Form 5014-S6 Schedule 6 Canada Workers Benefit - Canada

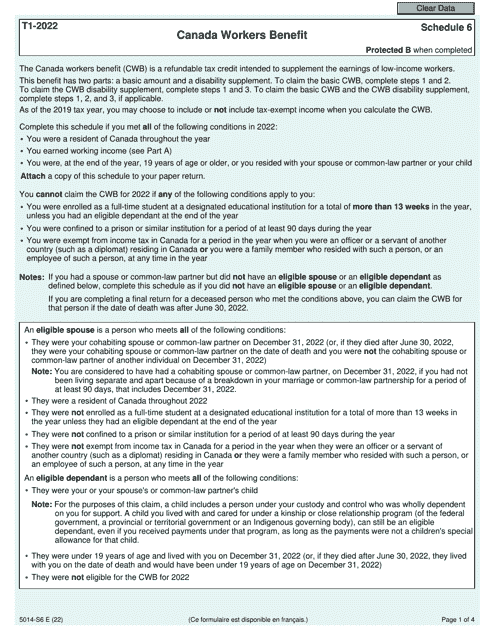

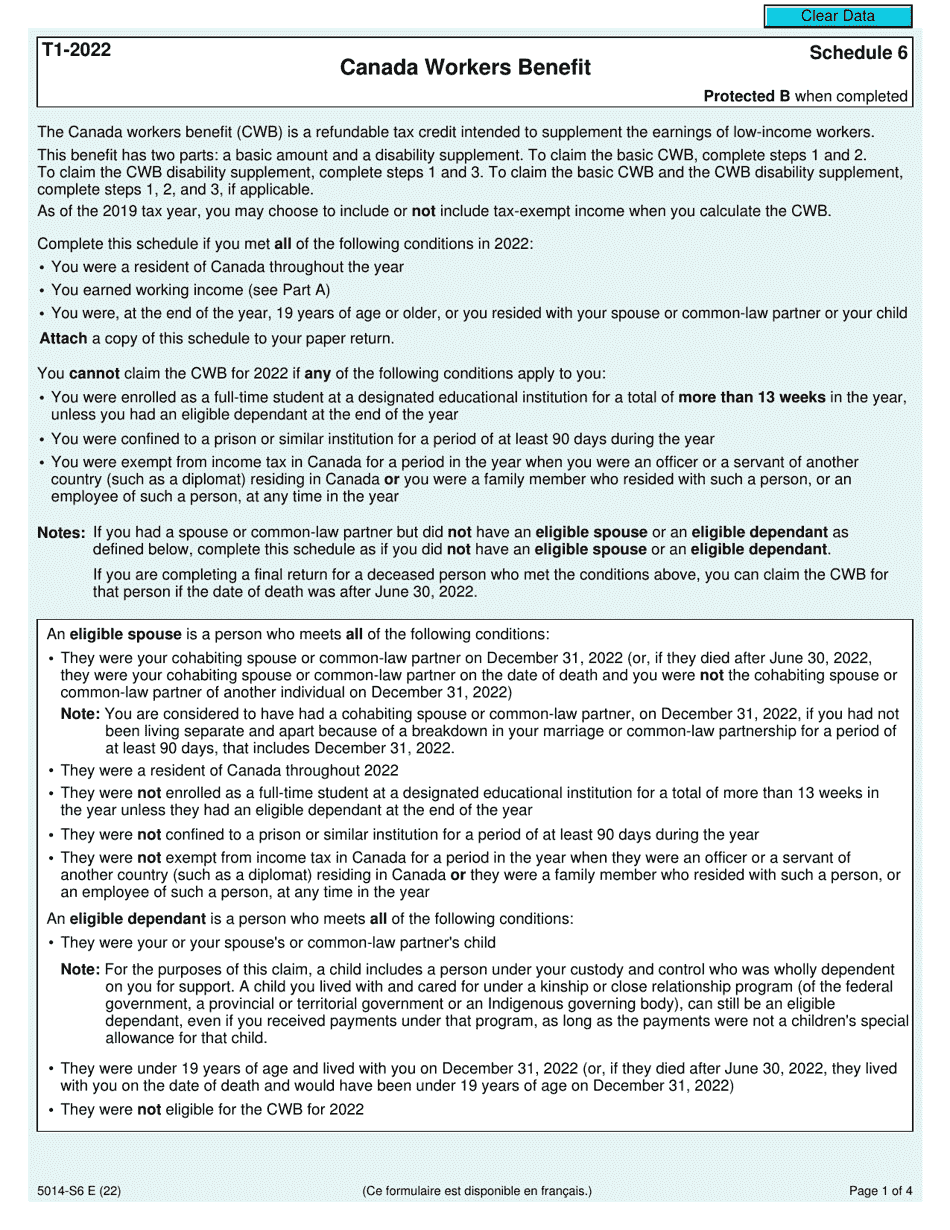

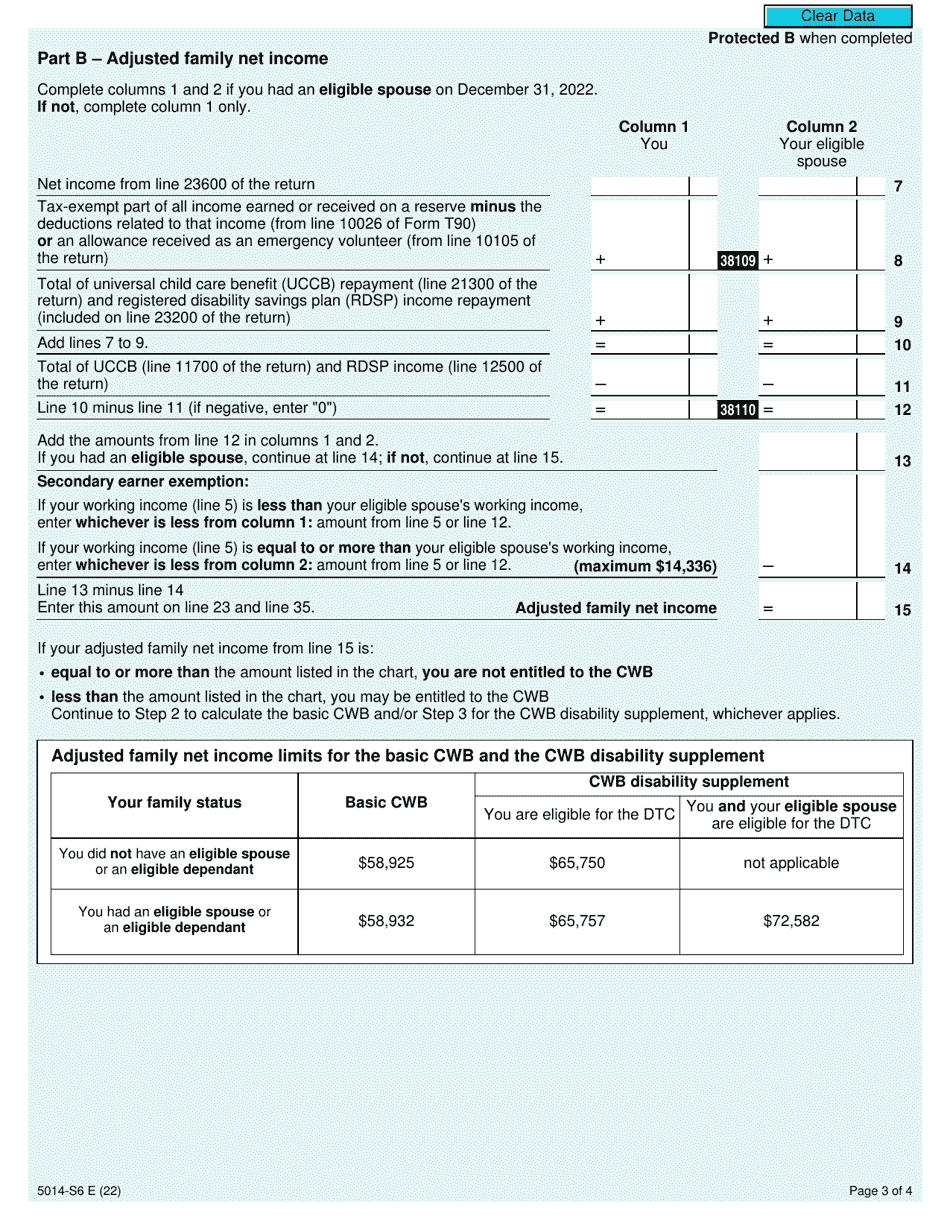

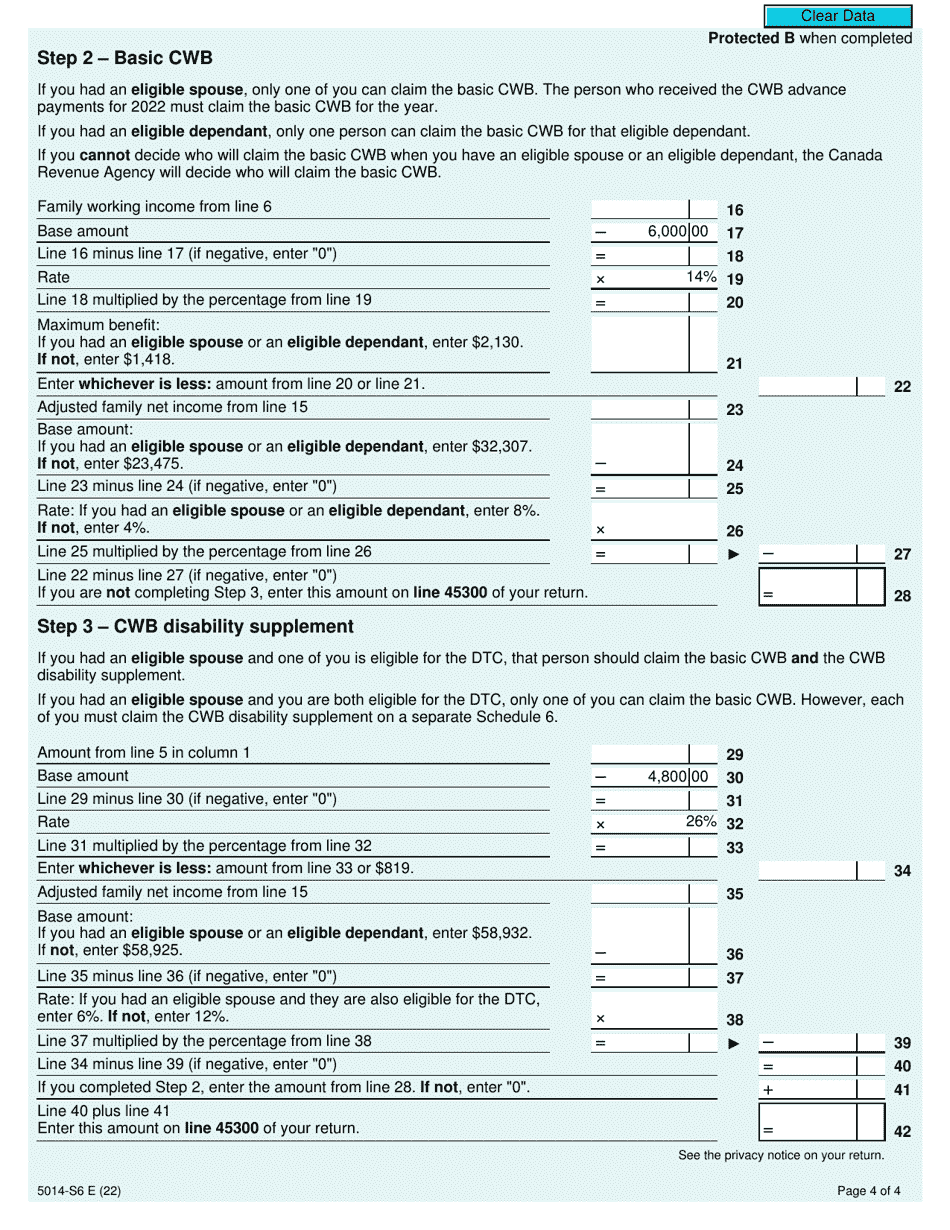

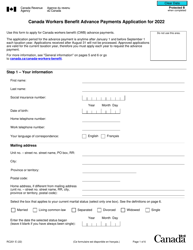

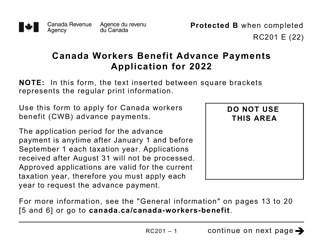

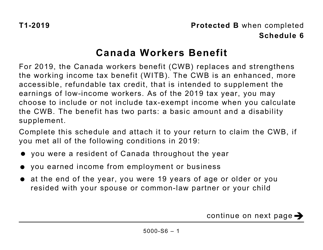

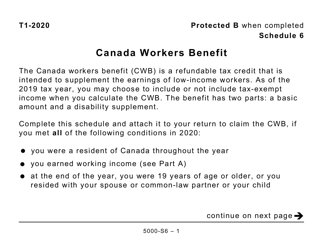

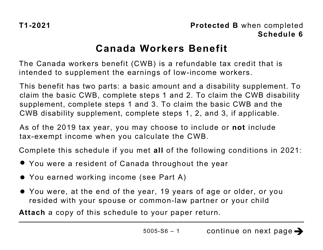

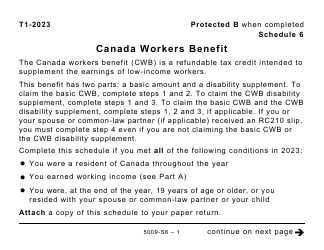

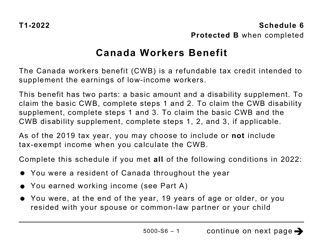

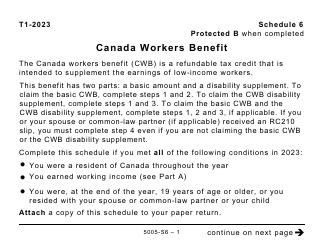

Form 5014-S6 Schedule 6 is used in Canada to calculate the Canada Workers Benefit (CWB). The CWB is a refundable tax credit designed to provide assistance