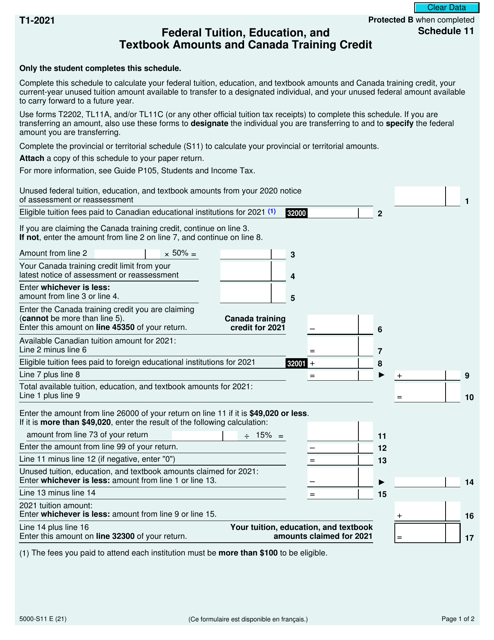

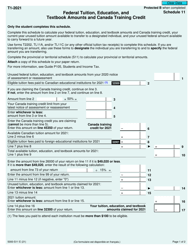

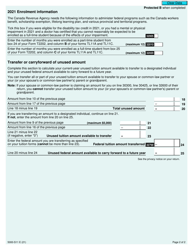

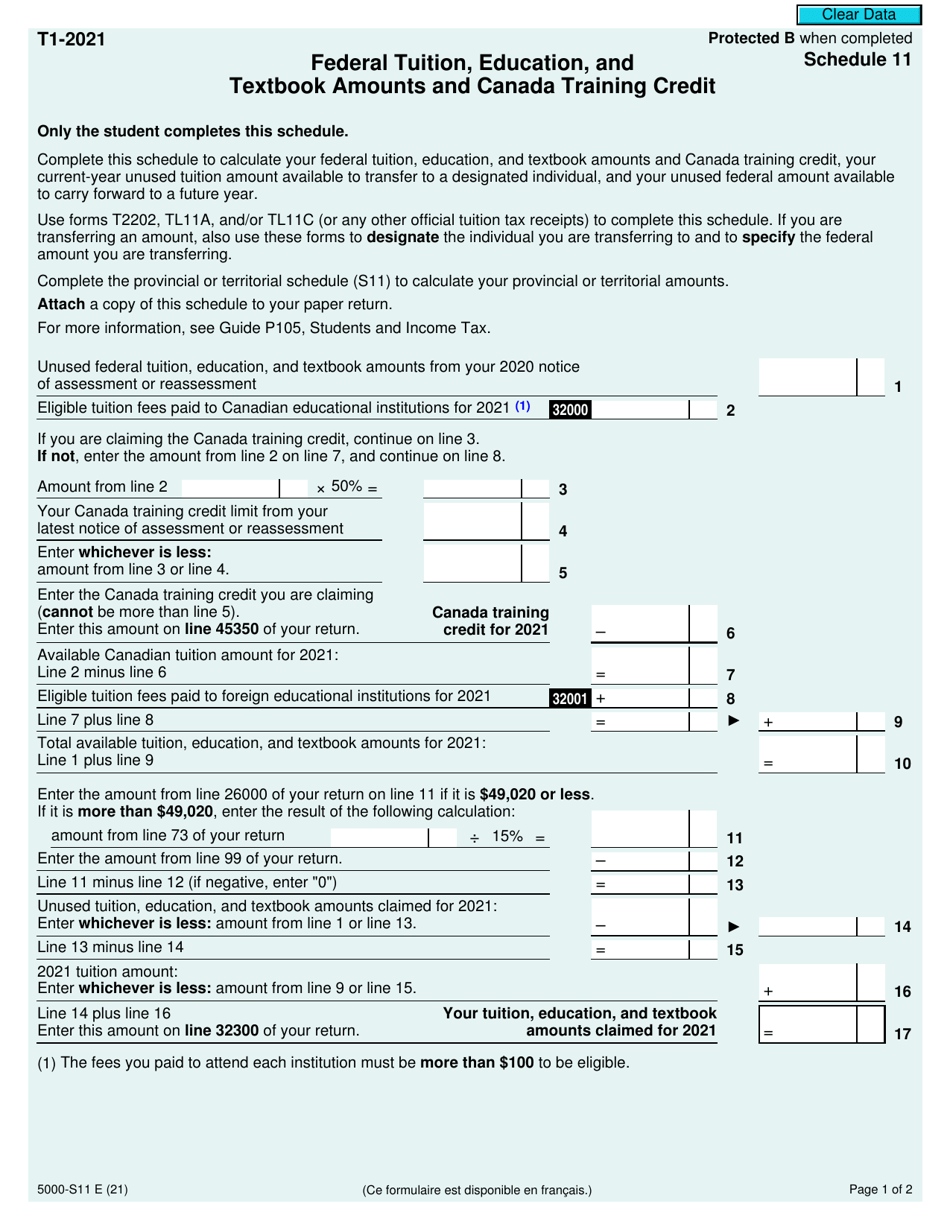

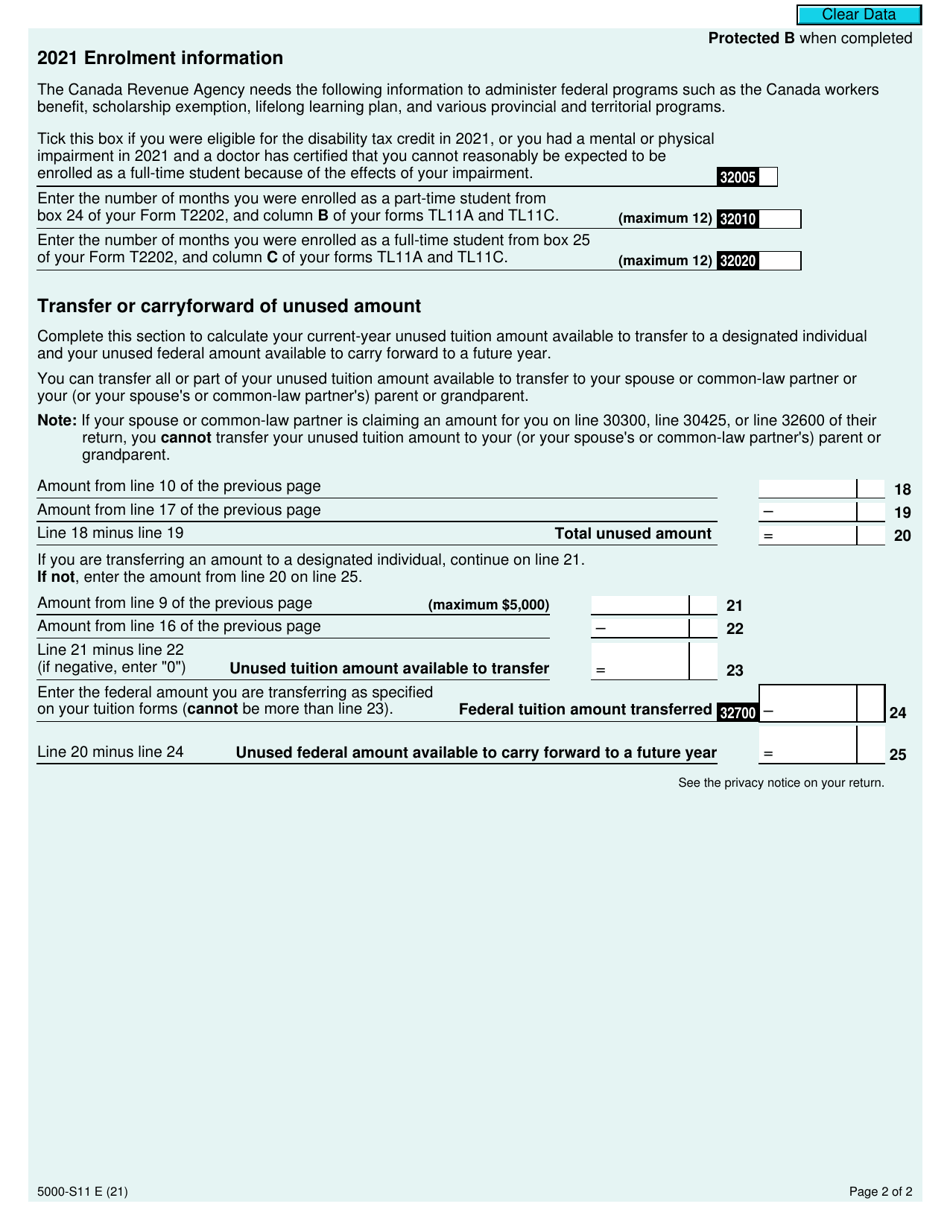

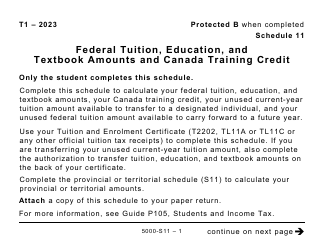

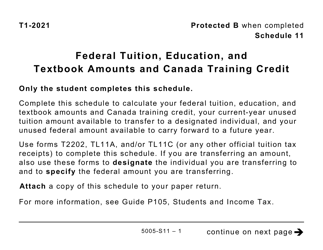

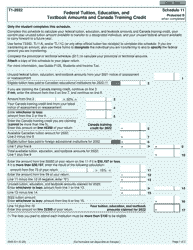

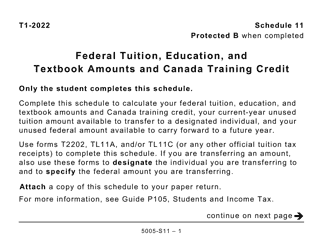

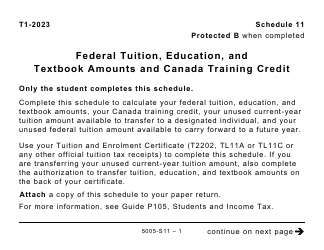

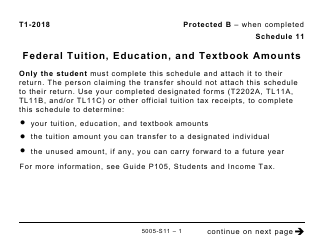

Form 5000 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For All Except Qc and Non-residents) - Canada

Form 5000 Schedule 11 is used in Canada to claim federal tax credits for tuition, education, and textbook expenses as well as the Canada Training Credit. It applies to all Canadian residents except those living in Quebec and non-residents.

The Form 5000 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For All Except Qc and Non-residents) is filed by Canadian residents.

