This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5013-R

for the current year.

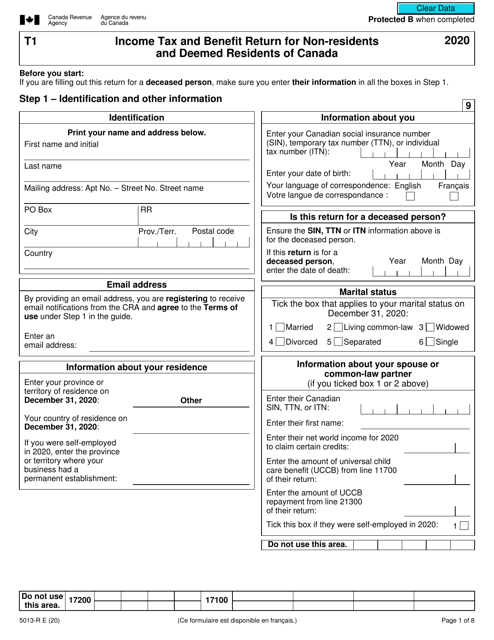

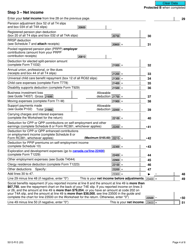

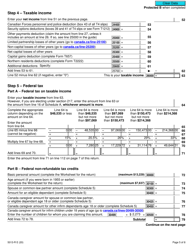

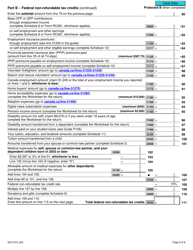

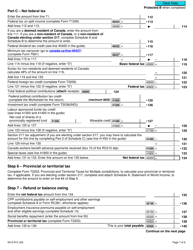

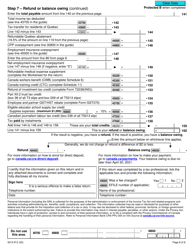

