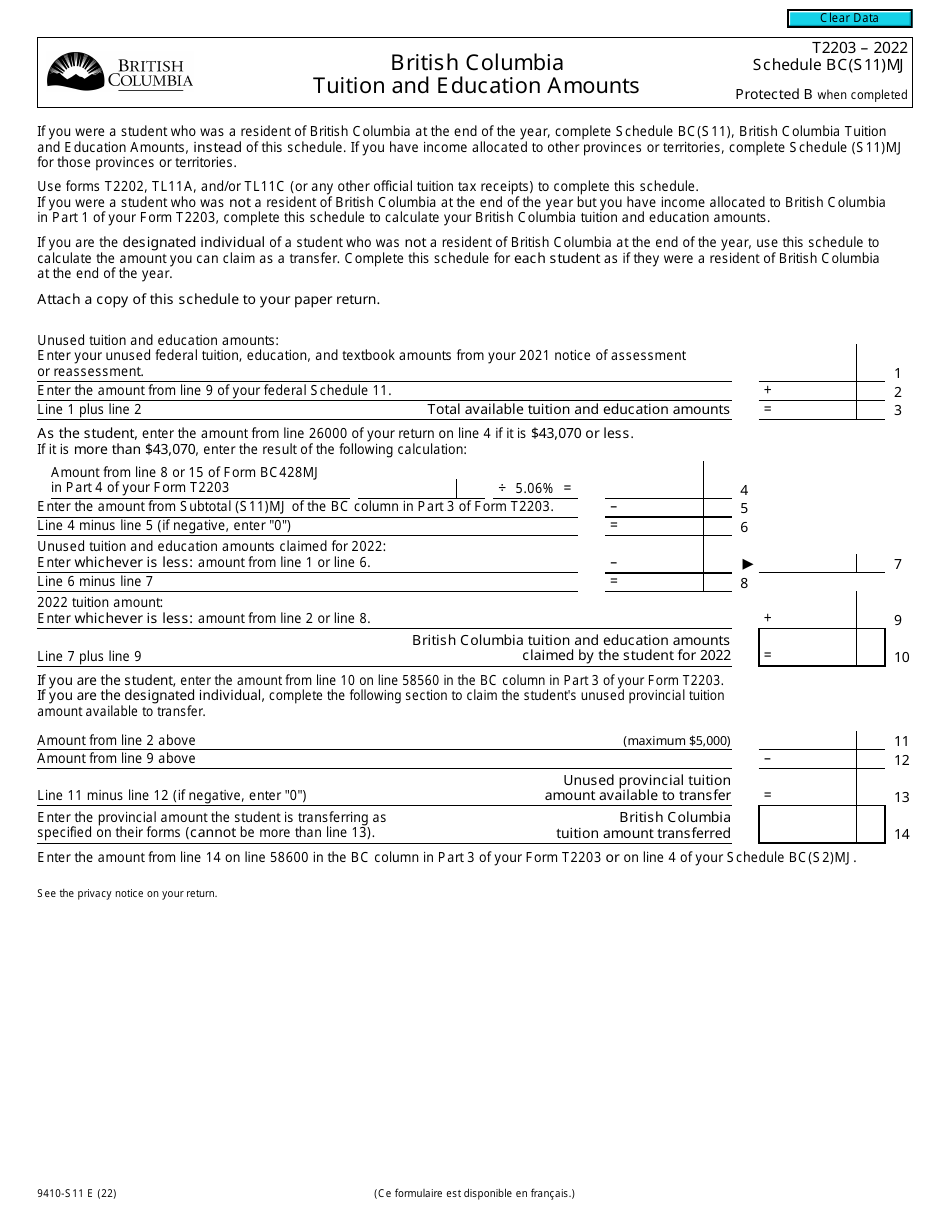

Form T2203 (9410-S11) Schedule BC(S11)MJ British Columbia Tuition and Education Amounts - Canada

Form T2203 (9410-S11) Schedule BC(S11)MJ is a document used in Canada for claiming the British Columbia Tuition and Education Amounts. This form helps individuals who are residents of British Columbia to calculate and report the amount of tuition and education expenses that they can claim as tax credits on their income tax return.

The Form T2203 (9410-S11) Schedule BC(S11)MJ is typically filed by individuals who want to claim the British Columbia Tuition and Education Amounts in Canada.

Form T2203 (9410-S11) Schedule BC(S11)MJ British Columbia Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada for claiming tuition and education amounts in British Columbia.

Q: What is Schedule BC(S11)MJ?

A: Schedule BC(S11)MJ is a schedule that must be filled out and attached to Form T2203 for claiming tuition and education amounts in British Columbia.

Q: What are tuition and education amounts?

A: Tuition and education amounts refer to the expenses paid for post-secondary education or courses in British Columbia.

Q: Who is eligible to claim tuition and education amounts in British Columbia?

A: Residents of British Columbia who have paid eligible tuition fees for post-secondary education or courses can claim these amounts.

Q: What is the purpose of claiming tuition and education amounts?

A: By claiming these amounts, individuals can reduce their taxable income and potentially receive a tax refund.