This version of the form is not currently in use and is provided for reference only. Download this version of

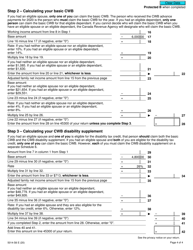

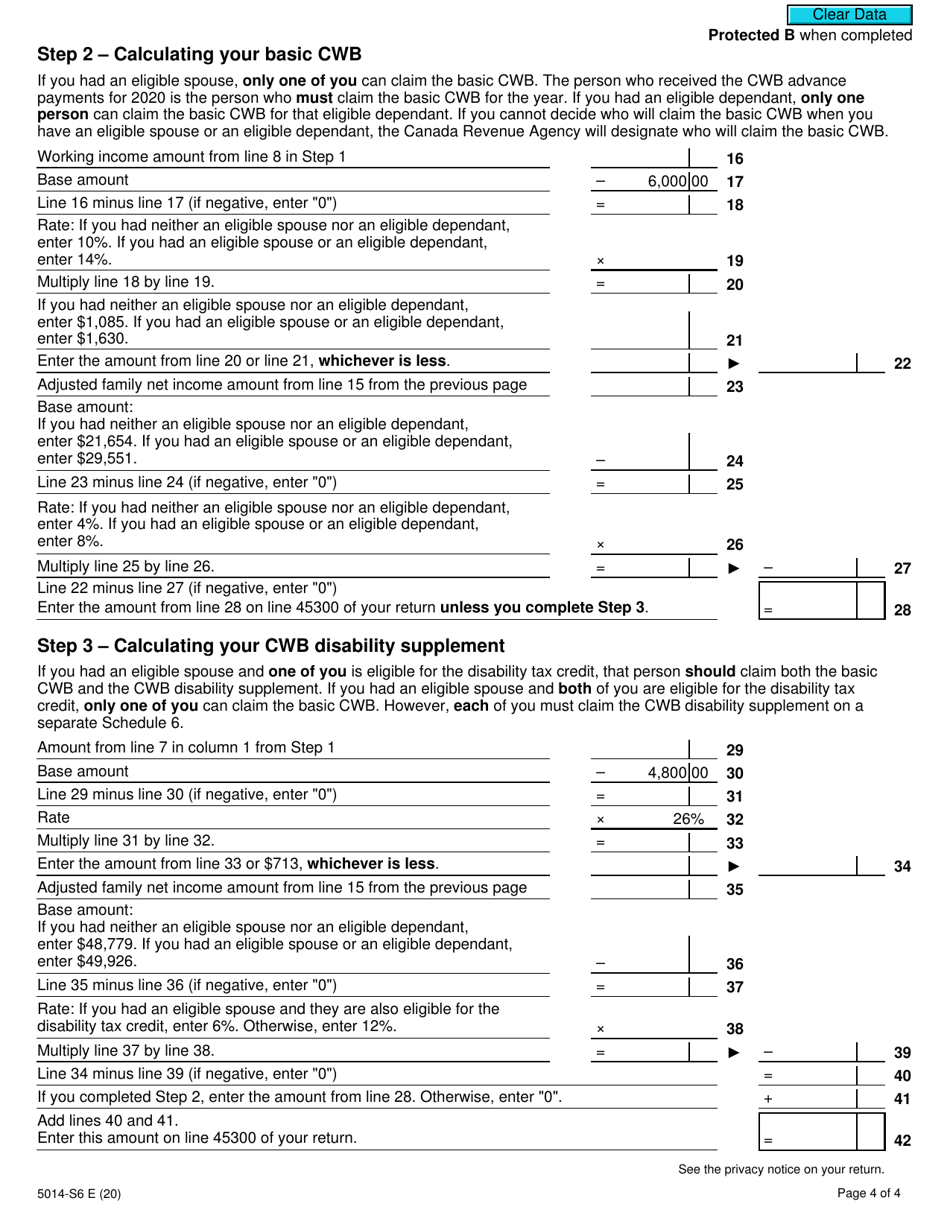

Form 5014-S6 Schedule 6

for the current year.

