This version of the form is not currently in use and is provided for reference only. Download this version of

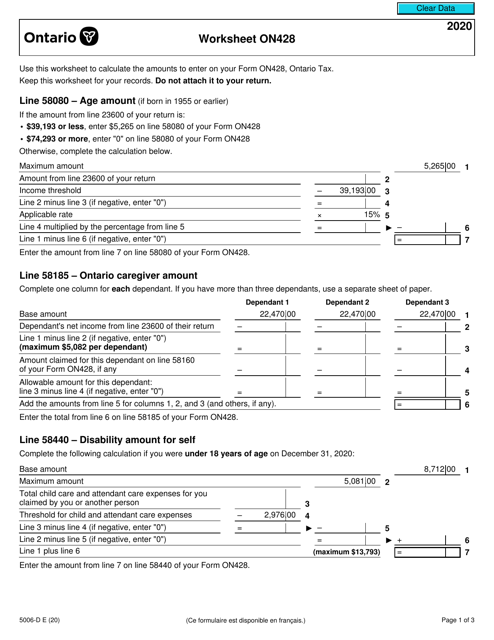

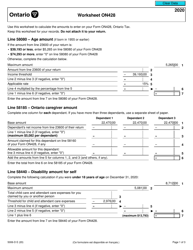

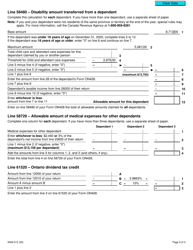

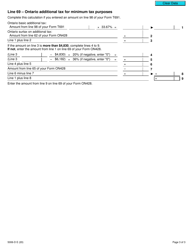

Form 5006-D Worksheet ON428

for the current year.

