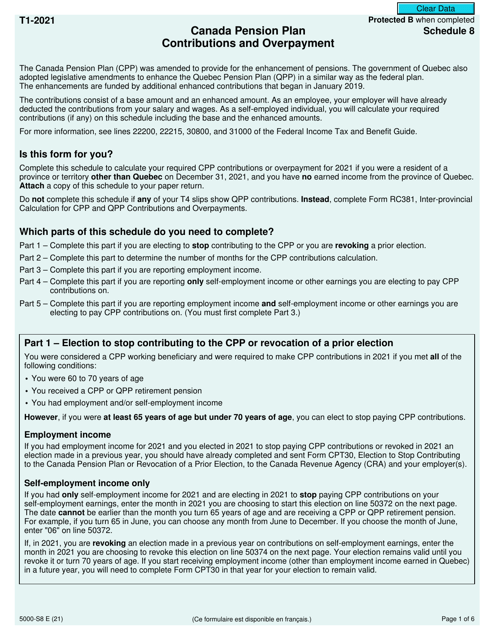

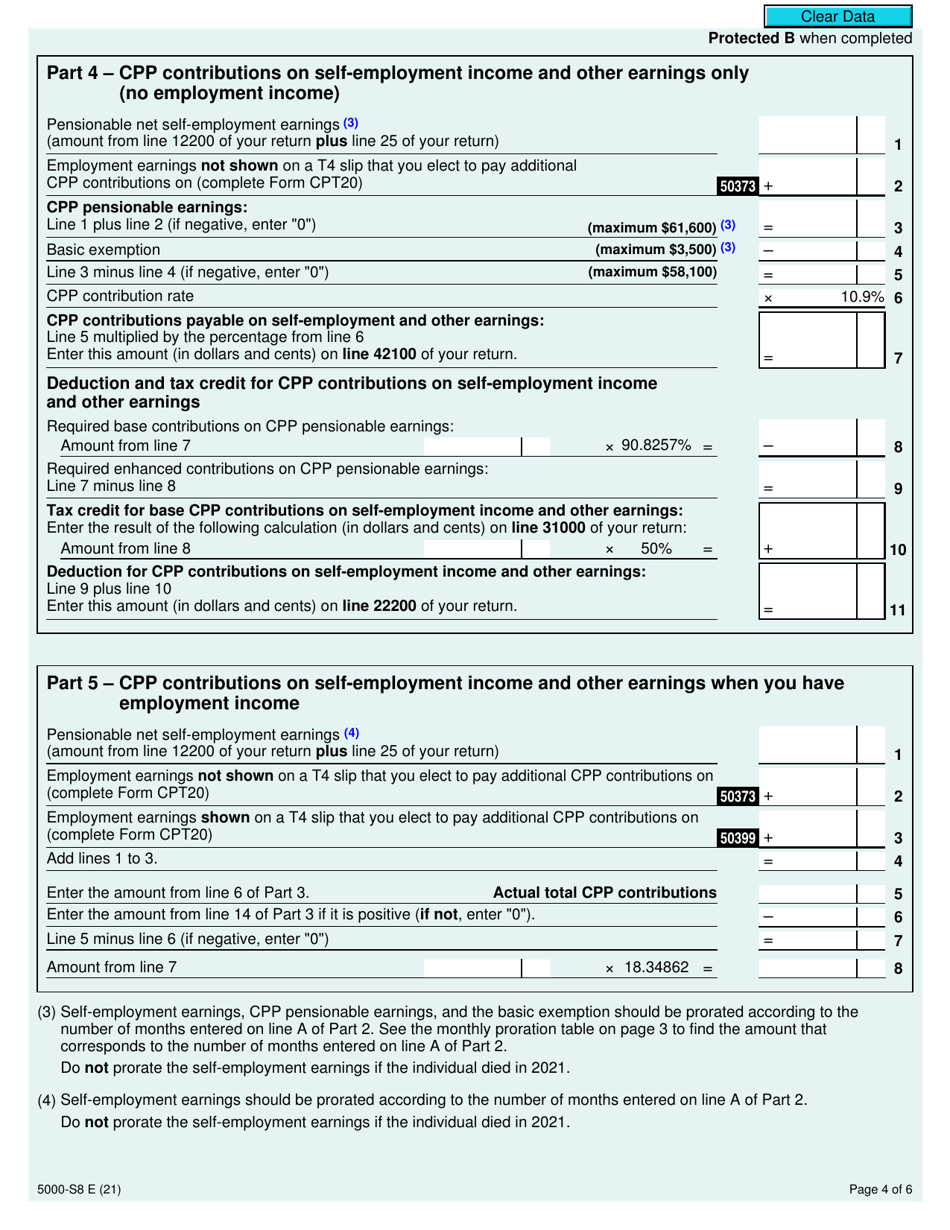

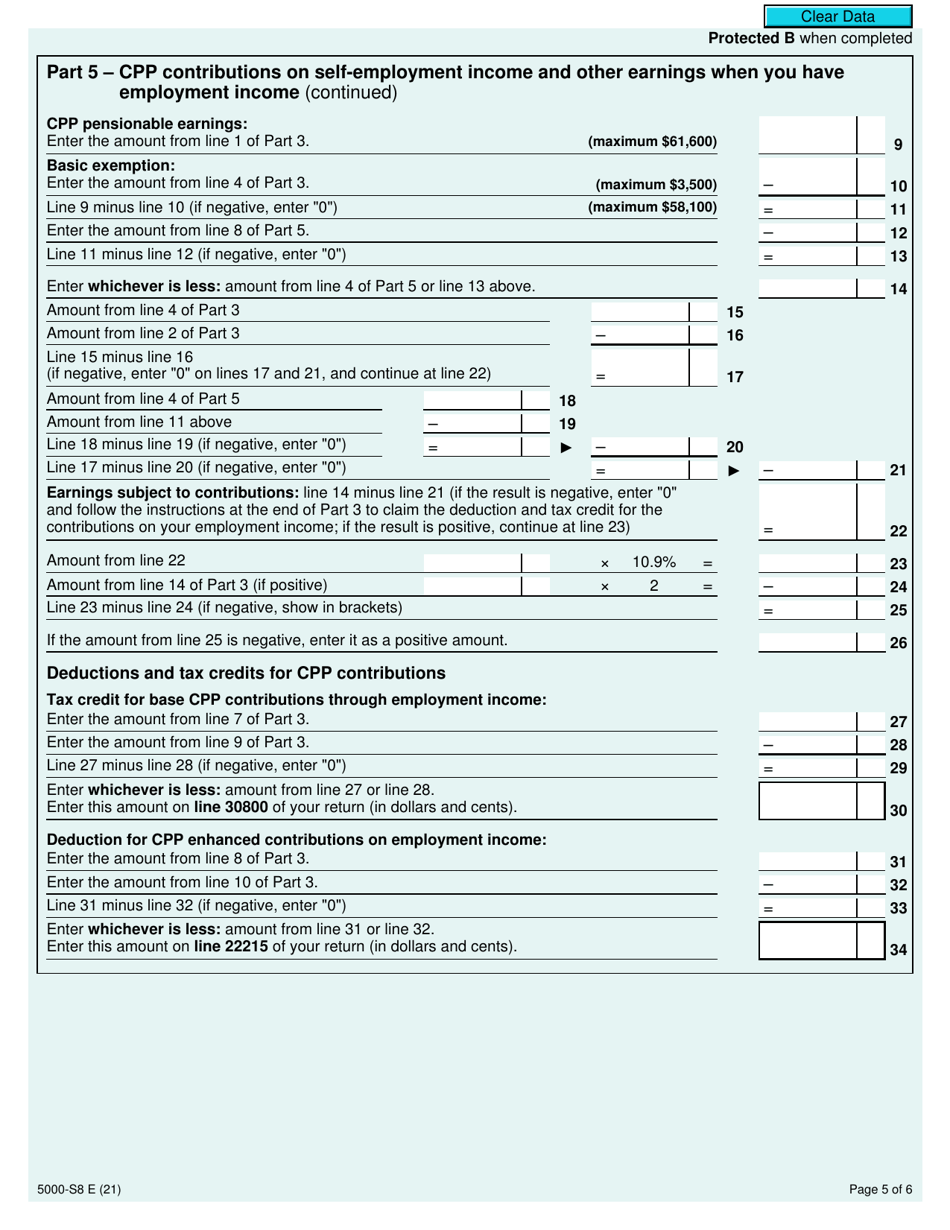

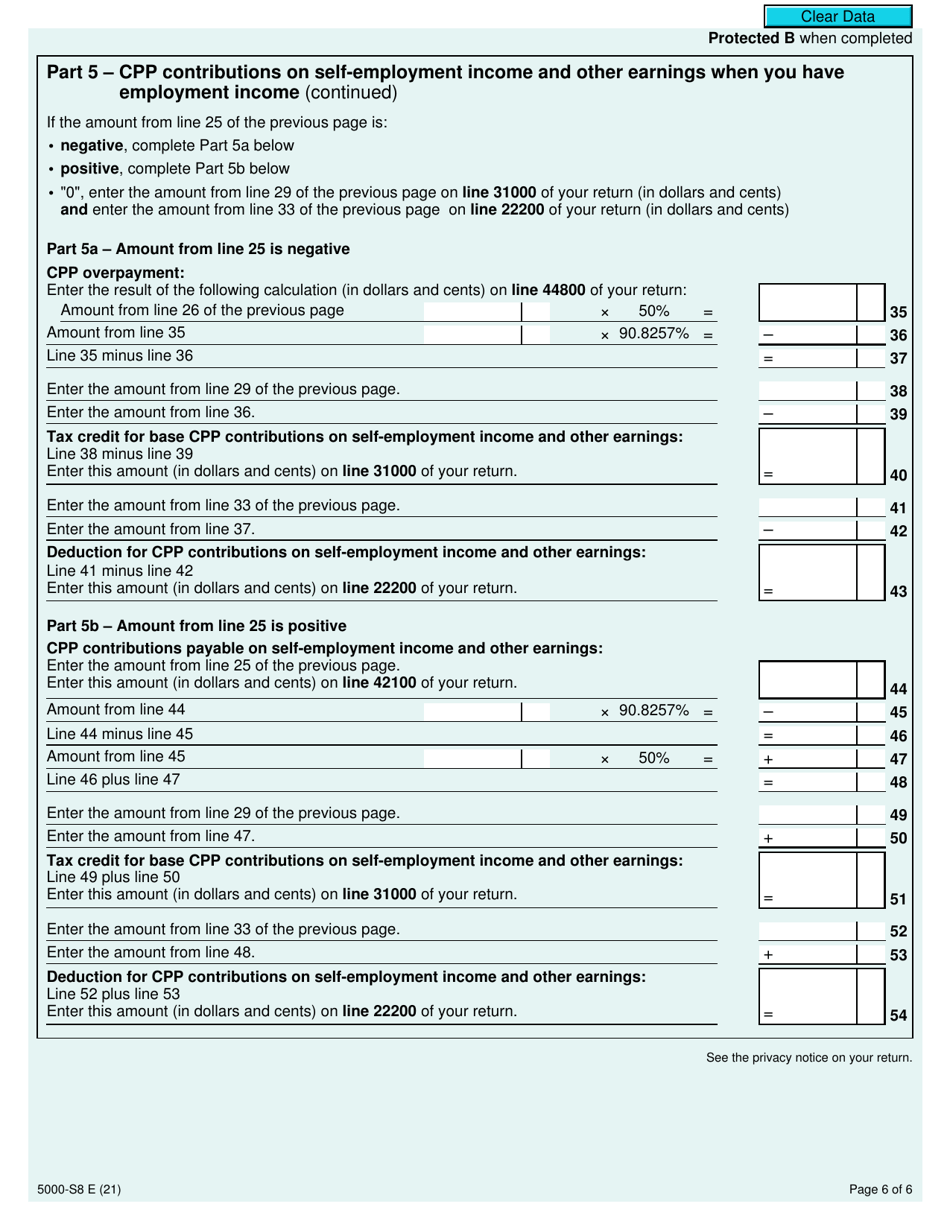

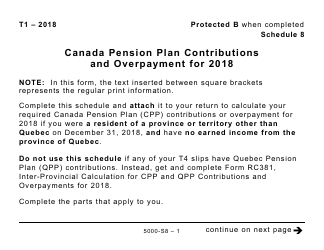

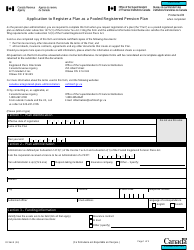

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment - Canada

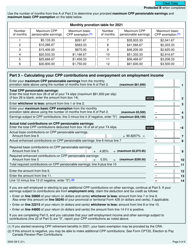

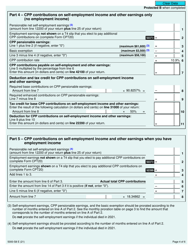