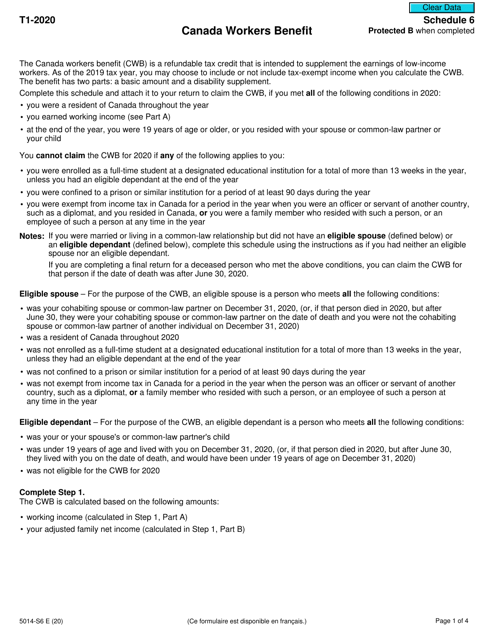

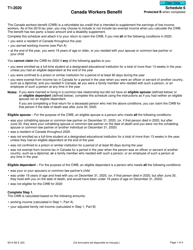

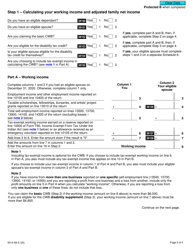

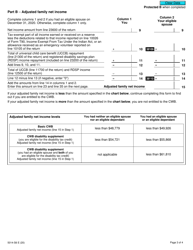

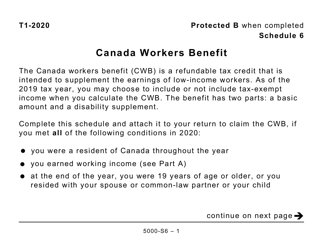

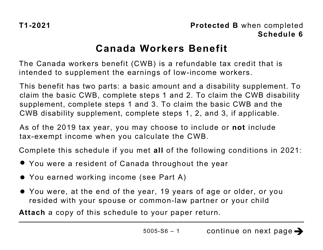

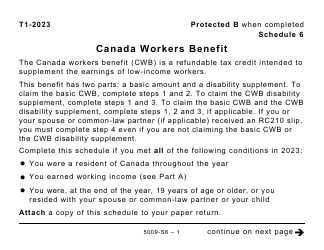

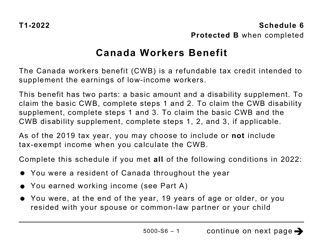

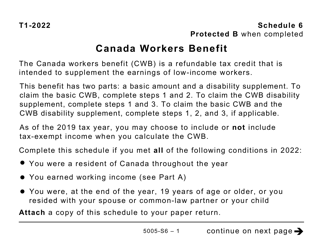

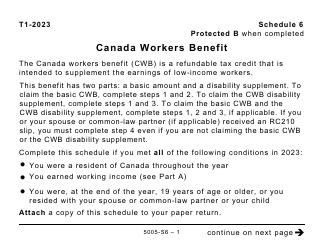