Form 5000 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For All Except Qc and Non-residents) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5000 Schedule 11?

A: Form 5000 Schedule 11 is a form used in Canada to report federal tuition, education, and textbook amounts and claim the Canada Training Credit.

Q: Who can use Form 5000 Schedule 11?

A: Form 5000 Schedule 11 can be used by individuals in Canada, except for residents of Quebec and non-residents.

Q: What does Form 5000 Schedule 11 report?

A: Form 5000 Schedule 11 is used to report the amounts of federal tuition, education, and textbook credits that you are claiming, as well as to claim the Canada Training Credit.

Q: What are federal tuition, education, and textbook amounts?

A: Federal tuition, education, and textbook amounts are credits that can be claimed to reduce the amount of tax you owe. These credits are based on eligible tuition and education costs.

Q: What is the Canada Training Credit?

A: The Canada Training Credit is a new refundable tax credit that can be claimed to offset eligible tuition and education fees paid for courses taken after 2019.

Q: Who is not eligible to use Form 5000 Schedule 11?

A: Residents of Quebec and non-residents of Canada are not eligible to use Form 5000 Schedule 11.

Q: Do I need to attach supporting documents with Form 5000 Schedule 11?

A: Yes, you may be required to attach supporting documents, such as tuition tax receipts, to support the amounts claimed on Form 5000 Schedule 11.

Q: When is the deadline to file Form 5000 Schedule 11?

A: The deadline to file Form 5000 Schedule 11 is typically the same as the deadline to file your income tax return, which is April 30th of the following year.