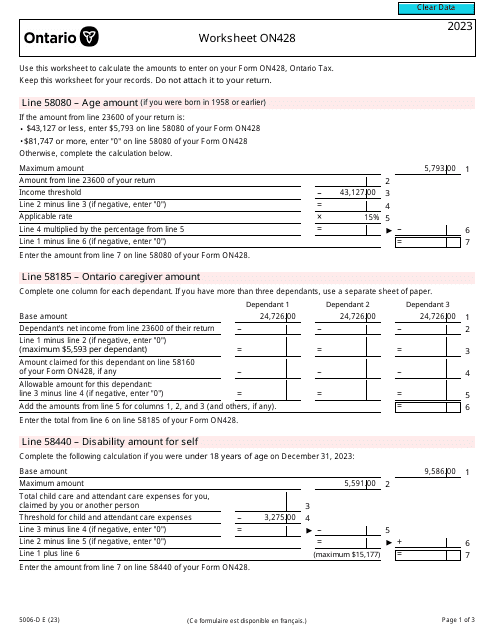

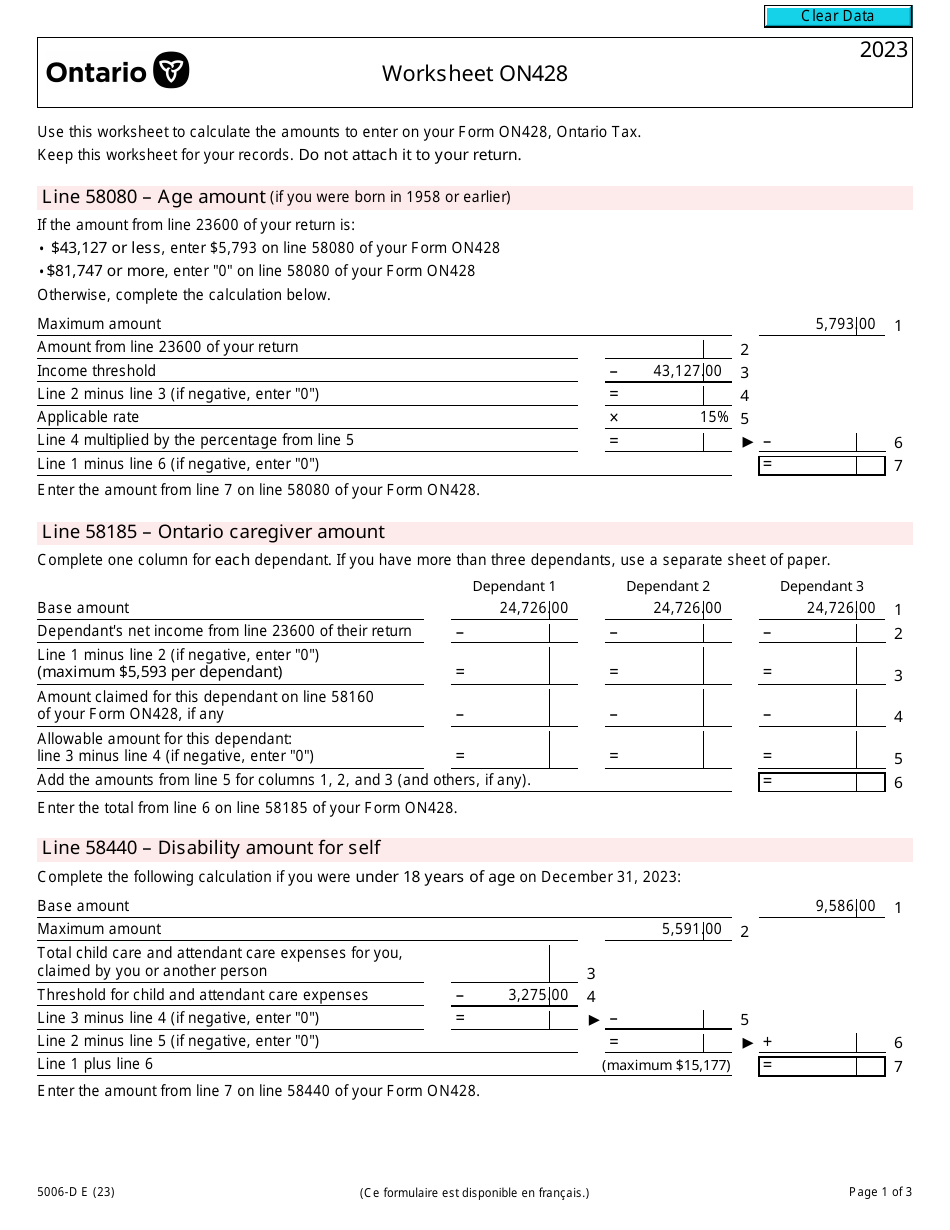

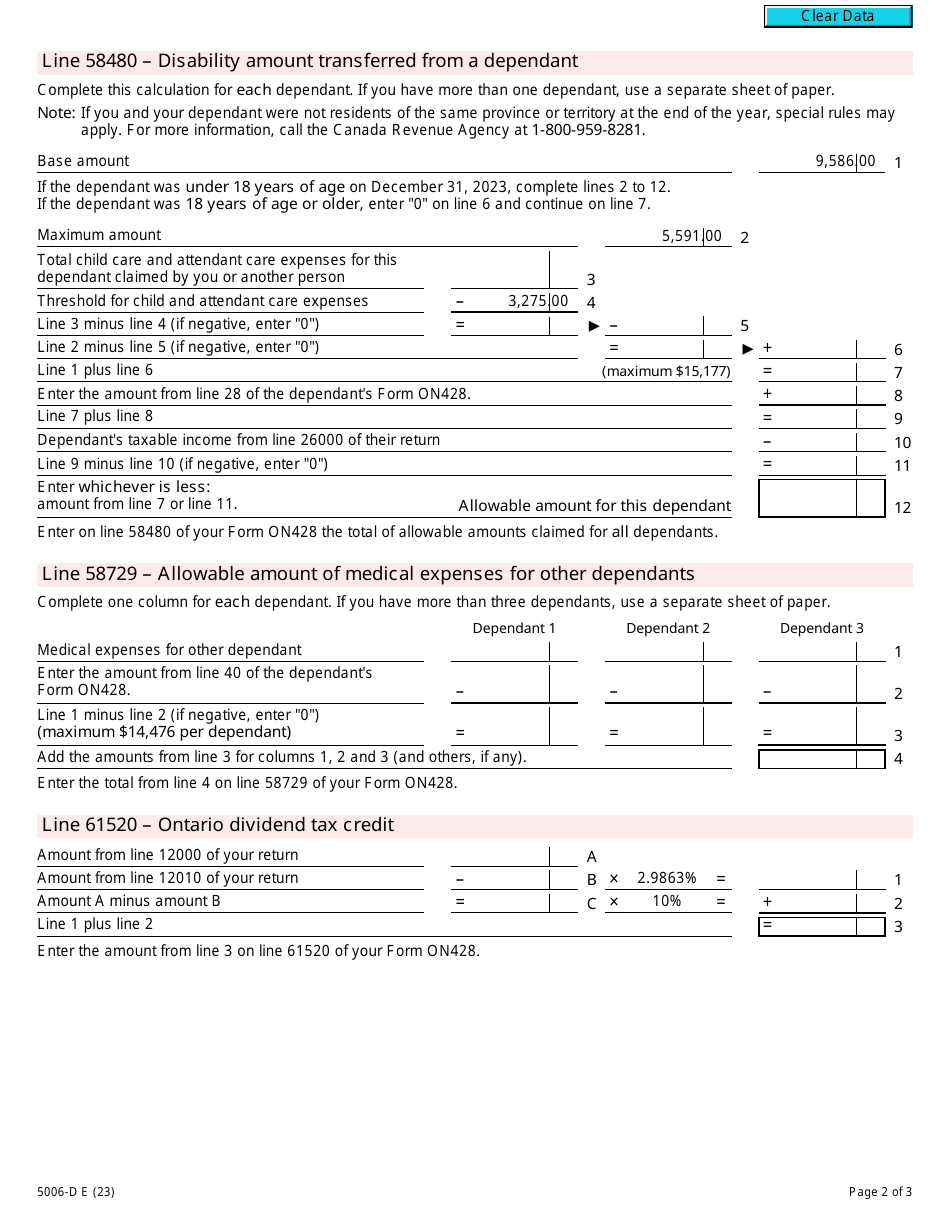

Form 5006-D Worksheet ON428 Ontario - Canada

Form 5006-D Worksheet ON428 is used in Ontario, Canada for calculating the Ontario provincial tax credits and deductions for individuals.

The Form 5006-D Worksheet ON428 Ontario - Canada is filed by individuals who are residents of Ontario, Canada.

