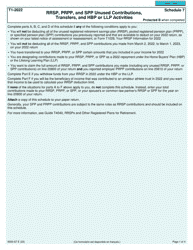

This version of the form is not currently in use and is provided for reference only. Download this version of

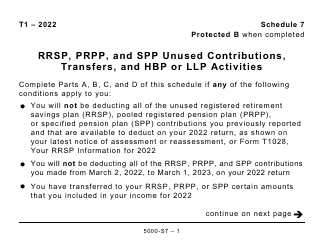

Form 5000-S7 Schedule 7

for the current year.

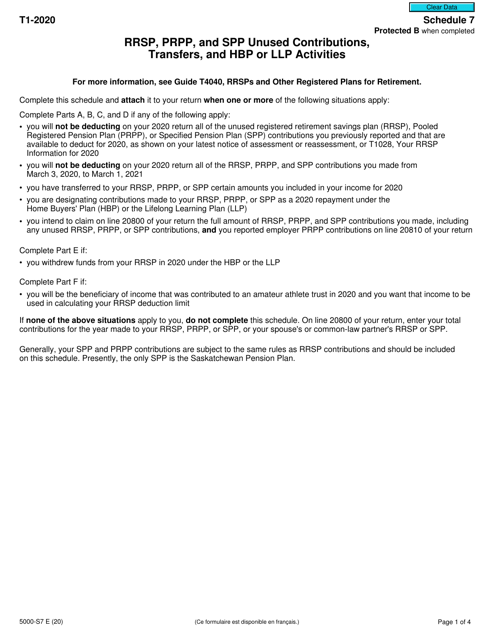

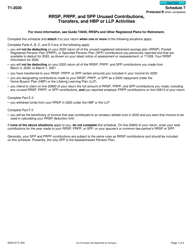

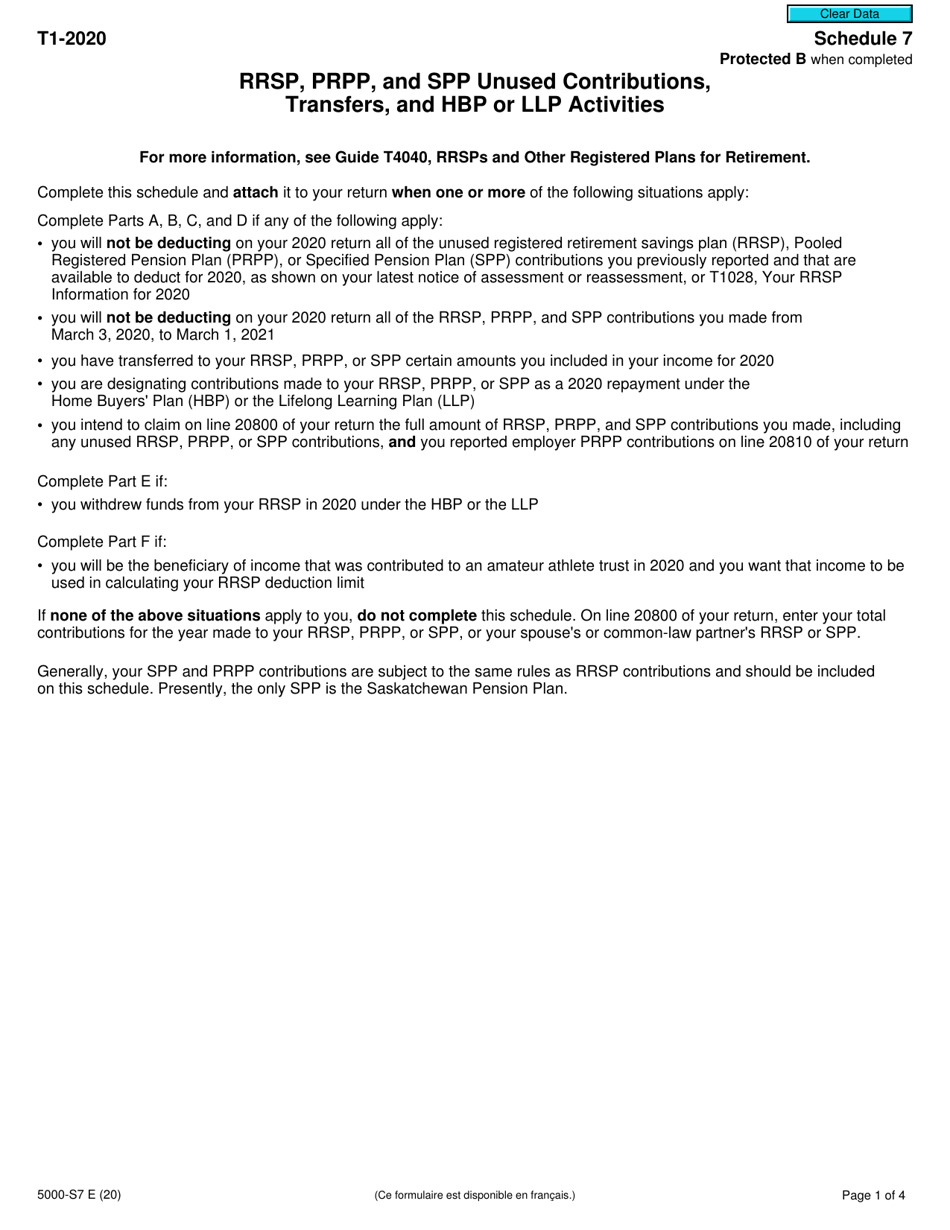

Form 5000-S7 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities - Canada

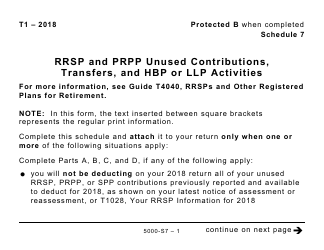

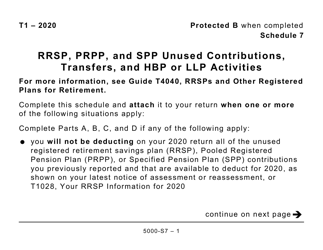

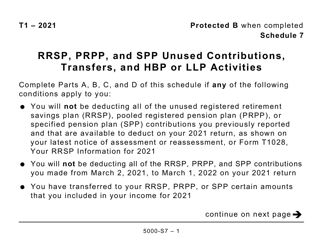

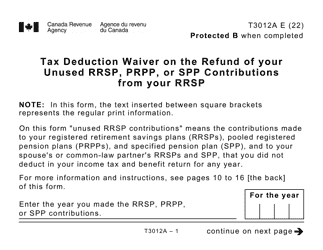

Form 5000-S7 Schedule 7 RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities is used in Canada for reporting any unused contributions, transfers, and activities related to Registered Retirement Savings Plans (RRSP), Pooled Registered Pension Plans (PRPP), and Specified Pension Plans (SPP).

The taxpayer who has made RRSP, PRPP, or SPP unused contributions, transfers, or participated in HBP or LLP activities files the Form 5000-S7 Schedule 7 in Canada.

FAQ

Q: What is Form 5000-S7 Schedule 7?

A: Form 5000-S7 Schedule 7 is a tax form used in Canada to report RRSP, PRPP, and SPP unused contributions, transfers, and Home Buyers' Plan or Lifelong Learning Plan activities.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan. It is a type of retirement savings account in Canada with tax advantages.

Q: What is PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings plan designed for individuals and employees of small businesses in Canada.

Q: What is SPP?

A: SPP stands for Specified Pension Plan. It is a pension plan created by or under an Act of Parliament or a provincial legislature in Canada.

