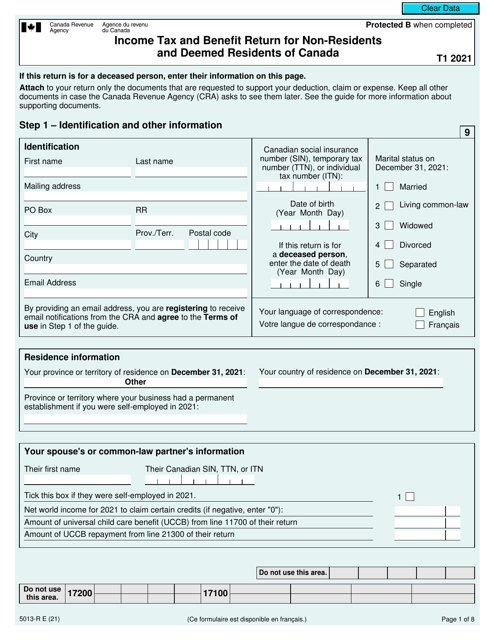

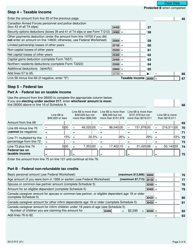

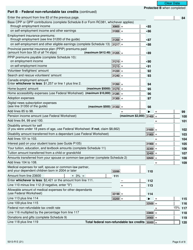

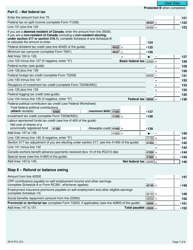

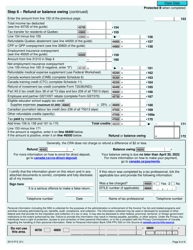

