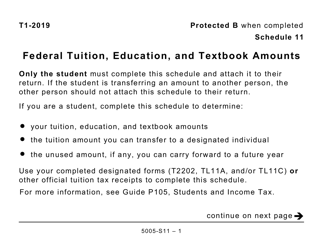

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5000 Schedule 11

for the current year.

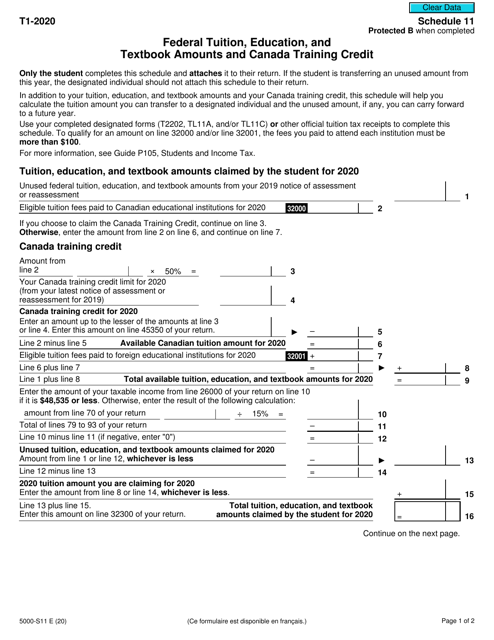

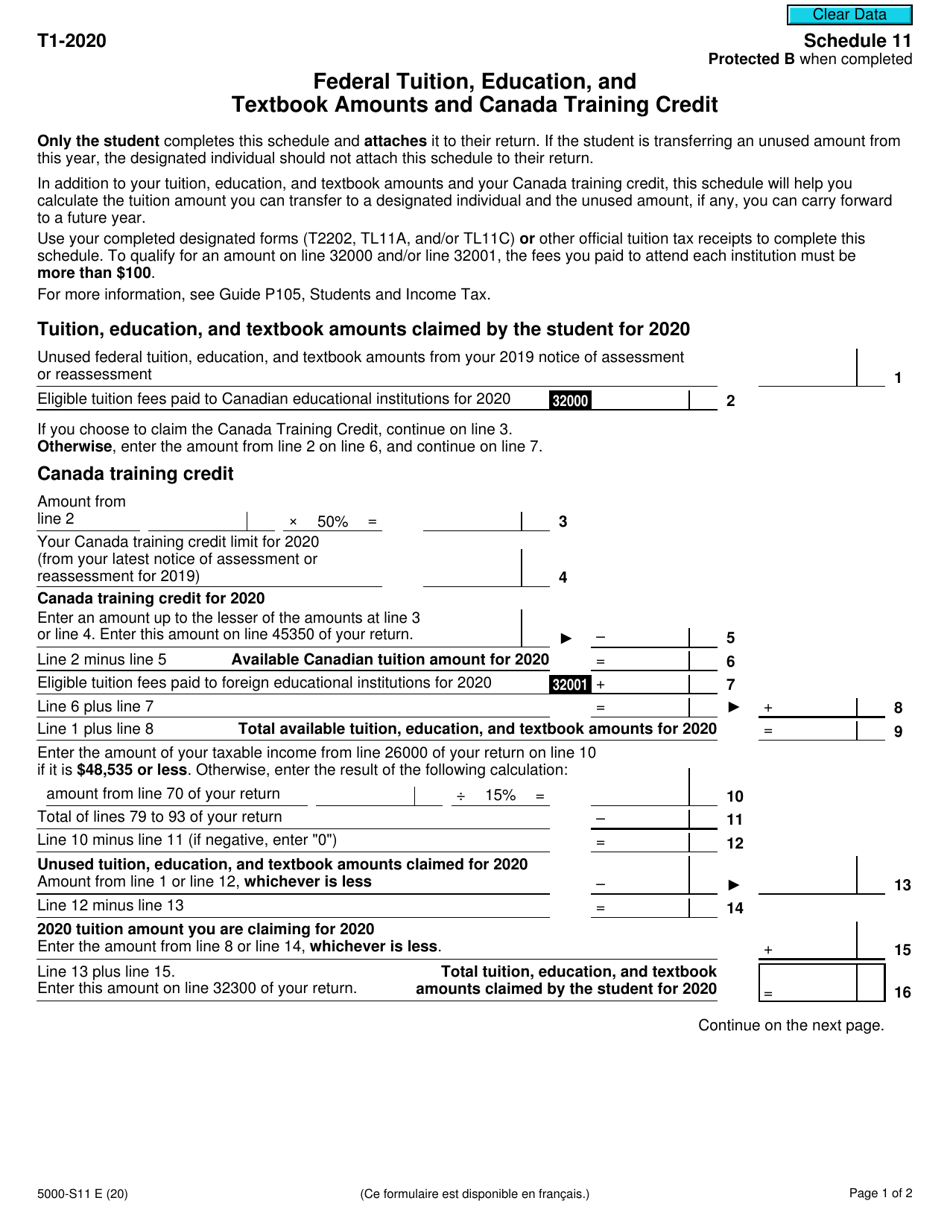

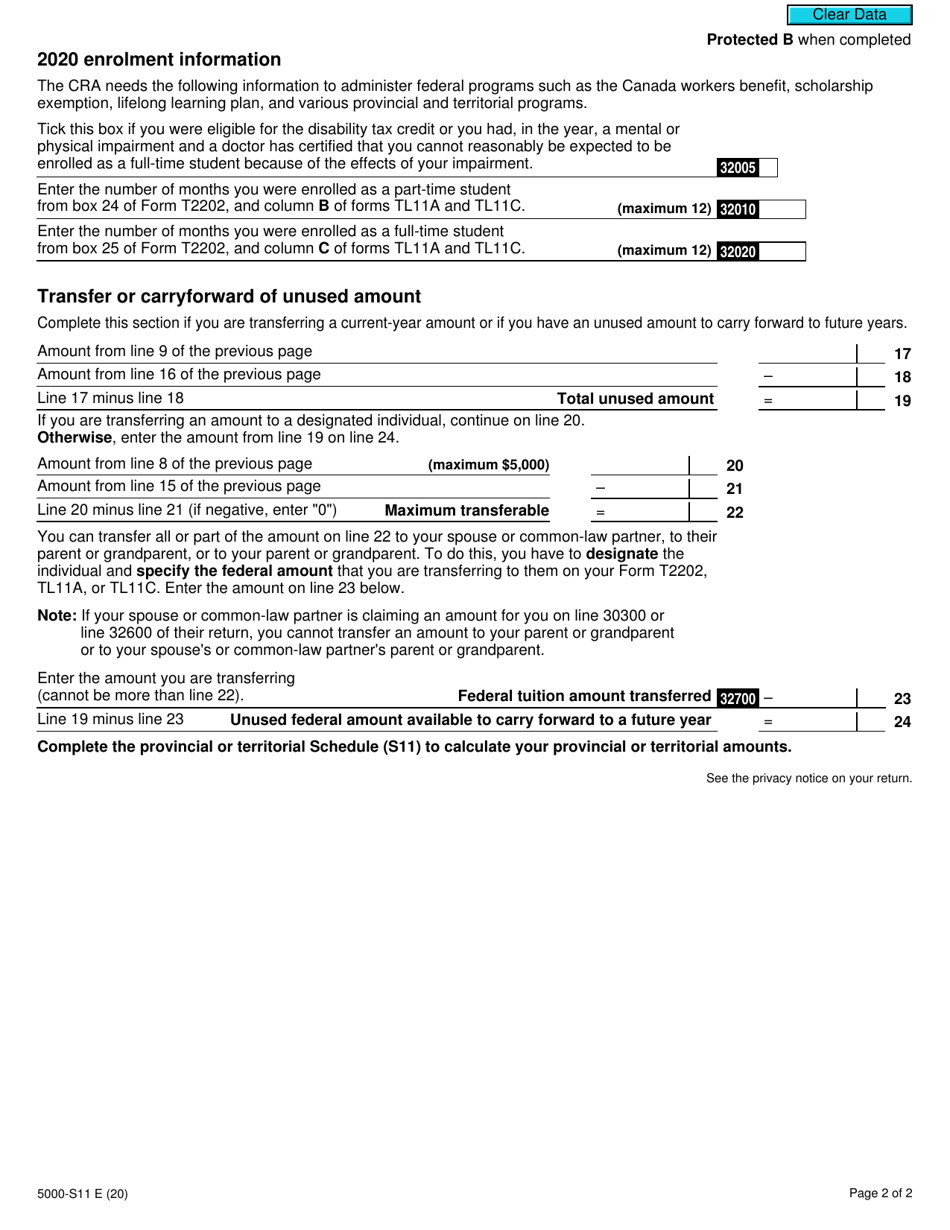

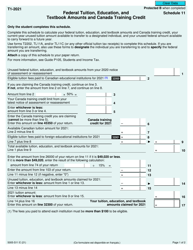

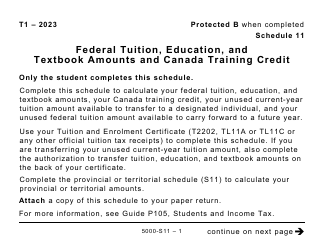

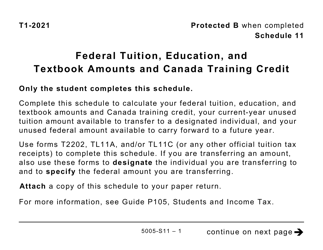

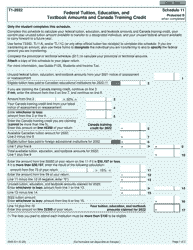

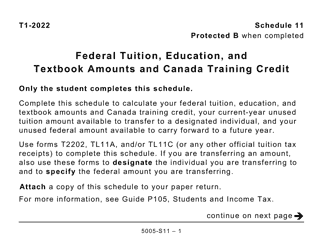

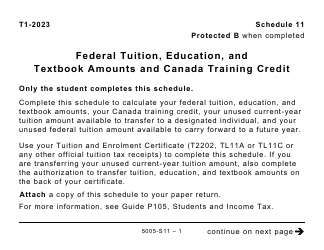

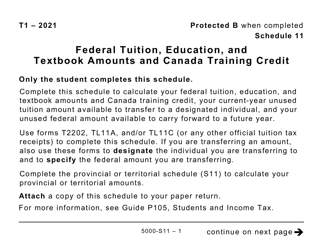

Form 5000 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit - Canada

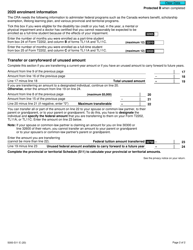

Form 5000 Schedule 11 is used by Canadian residents to claim federal credits for tuition, education, and textbook expenses, as well as the new Canada Training Credit.