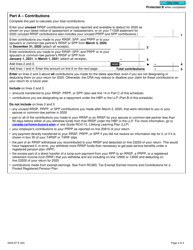

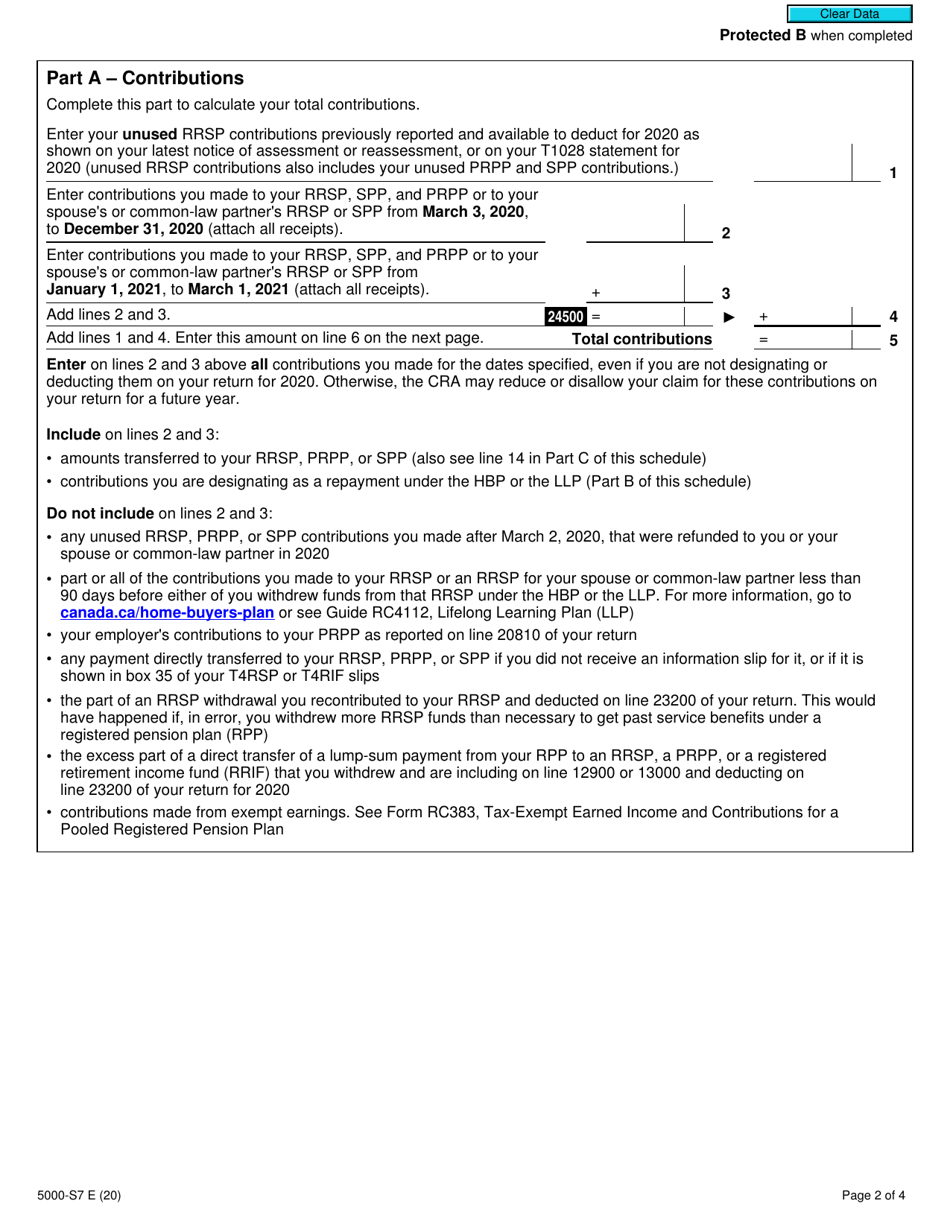

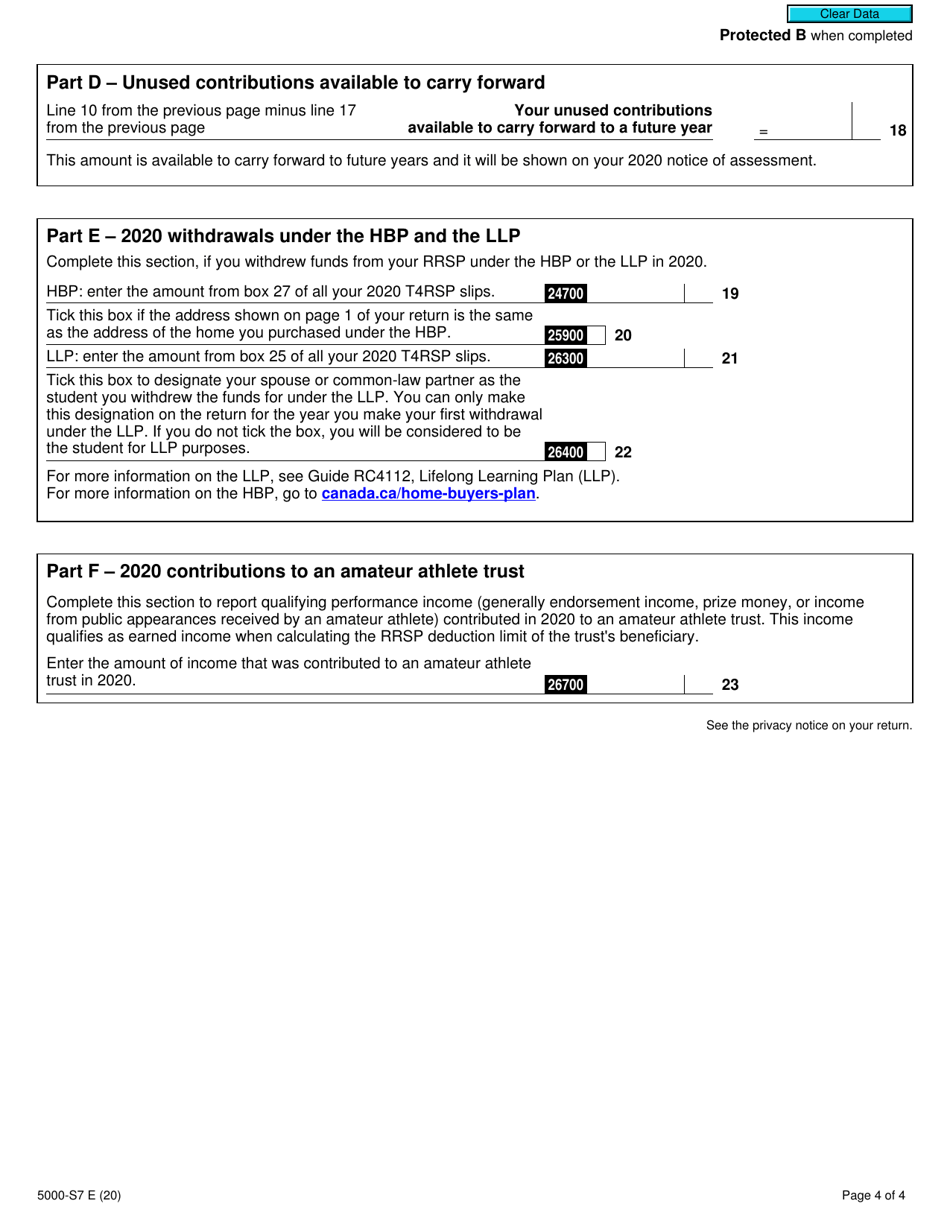

Q: What are unused contributions?

A: Unused contributions refer to the amount of contribution room that an individual has not used up in their RRSP, PRPP, or SPP for a specific tax year.

Q: What are transfers?

A: Transfers refer to the movement of funds from one RRSP, PRPP, or SPP to another, either within the same financial institution or between different institutions.

