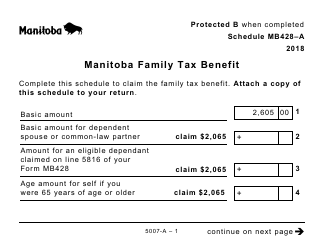

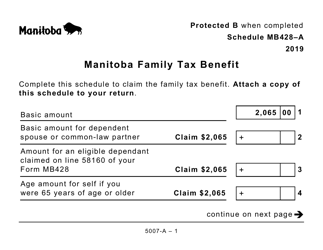

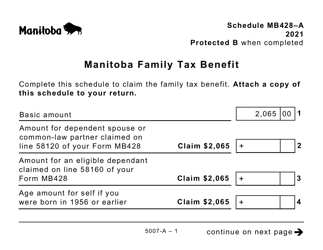

This version of the form is not currently in use and is provided for reference only. Download this version of

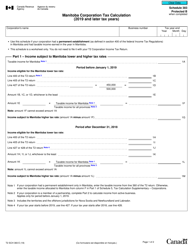

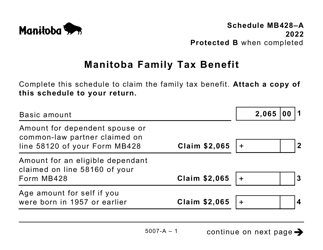

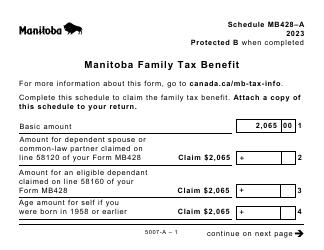

Form 5007-A Schedule MB428-A

for the current year.