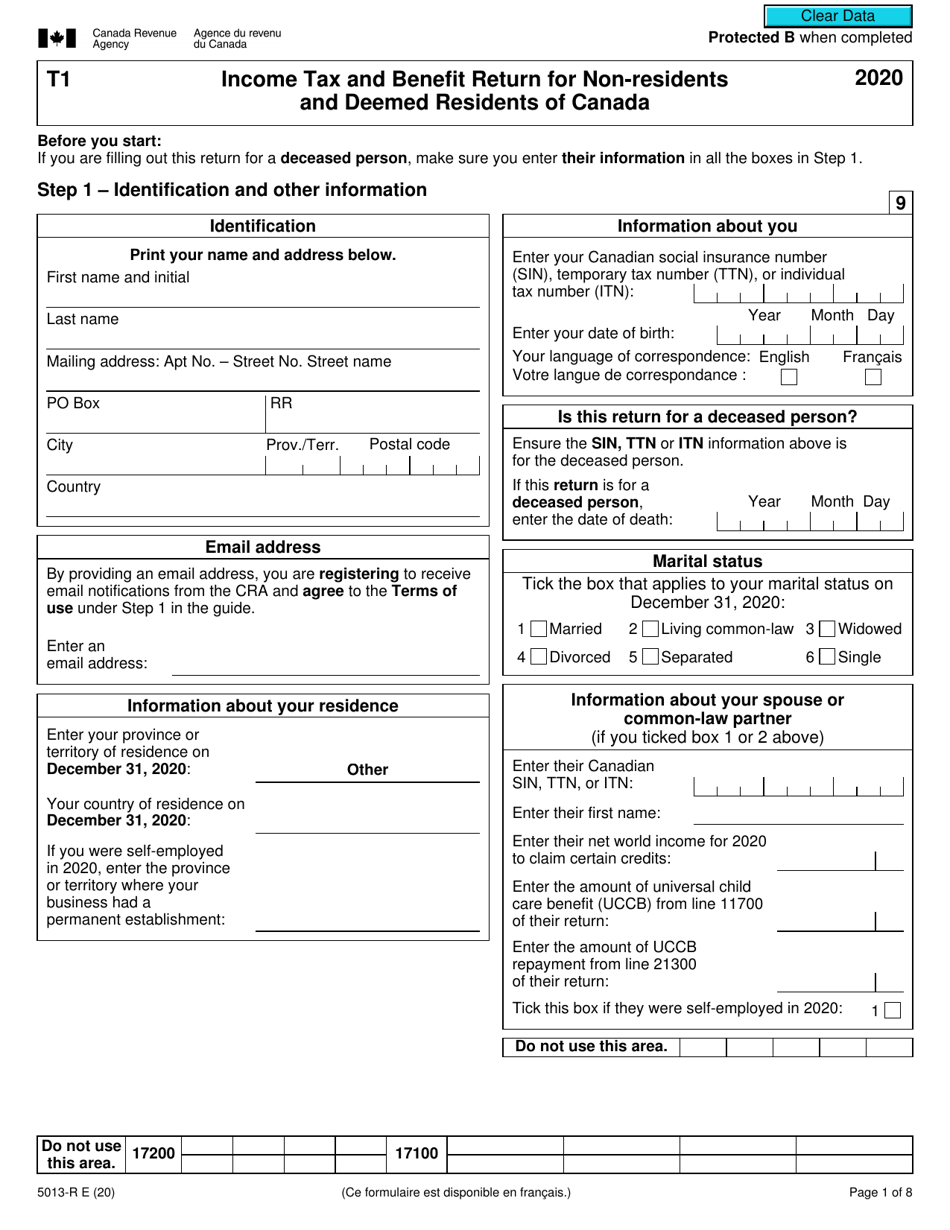

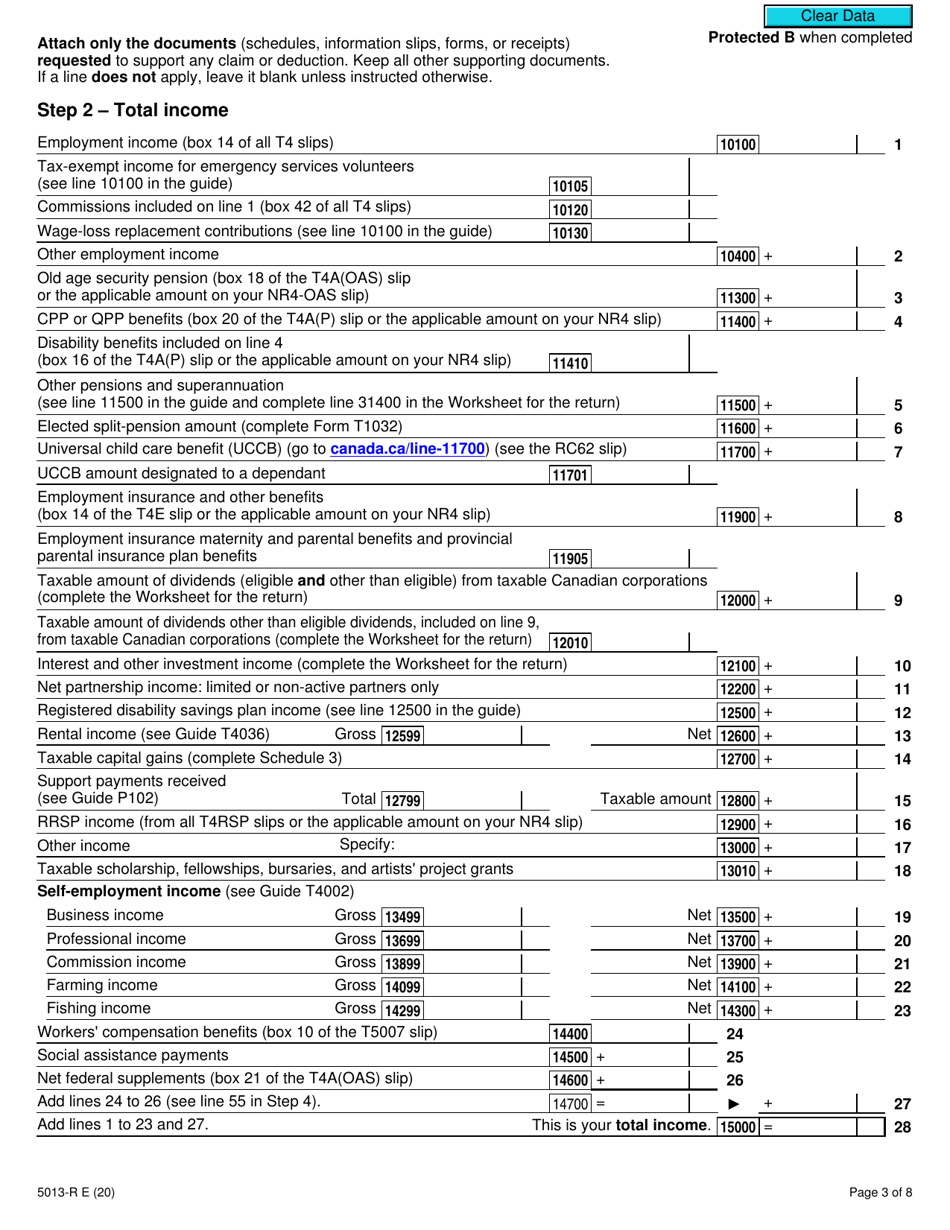

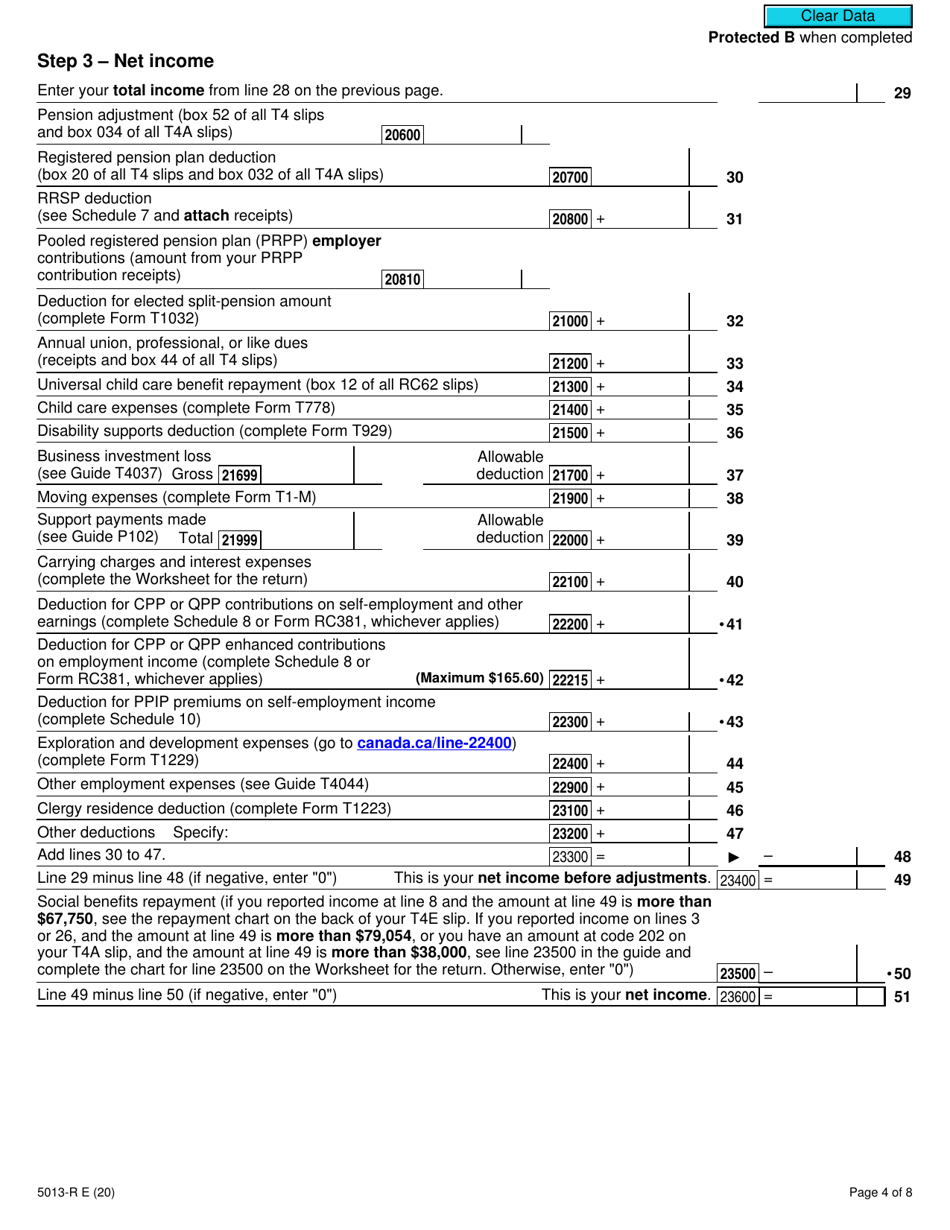

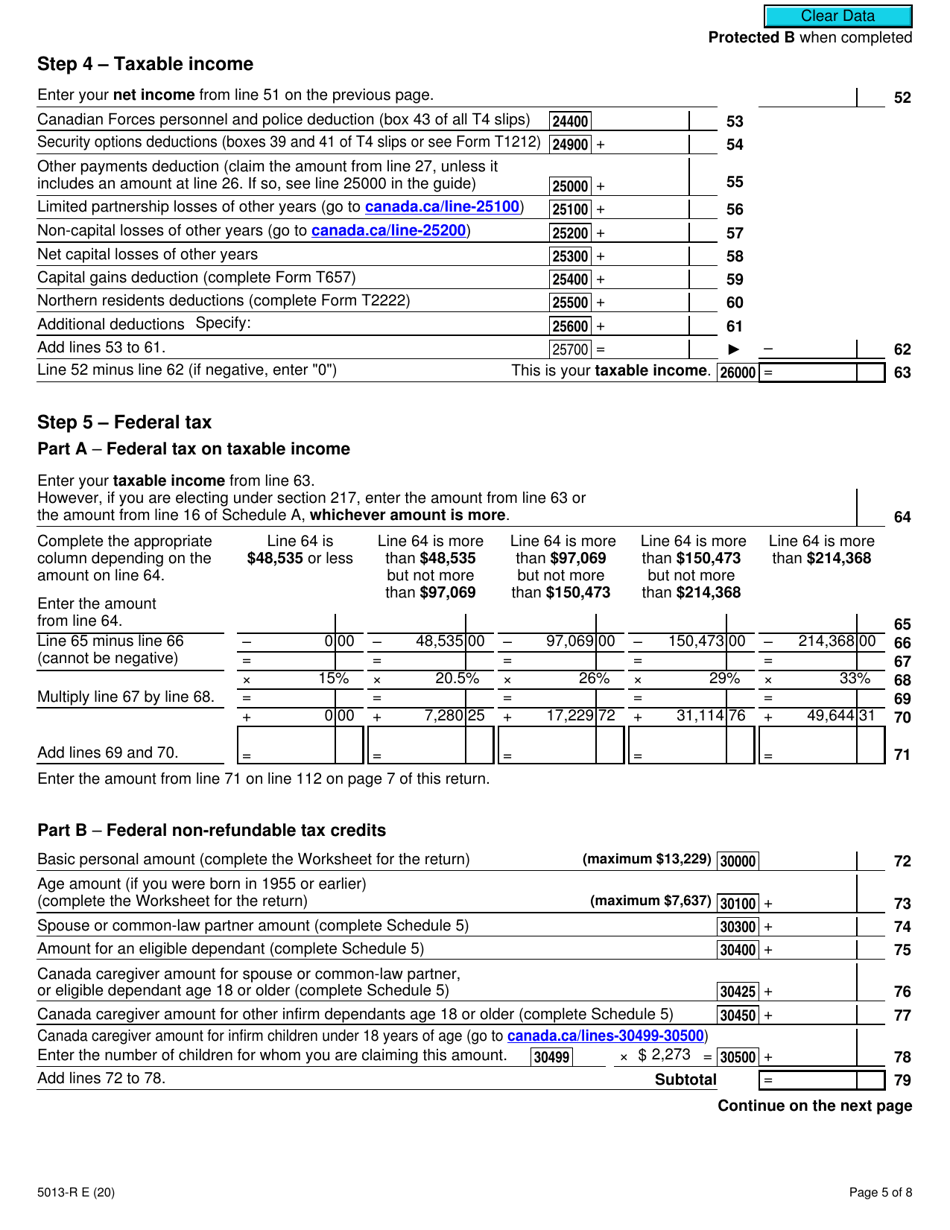

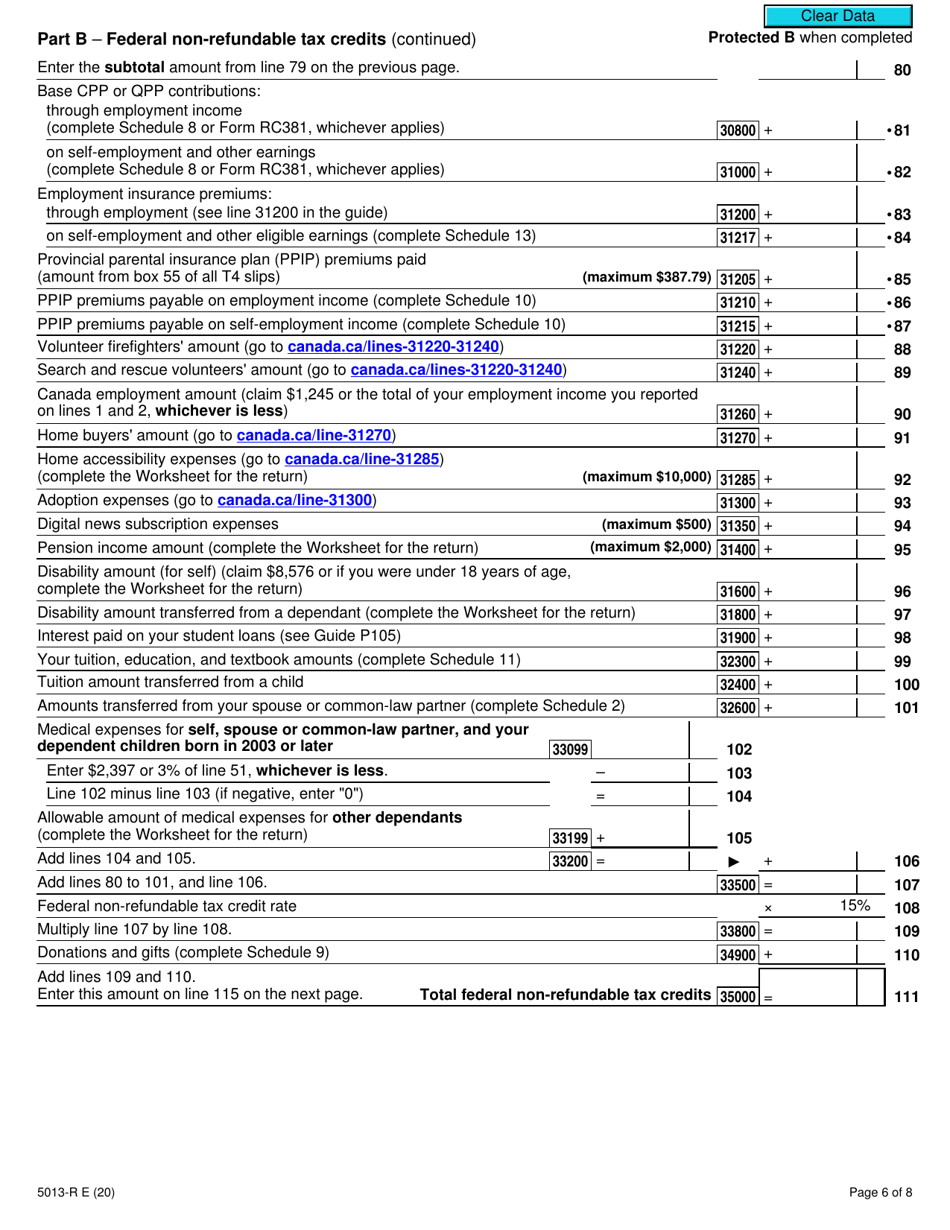

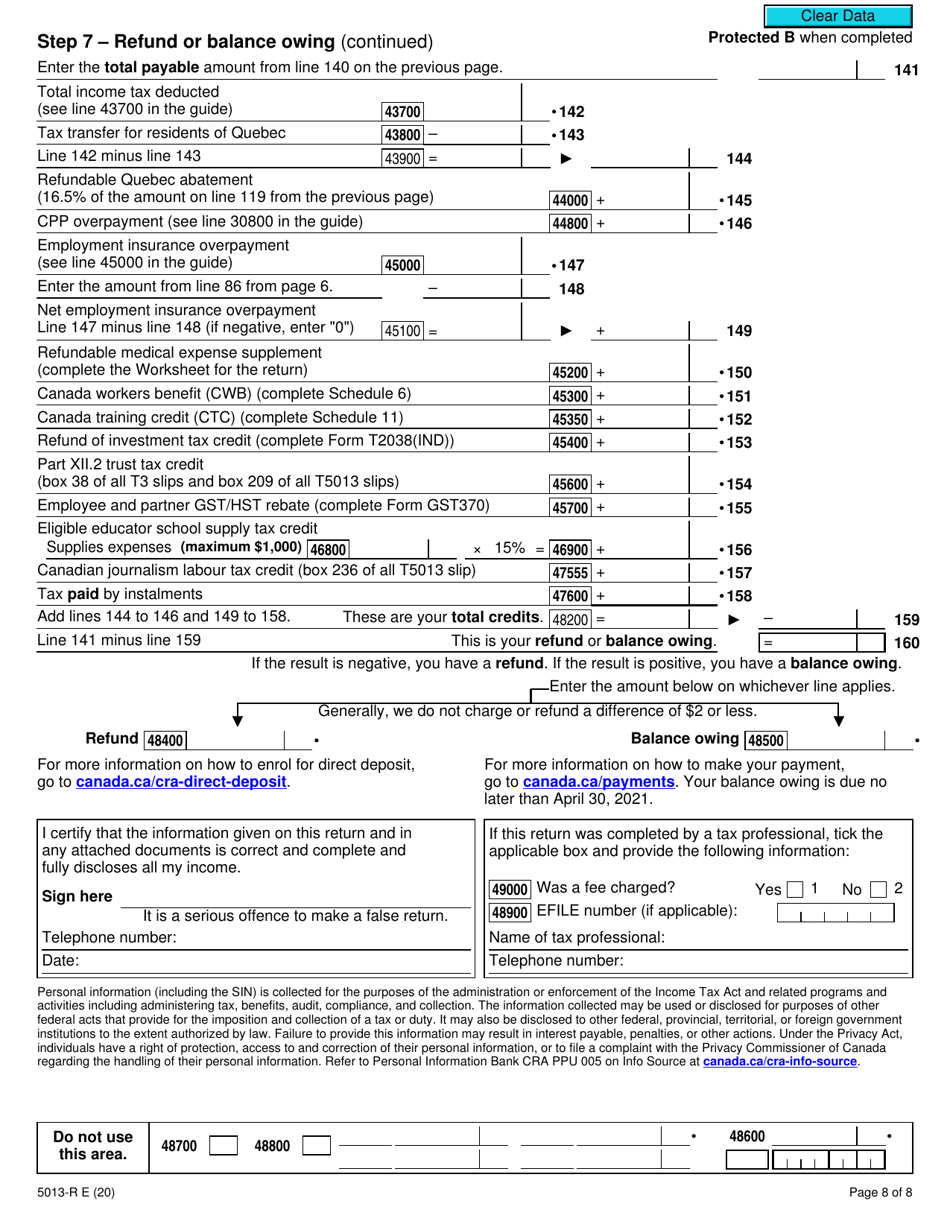

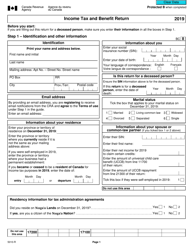

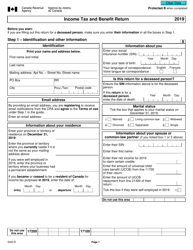

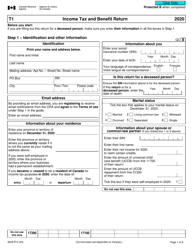

