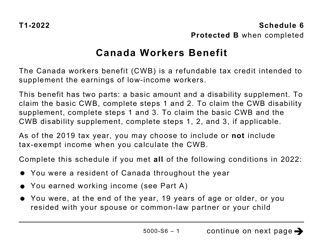

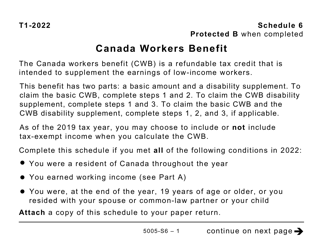

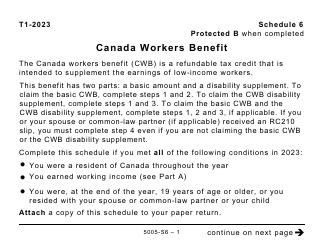

This version of the form is not currently in use and is provided for reference only. Download this version of

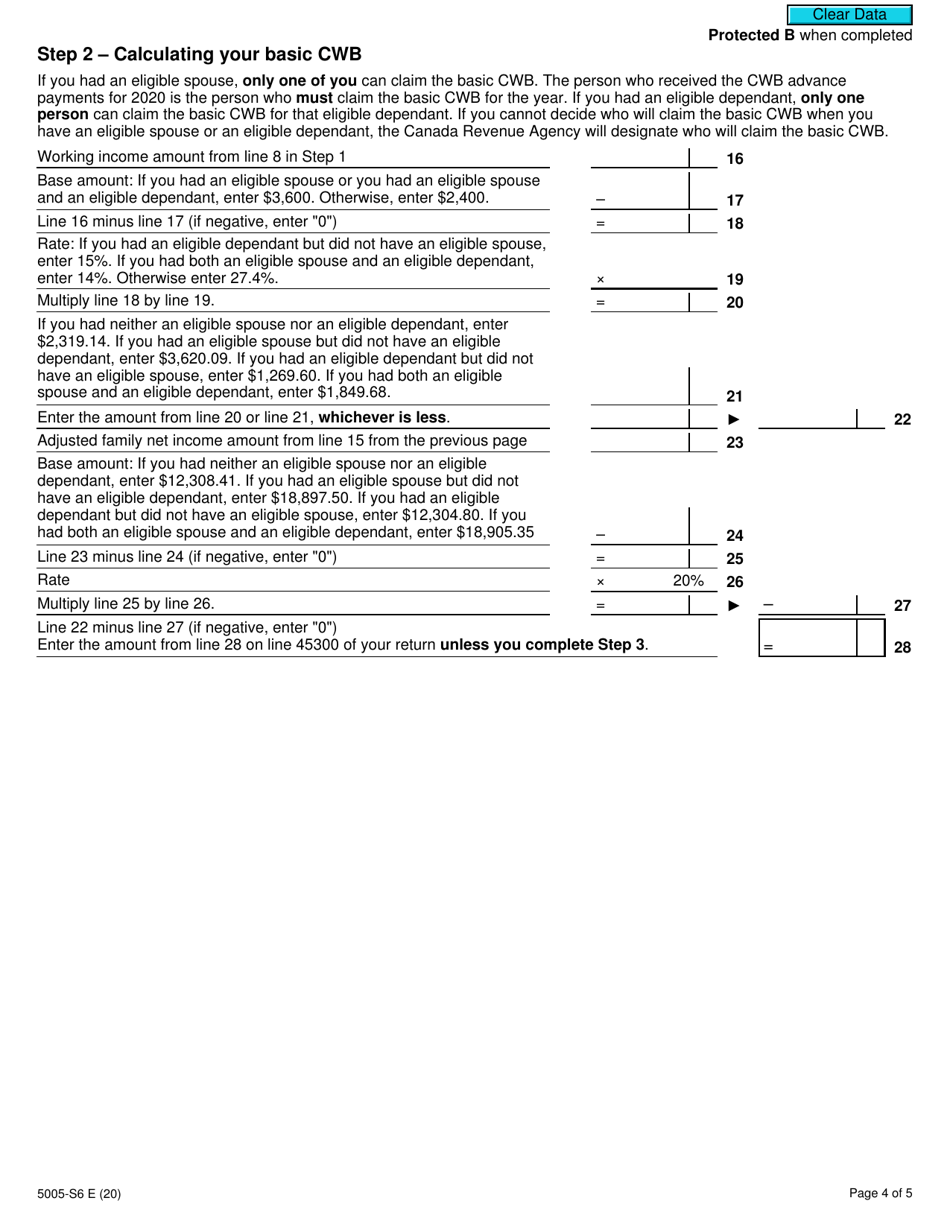

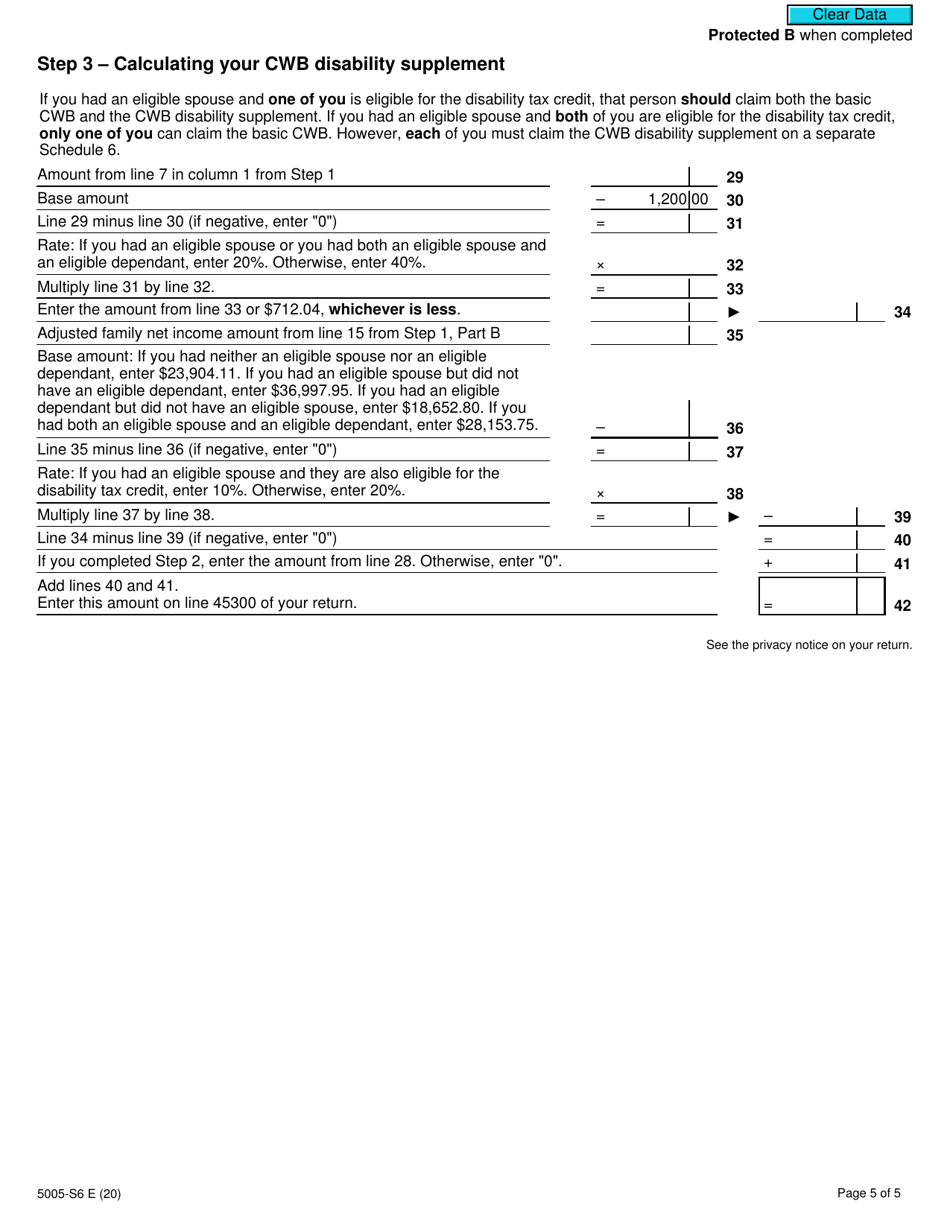

Form 5005-S6 Schedule 6

for the current year.