Form 5014-S6 Schedule 6 Canada Workers Benefit - Nunavut - Canada

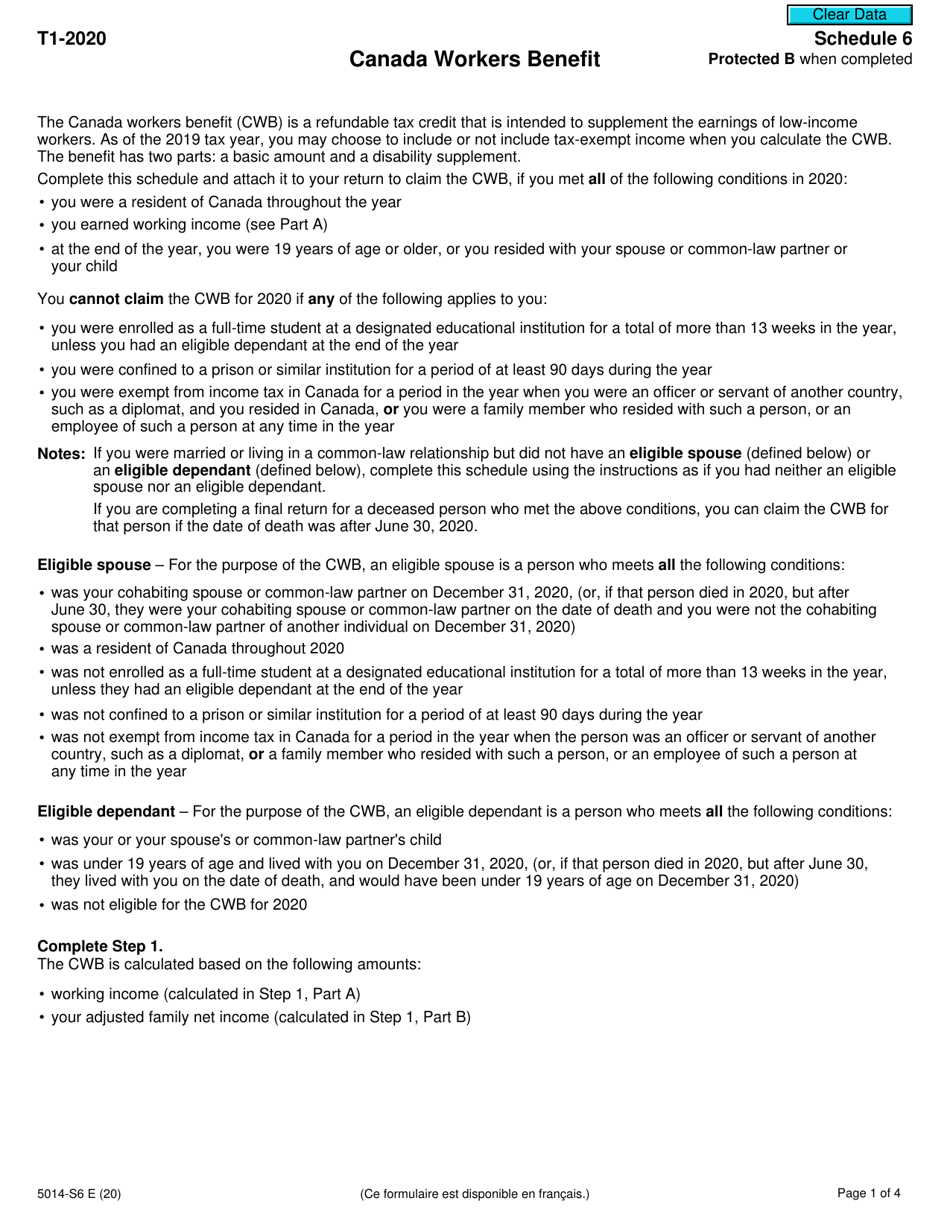

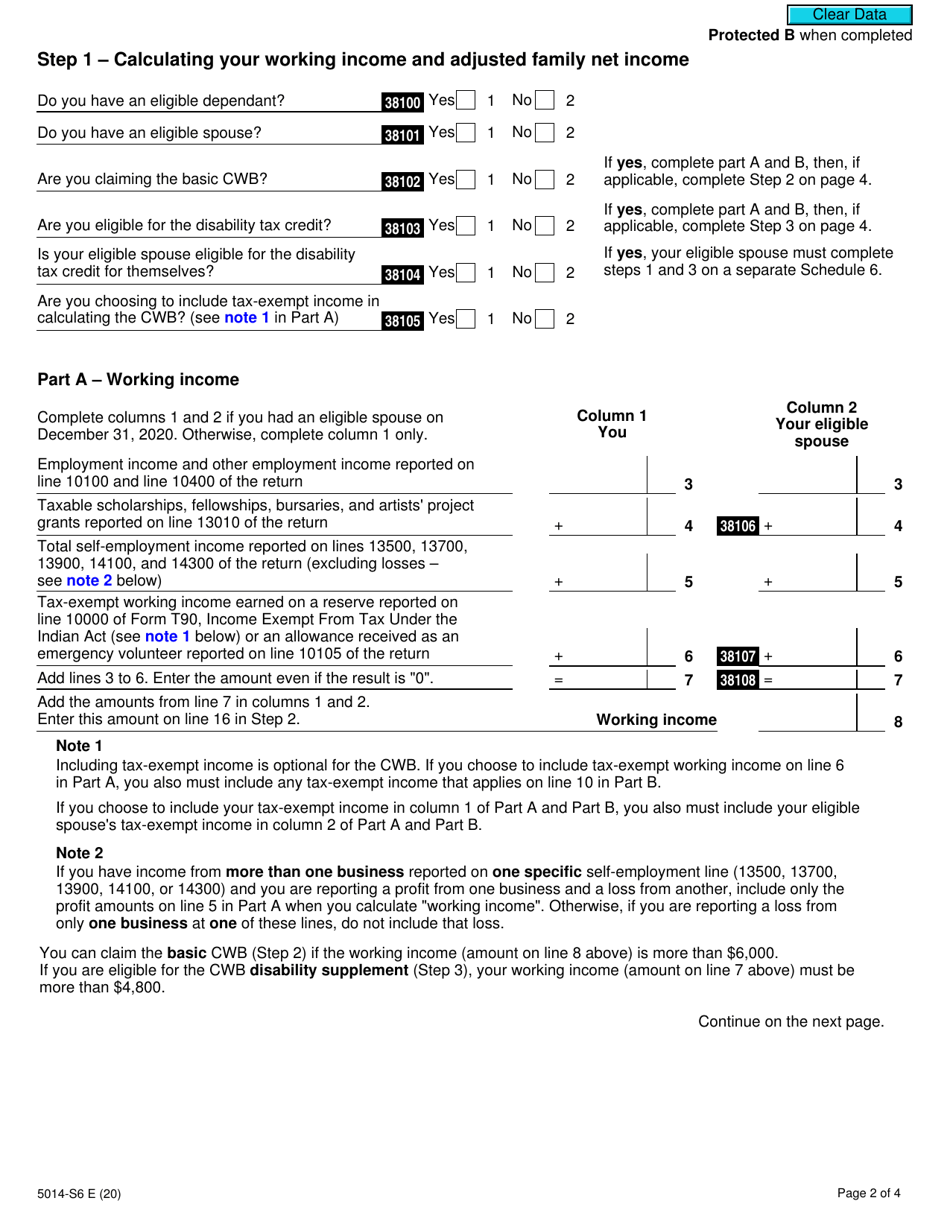

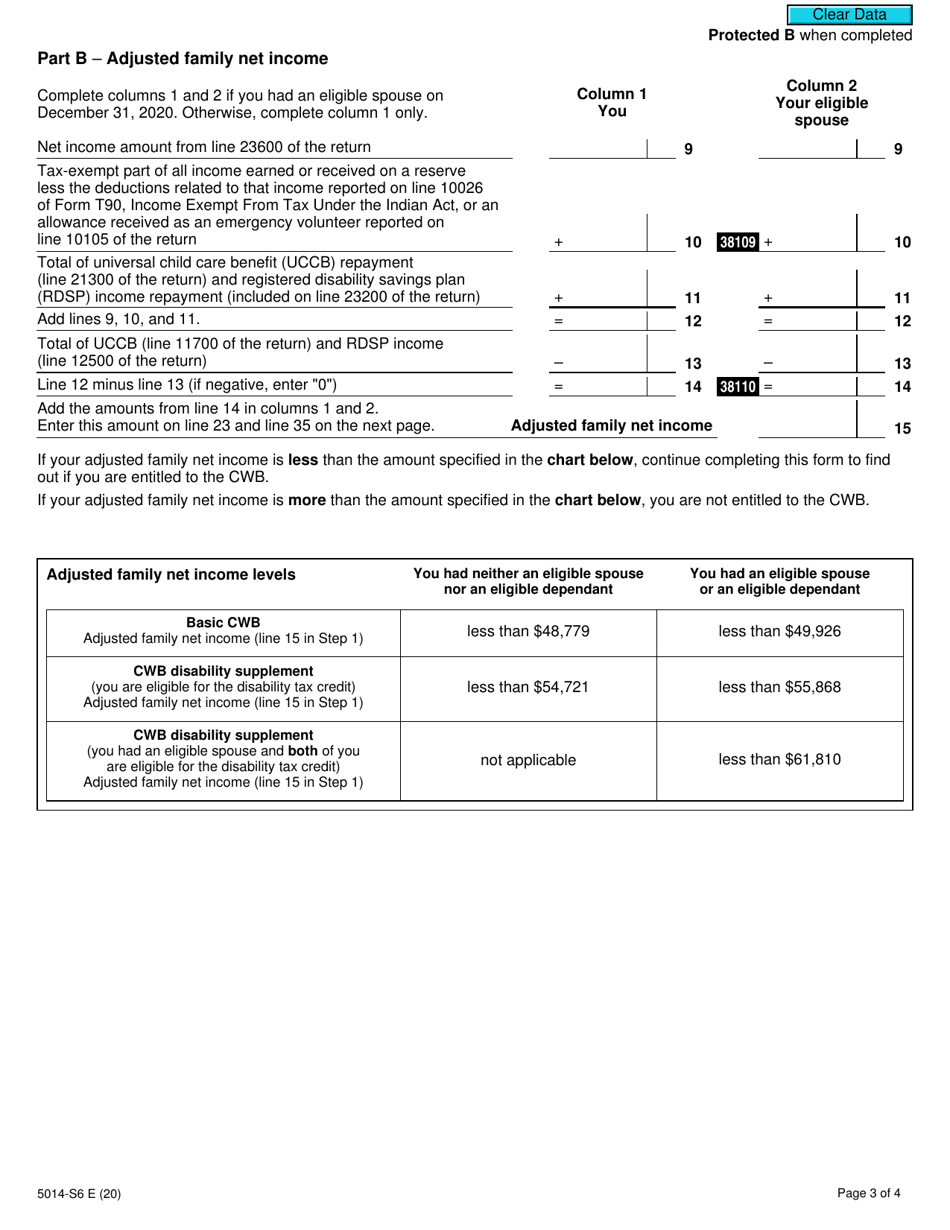

Form 5014-S6 Schedule 6 is used in Canada to claim the Nunavut Workers Benefit, which provides financial assistance to low-income workers in Nunavut. It helps eligible individuals and families with the cost of living and aims to reduce poverty in the region.