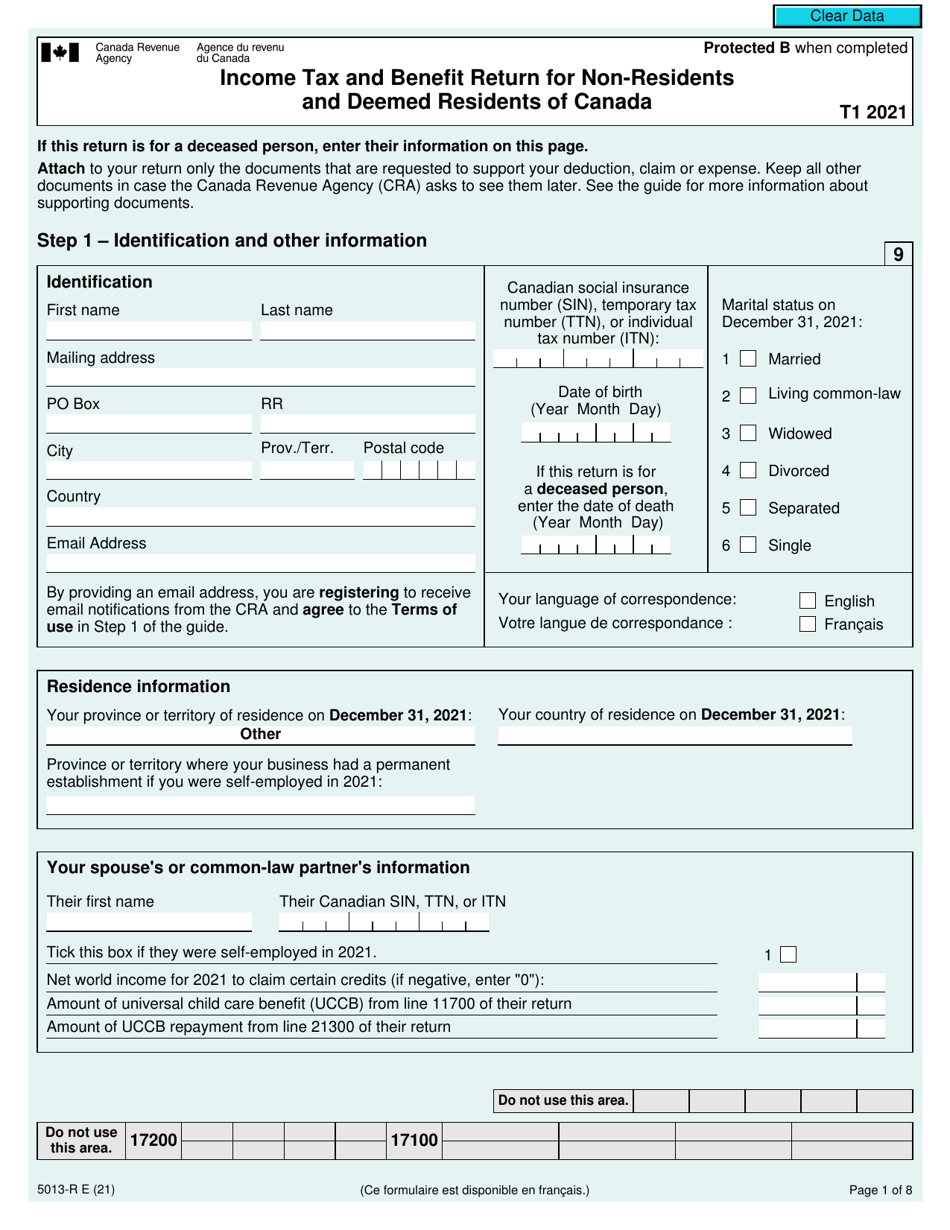

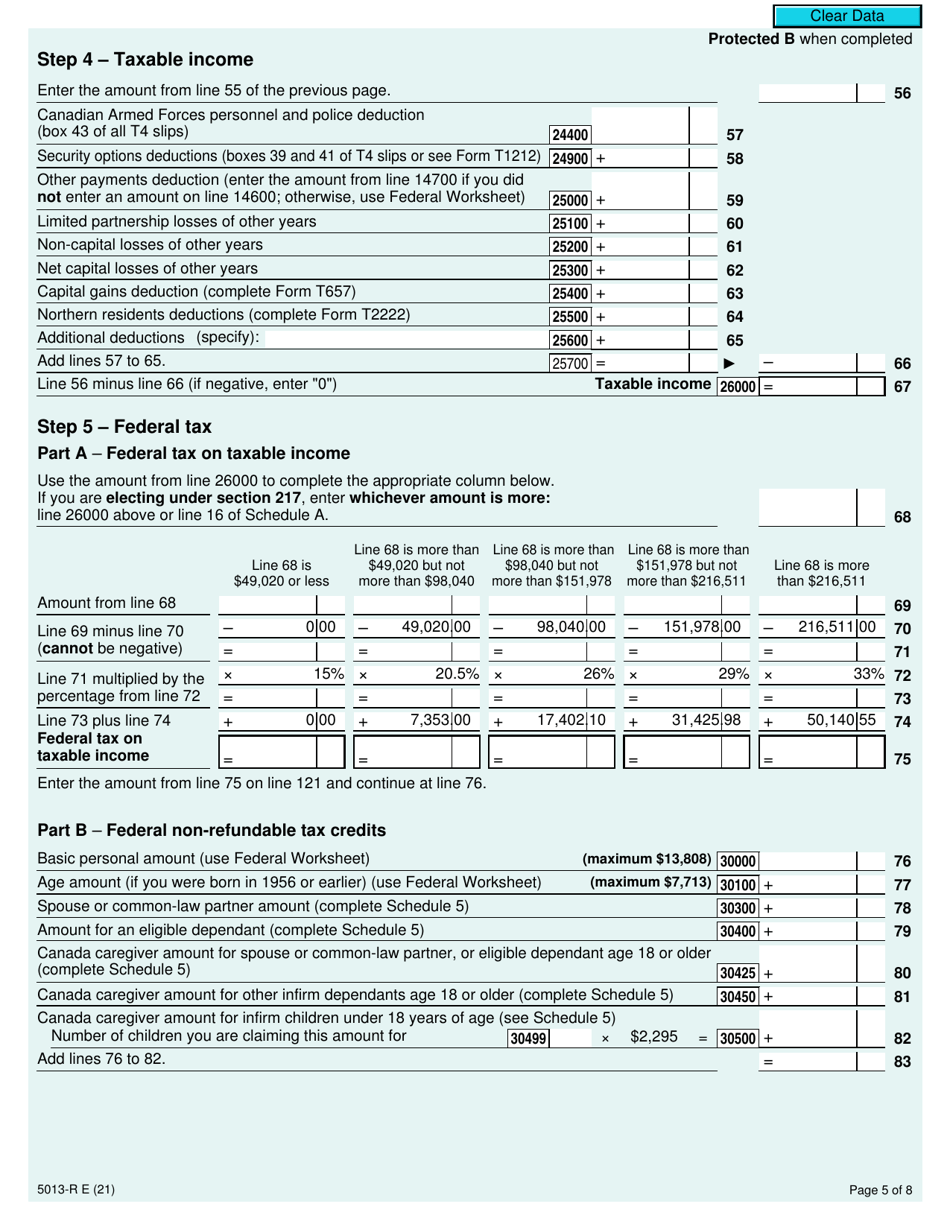

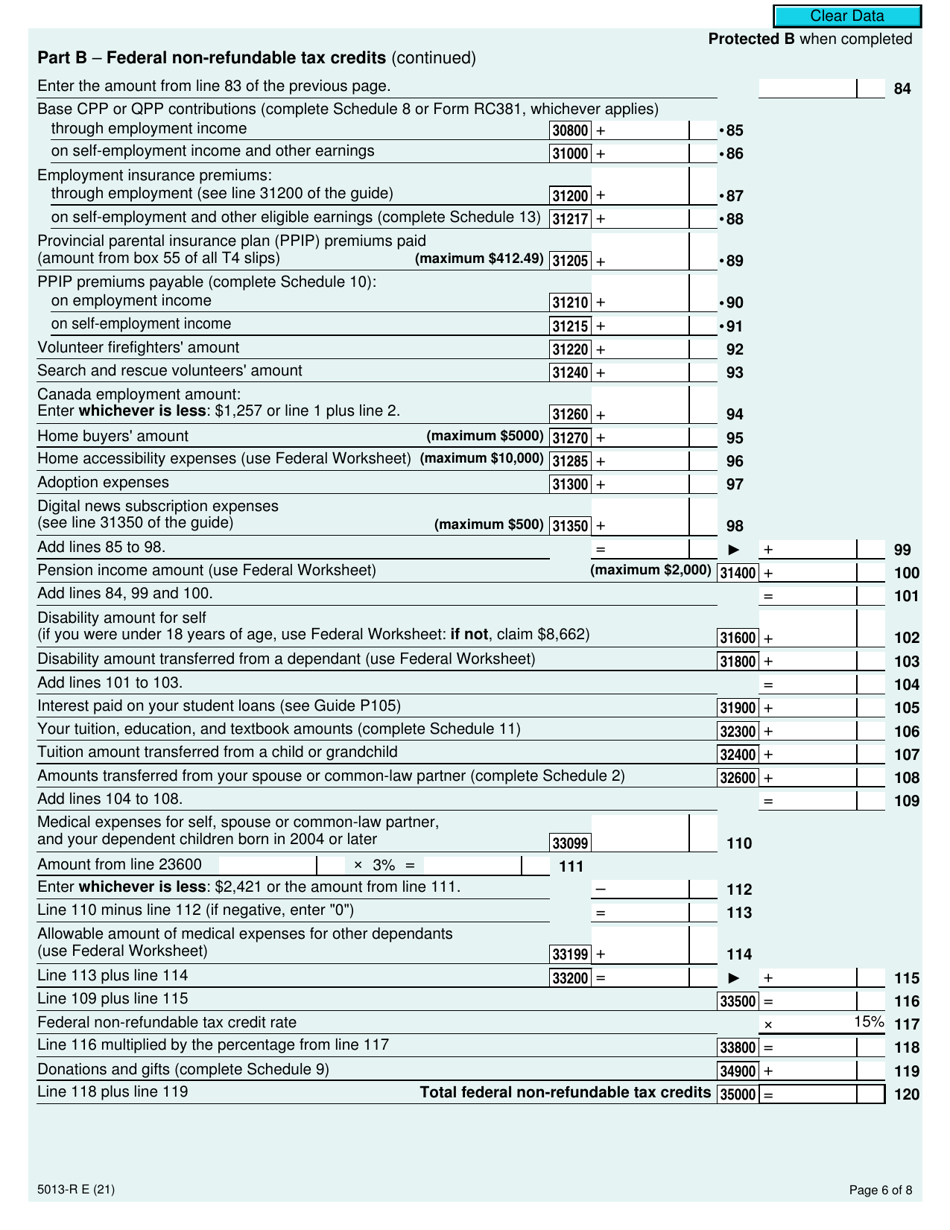

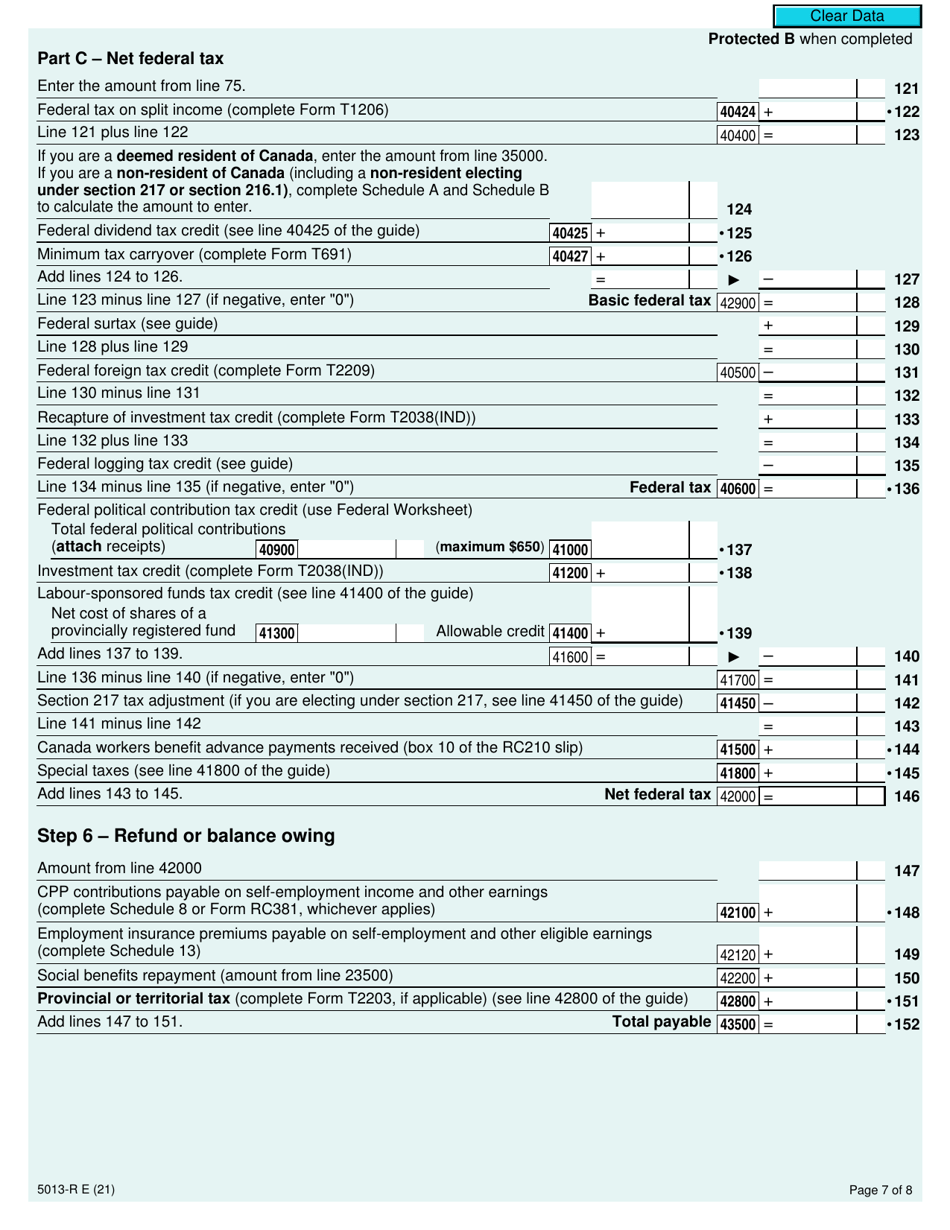

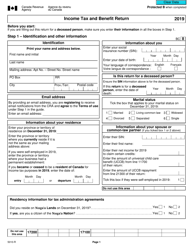

