This version of the form is not currently in use and is provided for reference only. Download this version of

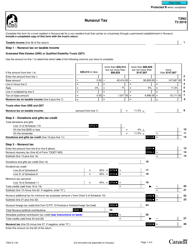

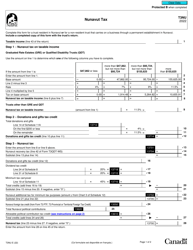

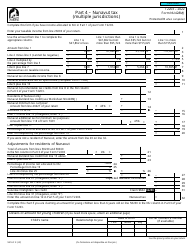

Form 5014-S11 Schedule NU(S11)

for the current year.

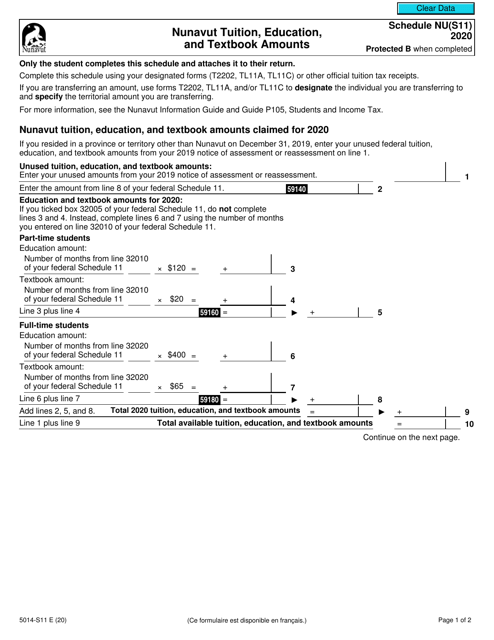

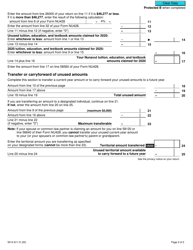

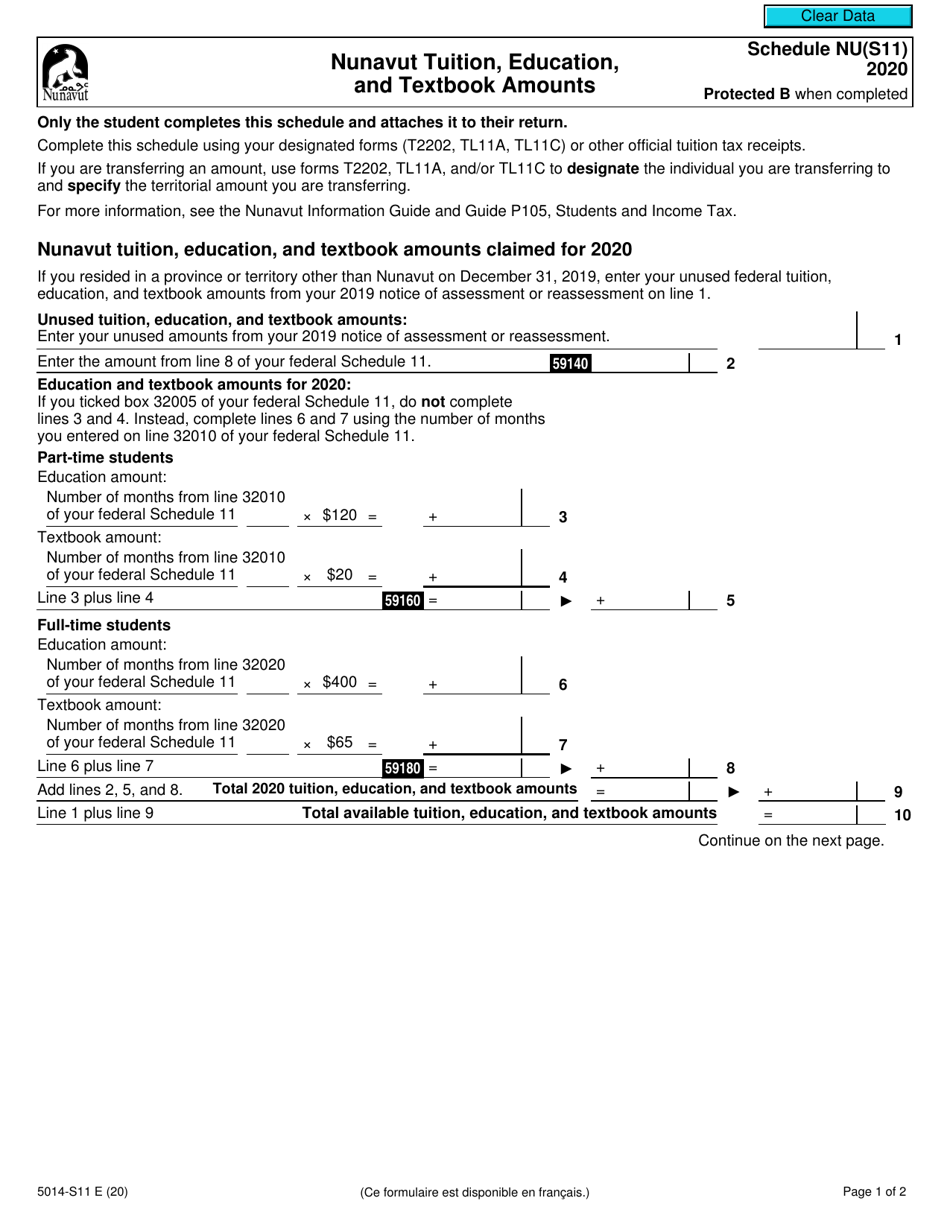

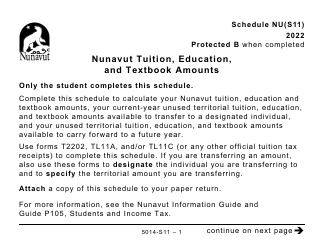

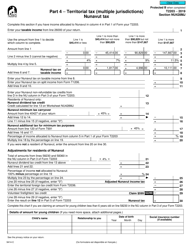

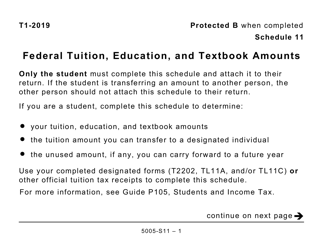

Form 5014-S11 Schedule NU(S11) Nunavut Tuition, Education, and Textbook Amounts - Canada

Form 5014-S11 Schedule NU(S11) is used to claim tuition, education, and textbook amounts for residents of Nunavut, Canada.

The Form 5014-S11 Schedule NU(S11) is filed by residents of Nunavut, Canada who are claiming tuition, education, and textbook amounts on their tax return.

FAQ

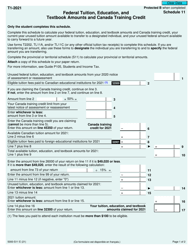

Q: What is Form 5014-S11?

A: Form 5014-S11 is a schedule used in Canada for claiming Nunavut Tuition, Education, and Textbook Amounts.

Q: What is Nunavut Tuition, Education, and Textbook Amounts?

A: Nunavut Tuition, Education, and Textbook Amounts is a provision that allows residents of Nunavut to claim deductions for their tuition, education, and textbook expenses.

Q: Who can use Form 5014-S11?

A: Residents of Nunavut who want to claim deductions for their tuition, education, and textbook expenses can use Form 5014-S11.

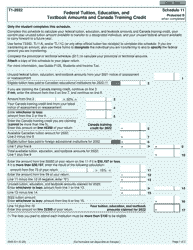

Q: What information is required on Form 5014-S11?

A: Form 5014-S11 requires information such as the student's name, student number, educational institution name, and the amount of eligible expenses.

Q: How do I submit Form 5014-S11?

A: Form 5014-S11 should be submitted along with your income tax return to the Canada Revenue Agency (CRA).

Q: What are the benefits of claiming Nunavut Tuition, Education, and Textbook Amounts?

A: By claiming these amounts, residents of Nunavut can reduce their tax liability and potentially receive a tax refund.

Q: Are there any eligibility criteria for claiming Nunavut Tuition, Education, and Textbook Amounts?

A: Yes, there are eligibility criteria that must be met, such as being a resident of Nunavut and attending a post-secondary educational institution.

Q: Can I claim expenses for my child's education on Form 5014-S11?

A: No, Form 5014-S11 is specifically for individuals to claim their own tuition, education, and textbook expenses.