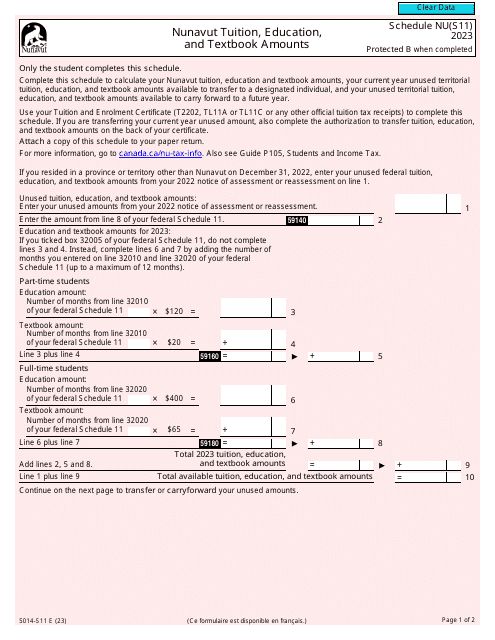

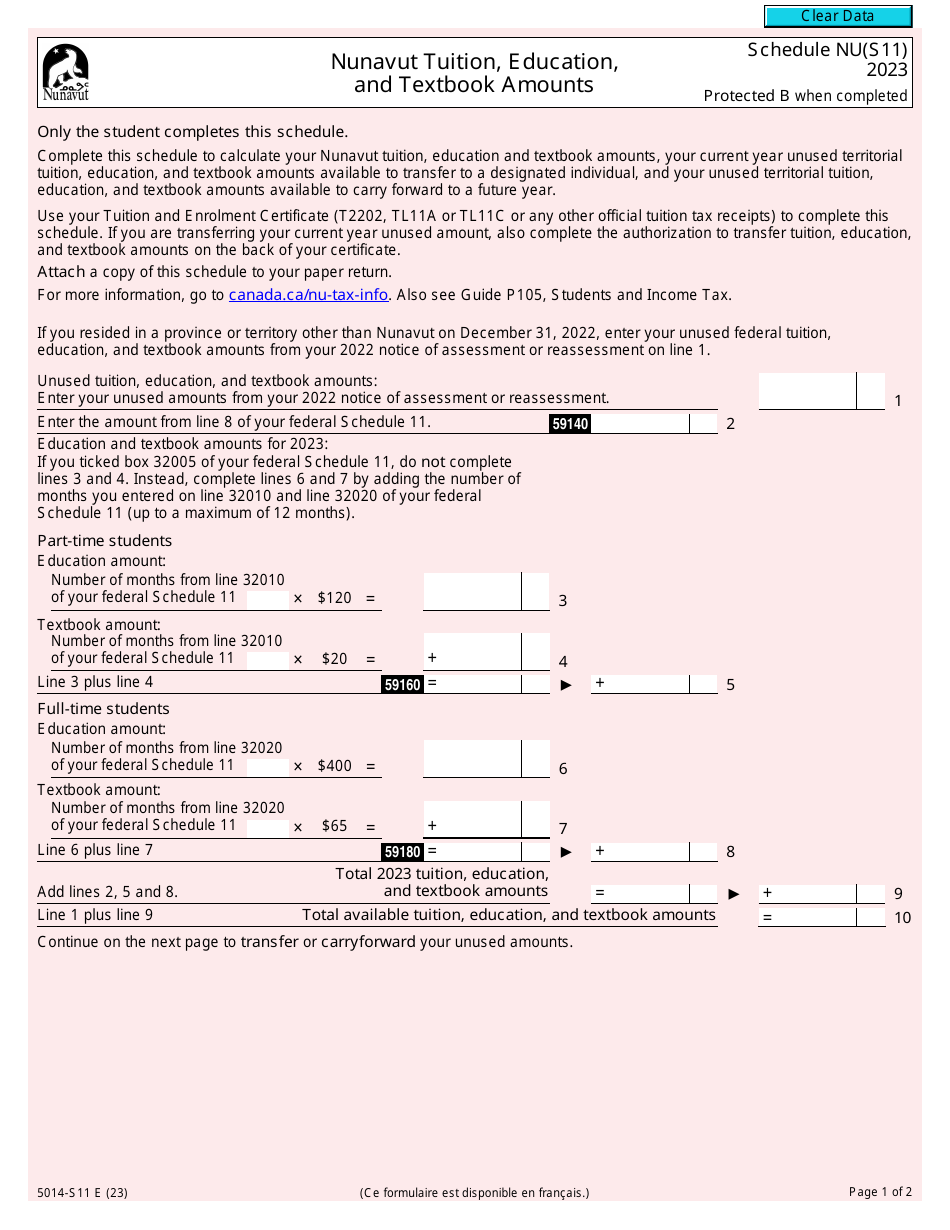

Form 5014-S11 Schedule NU(S11) Nunavut Tuition, Education, and Textbook Amounts - Canada

Form 5014-S11 Schedule NU(S11) is used in Canada for claiming tuition, education, and textbook amounts specifically for residents of Nunavut.

The Form 5014-S11 Schedule NU(S11) is filed by individual residents of Nunavut, Canada who want to claim the tuition, education, and textbook amounts.

Form 5014-S11 Schedule NU(S11) Nunavut Tuition, Education, and Textbook Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5014-S11 Schedule NU(S11)?

A: Form 5014-S11 Schedule NU(S11) is a tax form in Canada specifically for residents of Nunavut.

