This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S11 Schedule NL(S11)

for the current year.

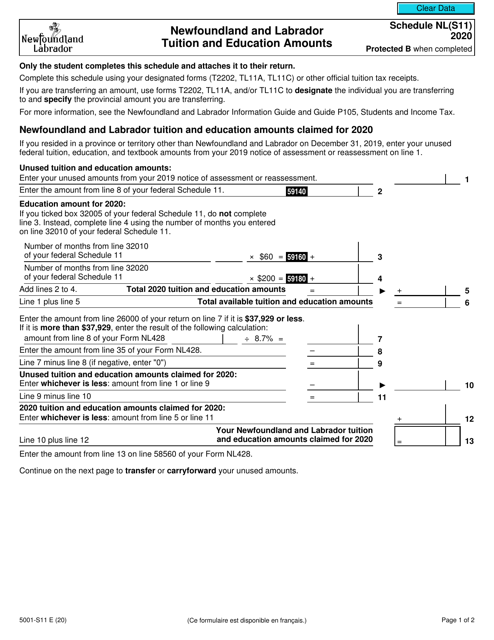

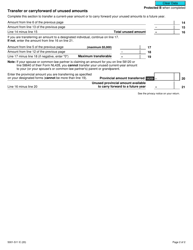

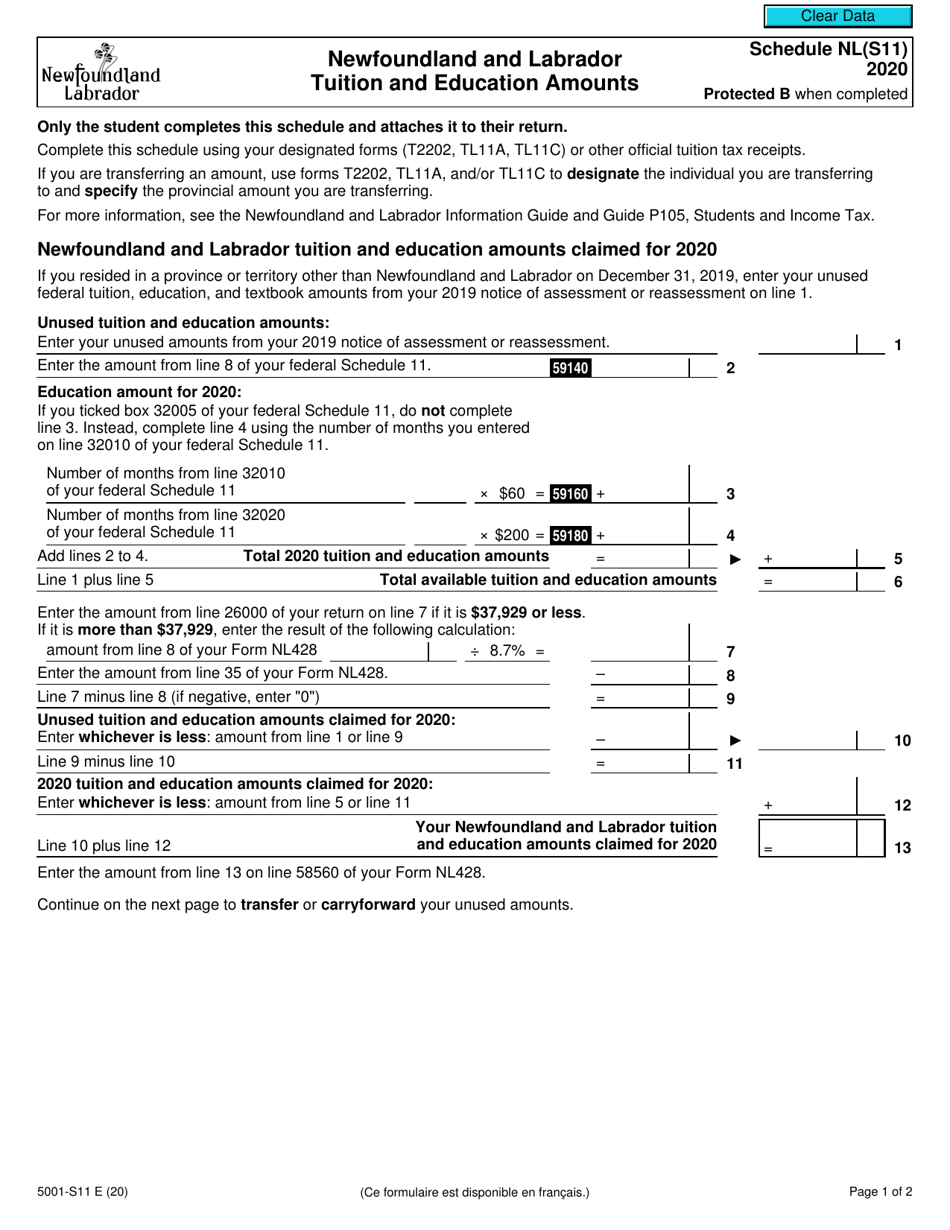

Form 5001-S11 Schedule NL(S11) Newfoundland and Labrador Tuition and Education Amounts - Canada

Form 5001-S11 Schedule NL(S11) is used in Canada for claiming tuition and education amounts specifically for residents of Newfoundland and Labrador.

The Form 5001-S11 Schedule NL(S11) Newfoundland and Labrador Tuition and Education Amounts in Canada is filed by individuals who are residents of Newfoundland and Labrador and are claiming tuition and education-related tax credits.

FAQ

Q: What is Form 5001-S11?

A: Form 5001-S11 is a tax form used in Canada.

Q: What is Schedule NL(S11)?

A: Schedule NL(S11) is a part of Form 5001-S11 used specifically for residents of Newfoundland and Labrador.

Q: What are the Tuition and Education Amounts?

A: The Tuition and Education Amounts are tax credits that can be claimed for eligible educational expenses.

Q: Who can fill out Schedule NL(S11)?

A: Residents of Newfoundland and Labrador who are eligible to claim the Tuition and Education Amounts can fill out Schedule NL(S11).

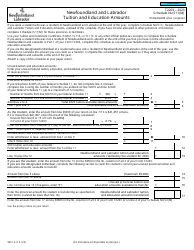

Q: What information is required on Schedule NL(S11)?

A: Schedule NL(S11) requires information about eligible educational expenses and any unused amounts from previous years.

Q: How do I claim the Tuition and Education Amounts?

A: To claim the Tuition and Education Amounts, you need to complete Schedule NL(S11) and include it with your tax return.