FAQ

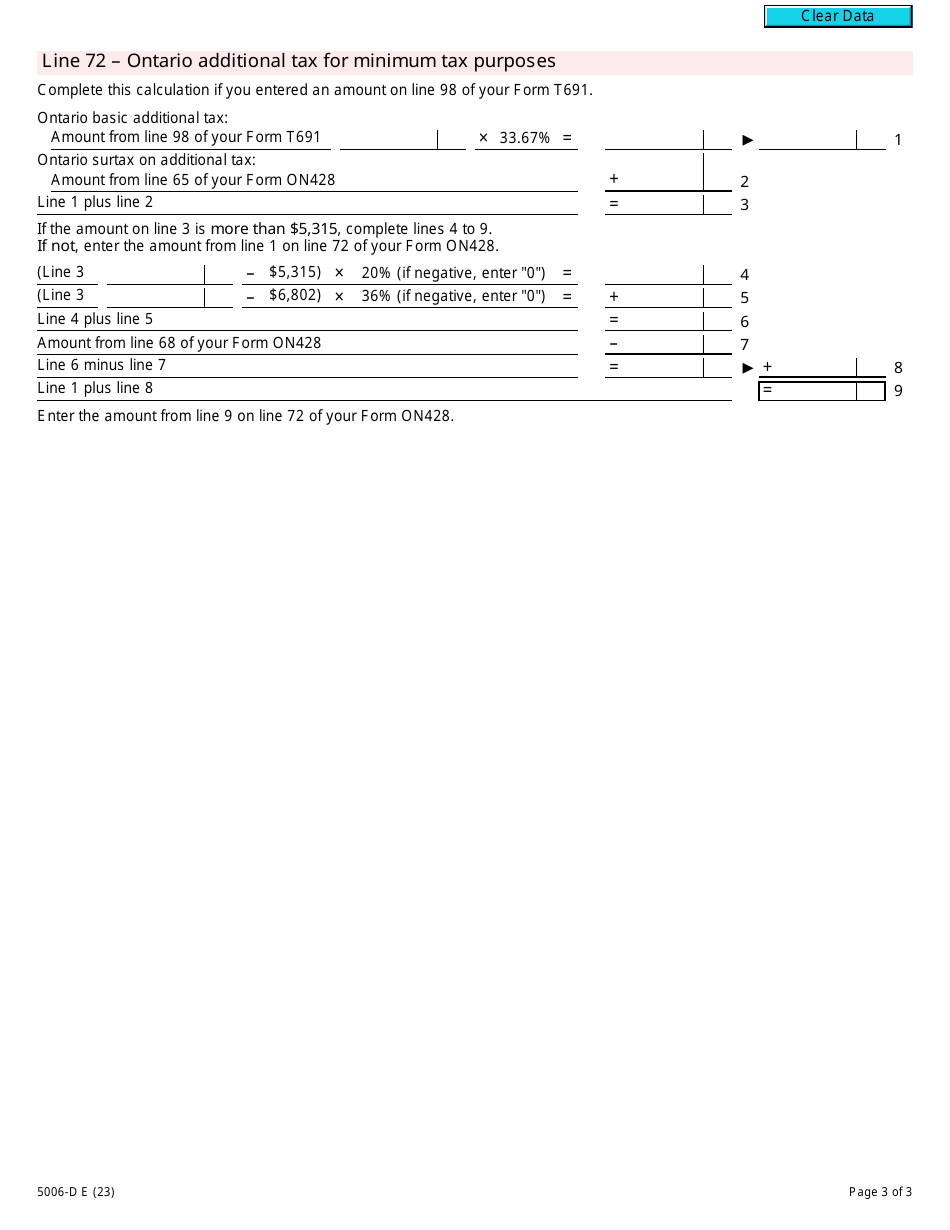

Q: What is Form 5006-D?A: Form 5006-D is the worksheet for calculating tax payable in Ontario, Canada.

Q: What is ON428?A: ON428 is the Ontario Tax form that individuals use to calculate their provincial income taxes in Canada.

Q: Who needs to fill out Form 5006-D?A: Residents of Ontario, Canada who need to calculate their provincial income taxes should fill out Form 5006-D.

Q: What information is required on Form 5006-D?A: You will need to provide your personal information, including your name and social insurance number. Additionally, you will need to provide details about your income, deductions, and tax credits.

Q: How do I fill out Form 5006-D?A: Carefully read the instructions on the form and provide accurate information about your income, deductions, and tax credits. Double-check your calculations to ensure accuracy.

Q: When is the deadline to submit Form 5006-D?A: The deadline to submit Form 5006-D is the same as the deadline for filing your federal income tax return, which is April 30th of each year.

Q: Can I file Form 5006-D electronically?A: Yes, you can file Form 5006-D electronically using NETFILE, an electronic tax-filing service provided by the CRA.

Q: Can I get help filling out Form 5006-D?A: If you need assistance filling out Form 5006-D, you can contact the CRA directly or consult a qualified tax professional.

Q: Is Form 5006-D only for Ontario residents?A: Yes, Form 5006-D is specifically for residents of Ontario, Canada. Residents of other provinces will have different forms to complete.