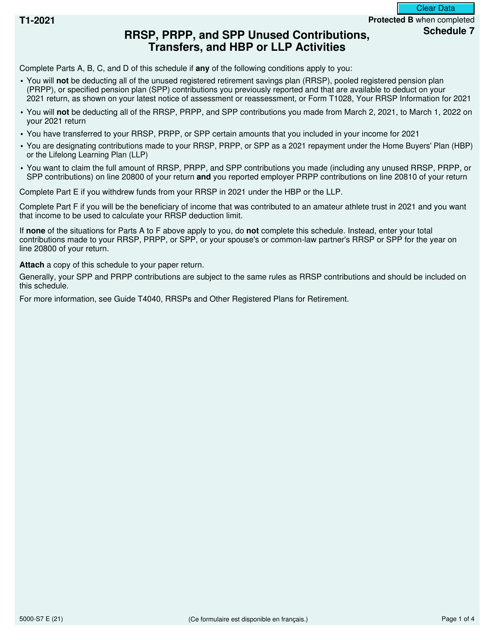

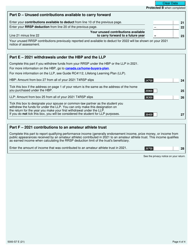

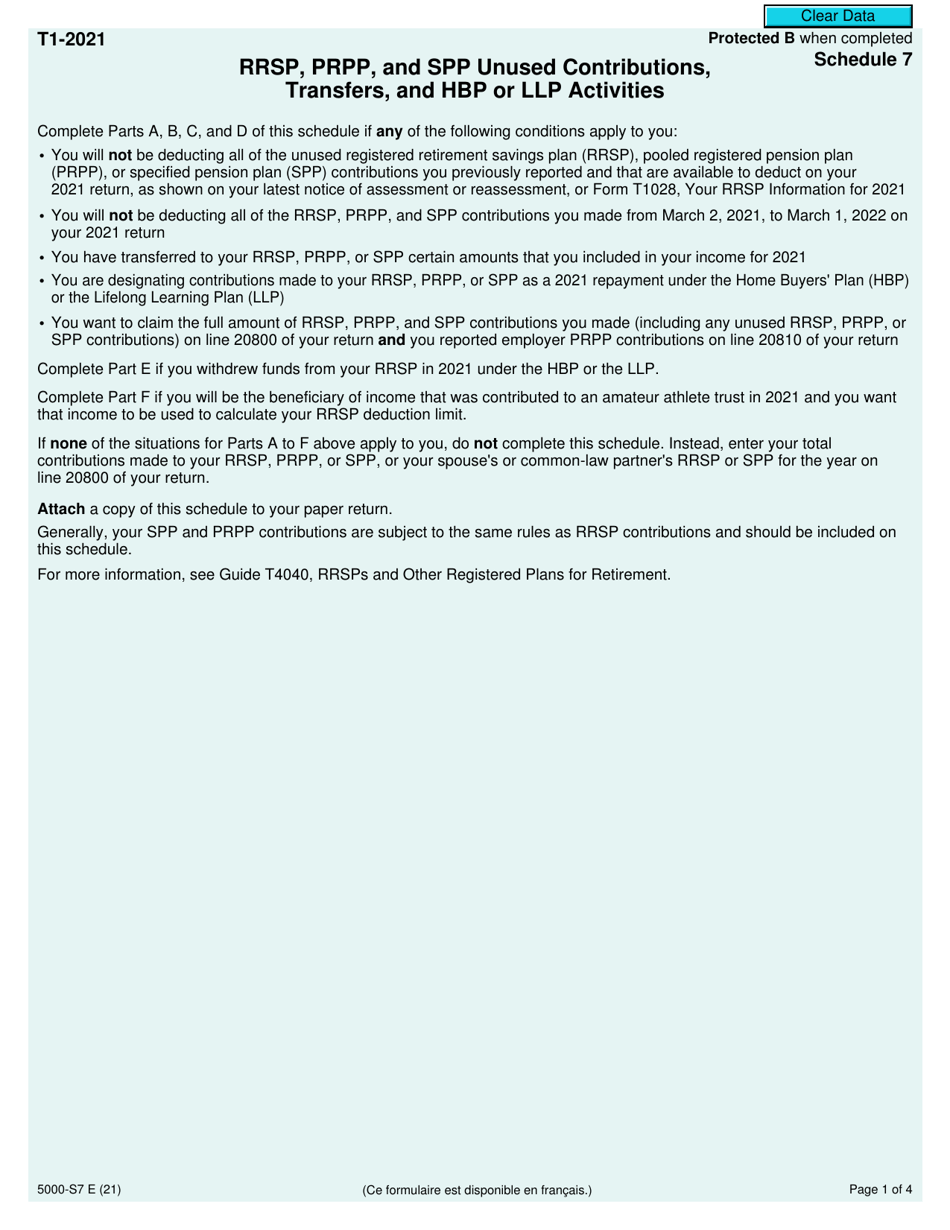

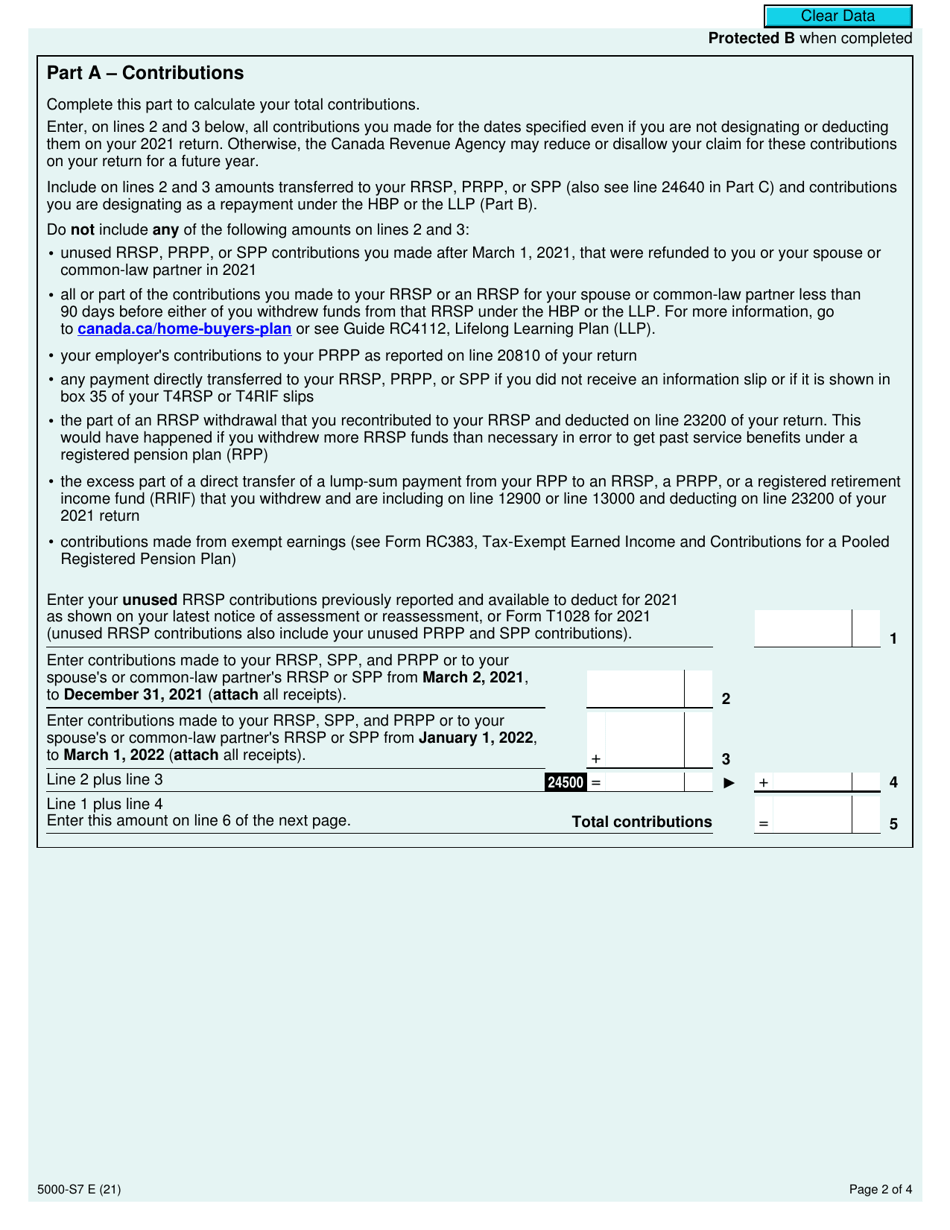

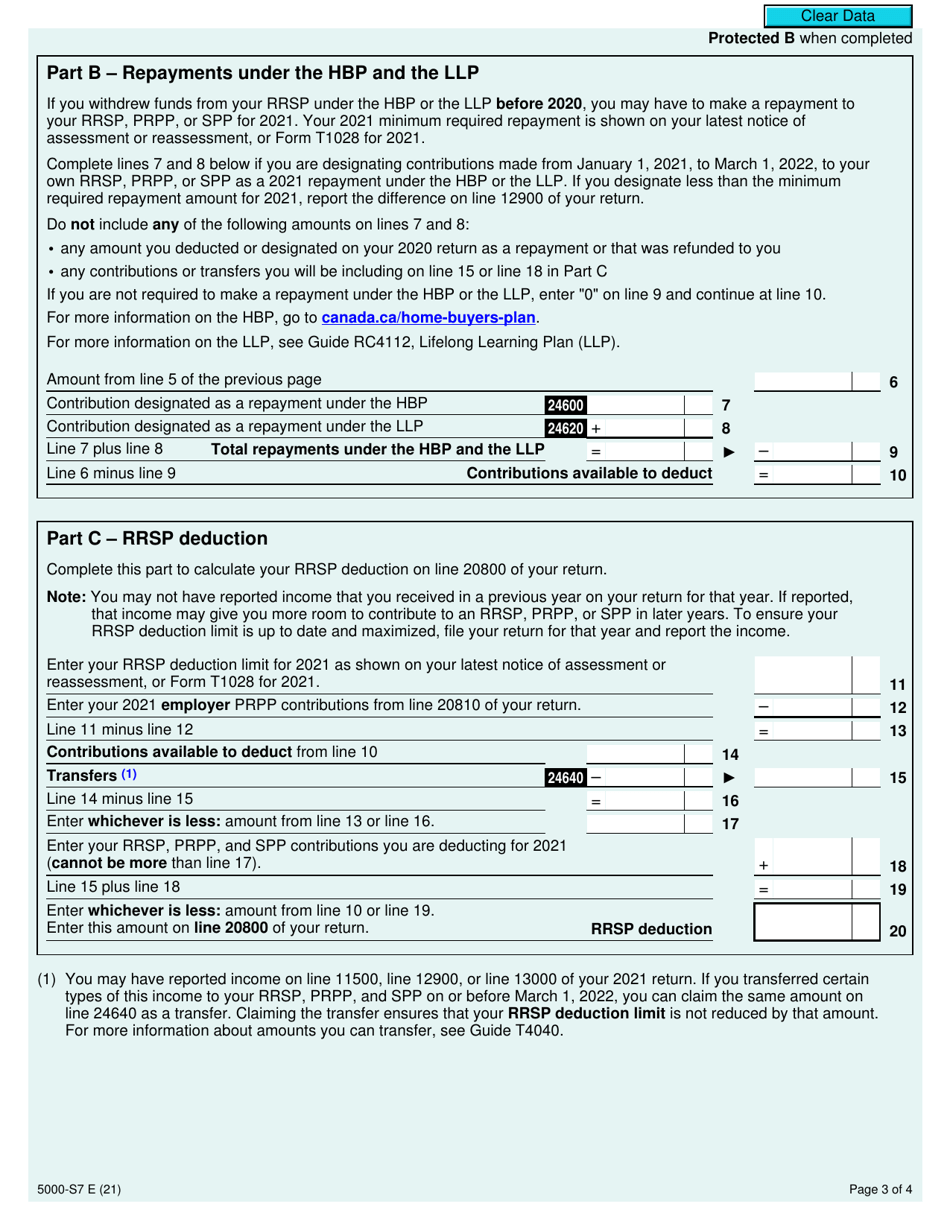

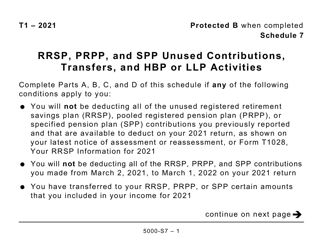

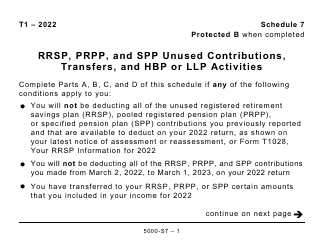

Form 5000-S7 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities - Canada

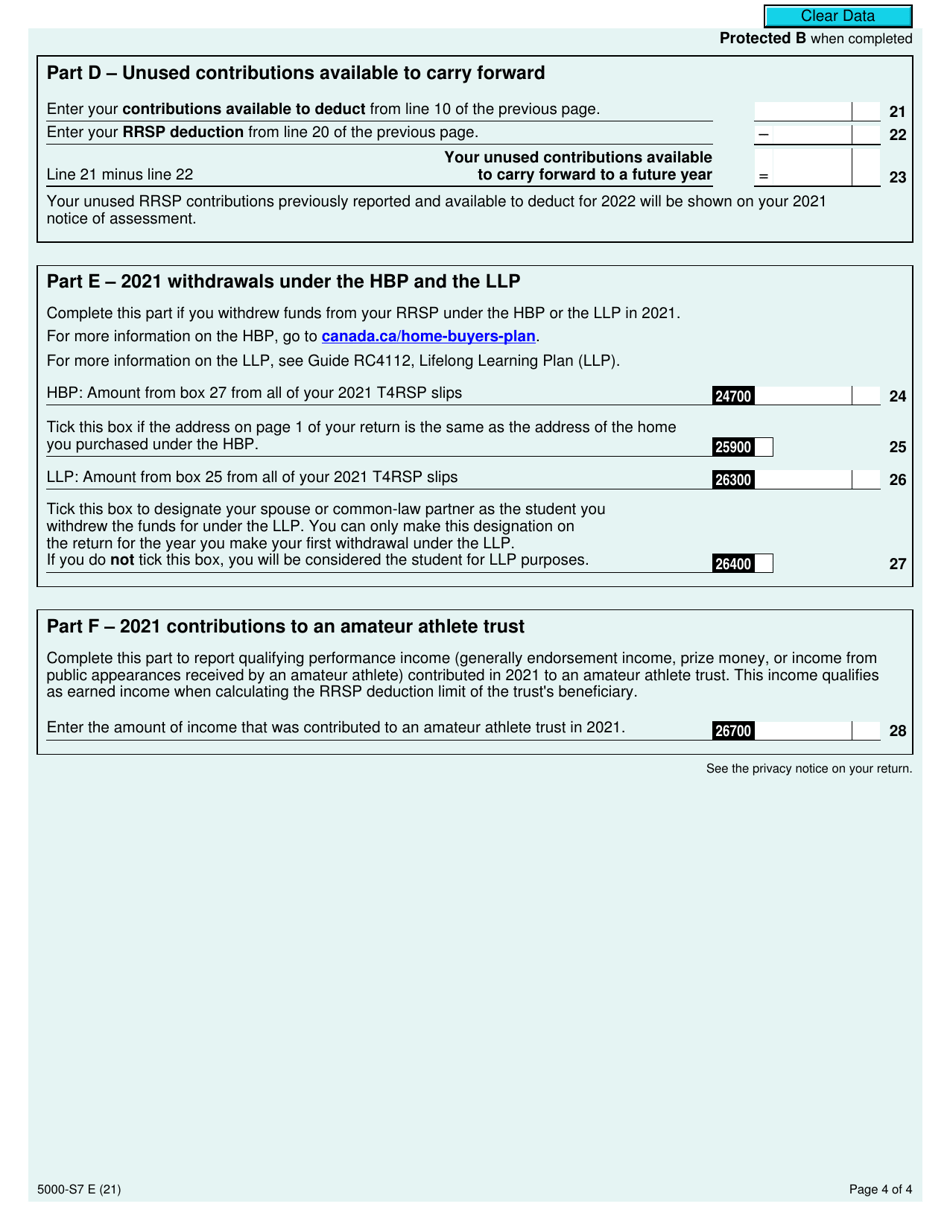

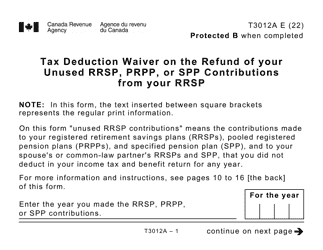

