This version of the form is not currently in use and is provided for reference only. Download this version of

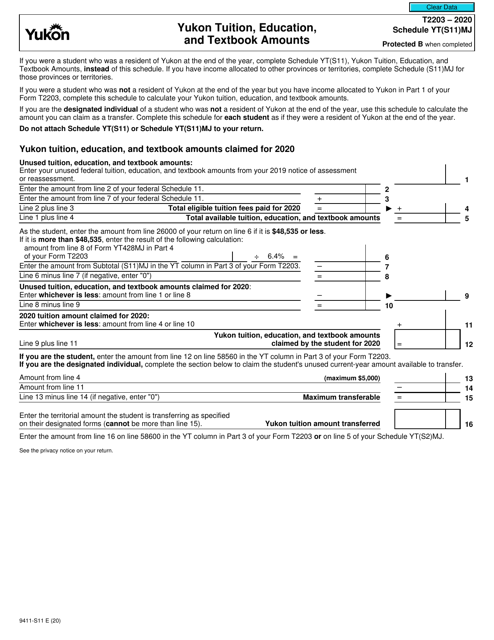

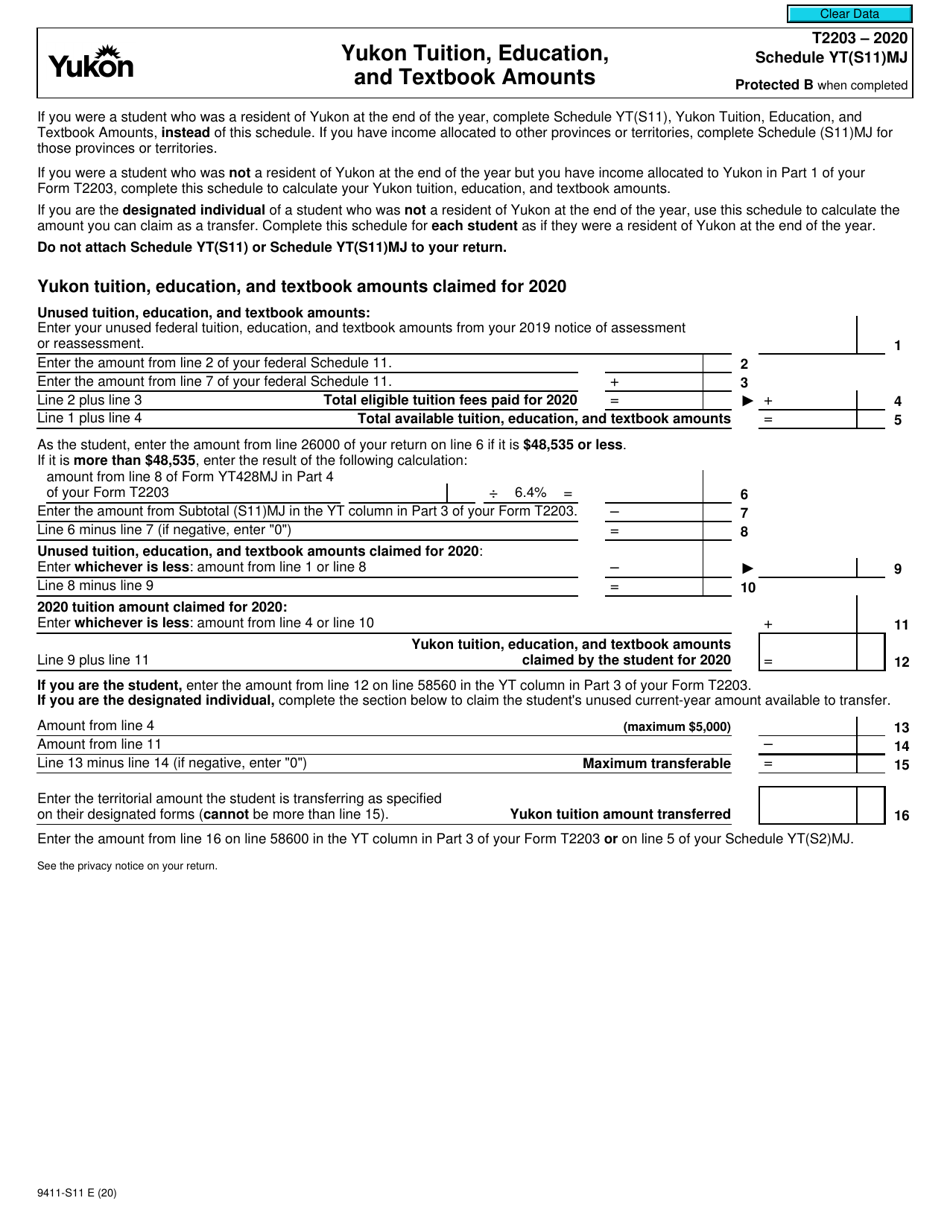

Form T2203 (9411-S11) Schedule YT(S11)MJ

for the current year.

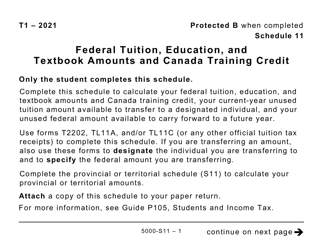

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada

Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada is a form used to claim the Yukon Tuition, Education, and Textbook Amounts on your Canadian tax return. This form allows residents of Yukon to claim eligible tuition and education-related expenses for tax credits.

The Form T2203 (9411-S11) Schedule YT(S11)MJ Yukon Tuition, Education, and Textbook Amounts - Canada is filed by individuals who are residents of Yukon and have eligible tuition, education, and textbook expenses.

FAQ

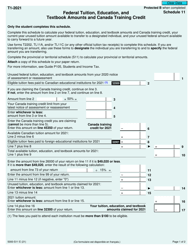

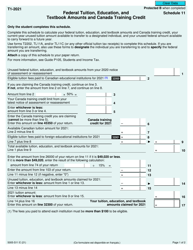

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to claim tuition, education, and textbook amounts.

Q: What is Schedule YT(S11)MJ?

A: Schedule YT(S11)MJ is a specific schedule of Form T2203 that is used by residents of Yukon to claim tuition, education, and textbook amounts.

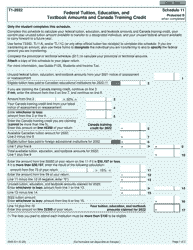

Q: What can be claimed using Form T2203?

A: Form T2203 allows you to claim the amounts you paid for tuition fees, education tax credits, and textbook costs.

Q: Is this form applicable to the United States?

A: No, Form T2203 is specific to Canada and cannot be used by U.S. residents.

Q: Who is eligible to use Form T2203?

A: Canadian taxpayers who have paid tuition fees or have received eligible educational assistance can use Form T2203.

Q: Is there a deadline for submitting Form T2203?

A: Yes, Form T2203 must be submitted along with your annual income tax return, typically by April 30th of the following year.

Q: Can I carry forward unused amounts?

A: Yes, unused tuition, education, and textbook amounts can be carried forward to future years, or they can be transferred to a family member.

Q: Do I need to keep supporting documents for Form T2203?

A: Yes, it is important to keep all relevant supporting documents, such as tuition receipts and T2202A forms, in case the CRA requests them for verification.