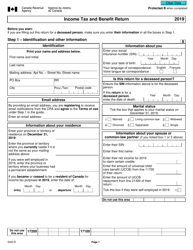

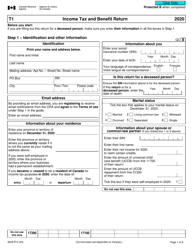

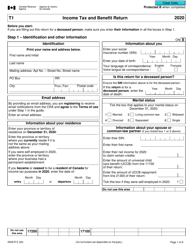

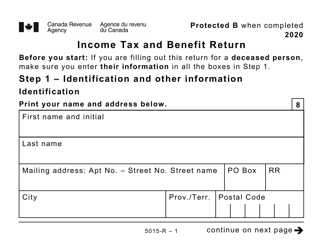

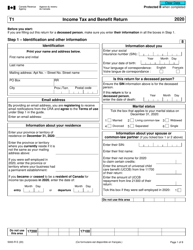

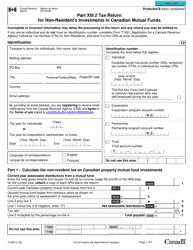

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Canada

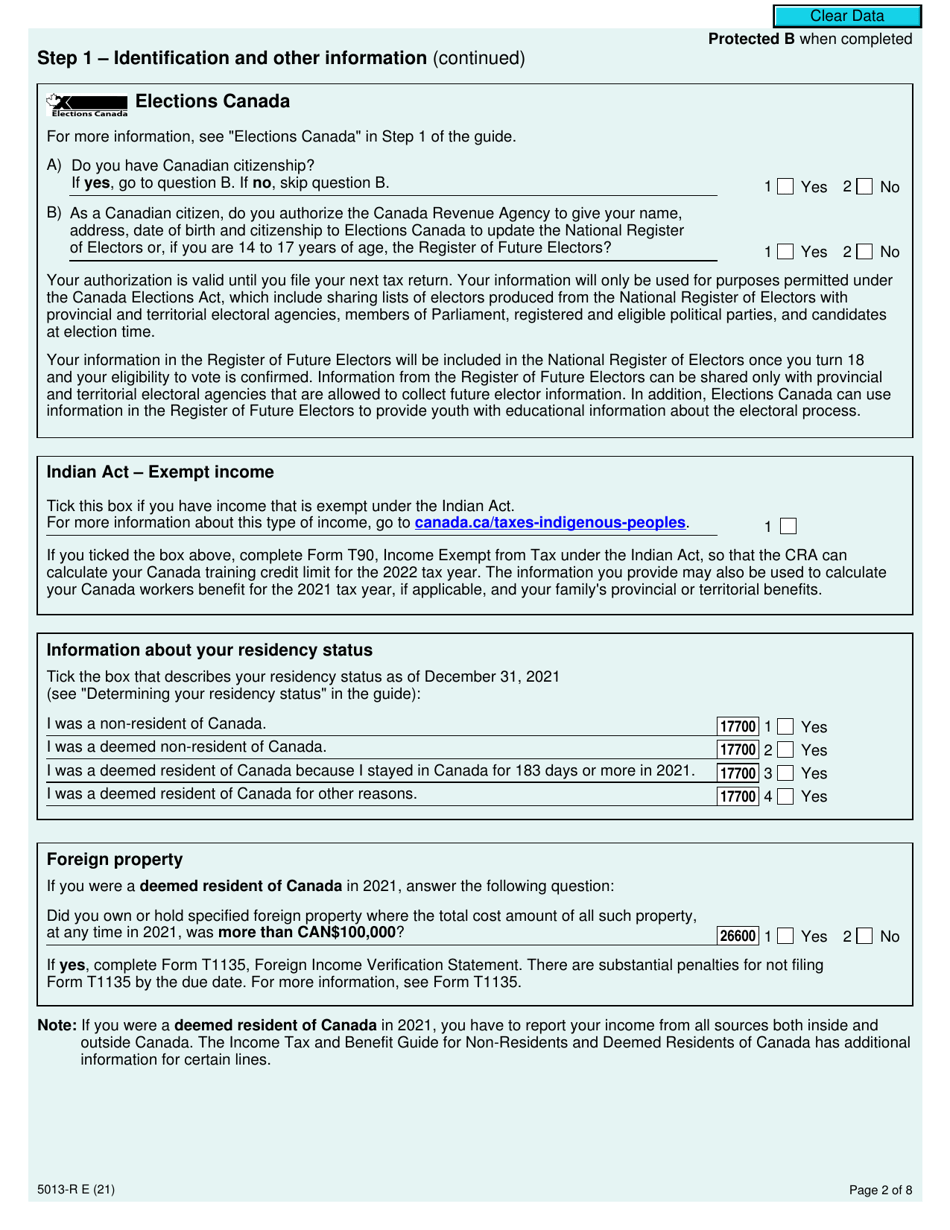

Form 5013-R is the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada. This form is used by individuals who are not residents of Canada but have income from Canadian sources. It allows them to report their income and claim any applicable deductions and credits.

The Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada is filed by individuals who are non-residents or deemed residents of Canada.

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Canada - Frequently Asked Questions (FAQ)

Q: Who needs to file Form 5013-R?

A: Non-residents and deemed residents of Canada.

Q: What is Form 5013-R?

A: It is the Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada.

Q: When is Form 5013-R required to be filed?

A: It is required to be filed by the deadline specified by the Canada Revenue Agency (CRA).

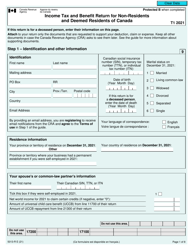

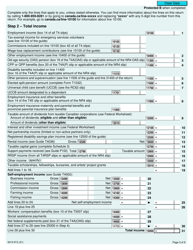

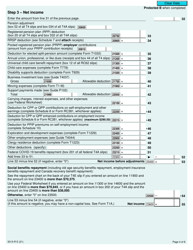

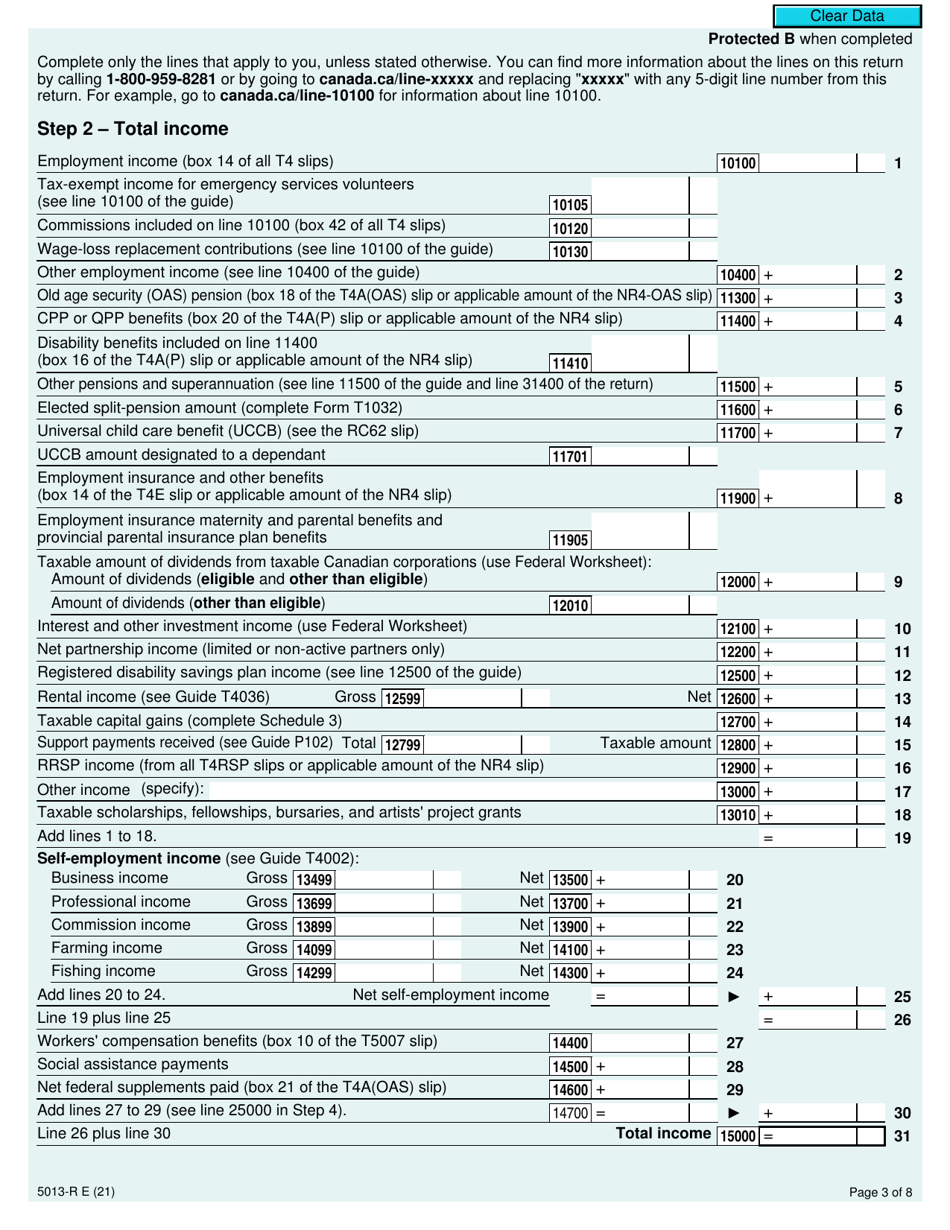

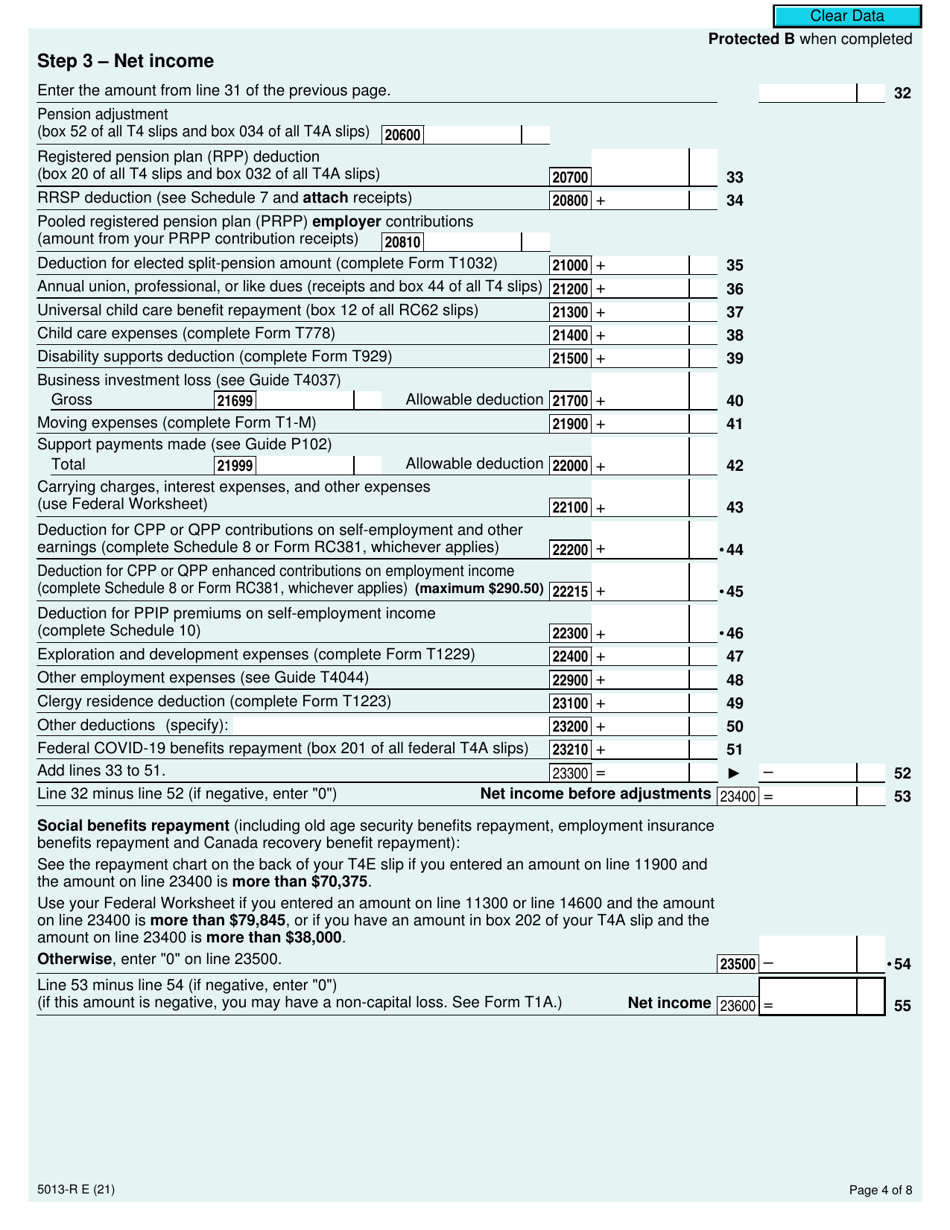

Q: What information is required to be reported on Form 5013-R?

A: Income earned in Canada and any applicable deductions and credits.

Q: Are there any penalties for not filing Form 5013-R?

A: Yes, there can be penalties for failure to file or for filing late.