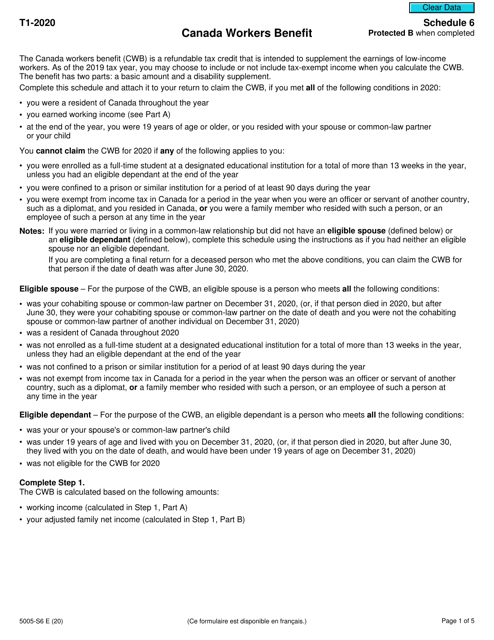

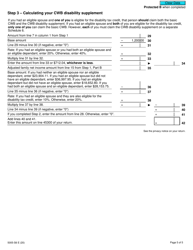

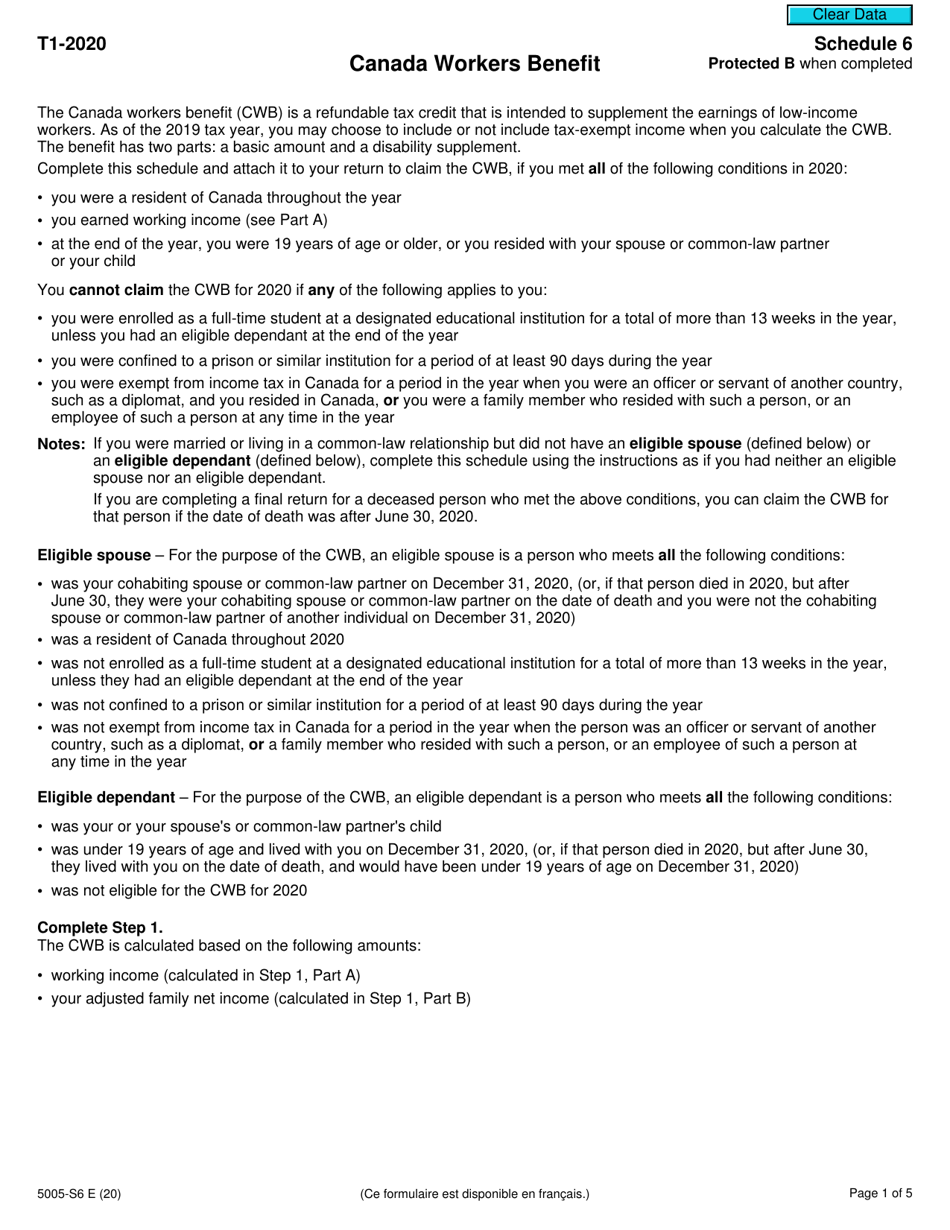

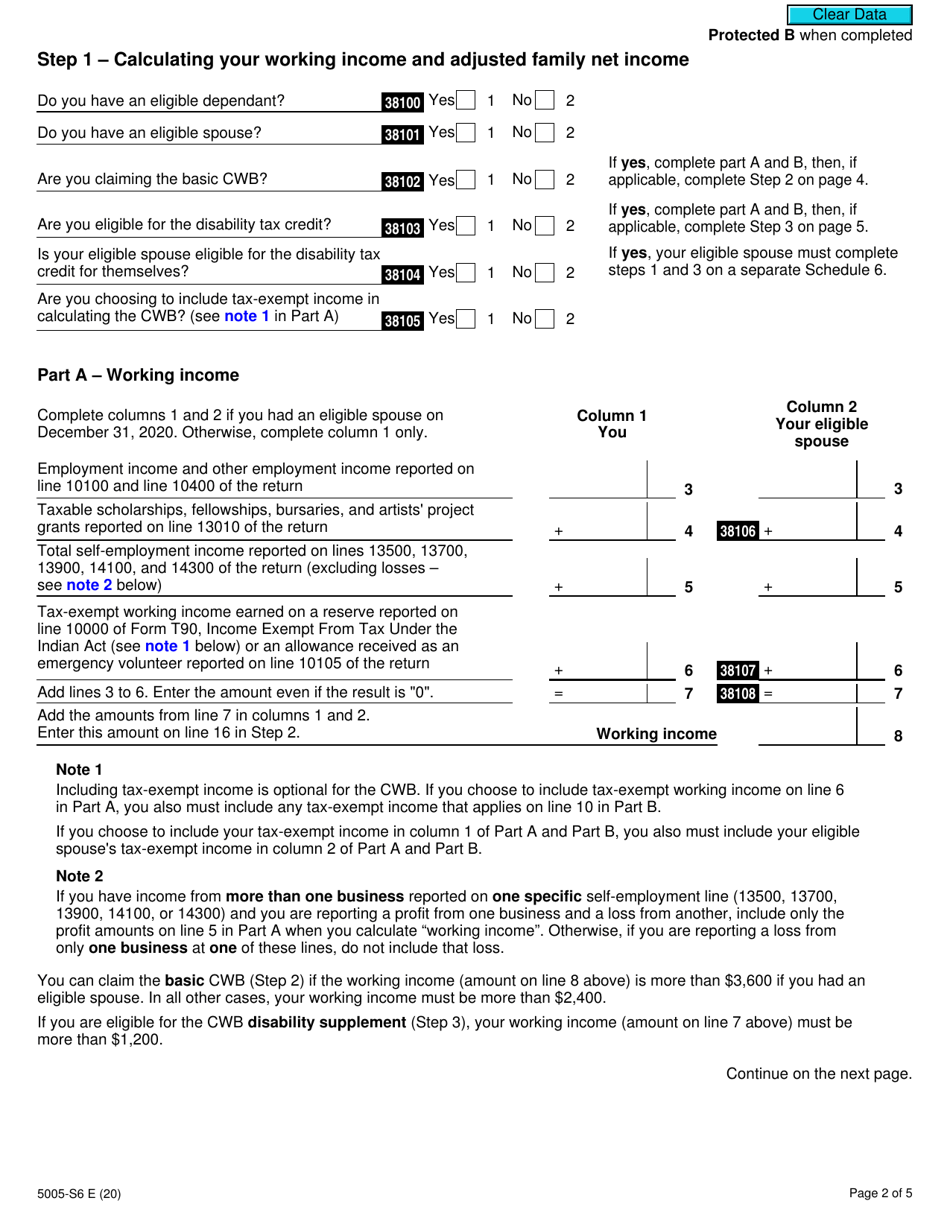

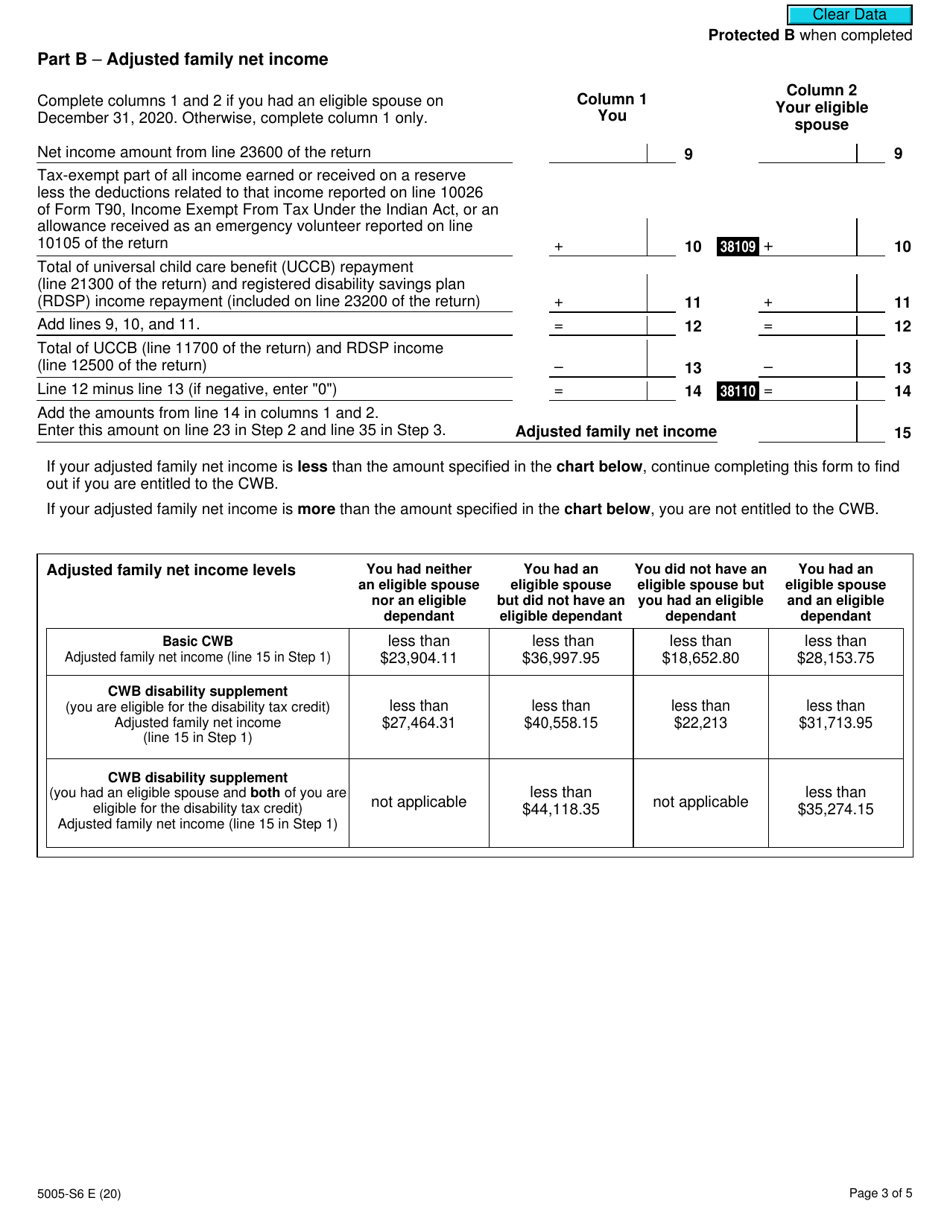

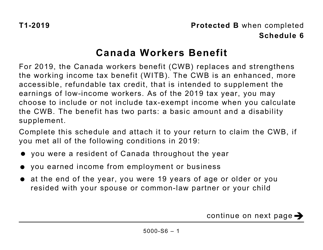

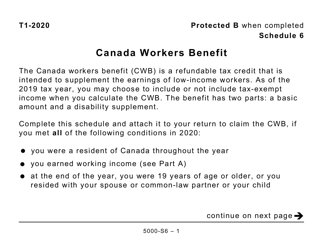

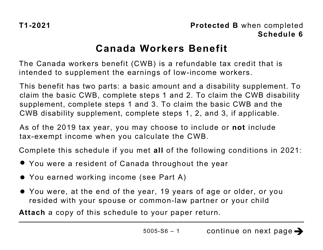

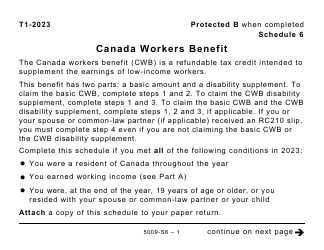

Form 5005-S6 Schedule 6 Canada Workers Benefit - Canada

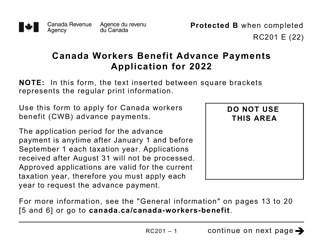