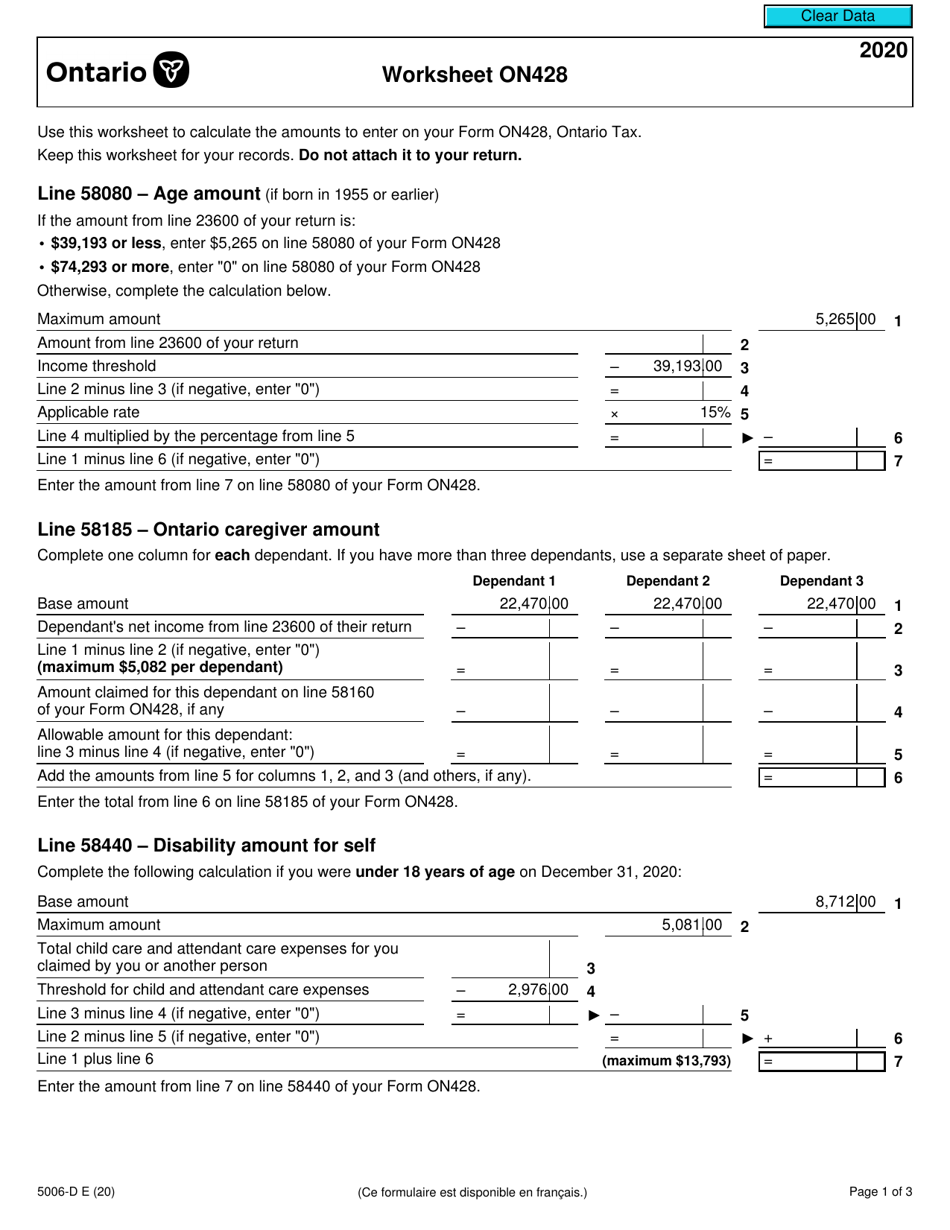

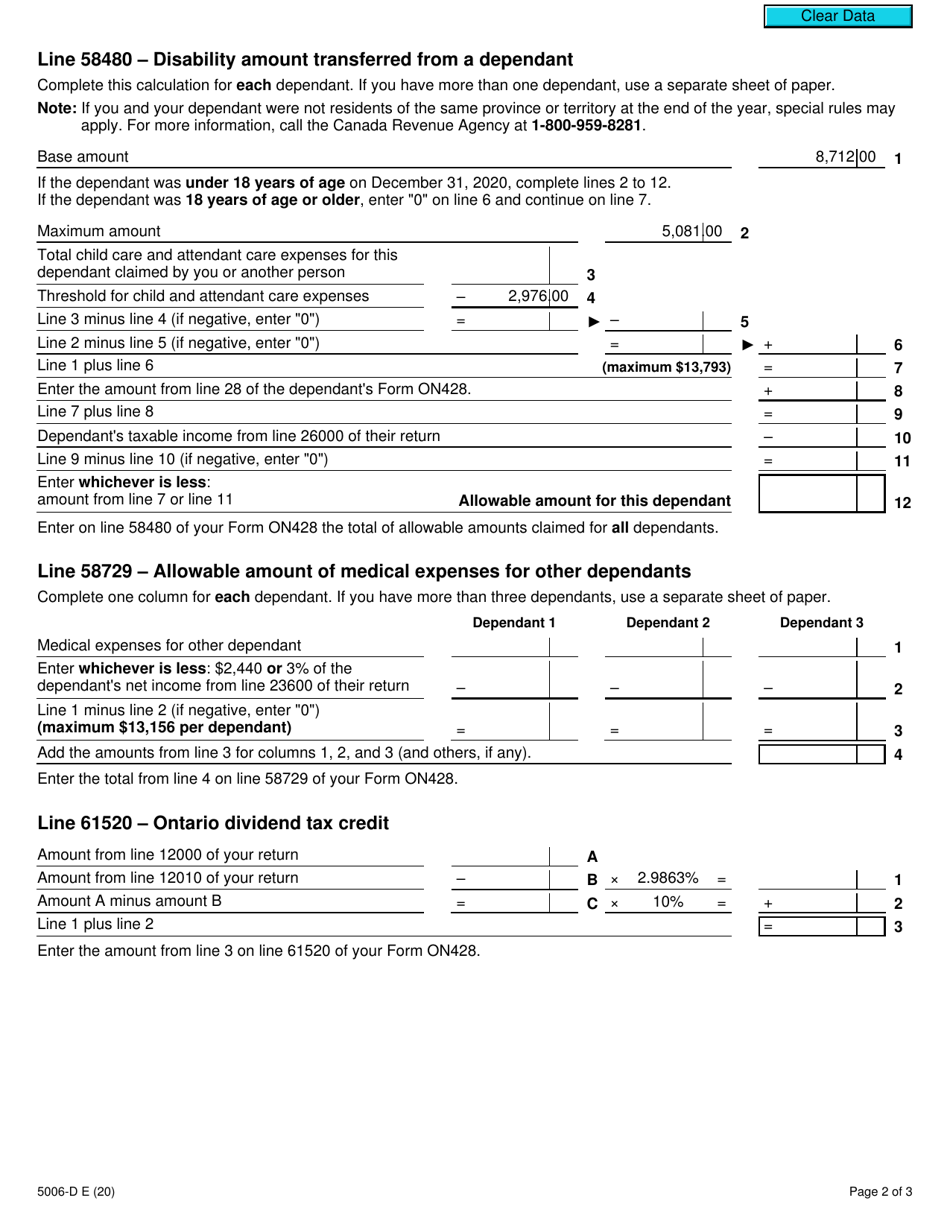

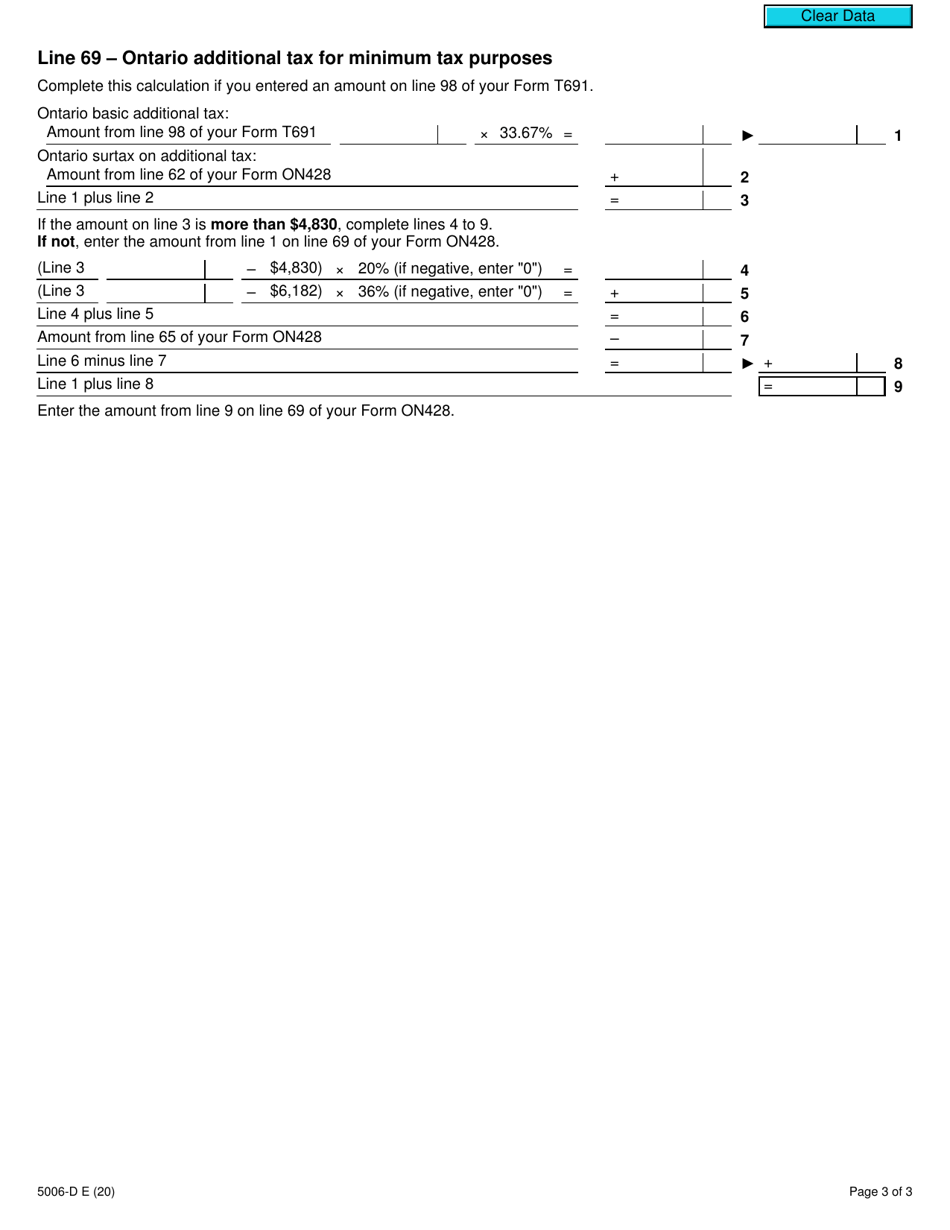

Form 5006-D Worksheet ON428 Ontario - Canada

Form 5006-D Worksheet ON428 Ontario - Canada is used for calculating the Ontario tax payable for individuals who are residents of the province of Ontario. It helps determine the eligible deductions, credits, and other amounts that may reduce the amount of tax owed in Ontario.

The Form 5006-D Worksheet ON428 for Ontario, Canada is typically filed by individuals who are residents of Ontario and are required to file a federal Canadian income tax return. This form helps determine the amount of provincial tax owed by the taxpayer.

FAQ

Q: What is Form 5006-D?

A: Form 5006-D is a worksheet used for calculating the Ontario tax payable by residents of Ontario, Canada.

Q: Who needs to file Form 5006-D?

A: Residents of Ontario, Canada who are required to file a tax return and have income to report need to use Form 5006-D.

Q: What information is required on Form 5006-D?

A: Form 5006-D requires information about your income, deductions, credits, and other tax-related details specific to Ontario.

Q: When is the deadline to file Form 5006-D?

A: Form 5006-D must be filed by April 30th of each year, or by June 15th for self-employed individuals.

Q: Can I file Form 5006-D electronically?

A: Yes, you can file Form 5006-D electronically using the CRA's NetFile or EFILE services, or through certified tax software.

Q: What happens if I file Form 5006-D late?

A: If you file Form 5006-D late, you may be subject to penalties and interest charges on any outstanding tax balance.

Q: Do I need to include supporting documents with Form 5006-D?

A: In most cases, you do not need to include supporting documents with Form 5006-D. However, you should keep them for reference in case the CRA requests them later.

Q: Can I claim tax credits on Form 5006-D?

A: Yes, you can claim various tax credits on Form 5006-D, such as the Ontario Trillium Benefit, education credits, and medical expenses.