The individual who is claiming the federal tuition, education, and textbook amounts and Canada Training Credit in Canada will file the Form 5000 Schedule 11.

FAQ

Q: What is Form 5000 Schedule 11?

A: Form 5000 Schedule 11 is a federal tax form in Canada.

Q: What does Form 5000 Schedule 11 include?

A: Form 5000 Schedule 11 includes information about federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

Q: What are federal tuition, education, and textbook amounts?

A: Federal tuition, education, and textbook amounts are tax credits that can reduce the amount of taxes you owe based on your eligible education expenses.

Q: What is the Canada Training Credit?

A: The Canada Training Credit is a refundable tax credit that can be claimed by eligible individuals to help cover the cost of training and education.

Q: Who is eligible to claim the federal tuition, education, and textbook amounts?

A: Students enrolled in eligible post-secondary education programs can claim the federal tuition, education, and textbook amounts.

Q: Who is eligible to claim the Canada Training Credit?

A: Individuals between the ages of 26 and 65 who have a valid social insurance number and meet certain income requirements are eligible to claim the Canada Training Credit.

Q: How do I fill out Form 5000 Schedule 11?

A: To fill out Form 5000 Schedule 11, you need to enter information about your eligible education expenses and calculate the amounts you are eligible to claim. The form provides instructions on how to complete it.

Q: Is Form 5000 Schedule 11 specific to Canada?

A: Yes, Form 5000 Schedule 11 is specific to Canada and is used for federal income tax purposes in Canada.