This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-S11 Schedule BC(S11)

for the current year.

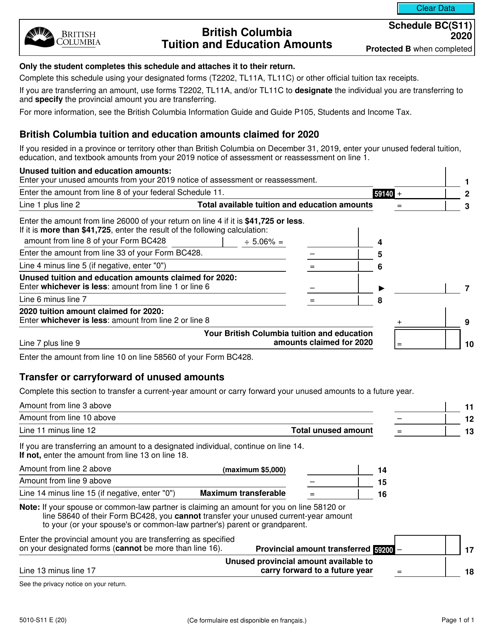

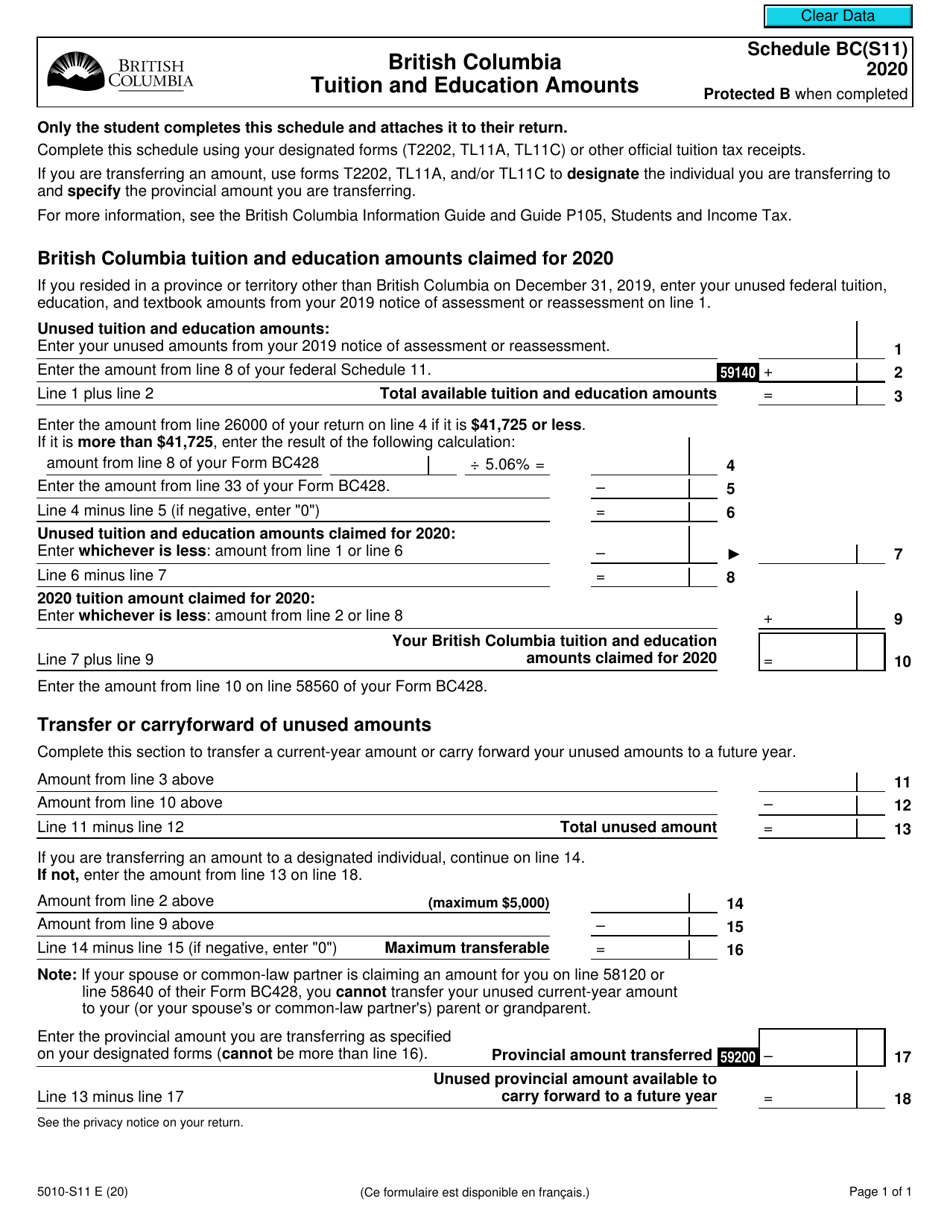

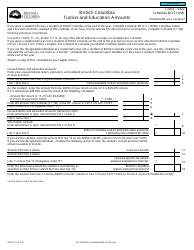

Form 5010-S11 Schedule BC(S11) British Columbia Tuition and Education Amounts - Canada

The Form 5010-S11 Schedule BC(S11) is used in Canada for reporting tuition and education amounts specifically in the province of British Columbia. It helps individuals claim tax credits or deductions related to their education expenses in that province.

The Form 5010-S11 Schedule BC(S11) for British Columbia Tuition and Education Amounts is filed by individuals who are residents of British Columbia in Canada.

FAQ

Q: What is form 5010-S11?

A: Form 5010-S11 is a tax form in Canada.

Q: What is Schedule BC(S11)?

A: Schedule BC(S11) is a specific schedule of Form 5010-S11.

Q: What is British Columbia Tuition and Education Amounts?

A: British Columbia Tuition and Education Amounts refers to the tax credits available for residents of British Columbia.

Q: Who is eligible for the British Columbia Tuition and Education Amounts?

A: Residents of British Columbia who are enrolled in post-secondary education are eligible for these tax credits.

Q: What information is required to fill out Schedule BC(S11)?

A: You will need to provide details about your education expenses and any tuition fees paid.

Q: Is the British Columbia Tuition and Education Amounts tax credit refundable?

A: No, the tax credit is non-refundable.

Q: Can I carry forward unused British Columbia Tuition and Education Amounts?

A: Yes, you can carry forward unused amounts to future years.

Q: Can I transfer British Columbia Tuition and Education Amounts to a family member?

A: No, these credits cannot be transferred to a family member.

Q: Do I need to submit receipts with Schedule BC(S11)?

A: No, you do not need to submit receipts with the form, but you should keep them for your records.