The Form 5014-S6 Schedule 6 Canada Workers Benefit - Nunavut - Canada is filed by individuals who are eligible for the Canada Workers Benefit and reside in Nunavut, Canada.

FAQ

Q: What is Form 5014-S6 Schedule 6?

A: Form 5014-S6 Schedule 6 is a tax form used in Canada.

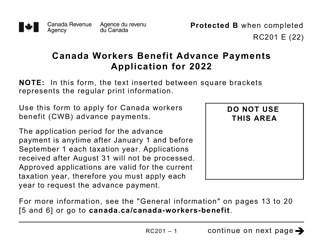

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a tax credit provided by the Canadian government to help low-income workers.

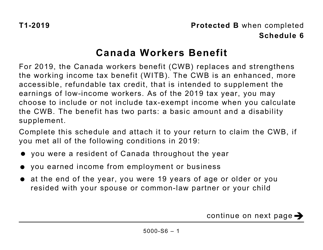

Q: Who is eligible for the Canada Workers Benefit?

A: Eligibility for the Canada Workers Benefit is based on income, age, and whether or not the individual has dependents.

Q: What is Nunavut?

A: Nunavut is a territory in Canada located in the northernmost part of the country.

Q: Why is there a separate schedule for Nunavut?

A: Nunavut has different tax rates and benefits due to its unique circumstances as a remote northern territory.