This version of the form is not currently in use and is provided for reference only. Download this version of

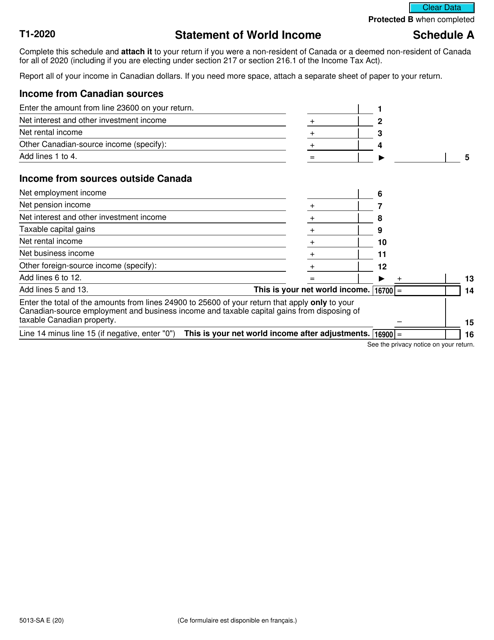

Form 5013-SA Schedule A

for the current year.

Form 5013-SA Schedule A Statement of World Income - Canada

FAQ

Q: What is Form 5013-SA Schedule A Statement of World Income?

A: Form 5013-SA Schedule A is a statement used by Canadian residents to report their income earned from sources outside of Canada.

Q: Who needs to file Form 5013-SA Schedule A?

A: Canadian residents who have earned income from sources outside of Canada need to file Form 5013-SA Schedule A.

Q: What should be reported on Form 5013-SA Schedule A?

A: Form 5013-SA Schedule A should include details of the income earned from sources outside of Canada, such as employment income, rental income, investment income, and more.

Q: Do I need to report foreign income on my Canadian tax return?

A: Yes, if you are a Canadian resident and have earned income from sources outside of Canada, you need to report it on your Canadian tax return using Form 5013-SA Schedule A.

Q: Is Form 5013-SA Schedule A for US residents?

A: No, Form 5013-SA Schedule A is specifically for Canadian residents to report their income earned from sources outside of Canada. US residents have different forms to report foreign income.