Form 5000-S7 Schedule 7 RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities in Canada is used to report unused contributions, transfers, and activities related to Registered Retirement Savings Plans (RRSP), Pooled Registered Pension Plans (PRPP), and Specified Pension Plans (SPP).

Individual taxpayers in Canada file the Form 5000-S7 Schedule 7 RRSP, PRPP, and SPP Unused Contributions, Transfers, and HBP or LLP Activities.

Form 5000-S7 Schedule 7 Rrsp, Prpp, and Spp Unused Contributions, Transfers, and Hbp or LLP Activities - Canada - Frequently Asked Questions (FAQ)

Q: What is Schedule 7?

A: Schedule 7 is a form used in Canada to report RRSP, PRPP, and SPP unused contributions, transfers, and HBP or LLP activities.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan.

Q: What does SPP stand for?

A: SPP stands for Specified Pension Plan.

Q: What is the purpose of Schedule 7?

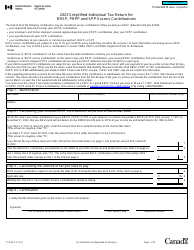

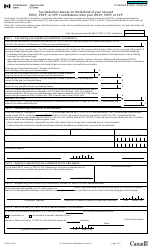

A: The purpose of Schedule 7 is to calculate and report unused contributions, transfers, and activities related to RRSP, PRPP, and SPP accounts.

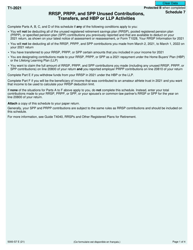

Q: What are unused contributions?

A: Unused contributions are amounts that you didn't contribute to your RRSP, PRPP, or SPP in a particular year, but that you can carry forward and deduct in a future year.

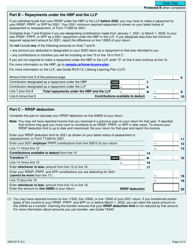

Q: What are transfers?

A: Transfers refer to the movement of funds from one RRSP, PRPP, or SPP account to another without being subject to tax.

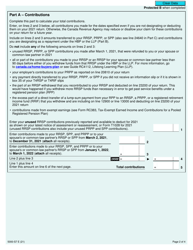

Q: What are HBP and LLP activities?

A: HBP stands for Homebuyers' Plan and LLP stands for Lifelong Learning Plan. These activities allow individuals to withdraw funds from their RRSPs to buy a home or finance their education, respectively, under certain conditions.

Q: How do I fill out Schedule 7?

A: To fill out Schedule 7, you will need to provide information about your unused contributions, transfers, and HBP or LLP activities. Consult the instructions provided with the form for specific guidance.