This version of the form is not currently in use and is provided for reference only. Download this version of

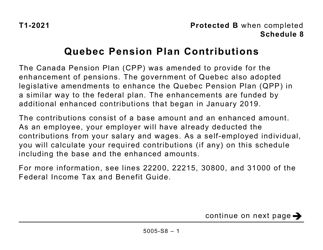

Form 5000-S8 Schedule 8

for the current year.

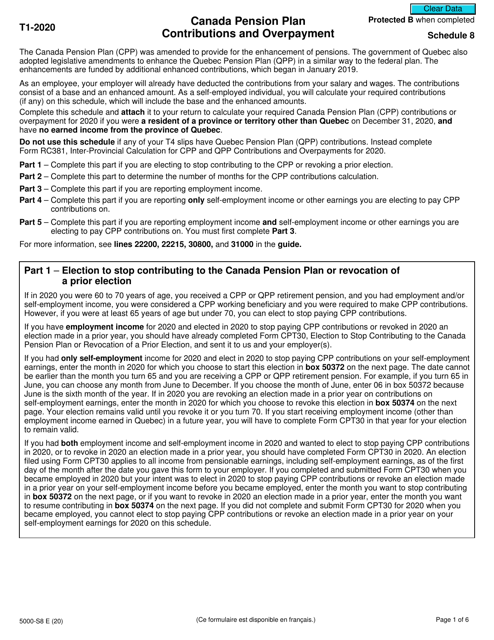

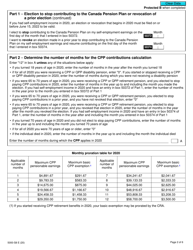

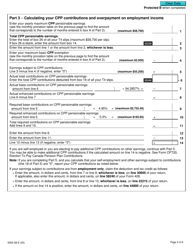

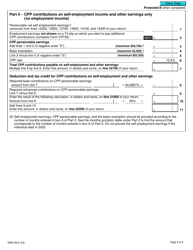

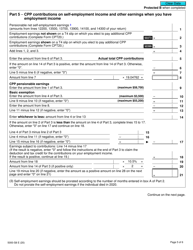