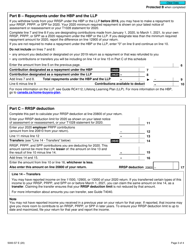

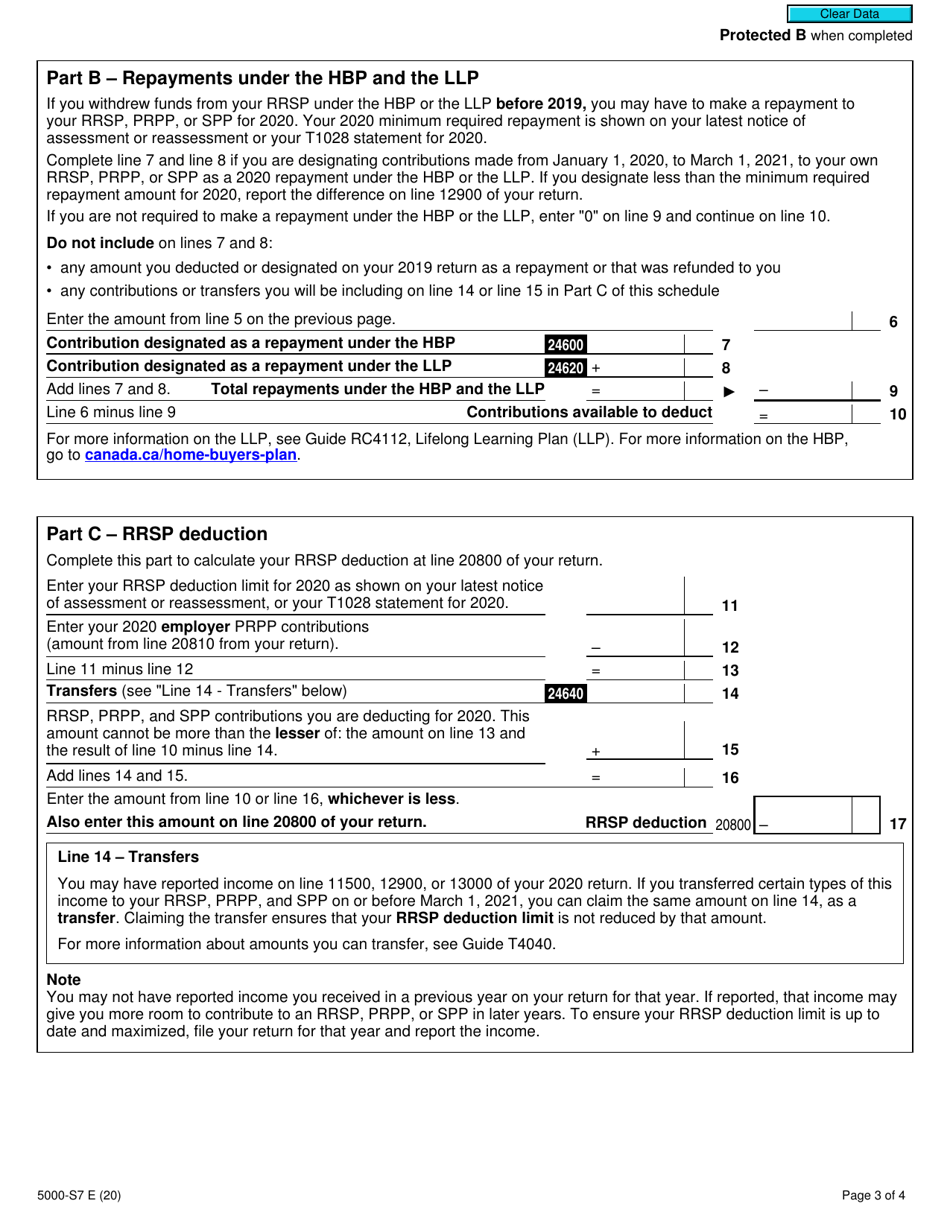

Q: What is the Home Buyers' Plan (HBP)?

A: The Home Buyers' Plan (HBP) is a government program in Canada that allows individuals to withdraw funds from their RRSP to purchase or build a qualifying home, with certain conditions and repayment requirements.

Q: What is the Lifelong Learning Plan (LLP)?

A: The Lifelong Learning Plan (LLP) is a government program in Canada that allows individuals to withdraw funds from their RRSP to finance full-time training or education for themselves or their spouse or common-law partner, with certain conditions and repayment requirements.