to low-income workers and their families. This form helps determine the amount of credit you may be eligible for based on your income and other factors.

The form 5014-S6 Schedule 6 Canada Workers Benefit is filed by individuals who want to claim the Canada workers benefit in Canada.

Form 5014-S6 Schedule 6 Canada Workers Benefit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5014-S6 Schedule 6?

A: Form 5014-S6 Schedule 6 is a form used for the Canada Workers Benefit in Canada.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a tax credit provided to low-income individuals and families who are working.

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals and families with employment income and whose income falls below certain thresholds may be eligible for the Canada Workers Benefit.

Q: What is the purpose of Form 5014-S6 Schedule 6?

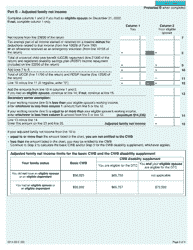

A: Form 5014-S6 Schedule 6 is used to calculate and claim the Canada Workers Benefit.

Q: When is the deadline to submit Form 5014-S6 Schedule 6?

A: The deadline to submit Form 5014-S6 Schedule 6 is the same as the deadline for filing your annual income tax return, which is usually April 30th of the following year.

Q: What information is required to fill out Form 5014-S6 Schedule 6?

A: To fill out Form 5014-S6 Schedule 6, you will need information about your employment income, social insurance number, and other relevant personal and financial details.

Q: Can I claim the Canada Workers Benefit if I am self-employed?

A: Yes, self-employed individuals may be eligible to claim the Canada Workers Benefit if they meet the income and other eligibility requirements.

Q: Is the Canada Workers Benefit a refundable tax credit?

A: Yes, the Canada Workers Benefit is a refundable tax credit, which means that if the credit amount exceeds the tax owed, you may receive a refund.

Q: Are there any other tax credits or benefits available in Canada?

A: Yes, there are several other tax credits and benefits available in Canada, such as the Canada Child Benefit and the Goods and Services Tax/Harmonized Sales Tax Credit.