Q: What is the purpose of Form 5014-S11 Schedule NU(S11)?

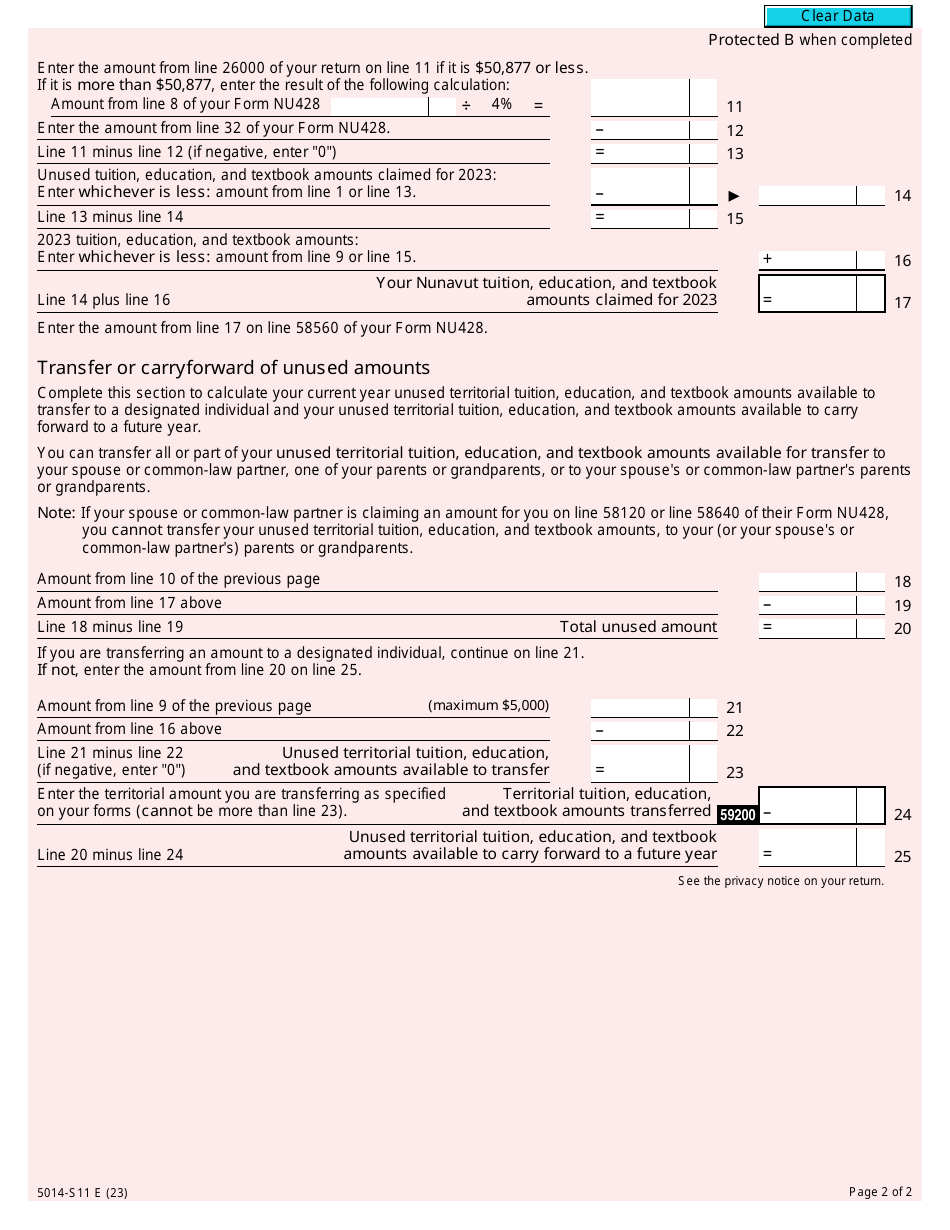

A: The purpose of Form 5014-S11 Schedule NU(S11) is to claim tuition, education, and textbook amounts for residents of Nunavut.

Q: Who is eligible to use Form 5014-S11 Schedule NU(S11)?

A: Only residents of Nunavut are eligible to use Form 5014-S11 Schedule NU(S11).

Q: What can be claimed on Form 5014-S11 Schedule NU(S11)?

A: Form 5014-S11 Schedule NU(S11) allows residents of Nunavut to claim tuition, education, and textbook amounts paid.

Q: How do I fill out Form 5014-S11 Schedule NU(S11)?

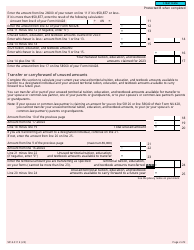

A: You should carefully follow the instructions provided on Form 5014-S11 Schedule NU(S11) and input the necessary information regarding your tuition, education, and textbook amounts paid.

Q: When is the deadline to submit Form 5014-S11 Schedule NU(S11)?

A: The deadline for submitting Form 5014-S11 Schedule NU(S11) is typically April 30th of each year, or the following business day if April 30th falls on a weekend or holiday.

Q: What happens after I submit Form 5014-S11 Schedule NU(S11)?

A: After you submit Form 5014-S11 Schedule NU(S11), the information will be processed by the CRA and any applicable credits or refunds will be applied to your tax return.

Q: Do I need to keep a copy of Form 5014-S11 Schedule NU(S11) for my records?

A: Yes, it is recommended to keep a copy of Form 5014-S11 Schedule NU(S11) for your records in case of future reference or audits by the CRA.