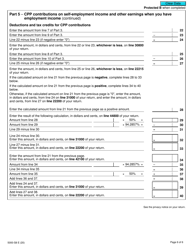

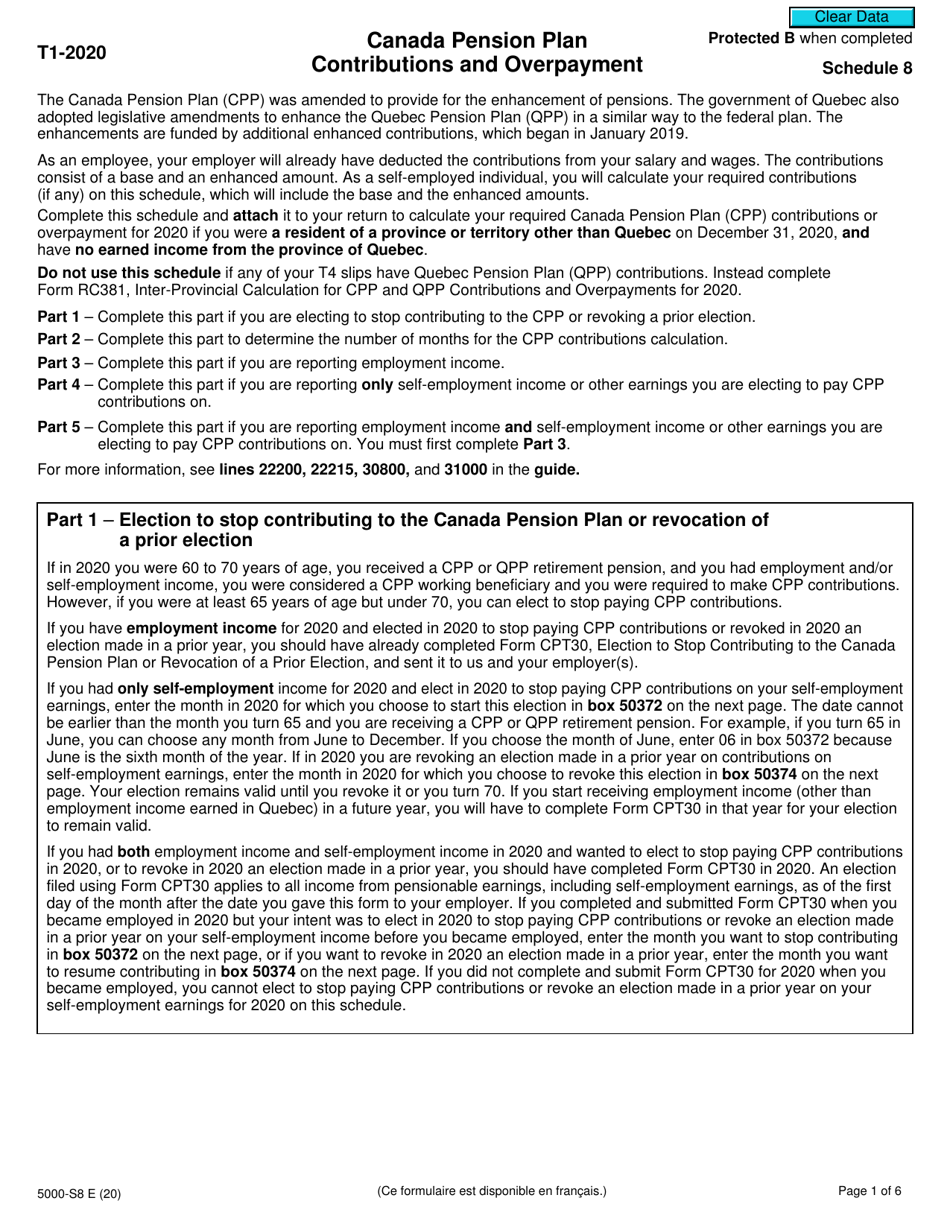

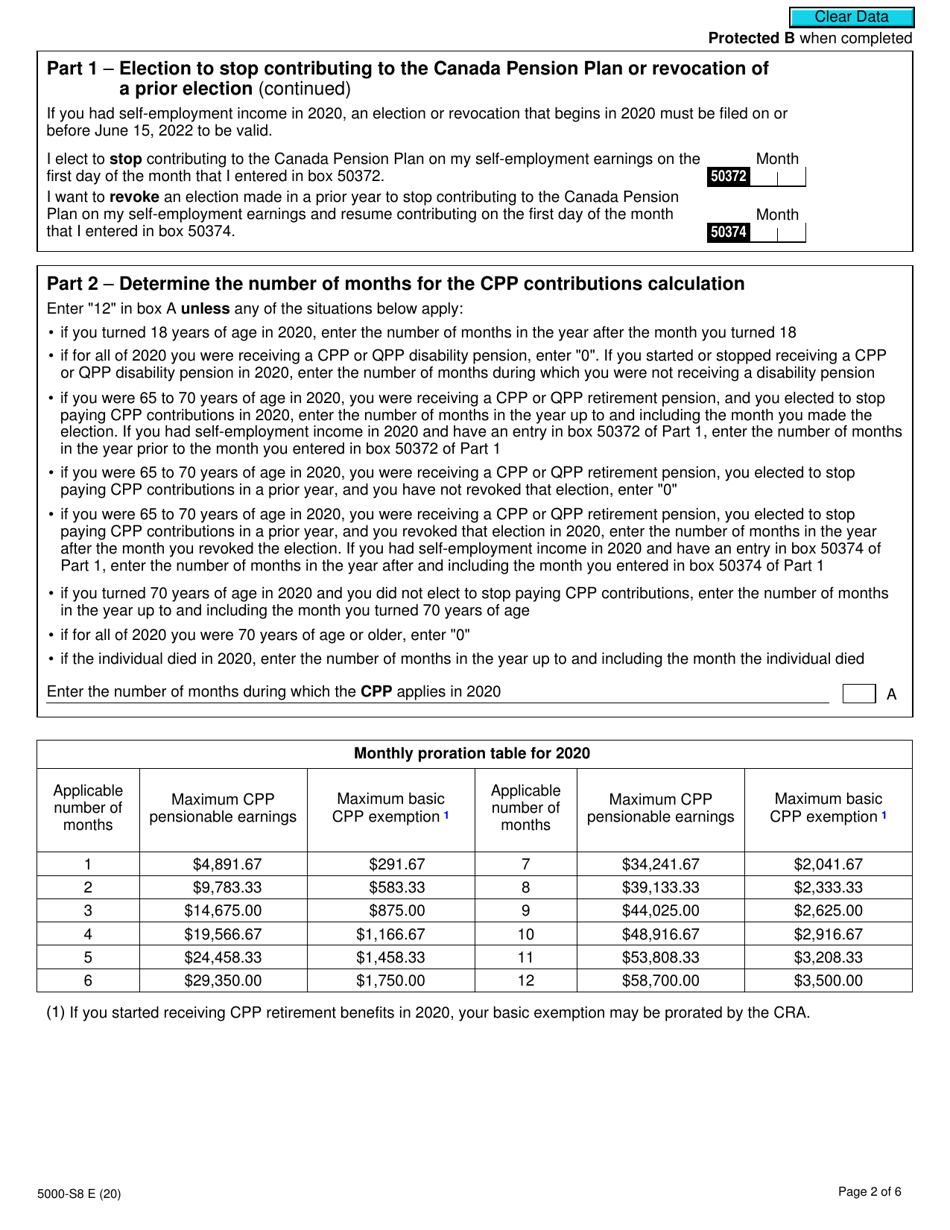

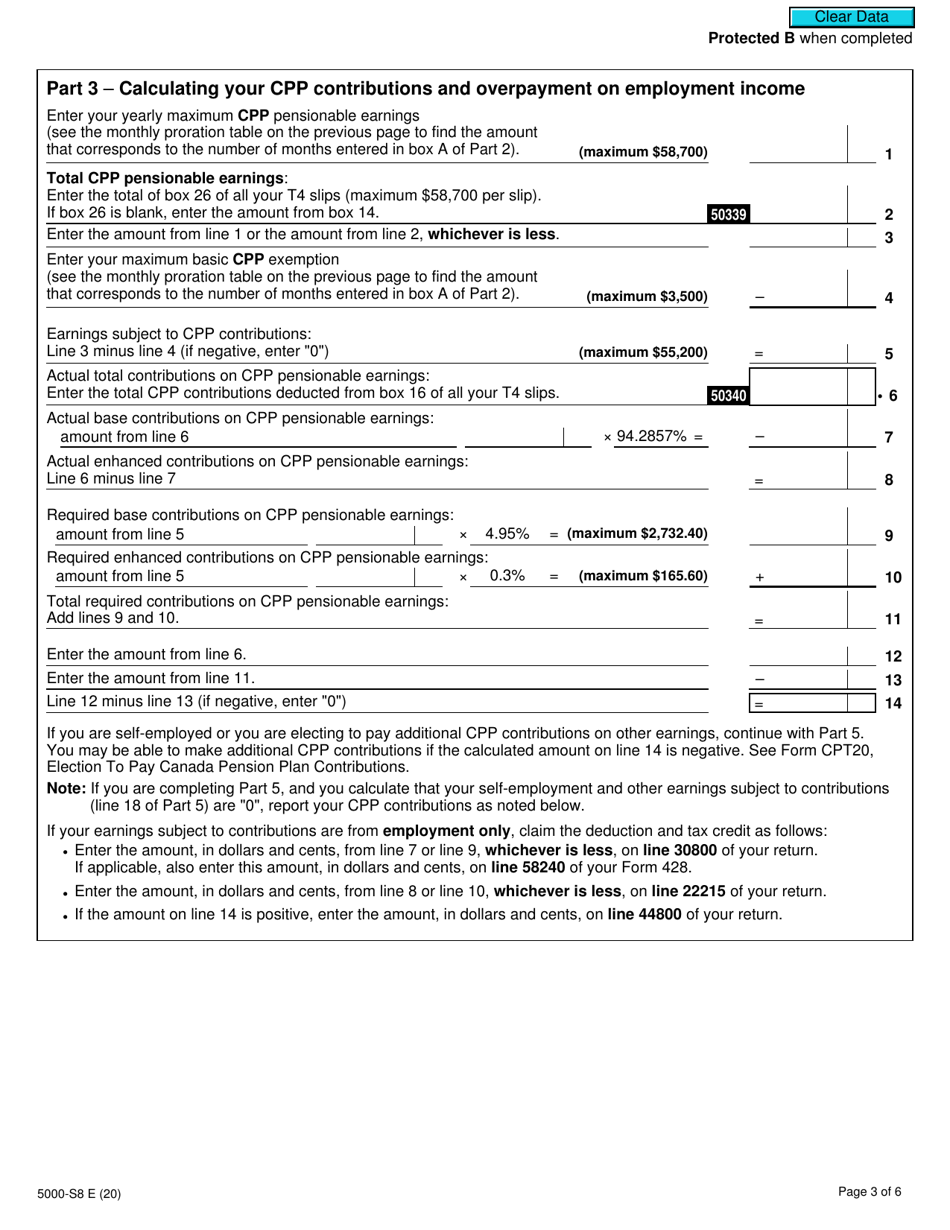

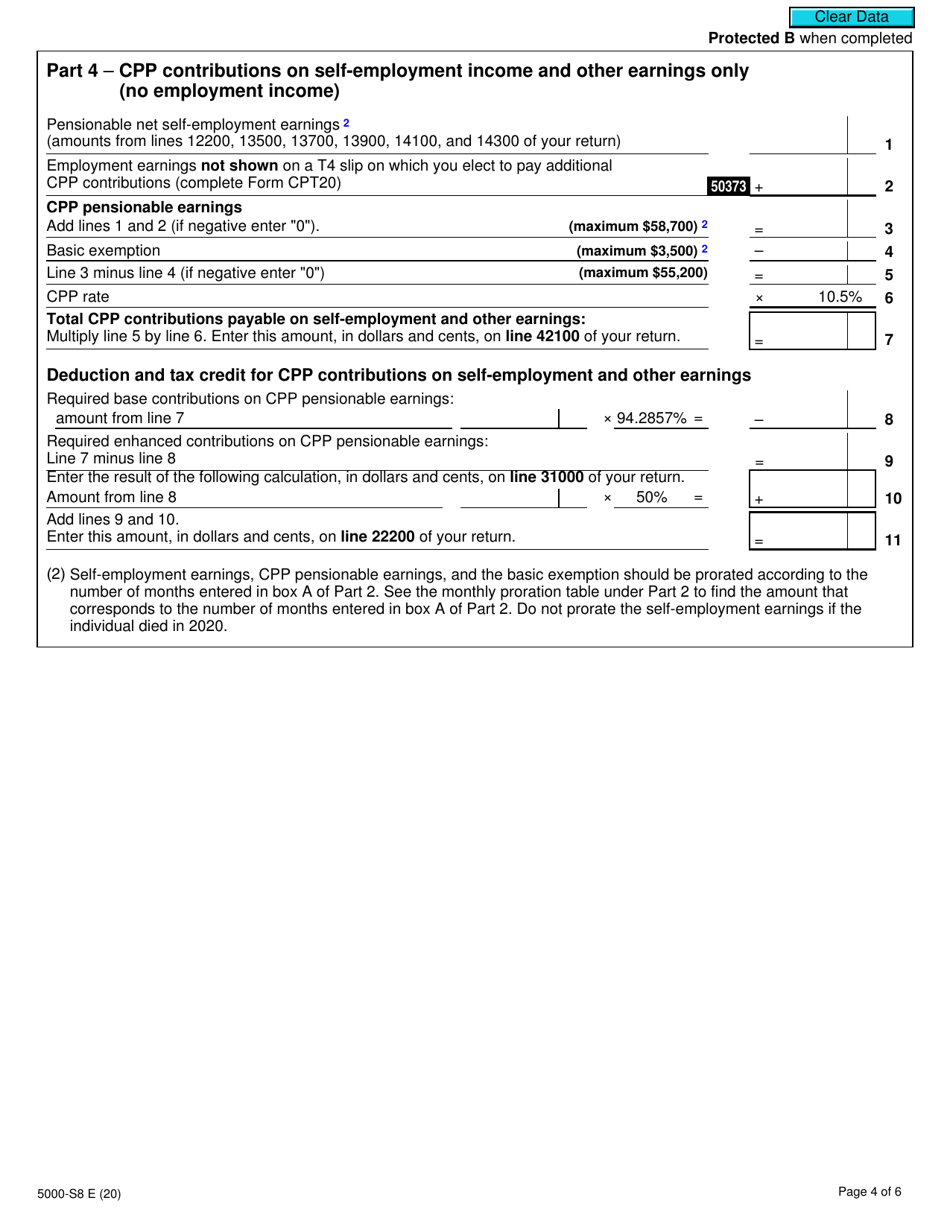

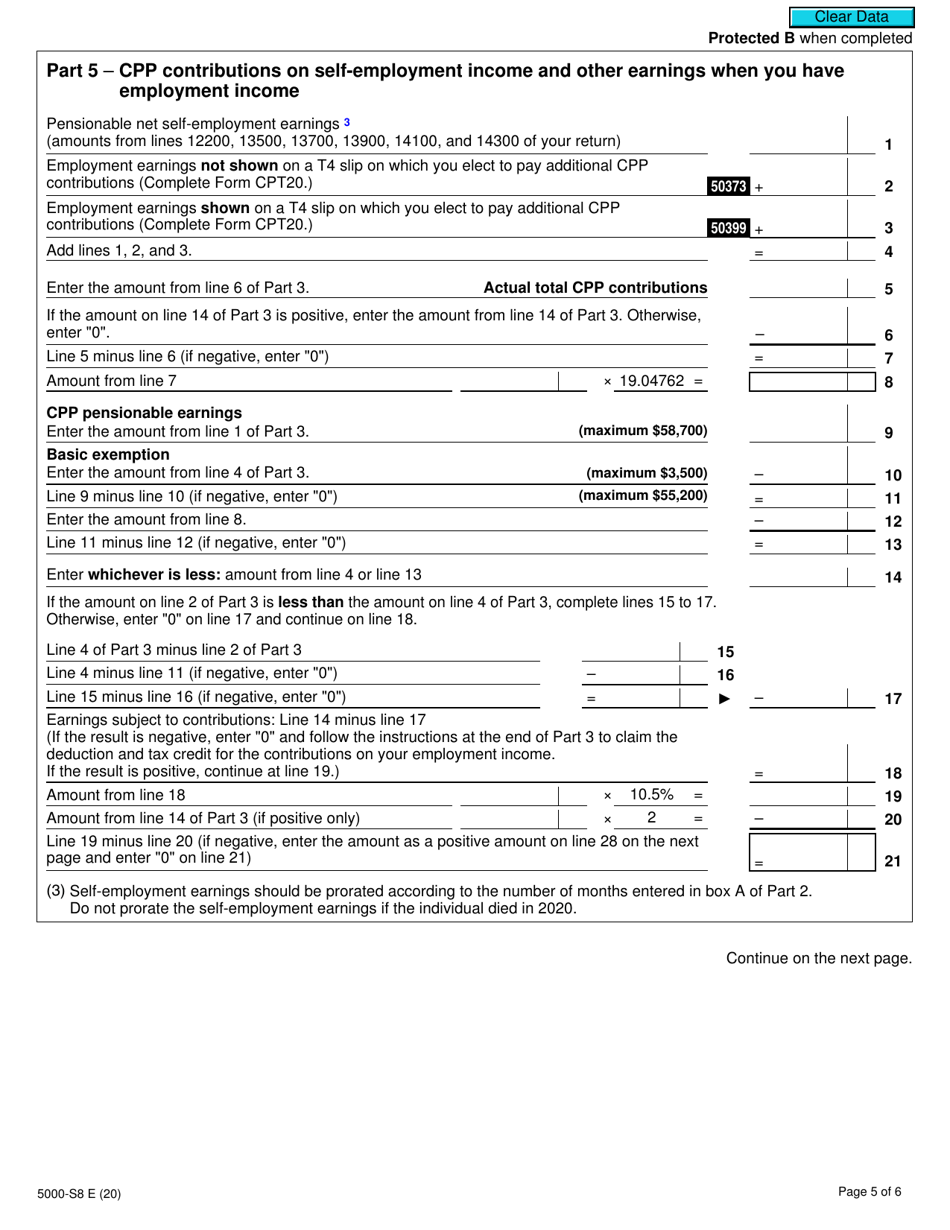

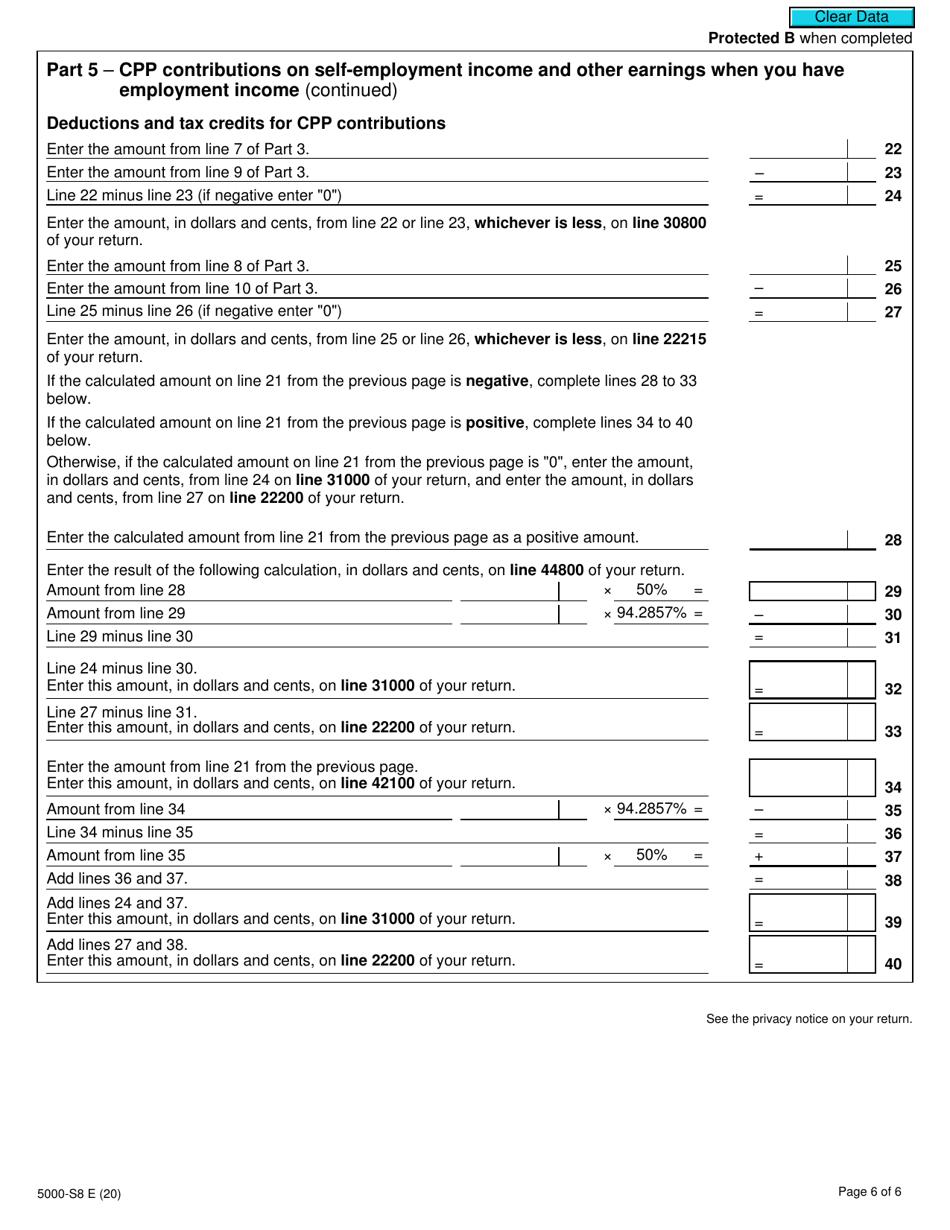

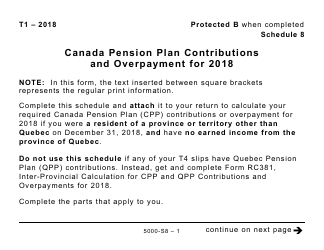

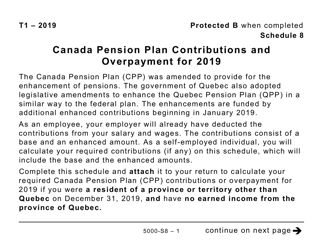

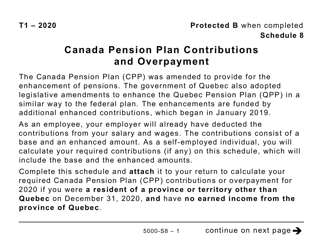