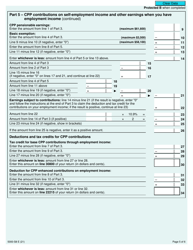

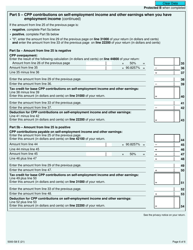

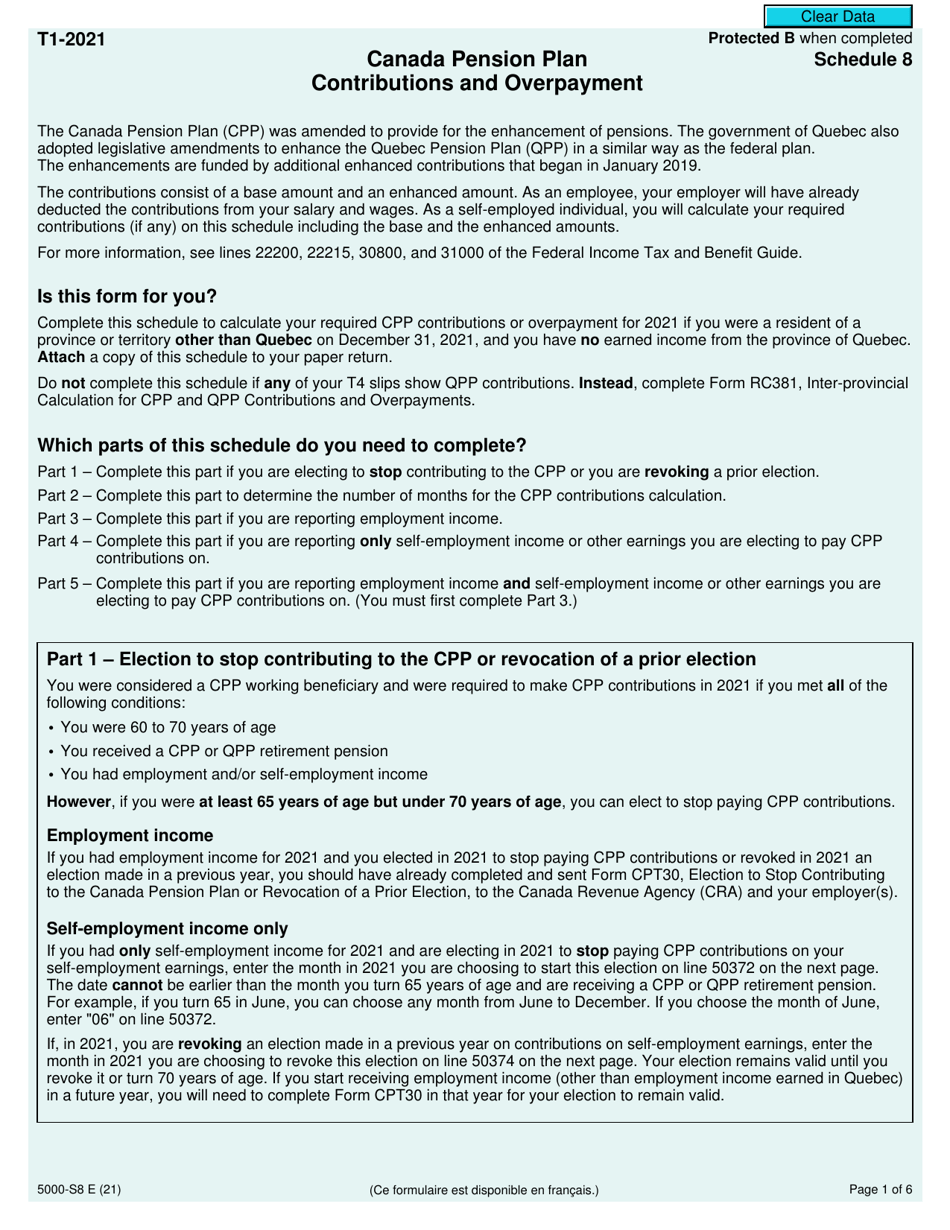

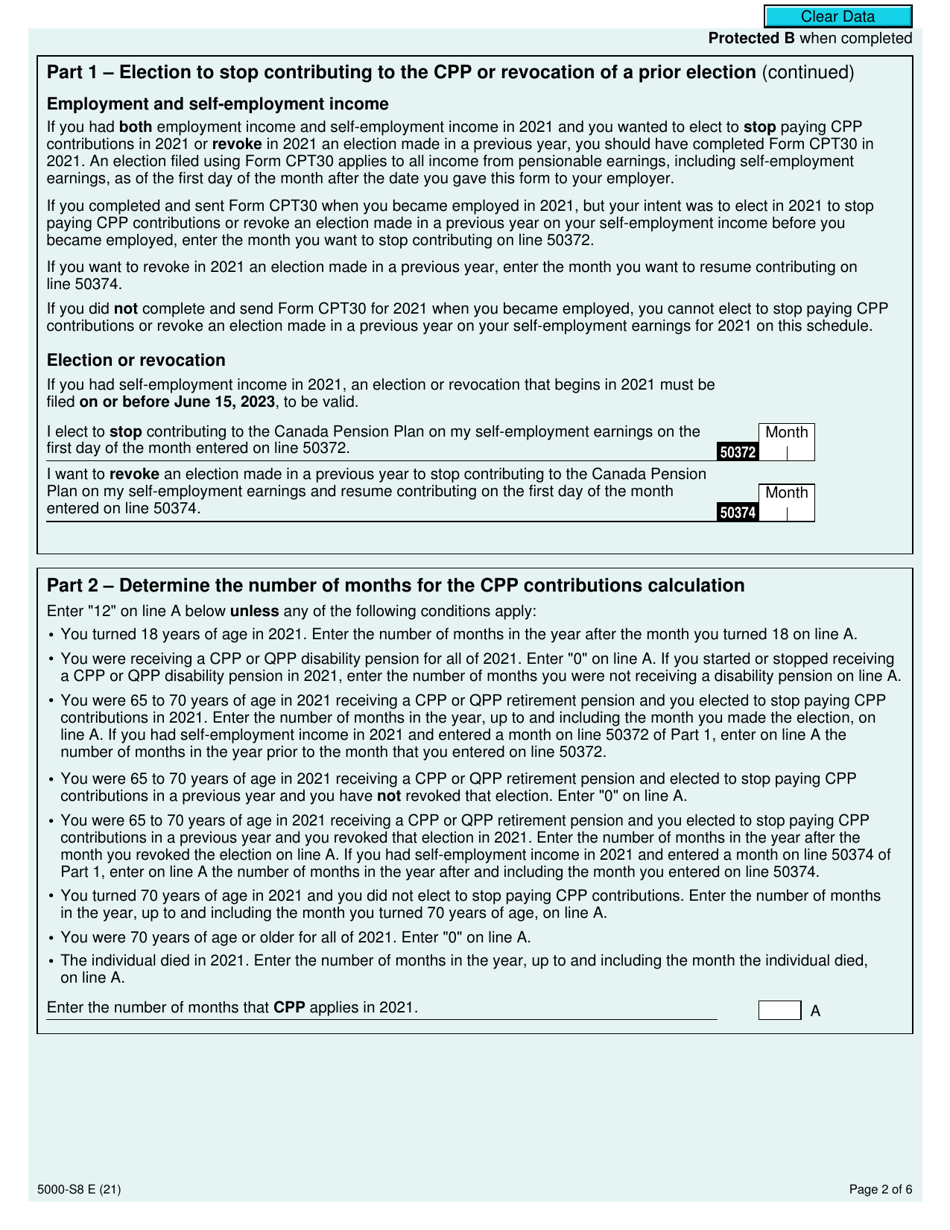

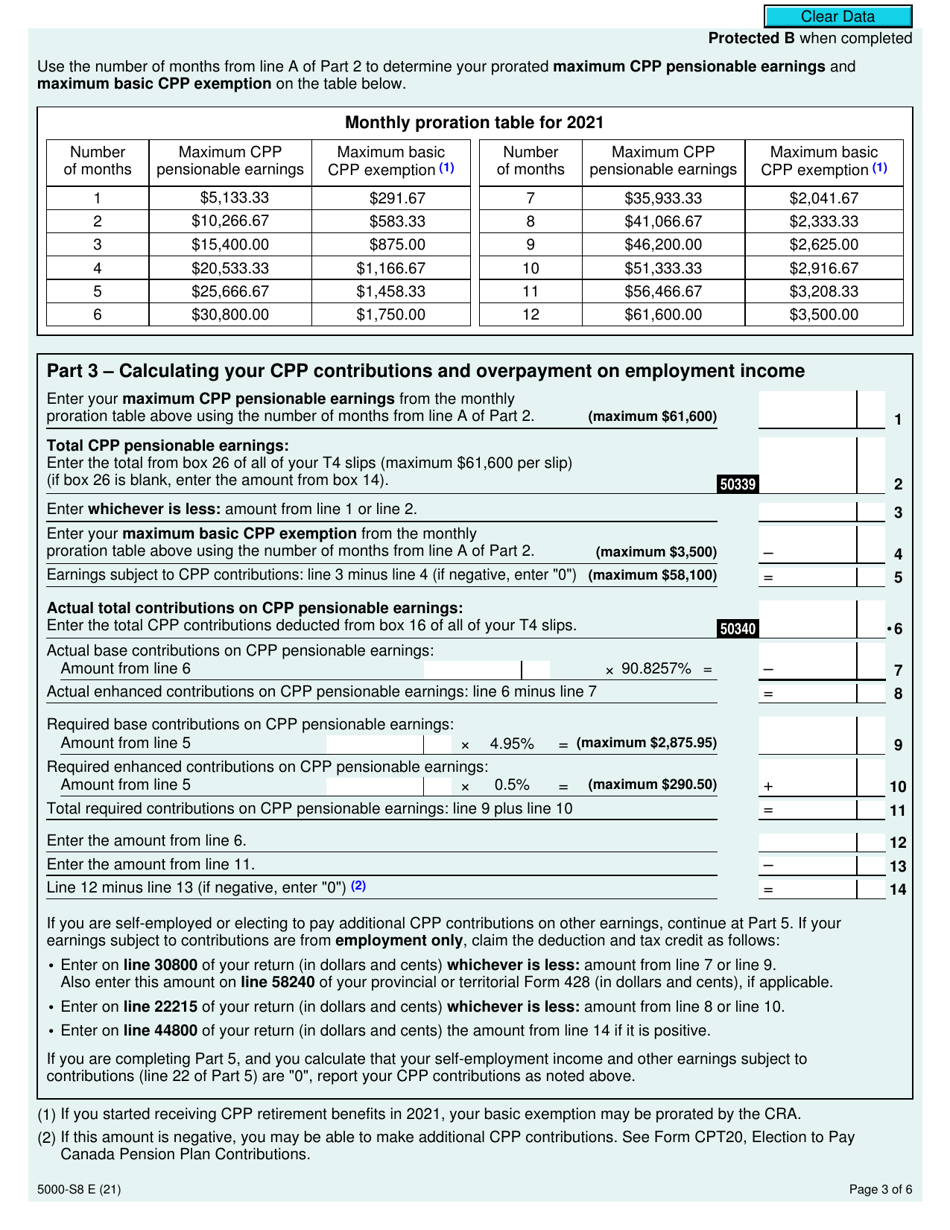

The Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment is used to report contributions made to the Canada Pension Plan and any overpayments made. It helps individuals keep track of their contributions to the pension plan and any adjustments needed for overpayment.

