This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5004-S12 Schedule NB(S12)

for the current year.

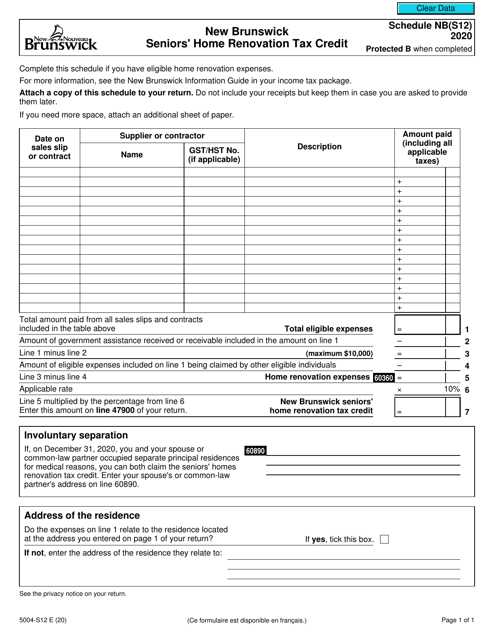

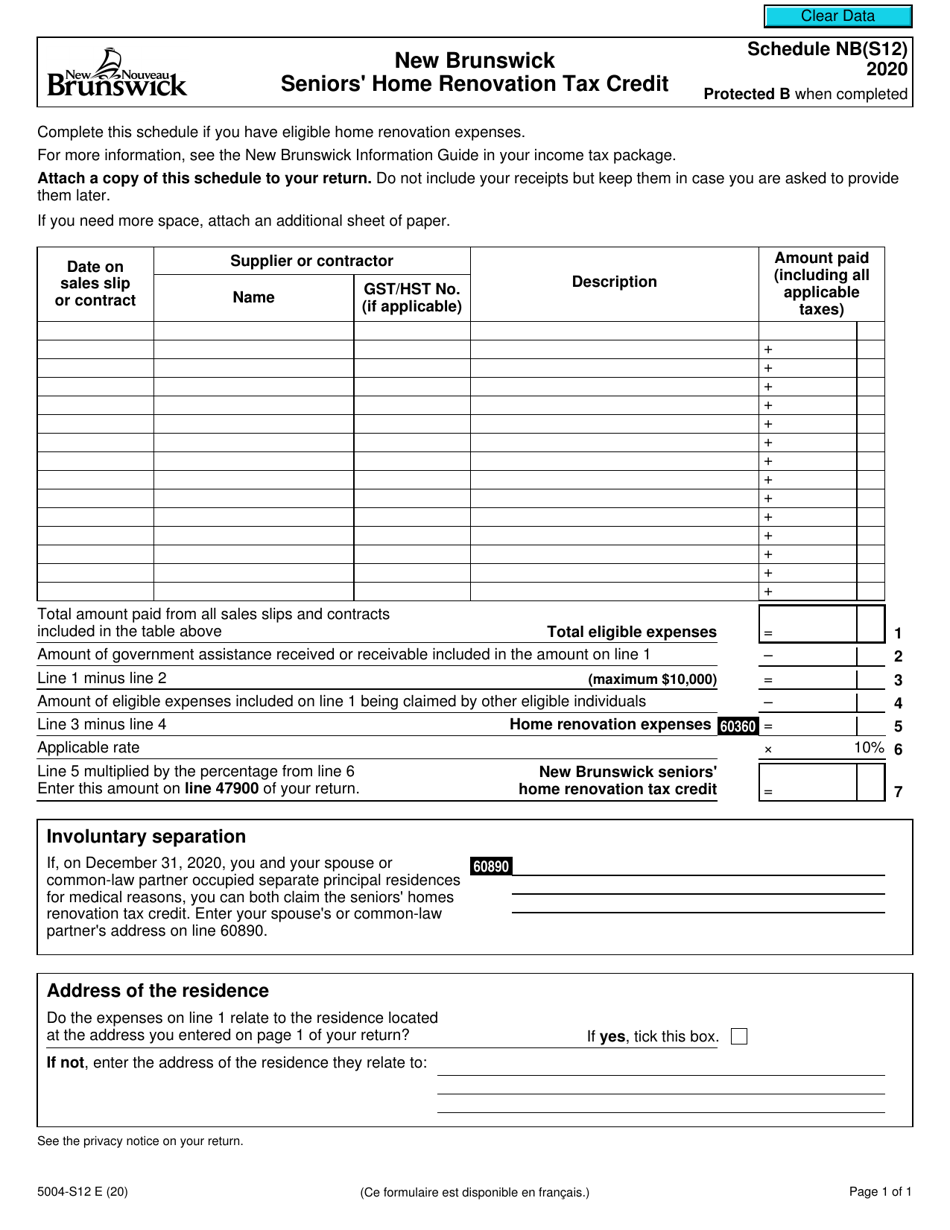

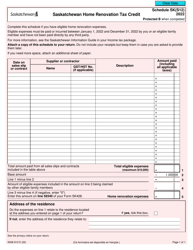

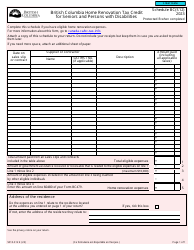

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada

Form 5004-S12 Schedule NB(S12) is used in Canada for claiming the New Brunswick Seniors' Home Renovation Tax Credit. This credit is designed to provide financial assistance to eligible seniors in New Brunswick for qualifying expenses related to home renovations.

The Form 5004-S12 Schedule NB(S12) for the New Brunswick Seniors' Home Renovation Tax Credit in Canada is filed by eligible individuals who are residents of New Brunswick and meet the specified criteria for claiming the tax credit.

FAQ

Q: What is Form 5004-S12 Schedule NB(S12)?

A: Form 5004-S12 Schedule NB(S12) is a tax form used in Canada to claim the New Brunswick Seniors' Home Renovation Tax Credit.

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit offered in the province of New Brunswick, Canada, to assist seniors with the cost of renovating their homes.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Seniors who are 65 years or older and own a home in New Brunswick are eligible for the tax credit.

Q: What expenses are eligible for the tax credit?

A: Expenses related to renovations that improve accessibility, safety, and mobility in a senior's home may be eligible for the tax credit. This includes costs for materials and labor.

Q: How much is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The tax credit is equal to 10% of eligible expenses, up to a maximum credit of $10,000.

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: You can claim the tax credit by completing Form 5004-S12 Schedule NB(S12) and including it with your annual income tax return in Canada.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, the tax credit must be claimed within four years from the end of the tax year in which the expenses were incurred.