This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5012-S11 Schedule NT(S11)

for the current year.

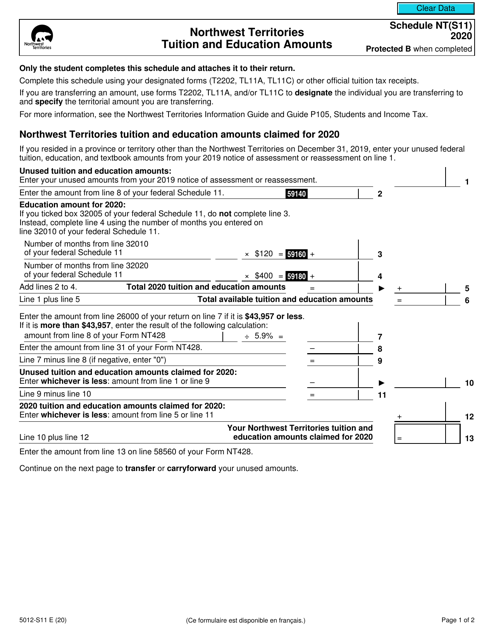

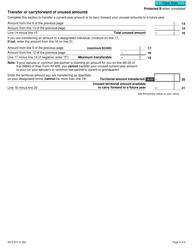

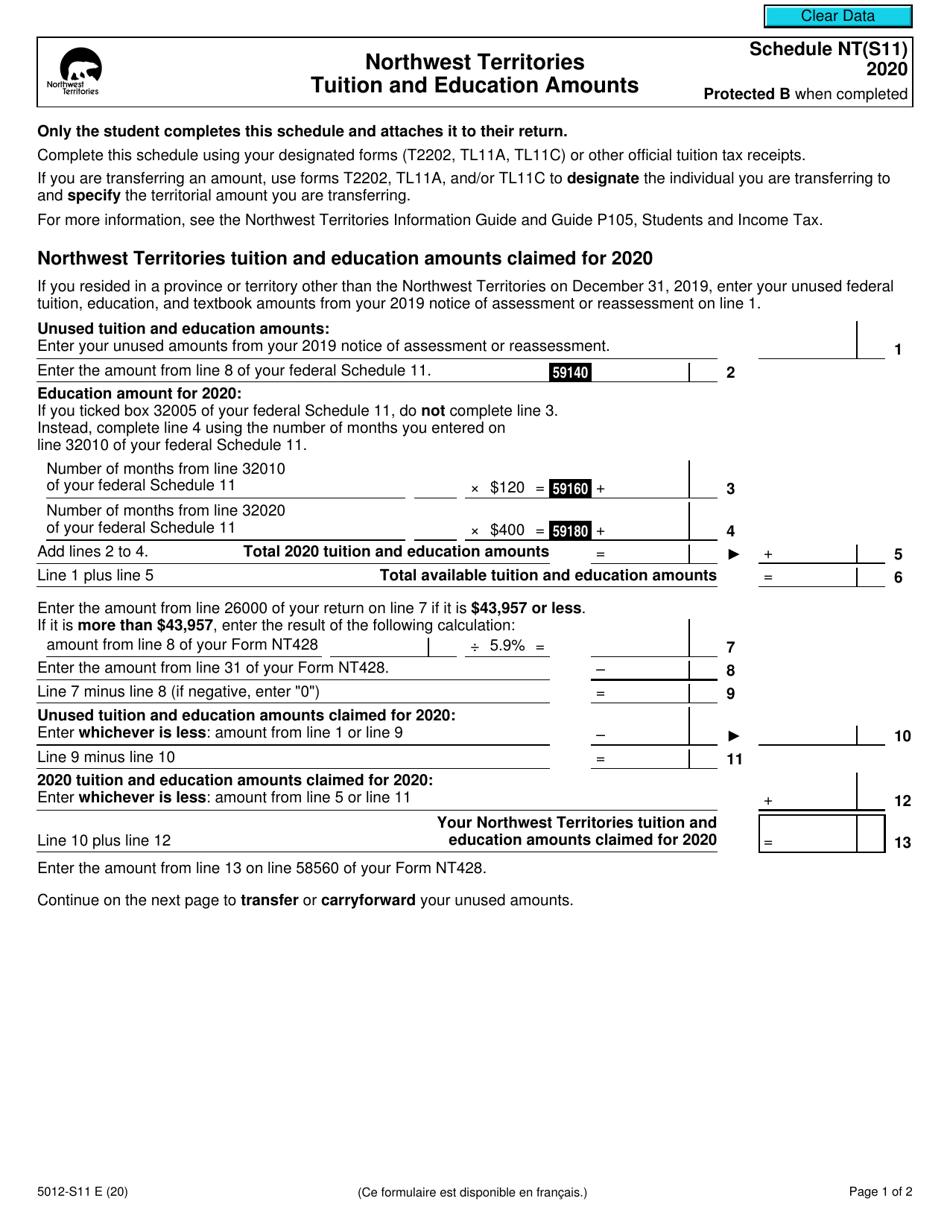

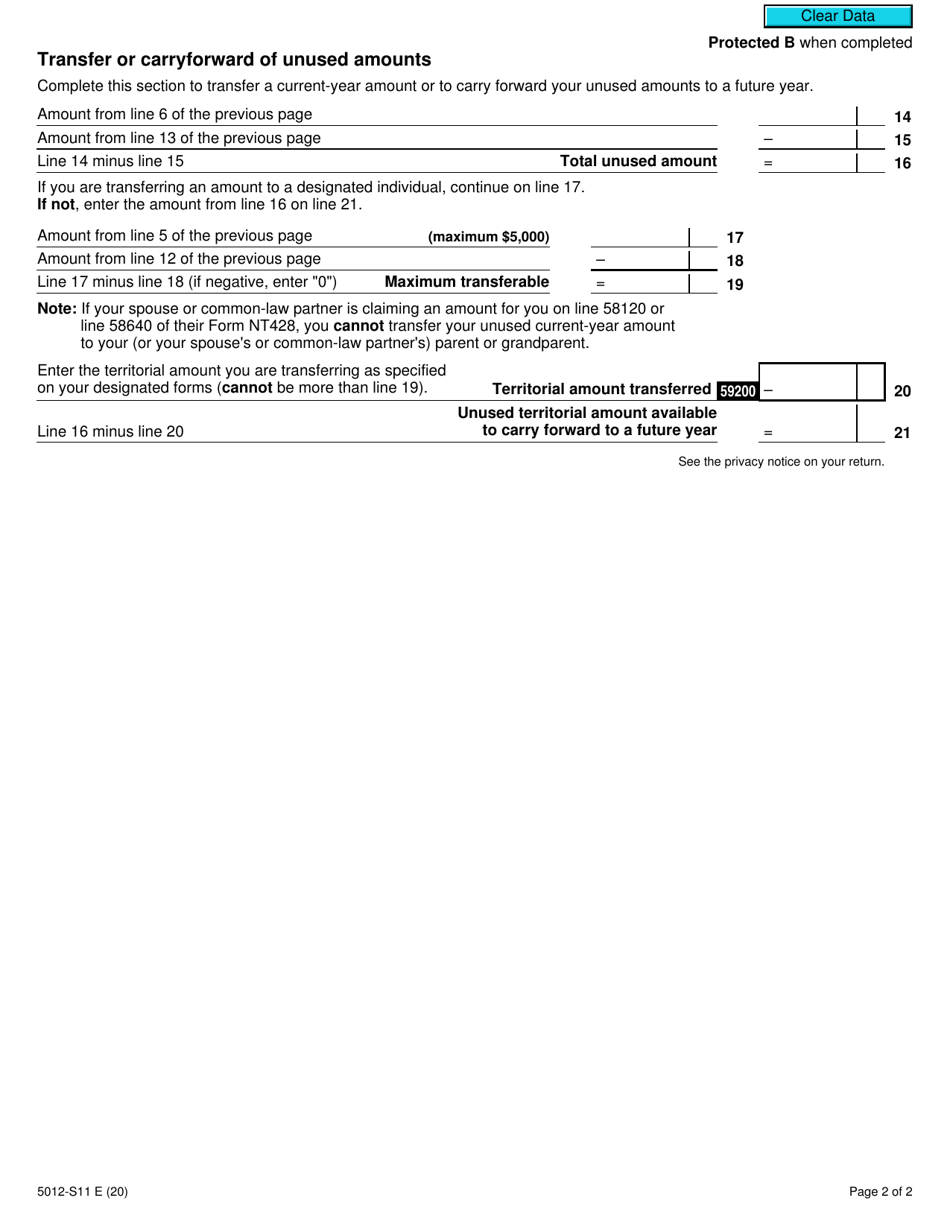

Form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts - Canada

Form 5012-S11 Schedule NT(S11) is used in Canada for claiming tuition and education amounts specifically for residents of the Northwest Territories.

The form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts in Canada is filed by residents of the Northwest Territories who are claiming tuition and education amounts.

FAQ

Q: What is Form 5012-S11 Schedule NT(S11)?

A: Form 5012-S11 Schedule NT(S11) is a tax form used in Canada specifically for reporting tuition and education amounts in the Northwest Territories.

Q: Who needs to file Form 5012-S11 Schedule NT(S11)?

A: Residents of the Northwest Territories in Canada who have incurred tuition and education expenses are required to file Form 5012-S11 Schedule NT(S11).

Q: What is the purpose of Form 5012-S11 Schedule NT(S11)?

A: The purpose of this form is to report tuition and education amounts, which may be eligible for tax credits or deductions.

Q: What information do I need to complete Form 5012-S11 Schedule NT(S11)?

A: You will need to gather information about your tuition and education expenses, as well as any applicable receipts or documents.

Q: Are there any deadlines for filing Form 5012-S11 Schedule NT(S11)?

A: The deadline for filing this form is usually April 30th of the following year. However, it is important to check with the Canada Revenue Agency for any updates or changes to the deadline.

Q: What are the possible benefits of filing Form 5012-S11 Schedule NT(S11)?

A: By filing this form, you may be eligible for tax credits or deductions, which can help reduce your overall tax liability.

Q: Can I claim tuition and education amounts for someone else on Form 5012-S11 Schedule NT(S11)?

A: No, this form is specifically for reporting your own tuition and education expenses. If you are claiming expenses on behalf of someone else, you may need to use a different form or process.

Q: Do I need to include supporting documentation with Form 5012-S11 Schedule NT(S11)?

A: It is generally recommended to keep supporting documentation, such as receipts and proof of enrollment, in case the Canada Revenue Agency requests them at a later date.

Q: What happens after I file Form 5012-S11 Schedule NT(S11)?

A: After filing this form, the Canada Revenue Agency will process your information and determine whether you are eligible for any tax credits or deductions based on the tuition and education amounts you reported.