The form 5000-S8 Schedule 8 for Canada Pension Plan Contributions and Overpayment is filed by individuals in Canada who have made contributions to the Canada Pension Plan.

Form 5000-S8 Schedule 8 Canada Pension Plan Contributions and Overpayment - Canada - Frequently Asked Questions (FAQ)

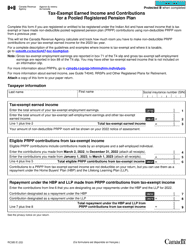

Q: What is Form 5000-S8?

A: Form 5000-S8 is a schedule used in Canada to report Canada Pension Plan (CPP) contributions and overpayments.

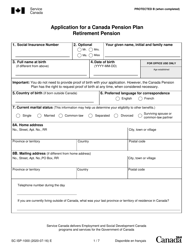

Q: What is the Canada Pension Plan (CPP)?

A: The Canada Pension Plan (CPP) is a social insurance program that provides income to retired and disabled individuals, as well as their dependents.

Q: What information do I need to provide on Form 5000-S8?

A: You need to provide your CPP contribution amount and any overpayments made during the tax year.

Q: Who needs to file Form 5000-S8?

A: You need to file Form 5000-S8 if you made CPP contributions or overpayments during the tax year.

Q: When is the deadline to file Form 5000-S8?

A: The deadline to file Form 5000-S8 is the same as your income tax return deadline, which is usually April 30th.

Q: Do I need to include Form 5000-S8 with my tax return?

A: Yes, you need to include Form 5000-S8 with your tax return, specifically with your T1 General form.

Q: What happens if I don't file Form 5000-S8?

A: If you don't file Form 5000-S8, you may not receive the appropriate CPP credits or benefits.

Q: Can I file Form 5000-S8 electronically?

A: Yes, you can file Form 5000-S8 electronically using the CRA's Netfile or EFILE services.