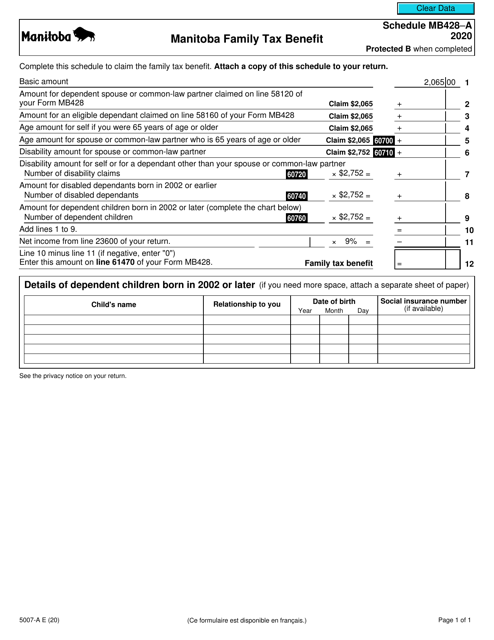

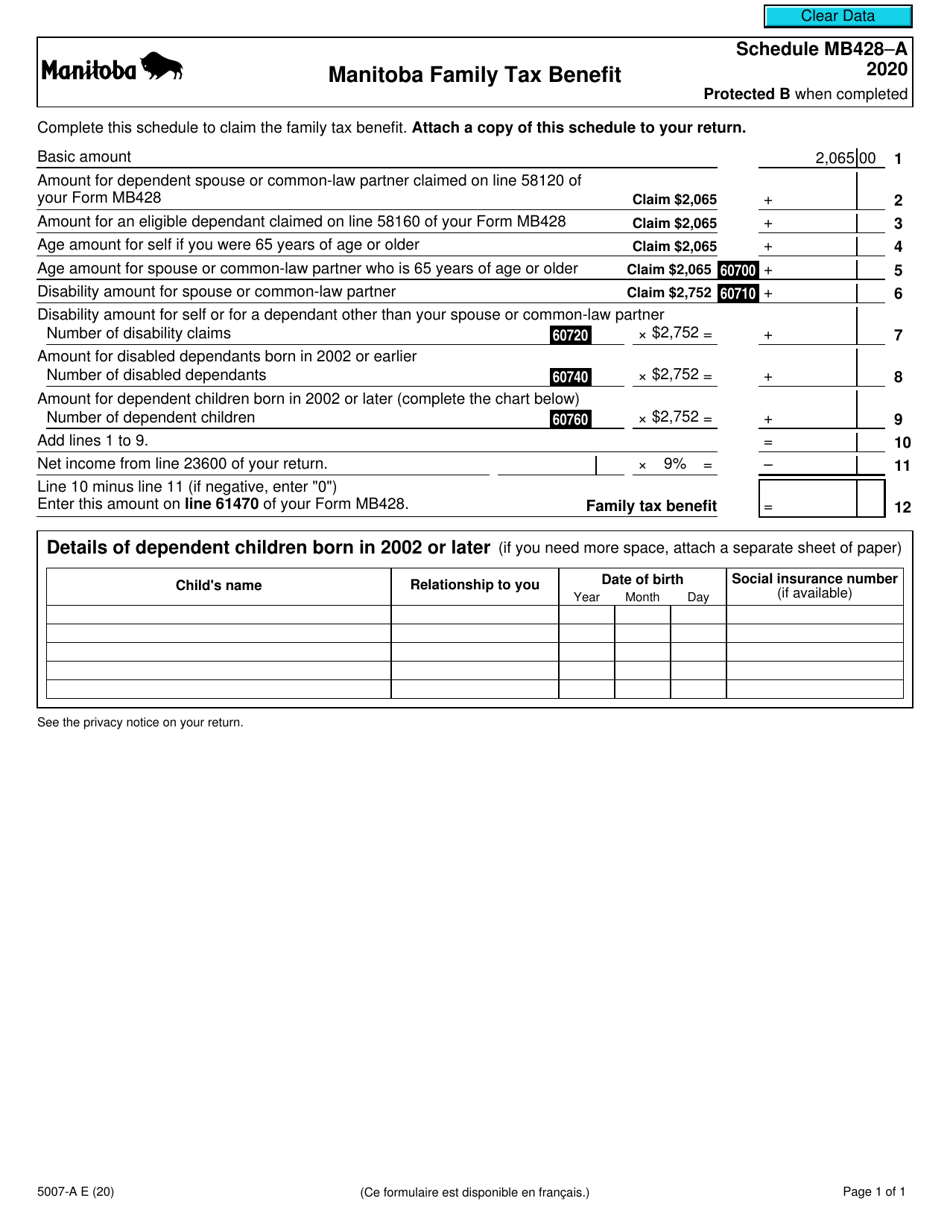

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit - Canada

Form 5007-A Schedule MB428-A, also known as Manitoba Family Tax Benefit, is a form used in Canada to claim the provincial tax credit for families residing in the province of Manitoba. This tax benefit is aimed at providing financial assistance to low-income families with children.

The Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit in Canada is filed by eligible residents of Manitoba who wish to claim the Manitoba Family Tax Benefit.

FAQ

Q: What is Form 5007-A Schedule MB428-A?

A: Form 5007-A Schedule MB428-A is a tax form used in Manitoba, Canada for reporting the Manitoba Family Tax Benefit.

Q: Who is eligible for the Manitoba Family Tax Benefit?

A: Residents of Manitoba, Canada who have eligible children and meet the income requirements may be eligible for the Manitoba Family Tax Benefit.

Q: How do I complete Form 5007-A Schedule MB428-A?

A: You need to provide information about your household, eligible children, and income to complete Form 5007-A Schedule MB428-A.

Q: When is the deadline to file Form 5007-A Schedule MB428-A?

A: The deadline to file Form 5007-A Schedule MB428-A is usually April 30th of each year, but it may be extended in certain situations.

Q: What happens if I don't file Form 5007-A Schedule MB428-A?

A: If you are eligible for the Manitoba Family Tax Benefit and do not file Form 5007-A Schedule MB428-A, you may miss out on receiving the benefit.

Q: Can I file Form 5007-A Schedule MB428-A electronically?

A: Yes, you can file Form 5007-A Schedule MB428-A electronically through the CRA's NetFile service or by using certified tax software.

Q: Are there any other documents required to be filed with Form 5007-A Schedule MB428-A?

A: No, Form 5007-A Schedule MB428-A is the main document for reporting the Manitoba Family Tax Benefit, but you may need to include supporting documents, such as income slips, if requested by the CRA.