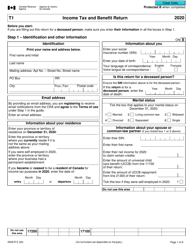

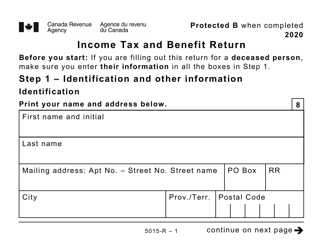

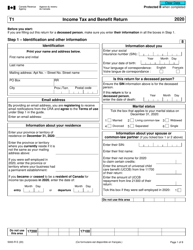

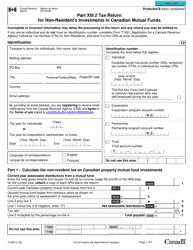

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Canada

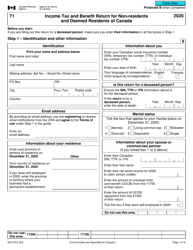

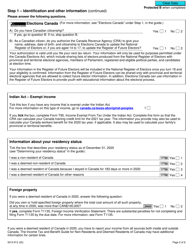

The Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada is used by individuals who are not residents of Canada or are considered to be residents of Canada for tax purposes. It is used to report their income and claim any applicable tax credits and deductions.

The Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada is filed by individuals who are non-residents or deemed residents of Canada for income tax and benefit purposes.

FAQ

Q: Who is required to file Form 5013-R?

A: Non-residents and deemed residents of Canada.

Q: What is Form 5013-R?

A: It is the Income Tax and Benefit Return form for non-residents and deemed residents of Canada.

Q: What is the purpose of Form 5013-R?

A: To report income earned in Canada by non-residents and deemed residents.

Q: Is Form 5013-R only for non-residents of Canada?

A: No, it is also for deemed residents of Canada.

Q: What is a deemed resident of Canada?

A: A deemed resident is someone who is not a resident of Canada for tax purposes but is treated as a resident.

Q: Are non-residents and deemed residents subject to Canadian income tax?

A: Yes, they are subject to Canadian income tax on income earned in Canada.

Q: Can non-residents and deemed residents claim deductions and credits on Form 5013-R?

A: Yes, they can claim deductions and credits that apply to their Canadian income.

Q: When is Form 5013-R due?

A: The due date varies depending on the individual's residency status.