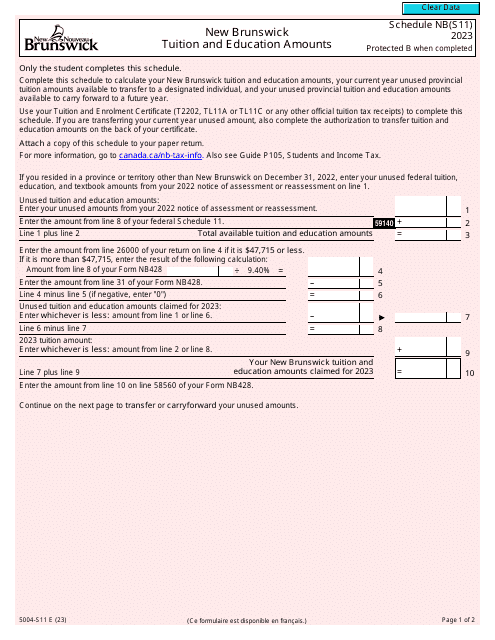

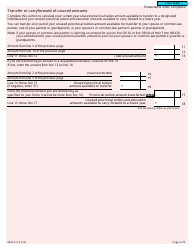

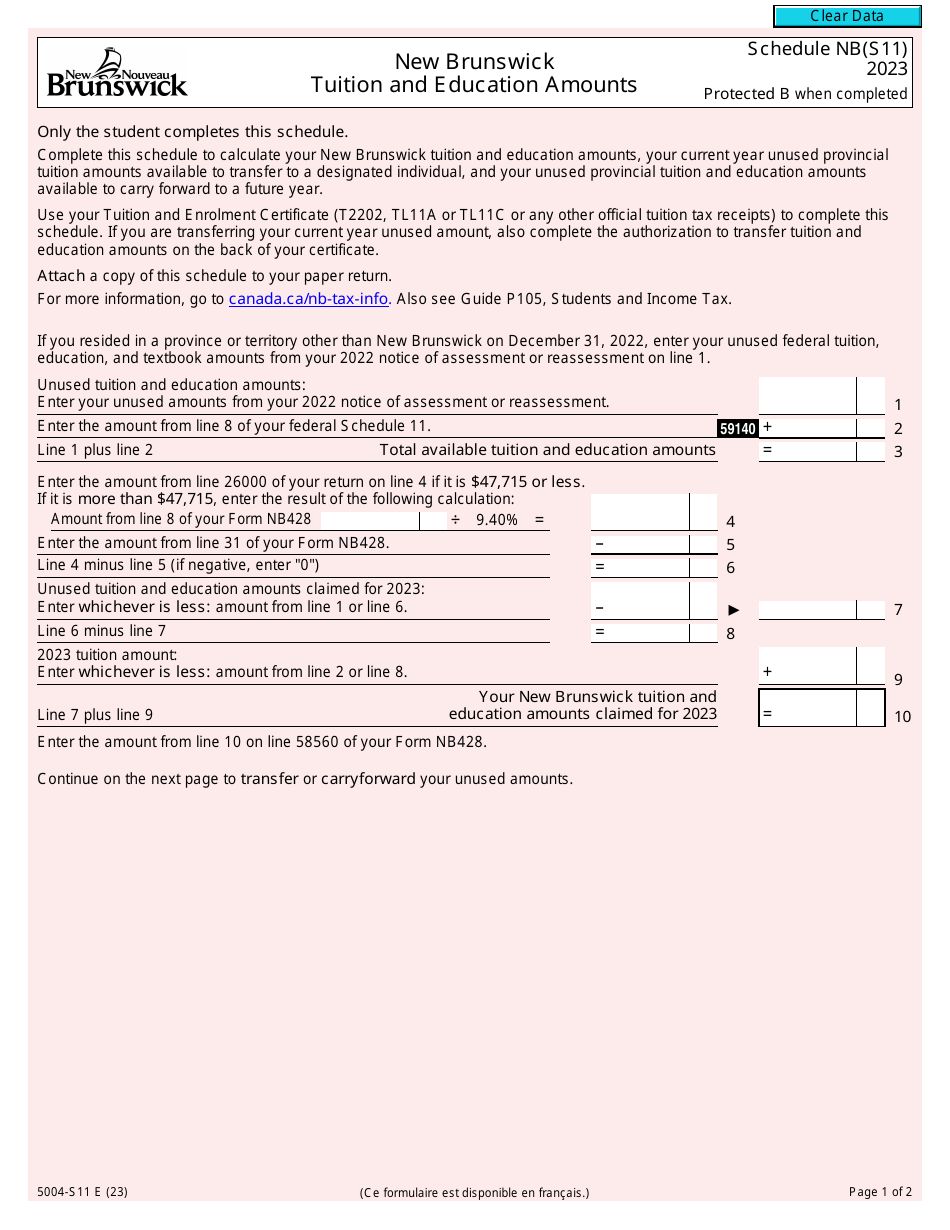

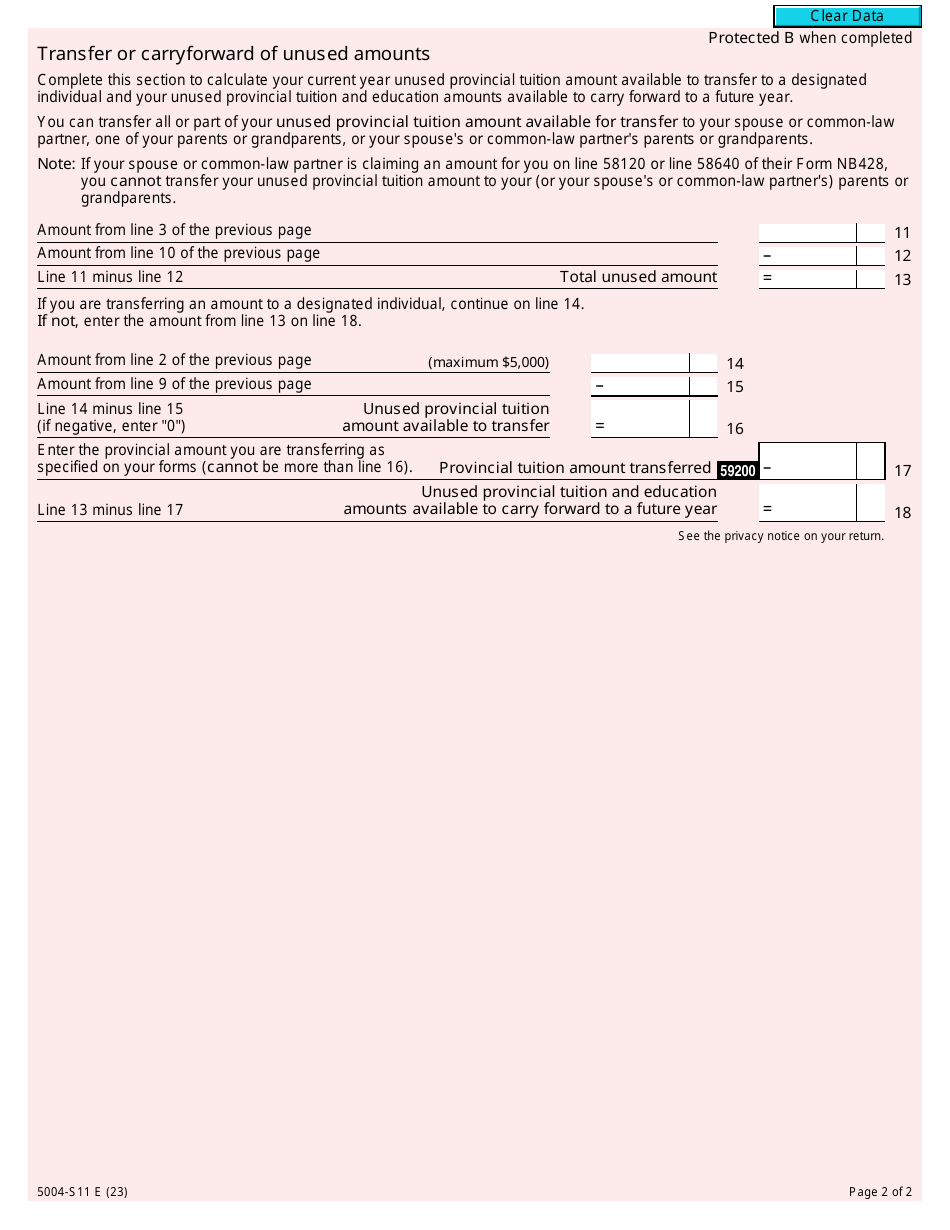

Form 5004-S11 Schedule NB(S11) New Brunswick Tuition and Education Amounts - Canada

Form 5004-S11 Schedule NB(S11) is used in Canada for claiming tuition and education amounts specifically for residents of the province of New Brunswick.

The individual who claims the New Brunswick Tuition and Education Amounts in Canada would file the Form 5004-S11 Schedule NB(S11).

Form 5004-S11 Schedule NB(S11) New Brunswick Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5004-S11?

A: Form 5004-S11 is a schedule used in Canada to claim tuition and education amounts in New Brunswick.

Q: What is the purpose of Schedule NB(S11)?

A: The purpose of Schedule NB(S11) is to calculate the amount of tuition and education credits that can be claimed for tax purposes in New Brunswick.

Q: Who is eligible to use Schedule NB(S11)?

A: Residents of New Brunswick who are pursuing post-secondary education are eligible to use Schedule NB(S11) to claim tuition and education amounts.

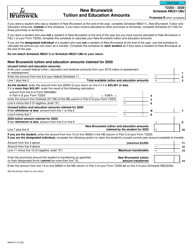

Q: What can be claimed using Schedule NB(S11)?

A: Using Schedule NB(S11), you can claim eligible tuition fees, education amounts, and carry forward unused credits.

Q: How do I fill out Schedule NB(S11)?

A: To fill out Schedule NB(S11), you need to provide information about your educational expenses and any unused credits from previous years.

Q: When is Schedule NB(S11) due?

A: Schedule NB(S11) is due on or before the personal incometax filing deadline, which is usually April 30th of each year.

Q: Can I claim both federal and provincial tuition credits?

A: Yes, you can claim both federal and provincial tuition credits. Schedule NB(S11) specifically deals with provincial credits in New Brunswick.

Q: What should I do if I have questions about Schedule NB(S11)?

A: If you have questions about Schedule NB(S11), you can contact the Canada Revenue Agency or seek assistance from a tax professional.