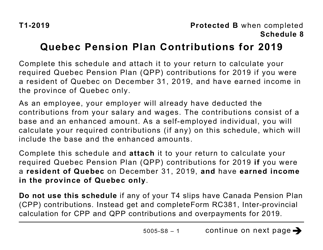

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment - Canada

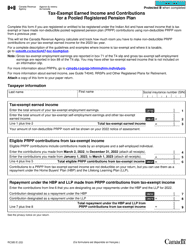

Form 5000-S8 Schedule 8, Canada Pension Plan Contributions and Overpayment, is used by individuals in Canada to report their contributions to the Canada Pension Plan and any overpayment that may have occurred.

The individual who wants to report their Canada Pension Plan contributions and overpayment in Canada files the Form 5000-S8 Schedule 8.

FAQ

Q: What is Form 5000-S8?

A: Form 5000-S8 is a schedule used to report Canada Pension Plan contributions and overpayments.

Q: What is the Canada Pension Plan?

A: The Canada Pension Plan is a social insurance program that provides income support to Canadians in their retirement.

Q: Who needs to use Form 5000-S8?

A: Individuals who have made Canada Pension Plan contributions or have overpaid their contributions need to use Form 5000-S8.

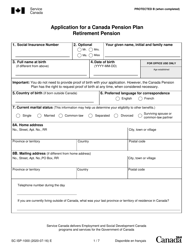

Q: What information is required on Form 5000-S8?

A: Form 5000-S8 requires you to provide your name, social insurance number, the year the contributions or overpayment were made, and the amount.

Q: When is the deadline to file Form 5000-S8?

A: The deadline to file Form 5000-S8 is usually April 30th of the following year.

Q: What should I do if I made a mistake on Form 5000-S8?

A: If you made a mistake on Form 5000-S8, you should contact the CRA for guidance on how to correct the error.

Q: Can I file Form 5000-S8 electronically?

A: No, Form 5000-S8 cannot be filed electronically. It must be printed, signed, and mailed to the CRA.

Q: What happens after I file Form 5000-S8?

A: After you file Form 5000-S8, the CRA will process it and determine if you are eligible for a refund or if you owe any additional contributions.

Q: Is Form 5000-S8 only for Canadian citizens?

A: No, Form 5000-S8 is for anyone who has made Canada Pension Plan contributions or has overpaid their contributions, regardless of citizenship.