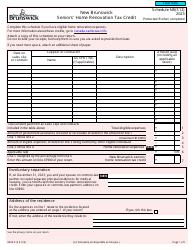

This version of the form is not currently in use and is provided for reference only. Download this version of

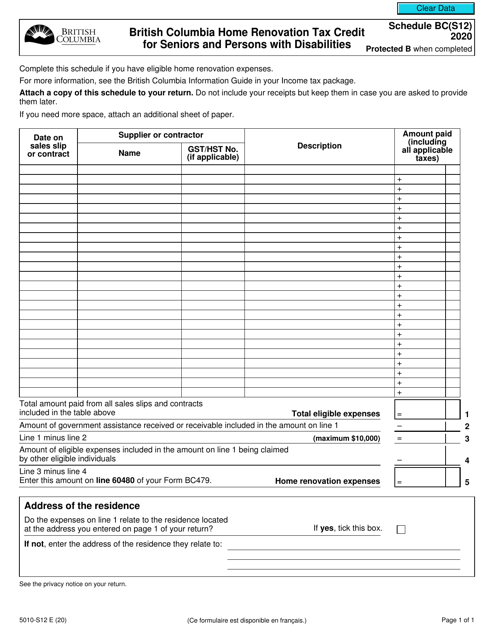

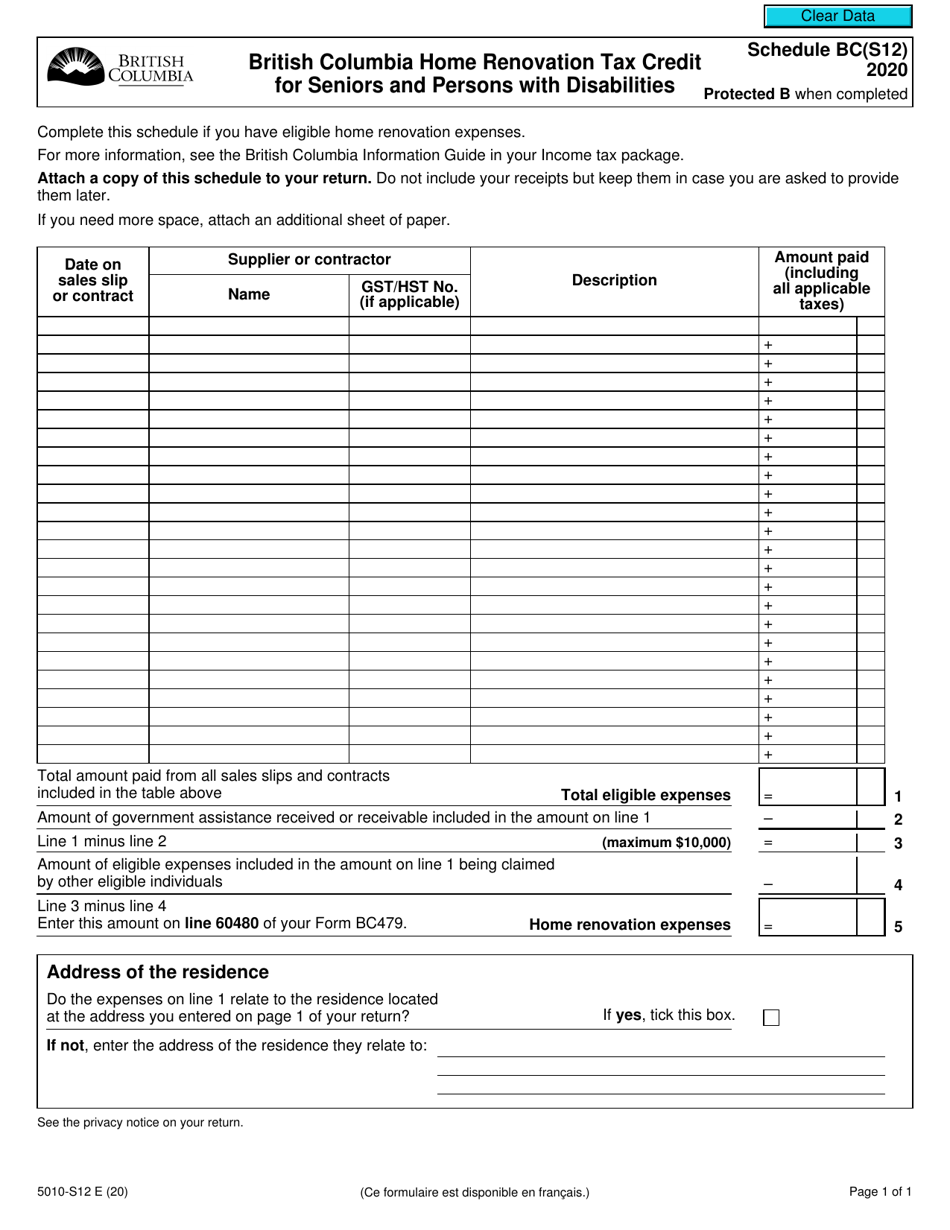

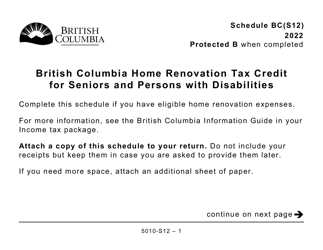

Form 5010-S12 Schedule BC(S12)

for the current year.

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities - Canada

Form 5010-S12 Schedule BC(S12) is used for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities in Canada. This tax credit is aimed at providing financial assistance to seniors and disabled individuals for eligible home renovations. It helps them make their homes more accessible and comfortable.

The Form 5010-S12 Schedule BC(S12) for the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities in Canada is typically filed by eligible individuals who meet the qualification criteria for this tax credit.

FAQ

Q: What is Form 5010-S12?

A: Form 5010-S12 is the schedule for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities.

Q: What is the purpose of the British Columbia Home Renovation Tax Credit?

A: The purpose of the tax credit is to provide financial assistance to seniors and persons with disabilities in British Columbia for eligible home renovation expenses.

Q: Who is eligible for the British Columbia Home Renovation Tax Credit?

A: Seniors and persons with disabilities who own a home in British Columbia and have incurred eligible renovation expenses are eligible for the tax credit.

Q: What are eligible renovation expenses?

A: Eligible renovation expenses include costs incurred for renovations that improve accessibility, safety, or mobility in a home.

Q: How much is the tax credit?

A: The tax credit is equal to 10% of eligible renovation expenses, up to a maximum of $10,000.

Q: How do I claim the tax credit?

A: You need to file Form 5010-S12, Schedule BC(S12), along with your income tax return to claim the British Columbia Home Renovation Tax Credit.

Q: Is there an income limit for eligibility?

A: There is no income limit for eligibility for the British Columbia Home Renovation Tax Credit.

Q: Are there any deadlines to claim the tax credit?

A: Yes, the tax credit must be claimed within 24 months after the end of the taxation year in which the eligible expenses were incurred.

Q: Is this tax credit available in all provinces and territories of Canada?

A: No, the British Columbia Home Renovation Tax Credit is specific to British Columbia and not available in other provinces and territories of Canada.