Form 5005-S6 Schedule 6-Canada Workers Benefit is used to calculate the Canada Workers Benefit (CWB) for individuals in Canada. The CWB is a tax-free credit that provides income support to low-income working individuals and families.

The individual who wants to claim the Canada Workers Benefit in Canada files the Form 5005-S6 Schedule 6.

FAQ

Q: What is Form 5005-S6?

A: Form 5005-S6 is a schedule that is used in Canada to claim the Canada Workers Benefit.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit is a tax credit provided by the Canadian government to support low-income workers.

Q: Who is eligible for the Canada Workers Benefit?

A: Individuals who have employment income and meet certain income requirements may be eligible for the Canada Workers Benefit.

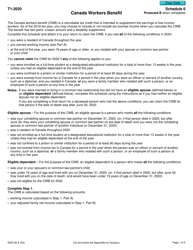

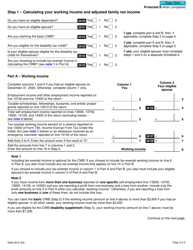

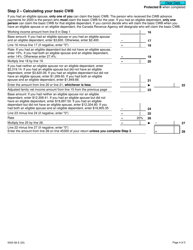

Q: What information is required on Form 5005-S6?

A: Form 5005-S6 requires information such as your social insurance number, employment income, and other income sources.

Q: How do I file Form 5005-S6?

A: Form 5005-S6 can be filed electronically using tax preparation software or it can be printed and mailed to the Canada Revenue Agency.

Q: When is the deadline to file Form 5005-S6?

A: The deadline to file Form 5005-S6 is usually April 30th of the following year.