This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5004-S11 Schedule NB(S11)

for the current year.

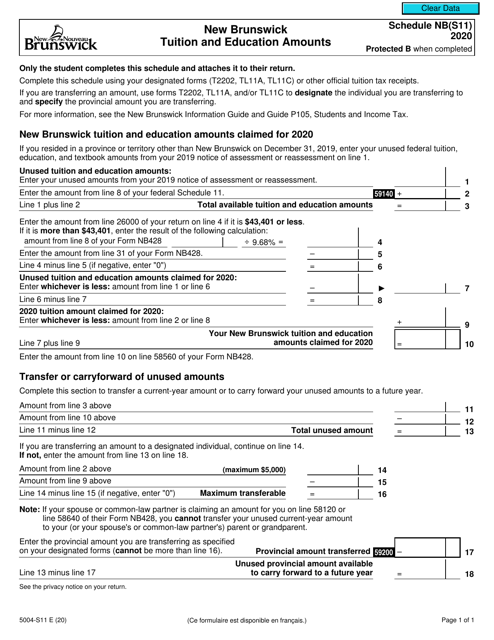

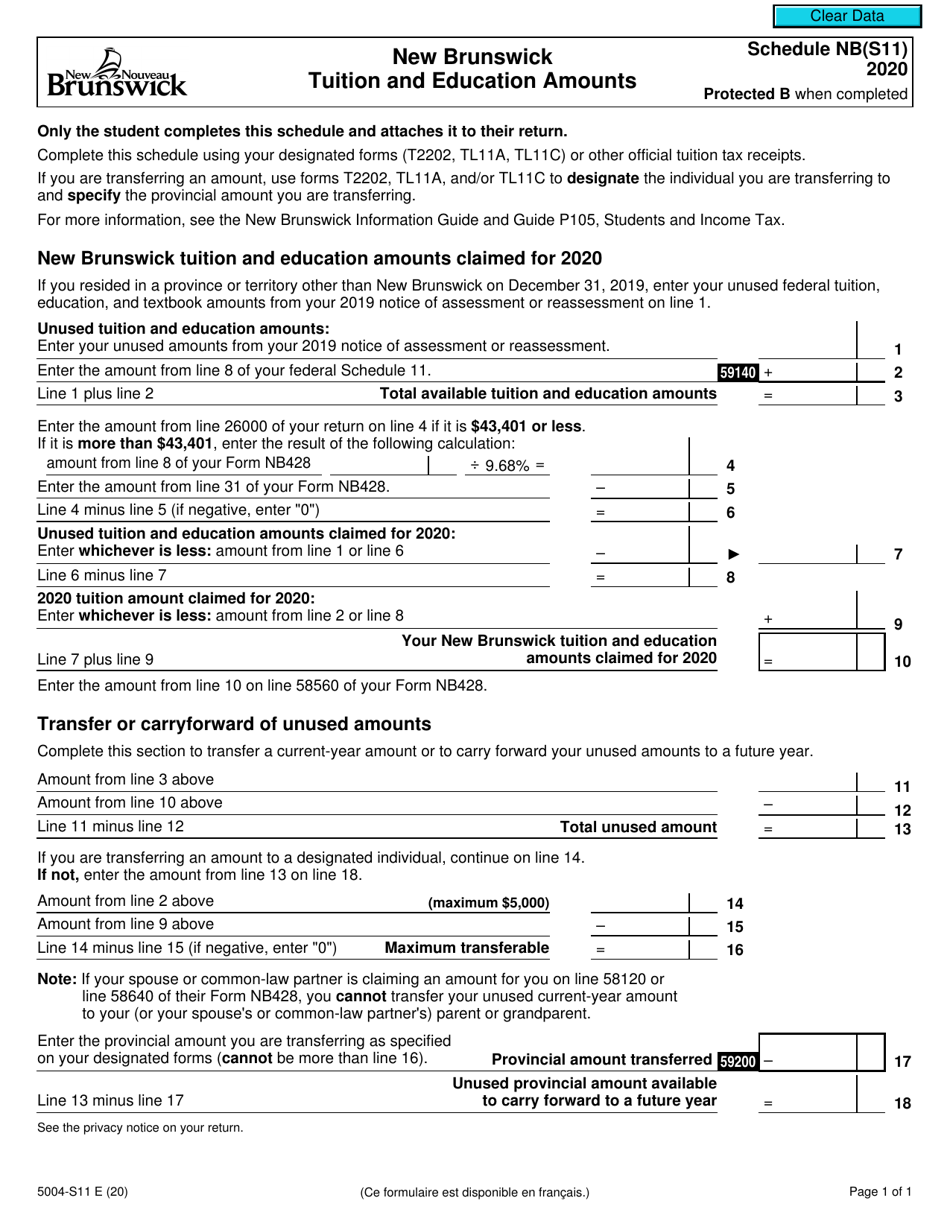

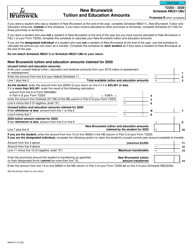

Form 5004-S11 Schedule NB(S11) New Brunswick Tuition and Education Amounts - Canada

Form 5004-S11 Schedule NB(S11) is used in Canada to claim the New Brunswick tuition and education amounts. This form is for individuals who attended an eligible post-secondary educational institution in New Brunswick and want to claim the tuition and education amount for provincial tax purposes.

The Form 5004-S11 Schedule NB(S11) for claiming New Brunswick tuition and education amounts in Canada is filed by eligible residents of New Brunswick.

FAQ

Q: What is Form 5004-S11?

A: Form 5004-S11 is the Schedule NB(S11) for claiming New Brunswick Tuition and Education Amounts in Canada.

Q: What are the Tuition and Education Amounts?

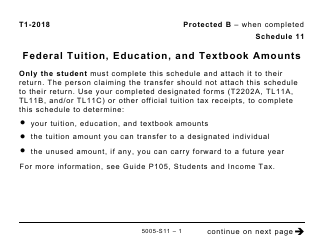

A: Tuition and Education Amounts are tax credits that can be claimed by students to reduce their income taxes.

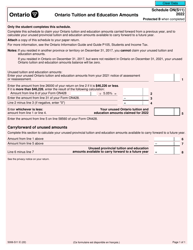

Q: Who is eligible to claim the New Brunswick Tuition and Education Amounts?

A: Residents of New Brunswick who were enrolled in an eligible education program may be eligible to claim these amounts.

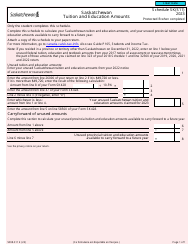

Q: What is the purpose of Schedule NB(S11)?

A: The purpose of Schedule NB(S11) is to calculate and claim the New Brunswick Tuition and Education Amounts.

Q: How do I fill out Schedule NB(S11)?

A: You need to provide information about your education program, tuition fees, and the months you were enrolled in the program. Follow the instructions on the form to complete it.

Q: When is the deadline to file Form 5004-S11?

A: The deadline to file Form 5004-S11 is usually the same as the deadline for filing your income tax return.

Q: Are there any other documents I need to include with Form 5004-S11?

A: You may need to include supporting documents such as official receipts for tuition fees or a certificate from your educational institution.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts if you meet the eligibility criteria for each.

Q: What should I do if I have further questions about Form 5004-S11?

A: If you have further questions about Form 5004-S11, you should contact the Canada Revenue Agency (CRA) or consult a tax professional.